Outlook 2025 – Bear Market Equities and Crypto, Higher Gold

Most analysts do their yearly outlook and predictions at the beginning of the year. I believe it is pretty hard to know what the year will do in the first few days, so I often do mine in February. Some years it is more clear and I did 2024 in early January that year. In my 2024 outlook, I expected the first half of the year to be the best and did not anticipate the strength of the Trump bump in the last quarter on 2024. However, that just over valued markets further and sets things up for a down year in 2025. From my newsletters this year you already know I am predicting a U.S. recession, a bubble top in markets with a down market in 2025. I am bearish on Crypto and Bitcoin, sort of neutral on oil but more bullish on Natural Gas. I am also bullish on gold and silver.

Outlook 2025

De-Globalization Accelerating

The weakness in globalization was brought to light with the Covid-19 plandemic that caused huge supply chain issues. Further more with war and conflicts like the sanctions on Russia and supplies of many commodities curtailed from Ukraine. Many countries around the world are working to source more commodities and energy within their borders including the revival of nuclear that not long ago was considered a no go. They are turning to close allies/trading partners and re-analyzing their supply chains. Trump's America 'First policy' is simply accelerating a trend that was already underway.

Wide open border policies are being reversed and while Trump's perspective and changes are making all the news, it is happening in many countries. Switzerland is excelling at removing immigrants slated for deportation, achieving the highest rate in Europe in 2024 with a 60 percent deportation rate and boosting its own progress by 18 percent over 2023. February 23. Germany became the latest country where voters rejected a left-leaning government largely because of their unhappiness over immigration and the economy. The center-left Social Democrats, who led the government for the past four years, tumbled to third place, with 16 percent of the vote. It was their worst showing in a national election since at least 1890.

This trend will negatively or positively effect different market sectors and stocks, something we have to keep in mind with all of our stock selections. For example the U.S. wants to make more chips at home and be a leader in AI. Trump is removing regulation in the sector revoking the "Safe, Secure, and Trustworthy Development and Use of AI" executive order under Biden. Trump announced an artificial intelligence-focused initiative called Stargate. This is positive for a stock on our list - Intel and also means strong energy demand for more AI and data centers.

Canada's Decline to Accelerate

Canada is stuck with the far left policies that have been a big contributor to it's decline while a lot of the world is changing - moving to the center or right. The government has said they will do some things to fix problems but nothing much will change until an election and change of government.

Many are hopeful that will happen soon as NDP Leader Singh says they will vote non confidence, but I would count him going back on his word. How do you know when a politician is lying? Their lips are moving. A poll that came out after Trudeau said he would resign showed Liberal support flat at 20% and the NDP down 3 more points to 17%. The Conservatives are at 46% so the NDP and Liberals know that an election now would no doubt lead to their demise. They are going to want to buy time and try to find some way to improve their odds, so a late October election seems most likely so little change for Canada this year but continuing down the steeper and steeper slope. Liberals have improved in the polls playing the Trump tariff card and Carney likely to replace Trudeau.

The other issue with the NDP is they have not been differentiating themselves from the Liberals as the Liberals have moved so far left that both parties are basically Socialists. Singh's NDP will want more time to come up with a new strategy of moving away from the Liberals while supporting them enough to avoid a non confidence vote.

China, some other countries and the Trump administration are going to take advantage of Canada's poor leadership, poor condition and basket case status. Of course the Trump tariff threat the big thing in the news.

I doubt Trump will impose wide spread tariffs, at least not right away. I believe Trump is mainly using tariffs as a threat and bargaining tool. Look what just happened in Colombia. Sunday evening a couple weeks back, and just under 10 hours after Trump lobbed the first shot in the first trade war of his second admin, the White House announced that Colombia had agreed to all of Trump's terms, "including the unrestricted acceptance of all illegal aliens from Colombia returned from the United States, including on U.S. military aircraft, without limitation or delay."

Based on this agreement, the White House notes, the hastily drafted tariffs and sanctions "will be held in reserve, and not signed, unless Colombia fails to honour this agreement.

For Canada, Trump might start with tariffs on certain things with the threat of more tariffs if this or that is not done. Right now his main issue is to get the Canadian border under control, it has basically been wide open under the Trudeau government. With Canada's poor leadership some reactions to tariffs could cause more or bigger problems so that is an uncertainty too. . I believe tariffs of some magnitude are definitely coming because the Liberal government is doing little to fix the border and fentanyl issue other than talk. The Liberal government wants tariffs so they can implement their own agenda and blame everything on Trump. Sadly, many Canadians will be fooled.

The level of uncertainty in the country is very high, never a good thing for the economy and business. I am expecting a weakening loonie, higher inflation and a deeper recession. I will continue to focus on mostly U.S. stocks with some exceptions in unique cases like I highlighted recently with Hemostemix

Stubbornly High Interest Rates, Strained Consumers, Government Turmoil and Bubble Markets.

This is the theme for 2025 and I expect the U.S. to go into recession this year, the one in Canada deepens further and this drags stock markets down for what will be the worst performance since the dot com or 2008 bubble crash. It will be a combination of politically driven uncertainty, a recession and a highly over valued markets that will probably turn a correction, than into a bear market.

Retail Investors Pile in at Top while Insiders and Smart Money Leaves

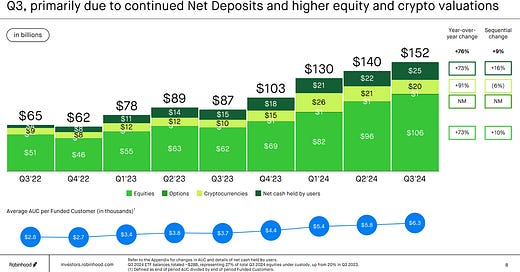

U.S. households’ stock allocation hit a record 49% in October 2024, surpassing the 2000 dot-com peak. Since the Great Financial Crisis, stock exposure has doubled, making investing more accessible — but also more complex! Robinhood is all retail investor accounts and they piled in big time in 2024.

According to JPMorgan, in 2024, retail investors saw returns of just +3.7% by November 2024, far behind the S&P 500’s impressive +25%. That only indicates that most of the increase at Robinhood was net deposits. However higher crypto prices helped.

Meanwhile and I mentioned this not long ago, Buffet's Berkshire Hathaway has been selling stocks and amassing a record $334 billion in cash. Also the CEO's of the tech giants were big sellers in 2024. We can sum up with this chart on insiders. The buy-sell ratio hit its lowest level since 1988, signaling mounting concerns about valuations.

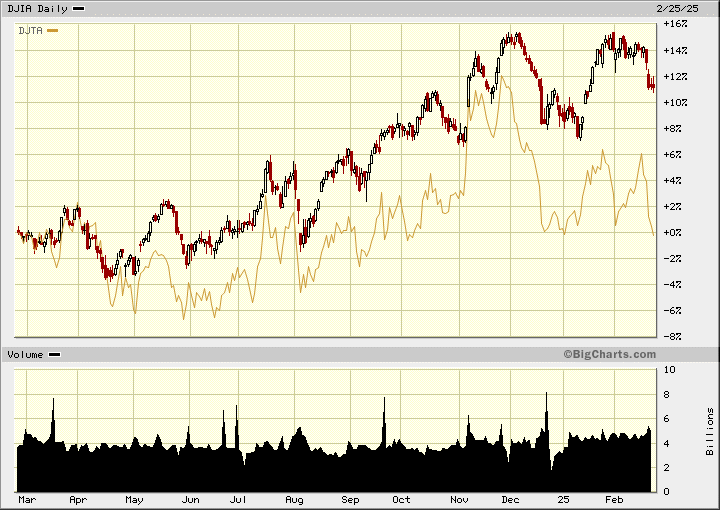

The S&P 500 has been bubbling along a top around 6,100 for the past 3 months and the Nasdaq composite has made a triple top. The 2nd chart on the DOW is more telling.

The DOW has put in a double top and the Transports (DJTA) have not confirmed the most recent top.

According to DOW theory the transport index should conform the DOW's moves. The reasoning is that if the economy is doing well than transports are doing well moving goods and services.. If we pick on FedEx, we can see the stock peaked last July when I started warning of a bubble top and an uptrend has now turned into a down trend.

The U.S. market does an extreme good job of creating wealth or should I say creating financial instruments. There is an increasing number of 'securities' being issued that don’t really serve any economic purpose and simply leverage the performance of those underlying entities for gambling purposes. For example -single-stock leveraged ETFs, cryptocurrency 'memecoins,' and numerous other sounding 'hedging' ETFs.

Markets recent all-time highs are breaking records based on every available metric: P/E ratios, CAPE ratio, market cap/GDP ratio, concentration risk, etc. This is accompanied by indexing, investor complacency and investor/ analyst euphoria. When such conditions have existed in the past, they have always been followed by bear markets unfolding over several years. Recent examples that I warned about were the Nikkei in 1989 (we bought Nikkei Puts) . NASDAQ Tech/Dot com in 2000, and the reals estate financial bubble in 2007/08.

Markets are now positioned for another historic bear market and/or crash.

And speaking of these numerous leveraged ETFs, there is one I watch called MAGS, it tracks the Magnificent Seven Stocks. Guess what, it is breaking down on the chart today. On Wednesday, much watched Nvidia will report financial results. It could trigger a bounce back up or further sell off. I would error on the side of caution.

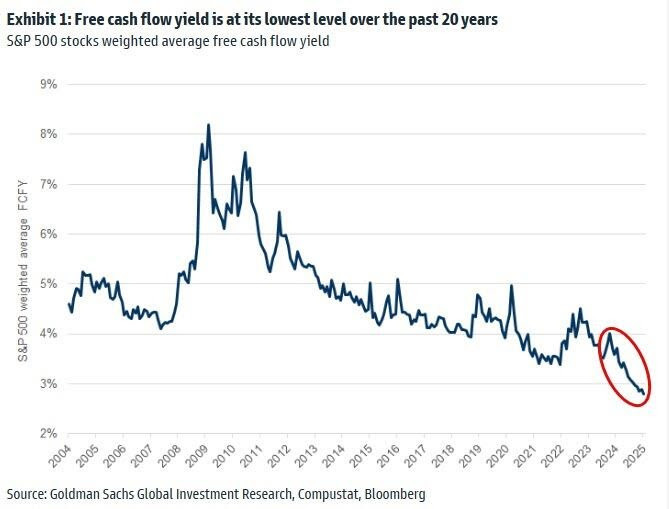

In yet another sign of over priced stocks is the S&P 500 stocks cash flow is at a record low compared to the index’s market cap.

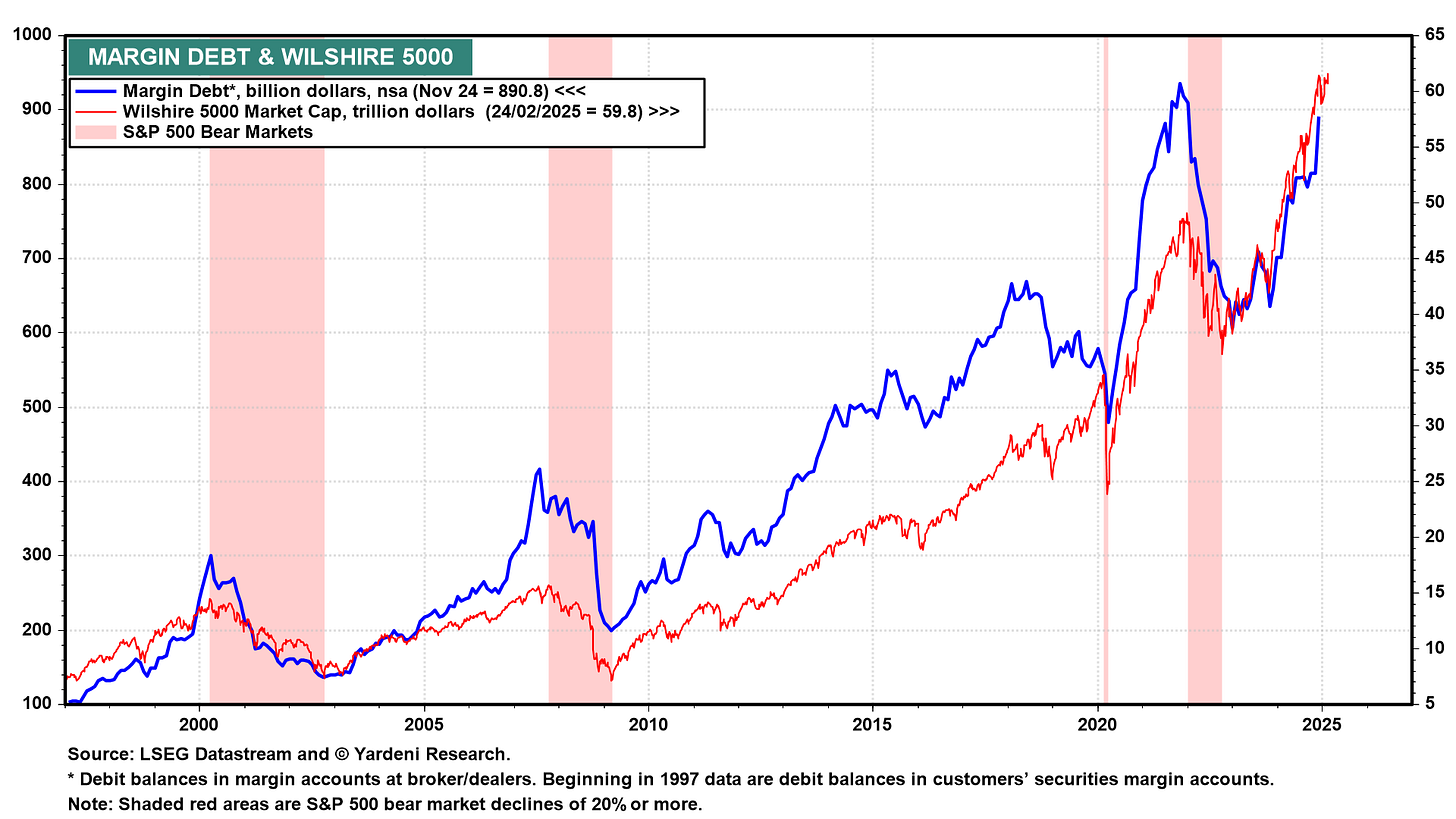

Another indicator I follow is margin debt at Yardeni Research. It's fast rise and high level is another danger sign. Margin selling can fuel steep and prolonged sell offs.

The other big elephant in the room is the Trump Administration.

I believe all the slicing and dicing cutting up government departments and spending is long over due. However, the extent and amount of it is unprecedented and never done before. Markets are uncertain and they hate that. Just Trump's immigration policy will cause a recession. Under Biden, all these immigrants, illegal or not and refugees, perhaps 10 to 20 million were given government support and hand outs to spend. It all boosted economic activity and that is all being removed.

The government layoffs and elimination of funding for various departments will all add to less economic activity. Elon Musk mentioned more than once that there will be short term pain and there will be a lot of it. It has already begun.

And than there are the tariffs. It is uncertain what they will end up mounting to, but I am expecting the 25% on Canada and Mexico. There already is 35% and higher on China and there will be reciprocal tariffs. For example if Germany has a 15% tariff on U.S. autos, the U.S. will put a 15% tariff on Germany autos.

The market and consumers are worried about higher inflation and an all out trade war.

I am expecting higher inflation in the coming months and then that tapering off in the later part of the year as a recession sets in.

Crypto Bubble Floating Among Pins and Needles

The irrational exuberance to use Greenspan's words has been so wild and markets have been so rigged that people are speculating upwards of $3 trillion in a Crypto bubble. From what I see it offers very little product or service and exists entirely digitally. It could go away faster than it arrived.

It is prone to numerous problems and corruption. Bybit, a major cryptocurrency exchange, was hacked for $1.5 billion in what is now the largest crypto heist in history. The attack compromised the exchange’s cold wallet, allowing hackers to swiftly transfer and liquidate the stolen funds, primarily in Ethereum. This is the largest crypto exchange hack to date.

A better way to play the short bitcoin is through MSTZ etf. It is 2 times short

Microstrategy - - NASDAQ:MSTR - - - Recent Price - $250

Microstrategy is the largest corporate holder of bitcoin and the world’s first Bitcoin Treasury Company

The fourth quarter of 2024 marked their largest ever increase in quarterly bitcoin holdings, culminating in the acquisition of 218,887 bitcoins acquired for $20.5 billion, since the end of Q3.

As of December 31, 2024, the carrying value of the Company’s digital assets (comprised of approximately 447,470 bitcoins) was $23.909 billion. As of December 31, 2024, the original cost basis and market value of the Company’s bitcoin were $27.968 billion and $41.789 billion, respectively, which reflects an average cost per bitcoin of approximately $62,503 and a market price per bitcoin of $93,390,

MSTR has bought more bitcoin in 2025 and now holds 499,096 bitcoin. For this evaluation I am using MSTR’ 447,470 bitcoin reported at Q4. Today this is valued at about $39 billion at a bitcoin price of $87,158. However, the market cap of the company is $73 billion. The stock would drop 47% if the premium came out of the price. Since Bitcoin provides no return or interest rate, Microstrategy can only succeed if bitcoin rises.

If bitcoin comes down to my $72,000 target, Microstrategy could easily fall to around $100.

I am not suggesting to short Microstrategy now, because bitcoin is very volatile and usually if it has a steep fall, it will have some sort of bounce back. Investors still have the 'buy the dip' mentality. I will send an alert out when I see the buy opportunity.

That said, the market could continue to fall so an average in strategy could work. Buy a bit of MSTZ around $28 - two times short MSTR etf now and more if bitcoin rises and MSTZ drops.

Gold and Silver

I predicted record gold prices for 2024 and it will be the same for 2025 with gold reaching between $3,200 and $3,800. Silver will also make record highs above $50. I will go into more depth on these at a later date. We are well positioned in the market,

but as far as general equities, raise some cash and also sell Crypto

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.