For months now I have been suggesting investors get out of the equity markets and especially the high flying techs. I want to emphasize again, the risks far out weigh potential returns, especially with these high flying tech and AI stocks. I think it is best to go to the sidelines and wait for the dust to settle. Trump's changes are upsetting apple carts everywhere and tariffs he will enact won't be good for the economy and markets in the short term either.

I talked about this yesterday and providing some more info. DeepSeek, a Chinese artificial intelligence (AI) startup, has rapidly emerged as a significant player in the global AI landscape. Founded in 2023 by Liang Wenfeng, DeepSeek has developed advanced AI models that rival those of established Western tech giants, achieving comparable performance at a fraction of the cost. This development has profound implications for the global AI market and the future trajectory of AI development.

Disruption of the Global AI Market

DeepSeek's AI Assistant, powered by its V3 model, has quickly become the top-rated free application on Apple's App Store in the United States, surpassing competitors like ChatGPT. This rapid ascent has unsettled global tech markets, leading to significant declines in the stock values of major tech companies. For instance, Nvidia experienced a historic 17% drop, erasing nearly $600 billion in market value—the largest single-day loss in U.S. stock market history.

The success of DeepSeek's cost-effective model challenges the prevailing belief that massive investments in AI infrastructure are necessary for progress. This shift could democratize AI development, making it more accessible to smaller players and potentially leading to increased competition and innovation in the AI sector.

Impact on AI Development Practices

DeepSeek's approach emphasizes efficiency and sustainability. By developing models that require significantly less computing power and financial investment, DeepSeek exposes the unsustainable costs associated with scaling AI models. This revelation highlights the need for ethical AI development focused on sustainability, practical innovation, and robust oversight to prevent environmental and societal harms.

Moreover, DeepSeek's open-source model fosters collaboration and transparency in AI research. By making its code freely available, DeepSeek enables researchers and developers worldwide to build upon its technology, potentially accelerating advancements in AI and broadening the scope of AI applications across various industries.

Geopolitical and Economic Implications

The rise of DeepSeek signifies a potential shift in the global AI power balance. Historically, the United States has been the unchallenged leader in AI innovation. DeepSeek's achievements suggest that other nations, particularly China, are rapidly closing the gap, prompting calls for increased focus and investment in AI development within the U.S.

This development also raises questions about the effectiveness of export controls and other measures aimed at hindering technological advancements in rival nations. DeepSeek's success, achieved with limited resources and without access to the most advanced hardware, suggests that innovation can thrive despite such restrictions, potentially leading to a reevaluation of current policies.

Conclusion

DeepSeek's emergence is a pivotal moment in the AI industry, challenging existing paradigms and prompting a reassessment of strategies in AI development and policy. Its focus on efficiency, sustainability, and open collaboration offers a new model for AI innovation that could lead to more inclusive and responsible advancements in the field.

I have no doubt the market has put excessive valuations on U.S. AI stocks based on revenues, profits and margins that will come nowhere close to being achieved with this new competitive landscape. Also Venture Capitalists invested billions in start-ups like OpenAI and Anthropic. The rise of the China’s DeepSeek calls that funding frenzy into question. Again, I suggest selling these stocks, sit on the sidelines until we see the dust settle.

Trump's Tariffs

This is all over the news and I am sure you have heard lots. I hope to shed some sense and reasoning into this with likely outcomes. One thing about Trump, is he is different than most politicians because when he says he will do something he will. However, it has become obvious that one of Trump's main objectives is to use tariffs as a bargaining tool.

I doubt he will slap 25% tariffs across the board on Canada and Mexico. He is more likely to pick and chose items and sectors and threaten more if his goals are not met. Another possibility mentioned from his Treasury Secretary Scott Bessent is start small around with a 2.5% universal tariff, but it steadily increases over time until goals are met.

Tariffs cause prices to rise and will impact inflation, perhaps the Feds will highlight that in today's FOMC meeting where they are expected to hold pat on rates. We are soon going to find out on tariffs, but I would be surprised if they are put on oil and gas. Trump wants to fill the SPR back up and have low energy prices so would make more sense for no tariffs here with a threat to do so later on.

Tariff the Metals

The other sector that we have a lot of interest in is the metals. The U.S. imports a lot of metals from Canada, Mexico and South America among other places. In 2022 the United States imported $196B in Metals, becoming the 1st largest importer of Metals n the world. That has not changed. More than half of Canada’s mineral exports - valued at more than C$80 billion, went to the US in 2022. Trump specifically mentioned steel, aluminum and copper, perhaps because they are refined products and copper being so very crucial, that Trump wants more domestic production.

According to S&P Global Report - The US is heavily reliant on imports for refined copper. It consumed an average of 1.7 million metric tons (MMt) of refined copper per year during 2019–23, and more than 44% of this was imported, mainly from Latin America. Chile accounts for almost 70% of the US’ refined copper imports. Like Peru (10%), Chile exports the vast majority of its production, but China - not the US - is the largest buyer. Regardless of US free-trade agreements (FTA) with Latin American producers, the US bargaining power is likely less than Chinese.

Reliance on Latin America is also likely to become a logistical challenge as climate change puts pressure on water levels. Almost 95% of seaborn US refined copper imports arrive in US East Coast and Gulf Coast ports via the Panama Canal. Transit through the Canal has been impeded since last year by low water levels in Gatun Lake (which feeds the Canal’s lock system).

You can see why Trump has a renewed interest here and says the U.S. should have never gave up control. In hindsight he is probably correct, especially with China controlling a port on each side of the canal. That said, the treaties the U.S. has with Panama allows the U.S. to defend the canal against any entities that try to impede free flow of goods. Maybe Trump can make an excuse to invoke this treaty and certainly in the case if China was to invade Taiwan, they could hurt Chinese imports.

Now back to copper. The US has more than 70 MMt of untapped copper reserves and resources that could be developed, in addition to production from already operating mines. This is comparable to the endowment of Canada and Australia combined.

Using metrics we know, it takes over 15 years to discover, permit and build mines and the S&P Global report points out it takes almost 29 years in the U.S., not far behind Canada at 27 years. This presents a real challenge and copper demand is very strong from electrification. The International Energy Agency (IEA) predicts total electricity consumption from data centers alone to reach more than 1000 TWh in 2026. That’s double their 2024 consumption. Data centers are only one piece of the mega electricity puzzle. There’s also worldwide EV growth and ongoing demand for electrification and sustainable energy in all industrial arenas.

I believe tariffs on copper would hurt the U.S. in the short term but it could be used to spark domestic production. That would have to go along with heavy investment, reversing a trend of little investment and huge changes in regulations to speed things up. Nothing would happen in Trump's term.

Silver Short Squeeze

I doubt tariffs are put on gold because it is money but silver has more of an industrial use and is an important metal. However the silver market is very tight after 4 years of supply deficits and there is a large short position in the market. Interesting is that spot silver prices have been a lot higher than future prices indicating there is high demand to bring silver into the U.S. market the last couple months. If 25% tariffs were enacted, it would put prices up several dollars and certainly enough to cause a short squeeze. I have suggested a number of silver stocks to buy in the past year so we are well positioned for this.

And on the topic of copper, big news with two of our copper stocks today.

Midnight Sun - - - TSXV: MMA, OTC: MDNGF - - - Recent Price $0.64

Entry Price - $0.27 - - - - - - - - Opinion – hold

Today MMA announced the results of the 2024 oxide copper drilling program. On Kazhiba that is one of 4 key target areas that comprise the Solwezi Project in Zambia, located approximately 6 kilometres southwest of First Quantum Minerals' Kansanshi Copper Mine. This drill program was designed to validate and confirm the potential oxide copper resource at the Kazhiba Target and is the first major step under the previously announced Cooperative Exploration Plan with First Quantum Minerals.

Highlights of surface drilling from the Kazhiba Oxide Copper Target include:

10.69% copper over 21.0 metres from drill hole MSZ22-028

5.60% copper over 26.0 metres from drill hole MSZ22-020

3.01% copper over 15.0 metres from drill hole MSZ22-012

4.66% copper over 7.0 metres from drill hole MSZ22-030

These are the higher grade intersects but overall the program was successful in starting to outline a resource. In total 54 Reverse Circulation ("RC") drill holes, totalling 2,005 metres were completed. Mineralization appears to extend north-northeast and remains open. 13 additional RC holes are planned to test this extension, as an initial part of a broader follow up program, currently being designed and anticipated to start April 2025

President/CEO, Al Fabbro, said: "We believed that high-grade, at-surface oxide copper mineralization encountered during previous work programs at our Kazhiba and Mitu Targets, was significant. We now have proof of concept. Oxide copper represents a tremendous value-driver for our Solwezi Project. By demonstrating that the mineralization has grade, scale, and growth potential, we intend to leverage the opportunity toward significant potential near-term cash flow. In parallel, we are excited to unlock the potential of the multiple large scale sulfide targets hosted within our property boundaries.............”.

The stock responded well on the news and I have had numerous buys on this the past 2 years so for now hold and watch our gains grow.

Zonte Metals - - TSXV:ZON, OTC:EREPF - - Recent Price - $0.07

Entry Price - $0.09 - - - - Opinion – strong buy

I have a strong buy on the stock because it is one of our copper juniors that has moved up yet. It will get it's turn and the idea is to buy low. Today's news is going to generate a lot of interest with the major mining companies if nowhere else.

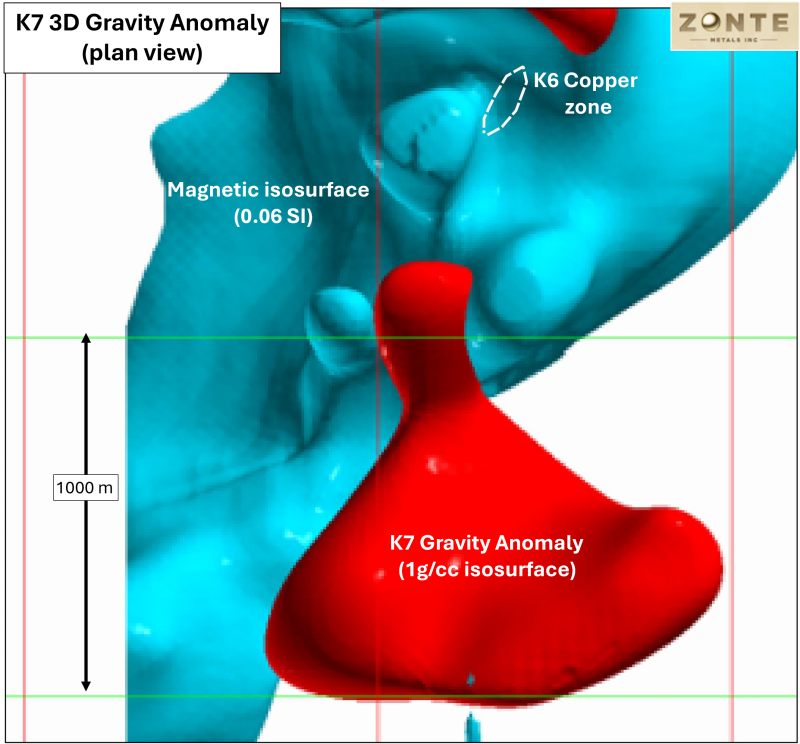

Zonte announced the advancement of the K7 target to drill stage, a large gravity anomaly, with dimensions of 1300 metres by 1250 metres and 1000 metres deep, measured along the longest axes. The anomaly sits in a structural zone with spatially coincident magnetics and copper-in- soil anomaly. It is just 400 metres south of the K6 target, where the company discovered copper mineralization in drill core.

The Company has compiled all datasets over the K7 target area (formally called K6S-K7) including newly reprocessed 3D inversion gravity and magnetic data, geochemical and geological data. Also further processing on K8 revealed a small gravity anomaly so Zonte will not further explore that target but still 11 targets remaining is a huge amount.

Terry Christopher, President and CEO, comments: “The K7 gravity anomaly sits coincident with magnetics, copper-in-soils, structural zones and alteration also is spatially close to the K6 target. The K6 target is just 400 metres to the north where the Company discovered copper in drill core. Combined, the data makes the K7 target a high-priority drill target. The Company now has four large targets, each at drill-stage. Additional field work in ongoing and an update will be issued in due course as we continue to advance targets to drill-stage.”

The stock has been bouncing along this bottom for about a year and a half now. Whenever it is down around the 6 or 7 cent level it is a very strong buy. It will soon have it's turn to move up so buy now at a bottom.

Recon Africa - - - TSXV:RECO, OTC:RECAF - - - - Recent Price $1.14

Entry Price - $0.56 - - - - - - - Opinion – buy

Today Recon announced the farm-down agreement with BW Energy Ltd is complete. The sale of a 20% working interest in petroleum exploration licence 73 (PEL 73), in northeastern Namibia, has been approved by the Namibian Ministry of Mines and Energy. They also announced the results of the Naingogo exploration well will be announced shortly. This is all virgin oil&gas exploration land so we don't have much to go on for expectations. The market is not pricing in much of a discovery and even if there is not it might come on the next exploration wells. I believe it is only a matter of when.

We have been riding this stock through ups and downs, I think another up is around the corner.

Goliath Gold - - - TSXV:GOT, OTC:GOTRF - - - - Recent Price - $1.85

Entry Price $1.22 - - - - - - - - Opinion – hold, buy on weakness

Gold stocks are up today and I have put out some updates on the stock as it finally broke out. Some more good news today as McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is making a strategic investment into Goliath Resources. This is on top of three previous investments McEwen CEO Rob McEwen has made in Goliath. Strategic Investment Highlights:

Post transaction, McEwen Mining will own 3.76% of Goliath Resources.

McEwen Mining will pay in McEwen Mining shares worth C$10 million based on the closing price of McEwen Mining and Goliath Resources on January 28, 2025.

McEwen Mining will receive a half warrant, exercisable at C$2.50 for 12 months.

Goliath Resources will own 868,056 shares of McEwen Mining.

Here is part of Rob McEwen, Chairman and Chief Owner of McEwen Mining, comments in the press release: “The Goliath Resources team has done a terrific job advancing their Surebet high-grade gold discovery in the Golden Triangle of British Columbia and McEwen Mining is thrilled to make a strategic investment into Goliath Resources. What initially caught my attention was the high-grade gold they discovered, and that it was a grassroots discovery in the Golden Triangle which is a prolific gold mining jurisdiction, one of the most important in Canada. Worldwide, grassroots discoveries of high-grade gold in a mining-friendly jurisdiction well-known for high-grade gold mines are exceedingly rare. They were able to make the grassroots discovery due to it until fairly recently being covered by glaciers and permanent snowpack that have receded to expose a large area of outcropping rock that has now been significantly advanced over the past few drilling seasons.”

The chart I showed previously this month showed $1.65 as resistance so this now becomes support. The stock has had quite a run and if you don't own it try buying on a pull back to $1.65 area.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

Midnight Sun seems to be developing as expected. Nice triple so far.