Playstocks Mid Day Market Report, Economic Data and Top Gainers

As part of my new website I decided to hire a new editor to do daily market updates. Here is the first one – These will not be uploaded on my website but on my Substack

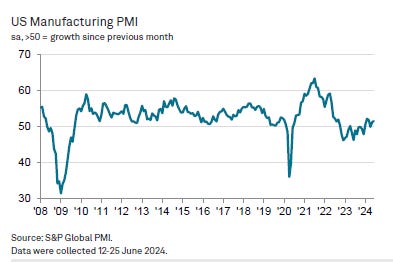

The seasonally adjusted S&P Global US Manufacturing Purchasing Managers’ Index™ (PMI®) ticked up to a three-month high of 51.6 in June from 51.3 in May. The index signalled on Monday, a modest monthly improvement in business conditions. Still not much above 50, where below 50 is considered contraction. The US manufacturing sector remained in growth territory at the end of the second quarter of the year. Although client demand remained muted and business confidence hit a 19-month low, new orders rose for a second month running.

On Monday, a key barometer of U.S. factories fell in June for the third month in a row, signalling that an ongoing slump in the industrial side of the economy shows no sign of ending. The Institute for Supply Management’s manufacturing index slipped to 48.5% in June from 48.7% in the prior month. Numbers below 50% signal that the manufacturing sector is shrinking.

“The manufacturing economy still appears to be stalled,” said Timothy Fiore, chairman of the ISM Manufacturing Business Committee.

Today, U.S. job openings rose slightly to 8.1 million in May despite the impact of higher interest rates intended to cool the labour market. Vacancies rose from a revised 7.9 million in April, the first reading below 8 million since February 2021, the Labour Department reported April openings were marked down from an originally reported 8.1 million.

Layoffs rose to 1.65 million in May from 1.54 million in April. The number of Americans quitting their jobs — a sign of confidence in their prospects — was basically unchanged.

ISM Services, trade deficit, factory orders and jobless claim on Wednesday while ending the week with the jobs report.

Today’s Top Gainers As of 12PM NOON

Ocean Power Technologies Inc (OPTT) +82.11%

Ocean Power Technologies Inc. (OPTT) stands at the forefront of renewable energy innovation, harnessing the power of the ocean to generate sustainable electricity. With increasing global emphasis on reducing carbon footprints, OPTT's cutting-edge wave energy conversion technology is poised to disrupt traditional energy markets. Their recent advancements in PowerBuoy systems, which provide reliable and continuous energy, position OPTT as a leader in the renewable sector. The company's strategic partnerships and expansion into offshore data and communication solutions further bolster its market potential. As governments worldwide continue to incentivize green energy, OPTT's growth trajectory looks promising, making it an attractive investment for those seeking long-term gains in sustainable technology.

Roadzen Inc (RDZN) +75.75%

Roadzen Inc. (RDZN) is revolutionizing the insurance and automotive industries through its innovative AI-driven technology. As a pioneer in leveraging artificial intelligence for risk assessment and claims management, Roadzen enhances efficiency and accuracy, driving significant cost savings for insurers. The company's expansion into telematics and connected car solutions positions it as a key player in the evolving mobility landscape. With the global automotive market increasingly embracing digital transformation, Roadzen's robust platform is well-positioned for rapid growth. Investors can expect substantial returns as the company continues to scale its operations and forge strategic alliances with major industry players.

SYLA Technologies Co Ltd ADR (SYT) +56.58%

SYLA Technologies Co Ltd (SYT) is at the cutting edge of semiconductor innovation, a sector critical to the advancement of numerous high-tech industries. With a strong focus on developing next-generation materials and components, SYT is well-positioned to capitalize on the growing demand for faster and more efficient electronic devices. The company's recent breakthroughs in nanotechnology and quantum computing components highlight its leadership in the field. As global reliance on semiconductors intensifies, SYT's advanced research and development capabilities make it a compelling investment opportunity, promising robust growth and significant market share expansion.

Versus Systems Inc (VS) +42.06%

Versus Systems Inc. (VS) is transforming the gaming and entertainment industries through its unique rewards-based interactive platform. By integrating real-time rewards into digital experiences, Versus Systems enhances user engagement and retention. The company's partnerships with major gaming studios and entertainment platforms underscore its innovative edge and market potential. As the gaming industry continues to expand, driven by increasing global engagement and technological advancements, Versus Systems stands out as a key player poised for substantial growth. Investors can anticipate strong returns as the company scales its operations and leverages its cutting-edge technology to capture a larger market share.

Zapp Electric Vehicles Group Ltd (ZAPP) +39.43%

Zapp Electric Vehicles Group Ltd (ZAPP) is at the forefront of the electric vehicle revolution, designing and manufacturing high-performance electric scooters. With a strong focus on sustainability and innovation, Zapp is addressing the growing global demand for eco-friendly transportation solutions. The company's state-of-the-art technology and sleek, user-friendly designs appeal to a broad consumer base, positioning it for rapid market penetration. As urbanization and environmental awareness drive the shift towards electric vehicles, Zapp's commitment to excellence and strategic market positioning make it a promising investment. Investors can expect significant growth as Zapp scales its production capabilities and expands its footprint in key markets worldwide.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.