Part 2 - High debt, Stagflation, Bubbles, No Soft Landing

Welcome and thank you to the new savvy and contrarian investors who have joined my substack. Please share with your friends and family as this will be free to evaluate for some time.

In Part 1 of this topic, I focused on the high debt, factors affecting labour markets that are pushing a wage/price spiral and we have entered a period of Stagflation. Part 2 is on the housing bubble and markets. I wrote this Sept 25/26th so some parts a little dated.

Housing Bubble

Housing affordability is becoming a problem in the U.S. and is transforming the market in ways that could be difficult for homebuyers and homebuilders alike. The latest report saw housing starts plunge by 11.3% month over month in August to 1.283M, marking the lowest level since June 2020. On a Y/Y basis, housing starts fell a further 14.8%, and well below the 1.435M units expected by economists.

Mortgage rates have jumped from 3.9% pre-pandemic to over 7% now, driving housing affordability to rock-bottom levels and suppressing demand. Mortgage applications for home purchases have sunk to mid-1990s levels.

Add in the fact that homeowners are reluctant to list because taking on a new mortgage at today's high rates is a non-starter for many. With demand already low, the scant supply is pushing prices higher.

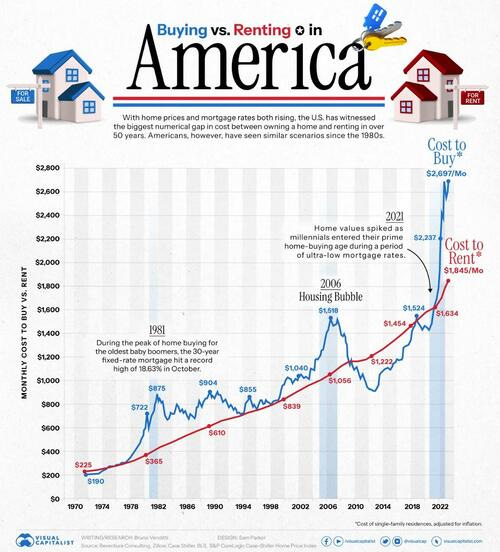

Compared to rent, the cost to buy has skyrocketed. When this happened in the past, 1981 and 2008 it was followed by a severe drop in house prices. This will happen again.

This lack of supply is great news for a company like Greenbriar TSXV:GRB with a U.S. housing project but the Canadian housing bubble is much more severe. Canada's big banks have been putting off the day of reckoning by extending amortization rates beyond the 30 year allowed limit. However these must be set to 30 years or less on the mortgage renewal date. The CMHC will not insure a mortgage with more than a 25 year amortization. For example if your 5 year variable rate mortgage is due for renewal, next year at this time, the banks have been extending the amortization period.

Victor Tran, mortgage and real estate expert at Ratesdotca, said in a recent interview with BNN Bloomberg that since the Bank of Canada began raising interest rates in March of 2022, some of his clients have drastically extended the amortization for their mortgages. “I’ve had many clients with amortizations, that are 70, 80, even 90 years remaining, in the extreme cases, and that's simply because their payments are not going towards any principle at all,” he said.

For the past year or so, Tran said homeowners have been able to stay in their homes while paying only the interest on their mortgage and avoiding the impacts of higher payments. However, he said this is only a temporary solution.

The big Canadian banks know this and are preparing for a meltdown. They set aside $3.5 billion in loan loss provisions in Q2 alone. They have been doing this for several quarters now and is why their earnings are dropping. This has not saw a peak yet.

An analyst who describes Canada as sitting on one of "the largest housing bubbles of all time" warns that if it bursts, the country could be thrown into a deeper recession than forecasted. "I wouldn't necessarily say it's imminent," Phillip Colmar, partner at Global Strategist at MRB Partners, told CTV News Channel. "I would say it's pretty inevitable."

Another factor that will come home to roost is over 1/3 of Canadian housing is bought by investors, especially new construction. The historic jump in borrowing costs is burning Canadian investors who entered contracts years ago to purchase properties directly from developers before they were built. For now the price has gone up for those that bought a few tears ago to help offset the mortgage rate increase.

The government has done nothing to address the housing shortage other than some recent lip service. In contrast their policies of high immigration and implementing a tax free home savings plan are basically adding to the demand side and trying to prop up the bubble.

There is no more air for the housing bubble but no pin prick either (yet).

Home prices are falling across the country, with average home prices taking a dip in seven provinces in August compared to the previous month. The national average home price in August 2023 was $650,140, a 3% decrease from last month and up by 2% year-over-year. Ontario, Canada’s largest housing market is on the edge of breaking even this month, as Ontario home prices hover around the same level as last year. The average home price in Ontario was $832,376 in August 2023, a 2.8% decrease since last month and 0.3% increase from last year.

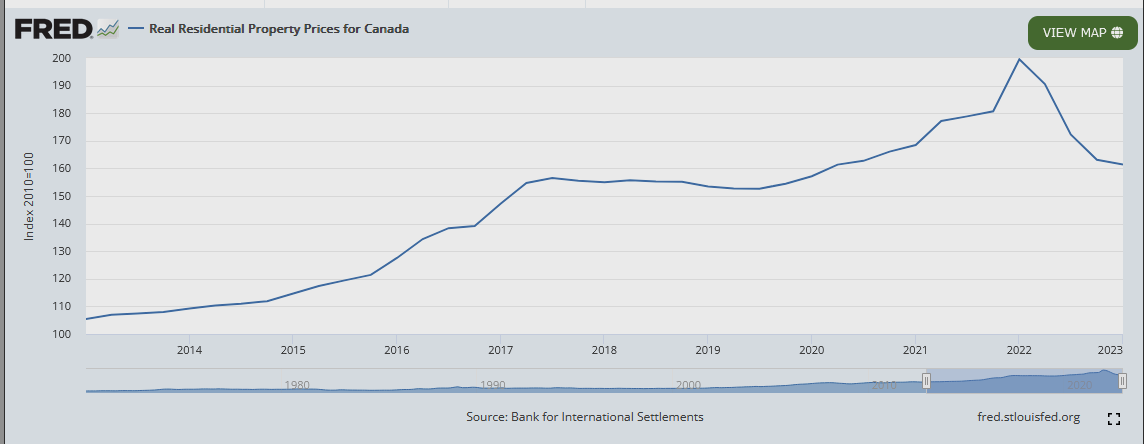

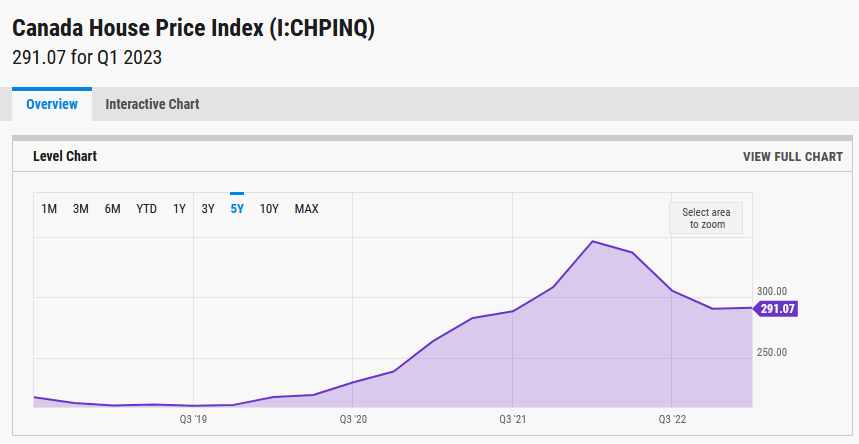

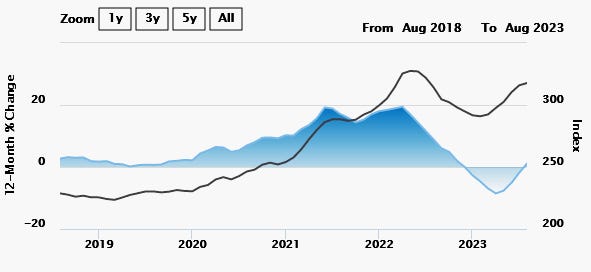

I started warning about the Canadian Real estate bubble in late 2021 and early 2022. In an April 2022 newsletter, I commented that the peak was in. The Fed chart shows the peak in Q1 2022 and the same with ycharts. In hindsight I can safely say my prediction was very accurate. That said, after prices came down in 2022, they levelled off in 2023 and even edged up slightly, but basically it has been flat. I strongly believe this is just a rest before the next leg down. What most don't realize is house prices are set at the margin. If there is one distressed sell in your neighbourhood, it becomes the new price for that neighbourhood.

Real estate is all about location, so you can find data on specific cities at Teranet-National Bank Composite. The Teranet-National Bank Composite Home Price Index™ (covers Canada's top 11 cities) rose by 1.1% from August 2022 to August 2023, the first annual increase in nine months. Gains were observed in 5 of the 11 cities making up the composite index in August.

I have been warning about Canadian commercial real estate with a louder bell and it has been crashing to new lows taking out the lock down lows of 2020. Here are charts of two Canadian Office building REITs, TNT.UN and SOT.UN.

Many of these commercial REITs will go under because they have 50% to 60% of the value of their properties mortgaged so payments have increased with rising rates and in time the value of these properties will fall below the mortgage amount.

And a brief update on the Chinese popping real estate bubble. Evergrande's shares dropped 25% on Monday (Sept 25th) after postponing a crucial debt meeting. Their subsidiary Hengda Real Estate is being investigated for potential information disclosure violations, has further shaken investor confidence. Hengda's unpaid debts have reached $38 billion, with nearly 2,000 pending lawsuits.

Despite all the negative developments I see coming, the markets are still mostly buying the 'soft landing' scenario. Like I have said a number of times, the Fed rarely gets it right so I will end with this chart of the S&P 500 with a near term target around 4,200. I have warned that September and October can be among the worse months in the stock markets and they are holding up their reputation.

This chart is September 25th when I first wrote this, so no surprise that market has gone lower and as of Wednesday Oct 4th, at 4240 is getting closer to my 4200 target.

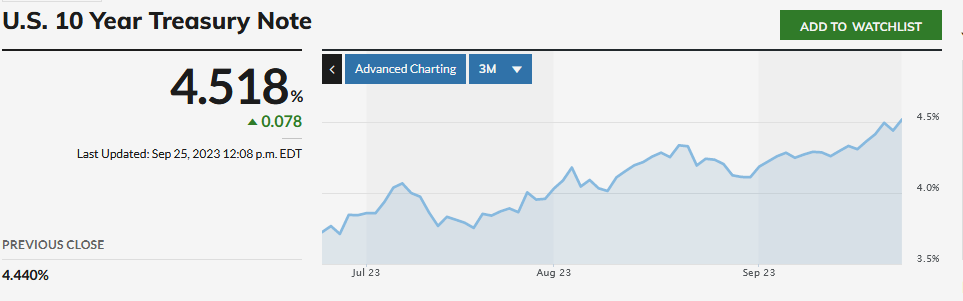

We have a potential head and shoulders topping pattern and the market has just broke to new lows since the late July peak. I see a test of 4,200 a pretty sure bet. The biggest negative factor is the rising bond yields as they grapple with rising inflation and out of control government debt. The day of reckoning is arriving. The 10 year treasury bond hit new highs Monday Sept 25, above 4.5%, going back to September 2007 and we know what soon followed that. Also no surprise that the yields have gone higher since this chart, hitting 4.8%

You may consider the ADVISORSHARES TRUST RANGER EQUITY BEAR ETF I have on the selection list

NY:HDGE - - - - - Recent Price - $24.45 Again chart from Sept 25th

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.