Save 20 cents/litre on Gas, Trump Tariffs, A Right View, Housing Crash

Canadian's - Save 20 cents/litre on Gas

As you know, I follow energy markets closely. Anyone that has lived in Canada long, knows that gas prices at the pump typically go up on long weekends. The oil&gas companies will say it is the increased demand. Maybe it is the increased demand that gives opportunity for higher prices and profits. Therefore it was quite strange to see gas prices go the other way and drop on the Easter long weekend. And they dropped big time. In fact they fell to their lowest level in several years, thanks to the carbon tax removal and oil price drop.

As it turned out, this was unique to my area, most locations across Ontario saw a big price jump the day before the long weekend began. I have never witnessed anything like this happen before. It was almost a 20% price swing which is not normal and opposite timing to what we usually see on long holiday weekends.

To be more accurate, I could have saved 20 cents per litre. However, election day is next Monday, April 28th and I would bet gas prices come back down. The Liberal government will want to show, hey look we brought down gas prices. In my area, the price has already dropped 10 cents per litre since it popped up. Prepare to fill your tanks on April 28th.

Trump Tariffs Working?

The Trump administration has spoken to at least 90 countries to negotiate trade deals after the president recently imposed sweeping baseline and reciprocal tariffs, Commerce Secretary Howard Lutnick said on April 23.

During an executive order signing ceremony in the Oval Office, President Donald Trump asked Lutnick how many countries had reached out to broker trade deals. The secretary said 90 U.S. trading partners had contacted the administration so far.

“They all want to make deals,” the president said. “But they’re going to be fair deals. They’re not going to be rip-off deals. We’re dealing with a lot of countries right now, and could be with China, but maybe we‘ll make a special deal, and we’ll see what it will be,” he said, adding that his administration has been in contact with China “every day.”

White House press secretary Karoline Leavitt told reporters at an April 22 press briefing that President Donald Trump believes his administration is “doing very well” and “moving in the right direction” toward establishing a trade agreement with the Chinese communist regime.

The Chinese say not so, maybe this just wishful thinking or softening market talk from Trump.

It certainly looks like Trump's 'lets make a deal' instead of tariffs is working for a lot of countries. Lets see how it all plays out, but it is looking better than what the media portrays.

And it appears China is really suffering.

According to Chinese financial publication Caixin, by April 10, there were almost no U.S.-bound container ships at ports in Shanghai, and containers that didn’t make it before the deadline were left stranded.

Maritime research consultancy Drewry, which tracks global shipping of a range of products, said in an early April briefing that the number of cancelled sailings in March and April on the Transpacific, Transatlantic, and Asia-North Europe and Mediterranean routes had risen to 198, compared to 135 in the same period last year.

Looking at this news, the tariffs are not causing inflation but there is a simple refusal to buy the goods at all. Again it is too early for conclusions, but I expect U.S. and China will come to some deal at some time. These high tariffs on each other are no good for either side.

The only other country with retaliatory tariffs is Canada. However, this is all election posturing by the Liberals. We will see a more clear picture of how it might resolve after the election. At this point nobody in the two countries is talking other than election propaganda.

A Right Wing View of Canada

I found a recent interview of Maxime Bernier (the founder of The Peoples Party) very interesting. He is right wing and not fond of Liberals or Conservatives so an interesting view. Here are a few highlights of an hour long interview. Many points are very interesting and many good ideas.

Trudeau is a socialist and globalist. He was not working for Canada and destroyed the country economically, socially and culturally. During Covid-19 it was a totalitarian government. Bernier was put in jail in 2021 for speaking in a park. Trudeau doubled the debt from $600b to $1,200B. Bernier said not getting the shot was the best decision in his life.

He wants a moratorium on immigration and Covid vaccines. Mass immigration is the biggest problem, he said 1.3M immigrants last year was 97% of the country growth.

Poilievre wont speak out against immigration because in a lot of ridings, a majority are immigrants.

He comments the Liberals trade war is saying we love you but Trump is bad so we will put on counter tariffs, which is really a 25% tax on Canadians. Carney says auto tariffs will bring in $8 billion and he will give back to corporations that are effected by tariffs. Essentially a tax on the poor to give to the rich.

He calls the Liberals and Conservatives the LibCon party, both too much the same. Both parties are for climate change because of promotion of CO2 capture.

China is funding many parliament members. Their 1st goal is to help China or also in the case of India, to help India.

Bernier believes in no more climate change, Paris accord, World Economic Forum or World Health.

Main stream media in Canada, treats him like he does not exist. He claims they changed TV debate rules to exclude him - Peoples Party of Canada .

Liberals giving $1.2 billion to CBC and $800 million to other media. They are all propaganda arms of the government. His new way of doing politics is social media, such as hour long type discussions (like this one).

If Liberals win, Quebec will do a referendum on independence after next provincial election. Alberta probably will too.

Justin Trudeau is full of himself but is charming and funny.

Health Care System not working, give Canadians insurance and let them choose between public and private. Need more private health care delivery.

Bernier comments on the Liberals that every solution must come from the government but the government is the problem.

Trudeau/Liberals taking guns because does not want Canadians to defend themselves. RCMP is a woke organization and now you don't need to be a citizen to join the armed forces. DEI is killing everything, Liberals giving a lot of money promoting it.

Main stream media at least talking about DEI because they talk about Trump and how he is against it, so Canadians are now learning more about it.

If this was any other country, Canada would be in revolution? It will be a quiet revolution not a violent one. Maybe another type of freedom convoy.

Mark Carney is the Globalist in Chief. He is part of the elites and Bernier also calls him Trudeau 2.1. Carney is a big spender and has a lot of support from main stream media.. He is campaigning against Trump to save Canadians. He is a fake patriot.

End US$ as reserve currency to fix trade imbalance. Must go back to gold standard and a lot gold flowing into U.S. Canada is the only western country with no gold reserves.

Bernier is about a balance budget, zero inflation target, flat business tax and no capital gain tax.

Thinks Trump is not about tariffs but a negotiation on a new world monetary order.

Resources are under Canada control but too many regulations and taxes. Liberals doing everything to stop development of natural resources.

Those think they can control the climate is just crazy. There is no climate emergency.

Two or three more years of mass immigration and Canada will be lost.

If there was a Canadian Trump, Bernier would be it. For those on X, here is the link to the interview

https://x.com/TuckerCarlson/status/1912551772859851125“

Reals Estate Crash in the Making

It has been a while since my last update on Canada's Real Estate bubble

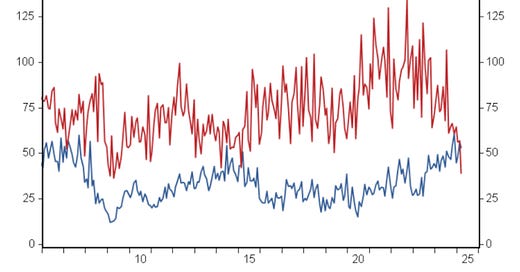

The data I am presenting here is what you would expect to see before a housing crash along the lines of the U.S. in 2008.

So the big cities go, outlying areas soon follow.

Home sales in the Greater Toronto Area fell 23.1% in March while more supply hit the market, helping bring down prices compared with a year ago.

The Toronto Regional Real Estate Board said 5,011 homes were sold last month, compared with 6,519 in March 2024. Sales were down 2.4 per cent from February on a seasonally adjusted basis.

Meanwhile, 17,263 new properties were listed in the GTA last month, up 28.6% compared with last year. Total inventory in the region surged 88.8% to 23,462.

The average selling price in March decreased 2.5 per cent compared with a year earlier to $1,093,254, as the composite benchmark price, meant to represent the typical home, was down 3.8 per cent year-over-year. These are small decreases to what I expect is coming.

Canada’s politicians spent billions in taxpayer resources to stimulate new homebuilding, and the exact opposite is happening. Canada Mortgage and Housing Corporation (CMHC) data shows a sharp decline in housing starts for March.

The decline is primarily due to a collapse in Ontario, where weak demand has led to the fewest new housing starts since the 2009 Global Financial Crisis. There is not the same problem in Alberta so this for sure is bubble related. Ontario saw the the biggest price increase in the bubble.

“Suffice it to say that seeing new starts in Ontario run below those in Alberta (as we saw in March) is extremely rare given that Ontario has more than 3x the population,” notes Kavcic at BMO

And the GTA Condo Market Continues in Free Fall

The Greater Toronto Hamilton Area (GTHA) new condo apartment market reported a total of 533 sales in first quarter of 2025, its lowest quarterly total since 1995, and the 215 new condo sales in the City of Toronto in Q1 fell to its lowest level since 1990, reports Urbanation Inc., a source of market analysis on the condo market.

Urbanation released its Q1-2025 Condominium Market Survey results earlier this month, which revealed that new GTHA sales have dipped 88 per cent below the 10-year average.

Unsold new condominium inventory totaled 23,918 units, increasing 6% from a year ago and 58% higher than the 10-year average. Unsold inventory was equal to 78 months of supply based on the pace of sales averaged over the last 12 months, a record-high that was approximately seven times greater than a balanced level of 10-12 months of supply.

The Toronto Star says Hundreds of planned condo units cancelled: ‘Market cratered almost overnight’. Almost 2,000 condo units across eight projects have been cancelled in Toronto since the start of 2024.

Leger conducted a survey for financial and insurance platform Rates.ca to gather Canadians’ opinions regarding condominium ownership. Only 22 percent of those polled described condos as a good investment. The survey also found that 57 percent of respondents said they would not purchase a condo for any reason compared to 11 percent who said they would.

Whether housing or condos, a supply that keeps increasing as demand keeps falling, only leads to one thing, and that is lower prices.

It is not that demand is not there, it is just not there at these prices!

And the economy is going to get a lot weaker. Oxford Economics is trimming its Canadian GDP forecast despite softening tariffs. The firm cut its GDP forecast by 0.4 points and expects 0.7% growth in 2025. Next year’s forecast also saw 0.1 points trimmed, with the firm now expecting a 0.2% contraction of GDP in 2026. That’s a big change from the recent population-driven booms seen over the past few years. This would mean the GDP per capita will get far worse too.

And all this political rhetoric about Trump in the Liberal election platform is only sowing unjust uncertainty in the economy. Of course they don't care about the economy and people, only about getting elected.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.