I am certain that we are now living in very different and challenging times. The Toronto Maple Leafs won their first playoff series in 19 years. The hockey gods have come down to help them as their winning goal bounced off a skate and their old nemesis, the Boston Bruins who they would have met next got put out in 7 games. Can the Leafs win another series? We live in strange times.

According to Eric Sprott and if you believe in AI, ChatGDP recommends 20% of your portfolio in Gold.

Tamara Lynch, an indigenous woman who became the whipping girl of Canada's government and media because she was an organizer of the truckers convoy, just released her book. It became number one seller on Amazon Canada in it's first day. At it's peak the trucker convoy was 100 kms long, oh just a fringe minority, Trudeau would say. It was the biggest news story for Canada in 2022.

You can watch a 41 minute interview with her at Rebel news. It is a good interview, but at least watch to the 11 minute mark and you will know why, you will never hear her view anywhere else. And anyone that did not go to the convoy protest and investigate does not know what really happened.

You won't find Tamara's book in Chapters/Indigo, even though it's the best-selling book in Canada, even bigger than Prince Harry's autobiography. But if you click here or go to www.TheConvoyBook.com, you can get a copy shipped directly to your home.

Recession Watch

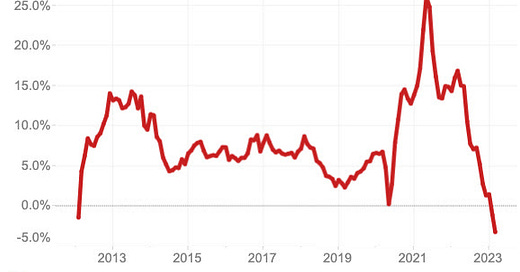

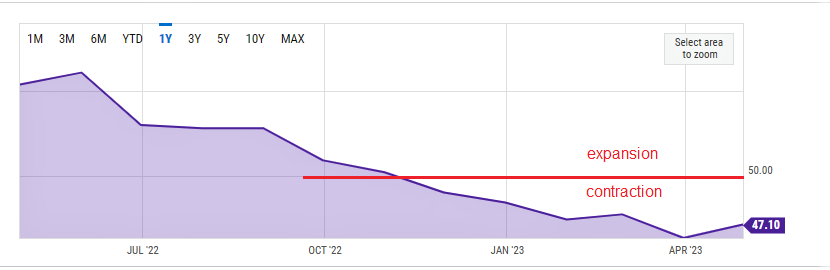

Despite rising from a 3-year low (46.3) to 47.1, US factory activity contracted in April for the sixth straight month and down from 55.40 one year ago. That’s the longest stretch of sub-50 readings for the ISM’s purchasing managers index since 2009. Further details of the report revealed that the Employment Index advanced to 50.2 from 46.9 and the New Order Index improved slightly to 45.7 from 44.3. Finally, and not so good news, the Price Paid Index, the input inflation component, jumped to 53.2 from 49.2.

The US economy expanded at a slower pace than expected in the first quarter with GDP rising just 1.1%. Meanwhile, the personal consumption expenditures index—the Fed’s preferred measure of inflation—increased by 4.2% (from 3.9% in Q4), well above the central bank’s 2% target. Core PCE rose 4.6%. More than 40% of the index’s components are still rising between 5-10%. Can you say 'stagflation'.

Housing teetering (still looks like the Coyote hanging in mid air after running off the cliff.)

US mortgage rates increased by the most in 2 months two weeks ago, rising to 6.43%. Demand for mortgage applications fell 10% from the previous week, the biggest drop since February. The new Redfin report reveals median US home sale prices experienced their biggest YoY drop since 2012, falling 3.3% in March from a year earlier.

In Canada The Office of the Superintendent of Financial Institutions is scrutinizing the risks that spiking monthly payments could pose to some borrowers who have variable-rate mortgages. The OSFI cited the possibility of a housing market downturn as the top risk it is watching in the year ahead in its annual outlook. Superintendent Peter Routledge said the OSFI is preparing for "sustained weakness" in housing markets through the rest of 2023.

Variable-rate loans were popular among borrowers in recent years, but as interest rates have jumped higher and payments stayed fixed, the amortization periods to pay off those loans have stretched longer, with about 1/3 of them beyond 30 years. When those mortgages come up for renewal, lenders typically reset amortization periods to their original terms. Are they going to rewrite the rules or will payments see large increases?

The OSFC is warning that although extensions to mortgage payment periods have helped borrowers absorb surging costs, the fix is short term and will keep them in debt for longer, threatening both their financial stability and that of the banking system. OSFC said higher costs of borrowing and a potential recession could deal a blow to already stretched homeowners and spur defaults. "The growth in highly leveraged borrowers increases the risk of weaker credit performance,"

The banking crisis is not near over yet!

The collapse of First Republic Bank on Monday left it under control of the U.S. government, which quickly sold the bank to JPMorgan Chase. JPMorgan Chase, the nation's largest bank, retained the majority of First Republic's assets and all of its deposits, JPMorgan Chase said on Monday. In turn, the deal fully protects depositors at First Republic, who immediately became customers of JPMorgan Chase.

JPMorgan CEO Jamie Dimon told listeners on an investor call this morning that "The system is very, very sound." Well it does not look that way to me, I guess if you are benefiting from the collapse, it is sound for you. To achieve the rescue, a federal agency provided $50 billion in financing to JPMorgan Chase, setting off questions about whether the government had orchestrated a bank bailout.

When First Republic’s investment strategy began backfiring, depositors started to pull out their money in large numbers — a classic bank run. By last week, First Republic revealed that customers had withdrawn more than half of the bank’s deposits.

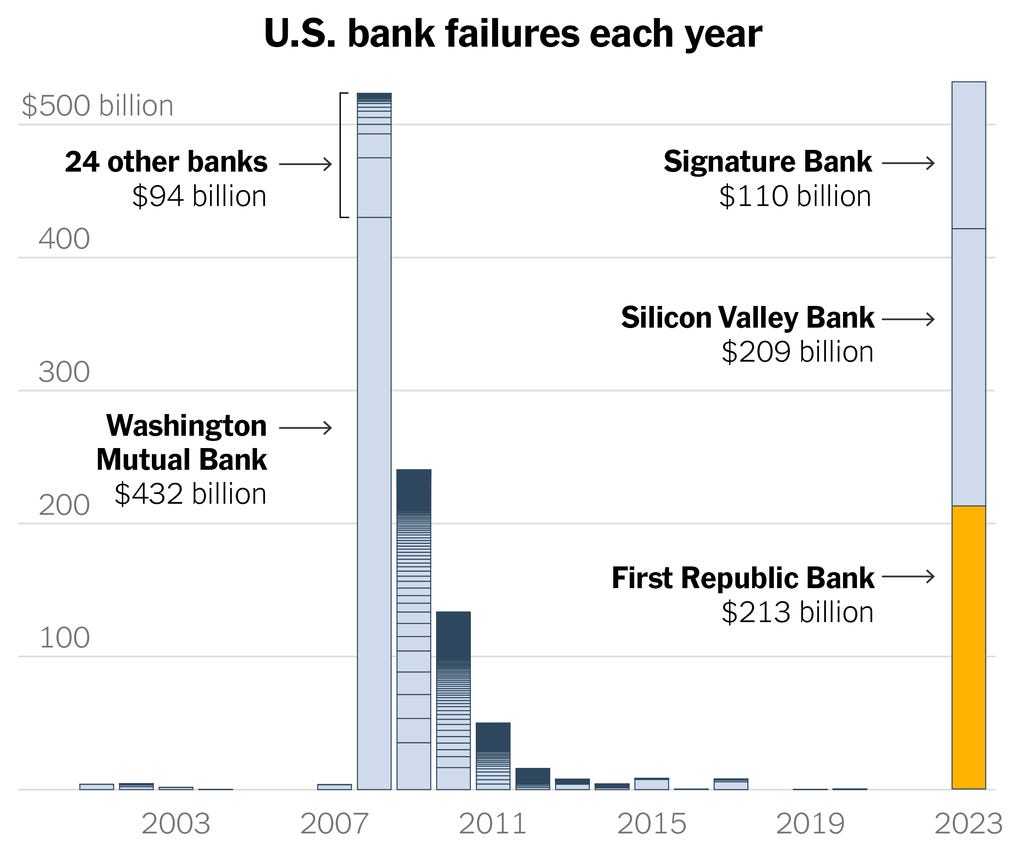

A very nice chart in the NY Times today. These numbers are adjusted for inflation and it is easy to see that the $$ amount of these first failures has already reached the level of the 2008 crisis and there is still 7 months left in 2023 to go. However, in 2008 there were also many failures other than banks.

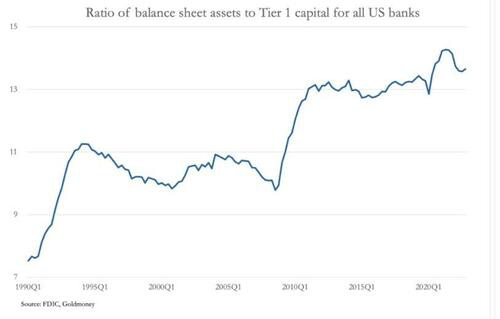

In the US, the balance sheets for all banks to Tier 1 capital is at a 30 year high. (See chart below). This is a precarious level which puts the US banking system in a very fragile position. US banks must now shrink their balance sheets substantially by demanding loan repayments. It is obvious that it will be primarily bank debt that sees further collapse. It means that credit will be expensive but also be scarce. This will lead to major defaults by borrowers and solvency pressures for the banks. And on top of that there is a big hammer to drop in the Commercial Real Estate space.

Covid-19 lock down policies emptied the office and it will never come back. Companies learned how to operate remotely with the at home office and Zoom etc.

Commercial real estate in down town cores is very bleak. For example in Vancouver “Total vacant sublease space downtown reached 722,000 square feet, the highest number recorded in 30 years due to an uptick in large and full-floor spaces given back by major tenants downtown,” CBRE said in its most recent office real estate report.

Despite an office vacancy rate that is nearing an 18-year high, downtown Vancouver has done better than peers in having tenants fill space. “Vancouver’s office-vacancy rate is among the lowest in North America,” said GWL Realty Advisors’ vice-president of research and strategy, Wendy Waters. She pointed to CBRE data that calculated Calgary’s downtown office-vacancy rate at 32.6% – marginally higher than the 32% vacancy rate in the downtown Dallas-Fort Worth area. Only 43% are back to the office in Washington.

The latest headline fuelling concerns about a potential CRE crisis involves a fund belonging to CRE giant Brookfield defaulting on a $161.4 million mortgage for twelve office buildings in Washington, DC. Brookfield has also defaulted on debt tied to two Los Angeles buildings, the Gas Company Tower and the 777 Tower.

The US commercial real estate (CRE) market has $1.5 trillion in front-loaded debt coming due before the end of 2025. The looming maturity wall is raising concerns over the ability of small and regional banks—who have been rocked by massive deposit outflows over the past month—to provide financing to borrowers as declining property values add to refinancing risks. This is another ticking time bomb!

I have no doubt, there will be many more bank failures and is an investment sector to avoid. The Fed is still expected to raise another 1/4 point tomorrow.

And one more dig at Canadian banks. TD Bank's High Interest Savings Account, which is shown on TD's website as offering an interest rate of "0.000 per cent" on balances below $5,000 and 0.05 per cent on higher amounts. What a joke!!

While markets have rallied some, it is not very healthy and very poor breadth. In fact, the top 10 stocks have accounted for 86% of the S&P 500’s returns YTD. Markets are down today and it looks close enough on the S&P 500 chart for a test of 4200. A double top in this bear rally?

Gold has continued to trade in my expected trading range of around $1980 to $2060, with June Comex currently at $2025. One junior gold explorer I follow had some very good drill news that moved the stock.

Aztec Minerals - - - TSXV:AZT - - - - OTC:AZZTF- - - - - Recent Price - $0.31

Entry Price - $0.40 - - - - - - - - - - Opinion – buy

Aztec reported the results from the first drill hole of its continuing 2023 core drilling program at the Tombstone project in southeastern Arizona. The first hole, TC23-01 is part of a 10-hole program that is being drilled in a fan-grid pattern over the length of the Contention open pit. Bonanza-grade silver was encountered in oxidized, altered silty limestones and Qfp dike at 126.5 metres (m) to 128 m with 3,477 grams per tonne (g/t) silver and 0.115 g/t gold (3,485.1 g/t silver equivalent (AgEq)) over 1.52 m, within a zone of 7.65 m with 733.92 g/t silver and 0.524 g/t gold (770.6 g/t AgEq) from 125 to 132.6 m.

Hole TC23-01 also returned a broad intersection of 0.58 g/t gold and 72.19 g/t silver (1.63 g/t gold equivalent (AuEq) using an 80:1 silver:gold ratio) over 125.0 metres.

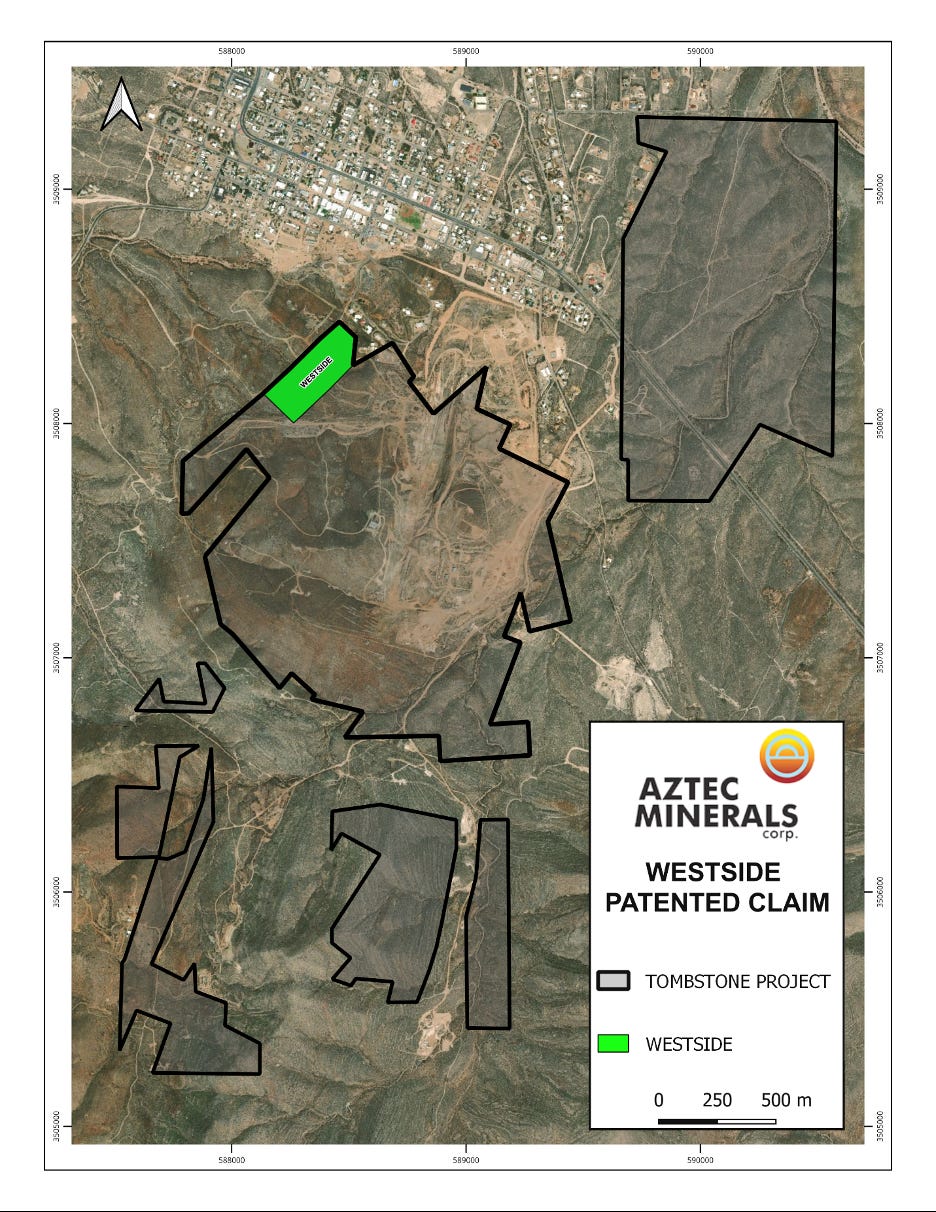

Aztec and Dragoon Resources LLC ("Tombstone JV Partner") announce the acquisition of one patented claim (private property rights) amounting to 7.82 hectares (19.33 acres), increasing the overall Tombstone Joint Venture (75% Aztec) land package to 452.02 hectares (1,116.94 acres). Aztec and Dragoon have acquired the Westside patented claim from a third-party for cash consideration of US$65,000.

The Westside claim covers several historic mine shafts, and prospects. Its main shaft had adjacent exploitation by underground workings with a vertical extent over 240 meters in depth. The West Side claim has the majority of the northeast striking Westside fissure-vein system. The claim covers on strike the Westside fissure for 450 meters with its oxidized, mesothermal quartz-gossan silver-gold mineralization. The Westside claim also has oxidized CRD replacement style, silver-lead-gold-copper mineralization hosted in the Westside roll (anticline) which continues into the Tombstone project for a total of a 650 meter long, southeasterly trend.

The stock moved on the news and has come back down to an attractive buy level again.

Talarus Therapeutics . . . . . . . NASDAQ:TALS . . . . . . . Recent Price - $2.74

Entry Price $2.20 . . . . . . . . Opinion – hold, buy on weakness around $2.50

The stock has had a nice run higher and has pulled back with the market correction today. I would be a buyer on further weakness to around $2.50.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication