Sell - A Bear Trap, US Housing Bubble Top

Make your voice heard, buy gold and silver. It is used in every economy everywhere. Your fiat money is useful in one place only, your own country and a few others at best. Staying in paper currency is your choice and your vote to stay in government garbage money.

Gold is not consumed and it is the only thing that is eternal. Gold is money that cannot be destroyed and never rusts. Gold is nobody's liability and the only thing other than fiat currencies that Central Banks hold as reserves. One does not buy gold, you save it.

A Bear Trap

I don't think we qualify for my 'Great Bear Trap' title yet. Most don't call this a bear market but I labelled it so because all the tech leaders went into a bear market and the NASDAQ low close was down -24%. An official bear market is a -20% decline. The S&P dipped into bear territory but on a closing bases dropped about -19.3%.

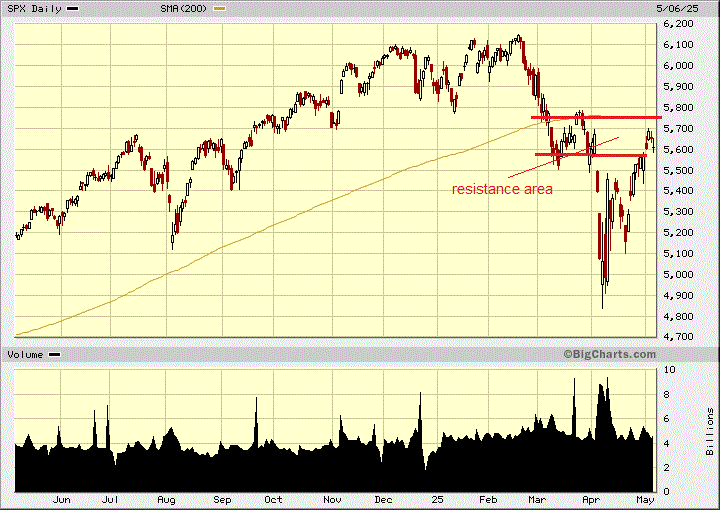

The S&P 500 is in my resistance area and the 200 Day MA is at the top of this range. I don't expect the market to break a higher high, above 5,800.

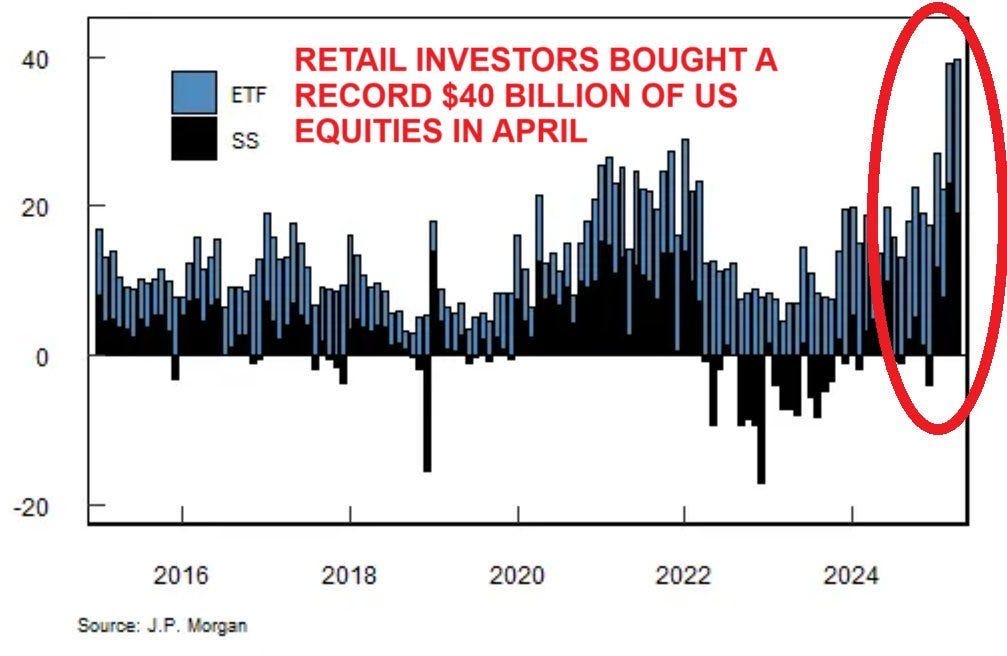

One of the worrisome signs is retail investors have piled in at records amount in April. Buying the dip was a real mania. Many retail investors are notorious for buying tops, and selling bottoms.

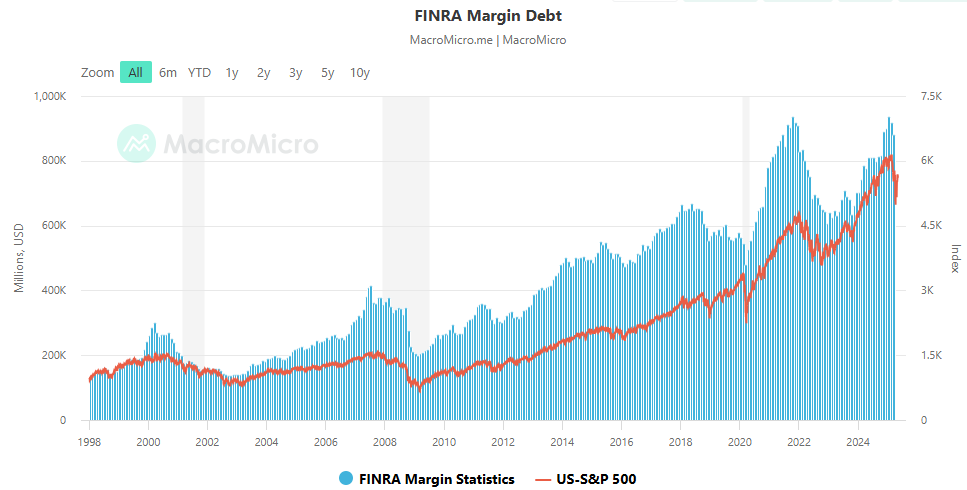

And margin debt is still close to record highs. There has hardly been any unwinding of this bubble thus far. The level is still up at $880 billion.

I have commented numerous times that Trump's policies would be disruptive and there will be short term pain, but not much of this has shown up yet, but it is surely coming. Markets have rallied on the appearance of trade war de-escalation and it will not be as bad as first thought, but it actually will be worse.

There is a strange eerie awe at trade ports as they are very quiet. Inventories were stocked up ahead of the tariffs so it simply has postponed the economic fall out that is coming. I believe Trump was too erratic and abrupt with tariffs. It would have been better if he just focused on the top 5 or 10 highest trade deficit countries. How do you negotiate 70 deals or more at once as the Trump administration says they are doing. Latest from Treasury Secretary Scott Bessent, is that the U.S. is in simultaneous talks with 17 countries.

Some prices for consumers will increase and demand will drop as foreign companies look to trade elsewhere. Supply chains also get disrupted as companies and countries adjust, we see this with the quiet ports

According to MSN article -Tariffs have led to a drop in U.S. exports around the world. Products that were once bound for ports worldwide now remain in the U.S. At the Port of Portland in Oregon, exports fell 50%. Data from U.S. ports also shows a decline in exports across the board, not just to China. There has been nothing like this since the Covid lock downs.

“The world is fragmenting into blocks as globalization unwinds. We see a rearrangement of global supply chains both for the U.S. and in general, across the multiple tiers of the supply chain,” Peter Swartz a supply chain CSO said. “The most obvious are the rearrangement of exports away from the highly tariffed U.S. China trade lane.”

Although some big investment deals in America have been announced, I don't think there will be the manufacturing boom that Trump harps about. Americans have gotten to use to cheap foreign goods and won’t want to pay the “Made in America” premium. Also consider that a lot of manufacturing jobs were lost to automation and that is only going to increase, especially with AI. Cheaper foreign labour is not the only thing in the equation. And I doubt that Millennials and Gen X are excited about manufacturing careers.

Now if the Trump administration can negotiate a bunch of trade deals and the tariffs get dropped quickly, than this can just be short term pain. However, I expect the China trade war will drag on as China can suffer pain longer than most and this tit for tat tariff battle has only raised the fences on both sides.

For Canadians, it will probably drag on as well. Things did not look to good at the Trump and Carney meeting yesterday. It was all Trump and Carney appeared pretty meek. Hopefully it was better behind closed doors. Trump seems fixated on this $200 million he says that the U.S. subsidizes Canada, plus military protection. Maybe that is just his bargaining rhetoric? Most of the $200 million is oil and Trump wants cheap oil and that is certainly what he gets from Canada. Plus the U.S. refiners are geared up to handle the Canadian heavy oil, so changing refineries is not a realistic option. If Carney can sell Trump on the fact we provide cheap oil and will get our act together on military and the border on fentanyl, maybe the trade deal can stay as is. Trump even mentioned keeping the trade deal as is, a possibility.

Meanwhile most trade is exempt from tariffs with the current trade agreement, but there is 25% on steel and aluminum. The auto tariffs are more confusing because so many parts go back and forth across the border. I think the biggest damage done was all the tariff fears during the election that killed business and consumer confidence. The narrative could have been much better to prevent this, but it was really about the Liberals wining the election more so than about consumers and business.

Most likely the U.S. trade deficit numbers will start to get attention by the market as much as the job numbers do. Trade deficit, including goods and services, widened 14% in March to a record seasonally adjusted $140.5 billion, the Commerce Department said yesterday. Many companies rushed to import foreign products while they were slightly cheaper than they would be with White House tariffs added to the cost. We should see a drop next month.

The Fed meeting and Powell's press conference will get a lot of attention this afternoon. They might just keep rates higher for longer just to show they are independent from the government (Trump's rhetoric). Regardless, rates probably will stay up because we have stagflation and the Fed will wait until the economy is in the tank before lowering them. Even so, the market might not co-operate and keep rates high anyway. The Fed’s preferred inflation measure, rose at an annualized clip of 3.6% in Q1, the highest it’s been in two years.

Interesting times to say the least. I called the top in the Canadian Real Estate bubble back in 2022 and although the U.S. real estate is not the bubble Canada was and still is, I think the top is in on the U.S. market now. Check out these charts from wolfstreet and FRED data.

U.S. Real Estate Top

Housing price increases have been stagnant for the past year. Sales have dropped while inventories have climbed and with a recession looming, prices are going to fall.

It is extremely bleak in the office space still reeling since Covid. Office vacancy rate in the US worsens to record 22.6% in Q1 amid Federal Government lease terminations. This increased the amount of vacant office space to a monstrous 1.1 billion square feet.

This pushed the vacancy rate to a record 22.6%, up from the 12%-13% range before the pandemic. What is more this is now pushing the delinquency rate up to the financial crisis levels.

Existing home sales have dropped to financial crisis levels and has caused a surge in supply as shown in the 2nd chart below.

With 12 years of rising house prices and now financial crisis level of low sales and high inventories. it is the perfect formulae for lower house prices.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.