S&P Double Top, Economy, Oil, Short Broadcom AVGO, CXB, AZT, Bitcoin down

Welcome and thank you to all the new, smart, savvy and contrarian investors to my substack. If you like outside the box thinking, a humble analyst that has spent his career studying market and economic cycles, picked numerous tops and bottoms, someone not afraid of controversial topics and can be a bull and a bear, your at the right place. Please share and subscribe.

I have been warning on a potential downward market shift in September and so it has begun. Markets are down big today, as of this writing, the DOW -485, NASDAQ -460 and S&P 500 -92.

As I have commented many times, the Fed is easing but for the wrong reasons. Not because they beat down inflation but beat down the economy. Once the market realizes that the Fed really pivoted to focus on job growth (economy) instead of inflation, the market will go down big. Our prediction of a double top in the S&P 500 is looking more likely. Here is support I am watching.

There is a lot of economic data this week, ending with the jobs report on Friday. That will be a lot of the focus and we can also be sure the number will be padded higher ahead of the election. If they revise July numbers lower, as the trend has been, the market might put a focus on that.

Today, construction spending posts bigger-than-expected drop in July as it fell 0.3% in July to $2.16 trillion, the Commerce Department reported Tuesday. The figure fell short of expectations. Economists surveyed by Dow Jones and The Wall Street Journal expected construction spending to fall 0.1% in July. Construction spending is still up on the year, but the slow down is obvious.

Economic activity in the manufacturing sector contracted in August for the fifth consecutive month and the 21st time in the last 22 months, say the nation's supply executives in the latest Manufacturing ISM® Report. The PMI® registered 47.2 percent in August, up 0.4 percentage point from the 46.8 percent recorded in July.

Timothy Fiore Chairman ISM says, "While still in contraction territory, U.S. manufacturing activity contracted slower compared to last month. Demand continues to be weak, output declined, and inputs stayed accommodative. Demand slowing was reflected by the New Orders Index dropping further into contraction.”

Oil also sold off big today on demand/economic worries. What is getting a lot of blame, the eight leading OPEC+ producers are expected to start unwinding voluntary output curbs with a 180,000 b/d boost in October, sending oil prices tumbling to $70.50 (WTI).

According to Kpler, China’s crude imports averaged 10.5 million b/d in August, up almost 1 million b/d compared to the 18-month low of July, however they remain well below any monthly average in February-June.

A lot of tech stocks have been riding the AI craze and semiconductor demand wave to unreasonable heights. I pick Broadcom to short for this market correction. In 8 months it went from $110 to $230 and I expect it is headed back to $110.

Broadcom Inc. (AVGO): $154, Buy December $120 Put at $3.00

Broadcom faces several headwinds that could negatively impact its stock. The company is heavily reliant on the semiconductor industry, which is currently experiencing supply chain challenges and slowing demand, particularly in consumer electronics. Additionally, rising competition in key markets, such as networking and broadband, could pressure margins and erode market share. Broadcom's aggressive acquisition strategy, while growth-focused, also carries integration risks and could strain financials, especially in a high-interest-rate environment. The company's exposure to cyclical industries further amplifies the potential for earnings volatility, making it a risky investment in the current macroeconomic landscape.

According to Marketwatch the stock has a current p/e of 49.3 and selling at 14.5 times book value. These are high valuations and I believe there is too much growth priced in. Revenues have been climbing to $12.49 billion last qtr from $8.73b the quarter a year ago. AVGO will report its third quarter fiscal year 2024 financial results and business outlook on Thursday, September 5, 2024 after the close of the market. I expect good numbers but already priced in and if the market is in a negative mood, it will find the negative aspect.

The stock broke down today with a large red engulfing candle. There is no support until the $130 to $140 area so it is probably headed there. If it drops below say $118 than it is going down to $90.

A good way to play this with leverage is out of the money Put Options. I like the December $120 Put at $3.00. December gives us lots of time and If we get a move to the support area, the Put should be valued around $8.00 for over a 100% gain. We could sell half and see if we get the big move down to $90. First things first, lets see if we get the first down move into support

Calibre Mining - - TSX: CXB; OTCQX: CXBMF - - Recent Price - C$2.22

Entry Price -$1.63 - - - - - Opinion – buy on weakness <$2.10

Calibre is among my favourite gold producers for 2024 and 2025. Today Calibre announce partial ore control reverse circulation (“RC”) infill drill results from the Marathon Pit (“Marathon”), The 2022 Mineral Reserves of 51.6 million tonnes grading 1.62 g/t gold containing 2.7 million ounces.

At the Marathon pit, the Company drilled 196 RC holes totaling 4,915 metres in three benches slated for mining in 2025. When comparing approximately the same tonnage to the 2022 Mineral Reserve model over three planned mining benches, the Ore Control Block model yields significantly more gold than the 2022 Mineral Reserve model due to 47% higher grades. These results coupled with the Leprechaun ore control results (see news release dated February 14, 2024) substantiate the 2022 Mineral Reserve and increase confidence.

Darren Hall, President and CEO of Calibre, stated: “The results from the initial Marathon pit ore control drilling are very encouraging with 47% higher gold grades resulting in 44% additional ounces vs the 2022 Mineral Reserve in the same area. Given these results, and construction at 77%, our confidence continues to increase as we responsibly advance towards first gold at Valentine during Q2, 2025.”

The stock has just come off new highs around $2.40. If it dips below $2.10, I would be a buyer.

Aztec Minerals - - - TSXV:AZT - - - - Recent Price $0.15

Entry Price - $0.40 - - - - - - Opinion – buy

Today Aztec announced:

Their JV interest in the Tombstone property has increased to 77.7% from 75.0% - their partners did not participate in the April – July exploration budget and were diluted down from 25% to 22.3%.

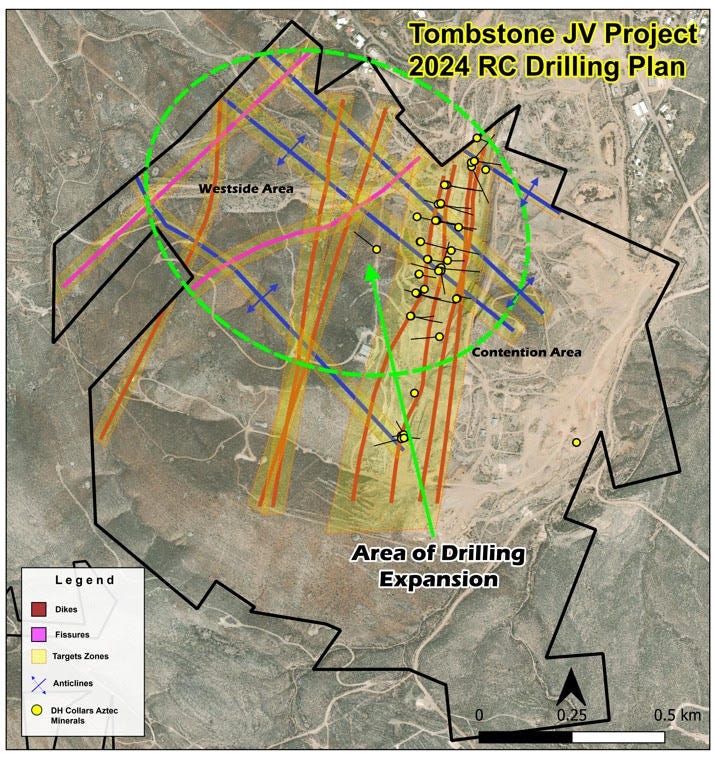

The JV management committee met in late August and approved a 2000m RC drill program at Tombstone. The program commences in September, with a rig contracted to mobilized over the coming weeks.

The drill program is focused on expanding in step outs testing several structure west of the Contention area.

The RC program is designed to expand the known mineralization horizontally and down dip beyond the holes drilled in 2020-23 at the Contention Pit, with step outs to enlarge the shallow, broad, bulk tonnage gold-silver mineralization discovered there, and explore new targets identified in the Westside area. The drilling target areas are located within the Tombstone property patented claim holdings (including the recently acquired Westside Patented Claim) which provides the JV with the ability to rapidly advance exploration with a short permitting timeline for future drilling.

I do not expect much weakness in gold but it could see a bit of a correction. I am going to see how that plays out and then will probably suggest averaging down in the stock before drill results.

Bitcoin – test of $50k likely

Bitcoin trades a lot with the market, sort of a risk on investment. If September is a bad month for the markets as I expect. It will be for Bitcoin as well. It has been in a steady slight down trend. I expect a retest of the $50k area. If it does bounce back some to around $62k I will probably suggest a short ETF.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.