Oil up, Investor Fear Monday, Movers - MOD, APP, DOCS, ITI, ET

Welcome and thank you to the recent new, smart, savvy and contrarian investors who have joined my substack. I am still small here so please share and subscribe while this is free.

Not much on the economic front today but lots next Tuesday and Wednesday with inflation data.

My bottom call on oil is looking good as it is up 3 days in a row now. Oil is set for a weekly gain after four straight week-over-week losses as Sept. Comex WTI is around $76.40 this morning. Fears of an impending economic recession were alleviated with the US jobs data I commented on yesterday. And markets are closely following possible Iran’s retaliation on Israel, geopolitics have added some bullish sentiment.

Europe’s benchmark TTF gas futures contract surpassed the €40 per MWh ($14 per mmBtu) threshold on Thursday for the first time since December 2023, after reports emerged that Ukrainian forces might have seized Gazprom’s Sudzha gas transit station. This is good news for our junior Turkey oil&gas play Trillion Energy (TCF).

Intensity of Red Sea Attacks Up - The Greek-owned Delta Blue tanker carrying Iraqi oil to Greece’s Corinth port has been attacked four times over the past 24 hours, surviving two grenade attacks, one missile strike and a maritime drone ramming attempt.

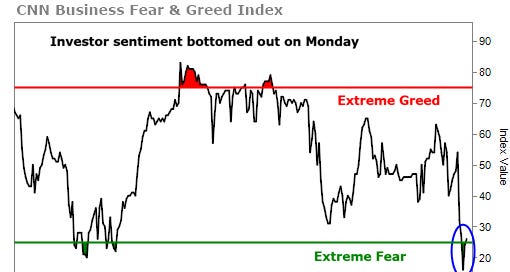

It appears the market may have had just a very quick correction and we could go sideways for the rest of August, but look out for September. With the Fear & Greed Index, a reading above 75 signals extreme greed and a score below 25 signals extreme fear. On Monday, this index hit its lowest level all year, pretty scary for many.

Market Movers and Shakers

Modine Manufacturing Company (MOD) $101.10

Modine is poised for strong growth, driven by its strategic focus on thermal management technologies across diverse sectors, including automotive, industrial, and building HVAC systems. The company’s recent restructuring efforts have streamlined operations, enhancing profitability and positioning Modine to capitalize on emerging trends such as electric vehicles and energy efficiency. With a strong balance sheet and a commitment to innovation, Modine is well-equipped to meet the increasing demand for sustainable thermal solutions. As global regulatory environments continue to tighten around emissions and energy use, Modine’s advanced technologies provide a competitive edge, supporting long-term revenue growth and shareholder value.

The stock is currently up over 100% this year but down from highs of about $124. End of July, Q2 results saw net sales of $661.5 million increased 6% from the prior year, organic sales increased 4%. Investors are keen on their Climate Solutions segment where sales were $357.3 million, compared with $286.7 million one year ago, an increase of 25%. Mostly driven by higher sales of data center cooling products.

AppLovin Corporation (APP) $74.43

AppLovin is at the forefront of the mobile app ecosystem, benefiting from the surge in mobile gaming and app usage globally. The company's comprehensive software platform enables app developers to optimize monetization and user acquisition, driving strong revenue growth. AppLovin's strategic acquisitions, particularly in the gaming sector, have diversified its portfolio, enhancing its ability to capture a larger market share. With a focus on data-driven insights and machine learning, AppLovin continues to improve its offerings, creating a robust competitive advantage. As mobile app usage continues to grow, AppLovin is well-positioned to benefit from this secular trend, making APP a compelling investment.

The stock is up about 100% this year but corrected some from July highs around $90. They reported upbeat Q2 profit numbers on Wednesday with net income of 89 cents/share compared to 22 cents in the year earlier period

Doximity Inc. (DOCS) $34.52

Doximity Inc. is revolutionizing the healthcare industry with its digital platform tailored for medical professionals. The company’s strong network effect, with over 80% of U.S. physicians as members, creates a significant moat. Doximity’s platform enhances communication, collaboration, and telemedicine capabilities, which are increasingly important in the evolving healthcare landscape. The company’s ability to monetize through targeted advertising and hiring solutions provides robust revenue streams. With the ongoing shift towards digital health and telemedicine, Doximity is well-positioned to continue its growth trajectory, making DOCS a standout player in the healthcare technology sector.

The stock popped 34% this morning on a significant revenue and profit beat reported after hours Thursday. Revenue of $126.7 million, versus $108.5 million, an increase of 17% year-over-year. Net income of $41.4 million, versus $28.4 million, representing a margin of 32.7%, versus 26.2%.

Iteris Inc. (ITI) $7.00

Iteris is a leader in smart transportation infrastructure, benefiting from the growing investment in intelligent transportation systems (ITS) and smart city initiatives. The company's expertise in traffic management, road safety, and data analytics positions it at the forefront of this evolving industry. With governments and municipalities prioritizing infrastructure upgrades, Iteris is poised to capture significant market opportunities. The company’s recurring revenue model from software and services, coupled with strategic partnerships, strengthens its financial stability. As the demand for smart transportation solutions grows, Iteris is well-positioned to benefit from these trends, making ITI an attractive long-term investment.

The stock is up a whopping 63% today on takeover news. ITI entered into a merger agreement to be acquired by Almaviva S.p.A. (“Almaviva”), a private Italian digital innovation group, in an all-cash transaction valuing Iteris at approximately $335 million equity value. Under the terms of the agreement, Iteris shareholders will receive $7.20 in cash for each share of Iteris common stock.

Energy Transfer (ET) $15.75 - (8.1% yield)

Energy Transfer is in my Millennium Index, a leading midstream energy company with a vast portfolio of assets across the U.S., including pipelines, storage, and processing facilities. The company’s scale and diversification provide a stable cash flow, even in volatile energy markets. Energy Transfer’s focus on expanding its natural gas and NGL (natural gas liquids) operations positions it well for growth, especially as global demand for cleaner energy sources rises. The company's commitment to returning capital to shareholders through dividends and debt reduction further enhances its investment appeal. As the energy sector continues to recover, Energy Transfer is well-positioned to capitalize on its strategic assets, making ET a compelling choice for investors seeking both income and growth.

The stock is just off a little from 5 year highs of $16.50. Late July, ET announced a dividend increase to $0.32 per quarter. ET remains one of my favourite dividend stocks in the energy sector and still a good buy at these higher prices.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.