Playstocks Mid Day Market Report - Jobs Report, Oil Rocking Again

Four top performing Oil Stocks

The big news today is of course the nonfarm payrolls report that increased by 206,000 jobs for the month of June. Data for May was revised sharply down to show 218,000 jobs added instead of the previously reported 272,000.

The 206,000 gain in non-farm payrolls beat the consensus at 190,000, this was more broadly a disappointing report when we factor in the 111,000 downward revision to past months and the further rise in the unemployment rate to 4.1%, which puts us one step closer to triggering the Sahm rule on recessions. According to the Sahm Rule, the early stages of a recession is signalled when the three-month moving average of the U.S. unemployment rate is half a percentage point or more above the lowest three-month moving average unemployment rate over the previous 12 months.

I don't follow that indicator much, especially when we have so much data manipulation. The BLS has been heavily padding job numbers with the Death/Birth rate model. This is where the bureau guesstimates the number of jobs created by newly formed business along with job losses from failed business. In April a whopping 363,000 jobs were created by the model and 231,000 in May, higher than the total number of jobs reported. They only guesstimated 59,000 in this June report, but without this the number, it would have been 147,000. With today's report they painted the perfect Goldilocks narrative, not too hot and not too cold, maybe just right for a September rate cut.

My comments on the plunge in oil to an early June bottom, was probably market intervention. The quick strong rebound makes it look more so.

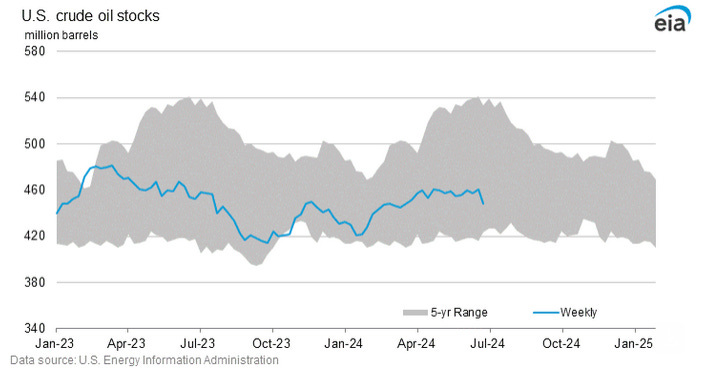

Not much has changed with fundamentals other than things that were blamed for the bearish sentiment and now causing the bullish sentiment. There was a drop in inventories but it was nothing huge.

Probably the biggest factor that is something new is that the 2nd hurricane of the year, Beryl has entered the gulf. It wreaked havoc to Jamaica and is expected to shift northwards and reach the Texas coast early next week. However it is not expected to damage US Gulf platforms as Beryl already weakened to a Category 2 hurricane. Occasionally they pick up strength again over water, so we will see.

Many Investors are missing big gains with oil&gas stocks.

Shell PLC (SHEL). Shell is taking up to a $2 billion impairment charge selling their Singapore refinery to Glencore, but it was no surprise to the market. The stock just touched $74, very close to it's yearly high. Shell PLC stands as a colossus in the global energy market, with a robust integrated portfolio encompassing oil, gas, and renewable energy. The company’s strategic pivot towards renewable energy and decarbonization positions it uniquely for future growth. Shell’s substantial investments in hydrogen, electric vehicle charging infrastructure, and biofuels illustrate its commitment to leading the energy transition. Additionally, its strong cash flow generation from upstream and downstream operations ensures ample liquidity to fund these initiatives and deliver consistent shareholder returns. Shell's diverse energy mix and resilience in navigating market fluctuations make it an attractive long-term investment. SHEL has been consistently buying stock back and the 5% yield from our $52.50 price is why it is in my Millennium Index.

Targa Resources (TRGP), Targa Resources is a key player in the North American midstream sector, specializing in natural gas and natural gas liquids (NGL) infrastructure. The company's extensive network of pipelines, processing plants, and storage facilities underpins its strong market position. Targa's strategic focus on high-growth areas like the Permian Basin, coupled with its efficient operational model, ensures robust earnings and cash flow. The company’s disciplined capital allocation and strong balance sheet provide a solid foundation for future expansion and shareholder returns. With increasing natural gas demand and favourable industry dynamics, Targa is well-positioned for sustained growth. The stock just went to 9 year highs above $132 and is way up from $117 when oil bottomed in June.

Suncor Energy (SU). Suncor Energy, a leading integrated energy company in Canada, offers a compelling investment opportunity due to its diversified operations across oil sands, refining, and renewable energy. Suncor's commitment to operational excellence and cost management enhances its profitability even in volatile market conditions. The company’s significant investments in sustainability and technology aim to reduce its carbon footprint and increase efficiency. Suncor's strong cash flow generation supports a competitive dividend yield and ongoing investments in growth projects. As global energy demand recovers, Suncor’s strategic positioning and resilient business model make it a promising investment. The stock at $38 is not far off from testing and perhaps breaking significant resistance around $42.

Diamondback Energy (FANG). Diamondback Energy is a premier player in the U.S. shale oil industry, renowned for its low-cost operations and significant presence in the prolific Permian Basin. A very good symbol as it is acting like a FANG stock. At $204 it is up from $30 four years ago and $150 in February this year. The company’s focus on efficient capital deployment and cost reduction has resulted in industry-leading margins and robust free cash flow. Diamondback’s strategic acquisitions and organic growth initiatives enhance its resource base and production capabilities. The company’s commitment to shareholder value is evident through its consistent dividend payouts and share buyback programs. With a strong balance sheet and a strategic focus on sustainable growth, Diamondback Energy is poised for continued success amid favourable oil market conditions.

Everyone should have oil&gas stocks in their portfolio, they will be around a long time and many will benefit from the energy transition whether it fails or succeeds.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.