Welcome and thank you to the 20 and more savy and contrarian investors who have subscribed to my substack. Please share with your family and friends, as this will continue free for some time.

Fed Spending – Beyond out of control

In just three months since the debt ceiling crisis was resolved, the U.S. has tacked on an additional $3 trillion to its national debt. Mainly because federal spending surged by a whopping 50% from 2019 to 2021.

As interest rates climb, so does the cost of servicing such a huge debt load. In January, I wrote an article called 'Something Could Break in 2023'. In particular I talked about the debt (bond) market could break and the U.S deficit could swell to $2.5 trillion. I mentioned that $800 billion in capital gains tax paid in 2022 will not happen in 2023. To me it is no surprise that federal tax receipts have dropped 8.4% over the past year, leading to a $300 billion more on the deficit. End of September is the U.S. government fiscal year end and looks like the deficit will top $2 trillion.

And it is just not government debt that is soaring as consumer debt is also breaking records.

Equifax Canada says credit card balances hit an all-time high of $107.4 billion in the second quarter of 2023, in a sign financial stress continued to build in the face of inflation and rising interest rates. The agency says total Canadian consumer debt reached $2.4 trillion during the second quarter.

The Federal Reserve Bank of New York’s Center for Microeconomic says total Household Debt reached $17.06 Trillion in Q2 2023 and credit card debt exceeds $1 Trillion. Auto loan balances rose by $20 billion, consistent with the upward trajectory seen since 2011.

What makes these records so much worse is the high interest rate is just piling on more debt. Outstanding student loan debt in the U.S. stood at $1.57 trillion in Q2 2023 and after a Covid hiatus, these loan payments are starting up again, just as consumers are already squeezed.

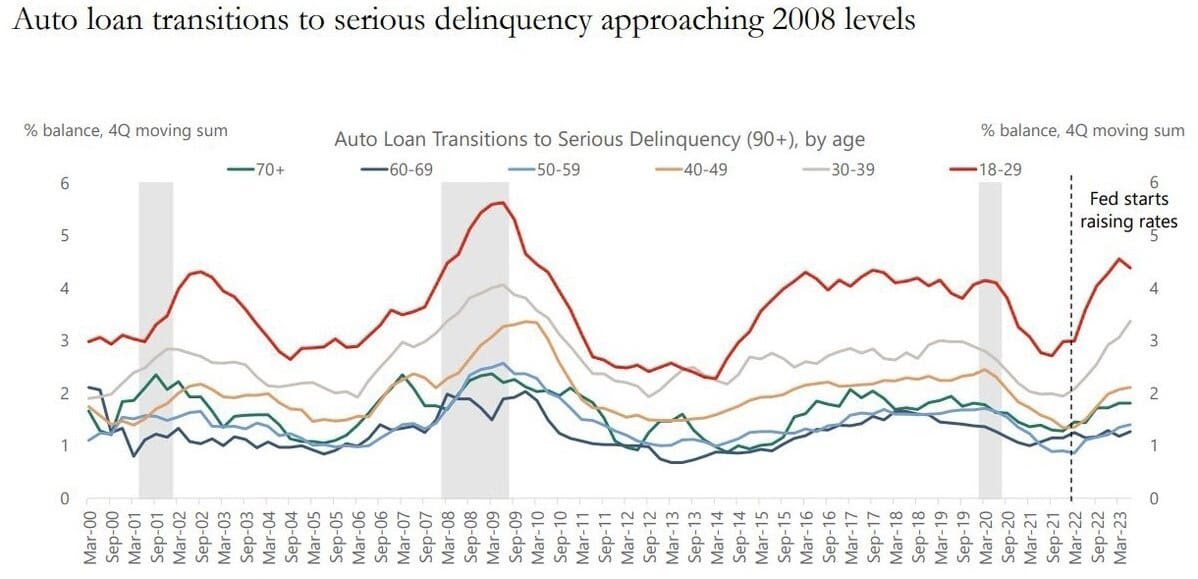

There is severe delinquency for auto-loans, the highest since 2006.

Non mortgage interest expense % of wages is highest sine 2007 at over 4%.

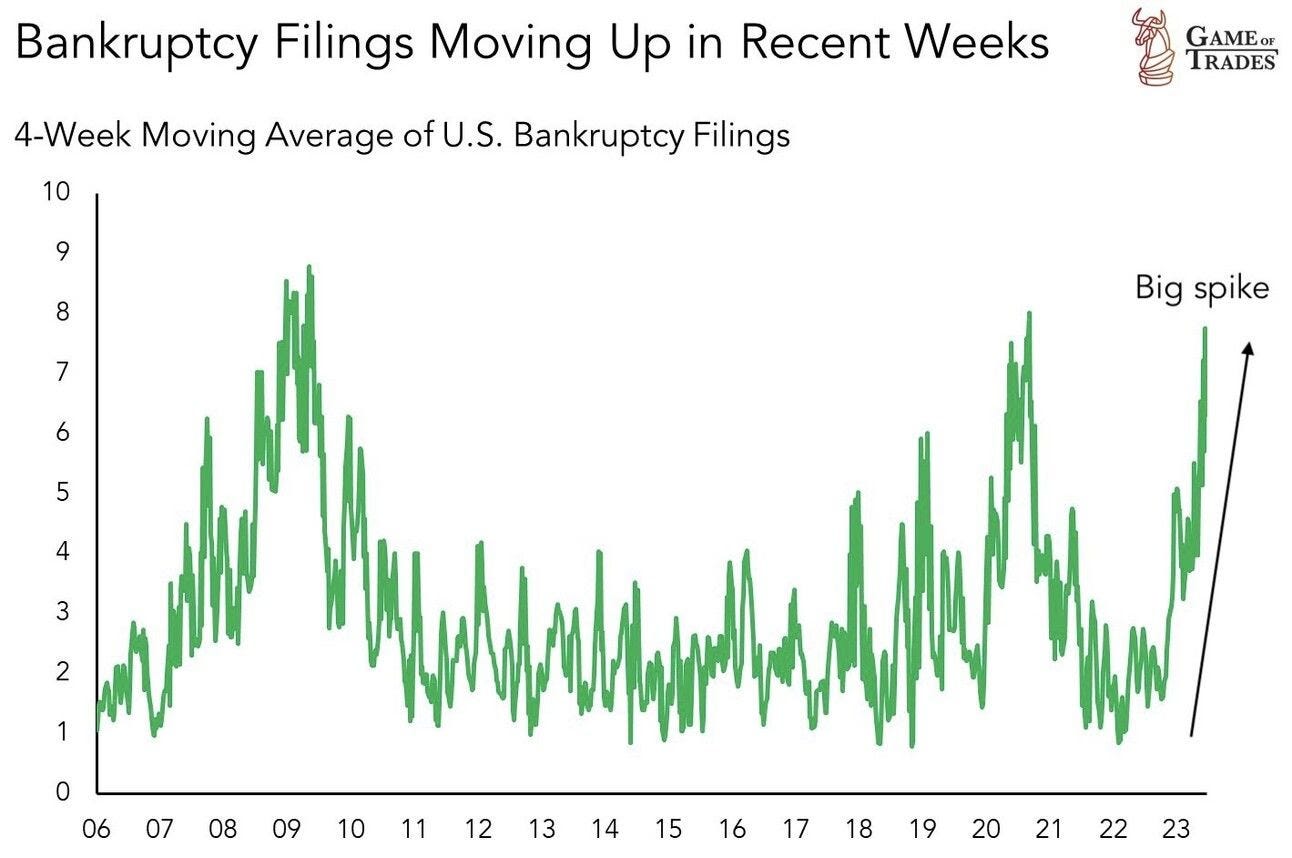

You can also see the squeeze with bankruptcy filings back to 2020 Covid highs and I have no doubt will reach the 2008 peak.

Job market not what it is reported

After my report on airlines, there was news of the top 10 worse airports in North America. Toronto came in at the 2nd worse. What is puzzling is the airport reported they got their staffing levels back to where they were in 2019 several months ago, but passenger traffic is still down more than -30% from 2019. How come the airport can't operate properly? Perhaps not enough flights and pilots.

In Canada we have ballooning record immigration, refugees and foreign students. The government says this is needed because of shortage in the labour market. However, as this chart shows from TD Bank, about 90% of temporary foreign workers are in low skill jobs.

Global news reported August 11th that despite record immigration we are losing tens of thousands of construction jobs.

According to Statistics Canada’s jobs data released on early August, the Canadian construction industry saw a loss of 45,000 jobs in July. This was a drop of 2.8 percent from the previous month. “In construction, employment decreased by 45,000 (-2.8%) in July, following a smaller decline of14,000 (-0.8%) in June. Since January 2023, employment in construction decreased by 71,000, offsetting cumulative increases of 65,000 from September 2022 to January 2023,” the latest Labour Force Survey read. The Canadian Construction Association estimates there are over 93,000 construction job vacancies in the industry that employs 1.3 million Canadians.

The Trudeau government is simply importing votes with it's immigration and refugee programs. The vast majority are low skills to no skills, competing with too many job seekers already trying to find employment. You can see the excess unemployed with hundreds lining up for entry level jobs. It is reported that Canada's unemployment level is around record lows, so why are so many lining up for entry level jobs? There are numerous photos in southern Ontario cities, here is just a couple.

Large line up at a Brampton city grocery store job fair

Canada's very loose immigration, refugee, foreign students and temporary workers is mostly bringing in low skill workers when we need higher skilled workers. This is having the same effect as a wage price spiral on inflation. No matter what skill level, all these new people require food, shelter, transportation, hospitals and schooling. It is putting extreme pressure on services and the demand is pushing prices up. Refugees are given $25,000 in the first year so creates demand. It is not like increased wages, but new or more wages that were not there the year before.

I say it is only importing Trudeau votes, because most Canadians don't know that you do NOT have to be a Canadian citizen to vote in the Federal election as of 2018. A person only has to say they are a citizen and don't have to prove it. You only need to provide two flimsy pieces of ID that show you live in the riding you are voting in. Elections Canada lists 48 peices of ID that are acceptable. For example, a library card and phone bill, or a student identity card and a public transit card. It is very loose that almost anything is accepted. And if you don't have any ID you can chose 'Option 3' just need someone who has ID and will vouch for you. As of 2015 students can vote on campus. Previously most young people were liberal voters.

Again a chart from TD Bank's report

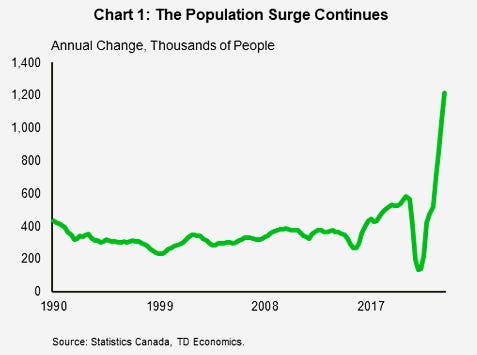

TD says “Canada’s 1.2 million population expansion over the past year is more than double the pace in 2019 and in the years that preceded it. For comparison, the U.S. population, which stands at nearly ten times the size, is estimated to have grown by a nearly comparable amount.

It has steadily lifted immigration targets, which are slated to welcome 500,000 people per year by 2025. But the bigger factor more recently has been in facilitating the entry of non-permanent residents (NPRs) in larger numbers. Of that 1+ million population influx, 60% arrived through the NPR channel. And social pressures are not limited to housing. The OECD estimated that Canada ranked 31 of 34 countries in the number of acute care hospital beds on a per capita basis in 2019. “

You may have seen the recent news of Trudeau accusing India, without presenting any evidence, of the targeted killing of Sikh extremist Hardeep Singh Nijjar on Canadian soil. For decades India has sought the cooperation of Canada and it's intelligence agencies against Khalistani separatism and the terrorists involved in targeted killings because huge numbers of them found asylum in Canada.

Many Sikhs migrating to Canada gain asylum by leveraging a loophole in Canadian immigration law, with some help from separatists in Punjab. The Khalistanis have functioned as an immigration scam at scale and of course for Trudeau's political favour. Jagmeet Singh, a partner in scam with Trudeau, is a supporter of Khalistan. He is essential to Trudeau as prime minister and leverages the Sikh population in Canada as a voting bloc to maintain support for the Liberal Party of Canada.

What is also troublesome is that I learned this Canada migration, call it that to cover all categories is set to ramp up much, much more higher. According to the Minister of Immigration, Refugees and Citzenship - In 2022, IRCC processed approximately 5.2 million applications for permanent residence, temporary residence and citizenship. That’s double the number of applications processed in 2021. There is a time lag between application and when a person or persons arrive so I have no doubt that 2023 and 2024 Canada migration levels will also be new records. I have nothing against these people but we simply cannot support such a large influx and it is going to wreak havoc on our infrastructure and economy for years to come. The problems they are causing now will only get worse.

Canada has created a new incentive to bring in foreign construction workers. If a person has 6 months on the job experience they can qualify. However, once again, the government is clueless. They will only qualify as labourers because it takes between 3 to 5 years here for a person to get their ticket (qualification) for the trades like plumbing, carpentry or electrician etc.

Inflation entrenched

I have been commenting that inflation will be quite persistent and actually go back up. The U.S. CPI (annualized) was 3.0% in June, 3.2% in July, and 3.7% in August. Some will say but wait. Core CPI (less food and energy) or super core also less housing has only gone up a little. The problem is that most Americans spend the majority of their income on food, energy and housing.

There are strikes and big wage increases in Canada that is also seeing inflation pressure from huge migration. In the U.S. their open border policy is a problem too but getting about the same numbers as Canada, it is a country 10 times bigger so can absorb that migration much easier.

Wages are on the rise in the U.S. though and the latest example is the auto sector strike. Union leaders are now asking for a 36 percent wage increase over four years, to match the similar recent pay increase for top executives. The union also wants pay to rise automatically with inflation in the future, as it did before the financial crisis. Without such cost-of-living increases, inflation causes de facto pay declines every year.

The last time I showed this chart from statista was in January, since then, wage increases have been outpacing the official inflation numbers. They have eased a bit but a couple months don't make a trend and judging by recent strike and wage agreements we are in a wage/inflation spiral.

I pointed out the lack of jobs in Canada for low skills and the numbers in the U.S. are not nearly as good as reported for two different reasons.

For 2023, the jobs print from every single month has been revised lower! That way the White House can take credit for a strong number (one which also sparks algorithmic buying in the market).

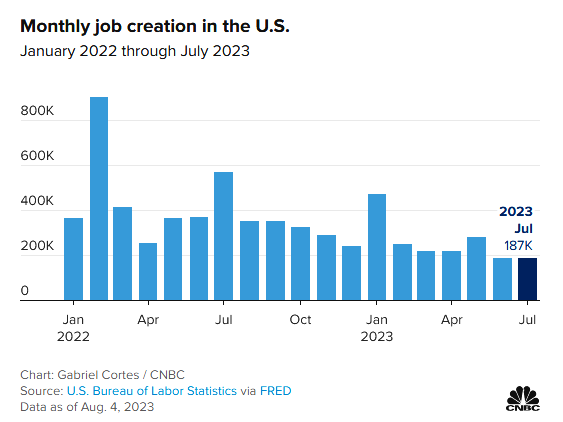

I have spoke of the Birth-Death (B-D) model many times, which is an estimate of new jobs from new business startups and which is one of the core "tweak" layers which the BLS uses to adjust the actual, raw underlying jobs numbers. For example the BLS reported that in July the number of full-time jobs plunged by 585,000 to 134.274 million, the biggest monthly drop since record covid crash of 14.7 million jobs! But they reported 187,000 jobs added, thanks to the B-D model you see on this next chart,

Do you really believe business is adding jobs when there is record bankruptcy filings? The labour department revised 500,000 jobs lower in the previous year to March 2023 and since then has consistently revised each monthly number lower.

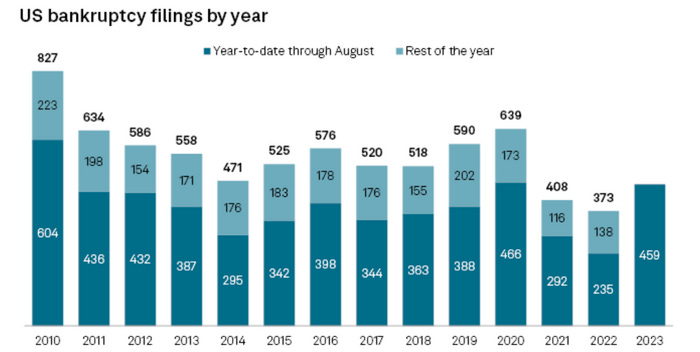

S&P Global Market Intelligence has recorded 459 filings as of Aug. 31, which compares with 373 for all of 2022 and 408 for all of 2021. That’s still well below the 639 recorded in 2020, when the pandemic forced many companies into Chapter 11, but this still 4 months to go in 2023. In August 2023 alone, some 57 companies filed for bankruptcy, among them Proterra Inc. PTRAQ, -4.74%, the Burlingame, Calif.-based maker of electric buses and trucks.

In its July jobs report — when hiring cooled to its lowest level since 2020 — the BLS revised May by 25,000, meaning it’s more likely that 281,000 jobs were added to the US economy that month rather than the 306,000 originally reported. This next chart shows revised numbers and you can compare and see that for most months, the U.S. would have lost jobs if not for the B-D adjustment. The U.S. economy could be much weaker than the main stream narrative.

The US economy grew at an annualized rate of 2.1% in the second quarter of 2023, compared to the preliminary figure of 2.4% and the first quarter's expansion of 2.0%. This chart reveals the slow growth of the U.S. economy, well below the inflation rate, hence we are in a stagflation setting.

I have been predicting a recession in the 2nd half of 2023, but the Atlanta Fed now forecast is pointing to strong growth in Q3. Consider that most construction loans are a 3 year term so we are still working off the benefit of low interest rates propelling growth, but that will continuously edge lower. Perhaps Q4 goes negative and my forecast holds true, but it is now looking more like first half of 2024. That said, Canadian GDP contracted 0.2% in Q2 so my forecast will probably hold true for Canada. For sure, Canadians face more stagflation than Americans.

Stay tuned for Part II tomorrow on real estate bubbles, markets and bonds.

I know this is not good news, but investors need to prepare for another bear market.