I have been getting several questions about what is happening with ReconAfrica and where I expect the stock to go. I also believe it is good timing to buy Zefiro if you have not already done so.

Recon Africa - - - TSXV:RECO - - OTC:RECAF - - - Recent Price -C$1.75

Entry Price - $0.56 - - - - - - - - Opinion – hold, buy

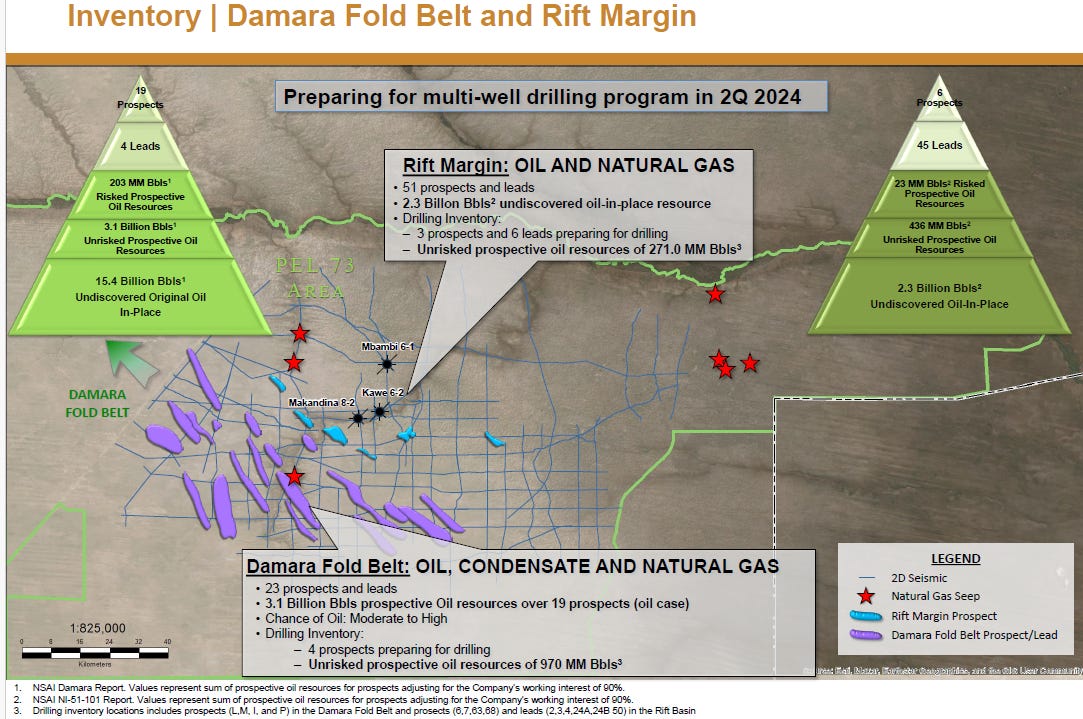

I updated RECO a number of times in late 2023 and earlier this year to buy when the stock was down around $1.00 with my latest update to buy at $1.20 on May 24.. They spud the first of 3 exploration wells on the Damara Fold Belt on July 7. The black splats show location of the 3 wells. I have gone over all the technical data and odds look very strong for a discovery.

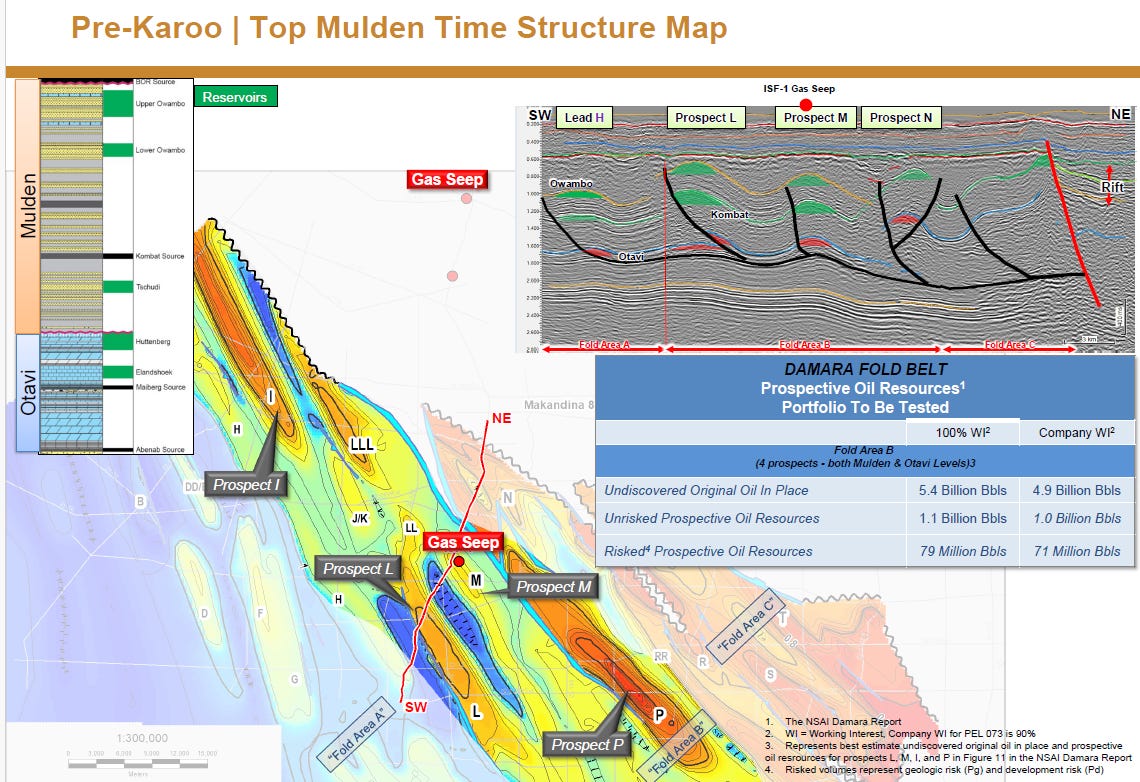

The next graphic is the structure map and this first well will test multiple potential oil bearing intervals on Prospect 'L'. The 2nd well will test Prospect 'P'. This first exploration well is targeting 163 million barrels of unrisked prospective oil resources, or 843 billion cubic feet of unrisked prospective natural gas resources, based on the most-recent prospective resources report prepared by Netherland, Sewell & Associates Inc. (NSAI) dated March 12, 2024, and available on the company's website. The well is expected to drill to a depth of approximately 12,500 feet, or 3,800 metres, and is projected to encounter four primary reservoir intervals targeting both oil and natural gas. Drilling is expected to take approximately 90 days and will include three sets of logging operations, coring and reservoir testing.

Recon Africa has their own drill rig which reduces costs by about 50% and gives them total flexibility on scheduling. They have done a lot of seismic and preliminary work in the last 2 years to de-risk these drill locations as much as possible. I am very optimistic they will make a discovery with these next 3 wells. Maybe more than one discovery.

The potential here is enormous and in the past I have commented that this could be another Ultra Petroleum for us where the stock went up 14,200%. Yes not a typo but a 142 times bagger. There are numerous $billion oil& gas companies focusing on the well known Permian basin. What RECO owns is like having the whole Permian basin to themselves.

I have been commenting that I expect the stock will fill the gap on the chart. In mid June it broke first resistance and made a higher high. I expect the stock can easily go over $2.00 and then fill the gap between $2.40 and $3.60. It has potential to go way higher on a discovery and/or on earn in partner agreement. The stock is about 80% in the hands of institutions so will be driven by that unless retail get interested again. Continue to hold the stock and if you don't own any, it is still a good buy here.

With the move higher in the stock, ReconAfrica announced this morning proceeds of approximately $1.9 million from the exercise of warrants. There was about 1.1 million $0.50 warrants with an August 30, 2024 expiry so I imagine these were all exercised. Most other warrants in the money don’t expire until 2025 but could bring in about $35 million.

Zefiro Methane - - - CBOE:ZEFI - - - - - Recent Price - $1.77

Entry Price - $1.70 - - - - - - - Opinion – strong buy

The stock made new highs on Friday and it could be a sign of it's first move higher. On July 2nd another JP Morgan exec joined the company.

ZEFI appointed Mohit Gupta as chief financial officer. Mr. Gupta has over three decades of banking and energy trading sector experience, most notably as one of the key founding members of J.P. Morgan's energy trading business. Mr. Gupta has also held senior executive roles with Ernst & Young and Wells Fargo.

Mr. Gupta commented: "While countless impressive new ventures have come and gone throughout my 30 years in energy trading, having the chance to help bolster Zefiro's comprehensive service model was a unique opportunity that I could not pass up. This forward-thinking senior leadership team has identified and capitalized upon a critical sector demand while addressing one of the most urgent global challenges, and I cannot wait to work with my new colleagues to expand Zefiro's service offerings to a growing, diverse customer base."

The company provided a video of their subsidiary Plants & Goodwin, Inc. It is very good and well worth watching. (“P&G”) has been featured in an episode of Future Earth , a new informational series by the British broadcasting conglomerate BBC, through its BBC News arm. In this third episode of the Future Earth series.

Only people in the UK can view this but the video is on youtube here. News will get out on this under the radar company and I expect it will go a lot higher. The trading history is short but you can see the new high on this chart.

#oil #methane

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

It should be a good time to buy RECO. In the past drilling news usually drove the price of oil companies up. Missed out on the run to $11 but there seems to be oil in the area and a hit would likely be big.