Coincidence that I do a newsletter yesterday on Bitcoin and it is soaring to yearly highs. This is all on the hype of BlackRock soon launching their Bitcoin ETF. The iShares spot Bitcoin ETF, has been registered with the Depository Trust & Clearing Corporation (DTCC). This indicates a possible green light from the United States Securities and Exchange Commission in the near future. BlackRock uses the ticker symbol IBTC. The market appears to be speculating that this will increase the demand and price of Bitcoin, but I doubt it in the short term for good reason if you do a bit of digging. Bitcoin is also entering resistance on the chart.

It is difficult to say how much investment flow will come into this new ETF. Keep in mind that Bitcoin trades 24/7 while this ETF will only trade 5 days a week during NASDAQ trading hours. Bitcoin is volatile and investors may hesitate buying the ETF because of big price swings over a weekend.

A big factor is that Coinbase will act as the Custody Trust Company holding Bitcoin for the ETF. Looking at Coinbase financial statements, as of June 30, 2023 , Coinbase held $280 million in Bitcoin at fair market value as it's own investment. Bitcoin was just over $30,000 at that time.

The ETF will be a great way for Coinbase to earn fees on their Bitcoin investment. Technically they would not have to buy more Bitcoin until the ETF achieved a market cap over $280 million. That is a lot of money and I doubt it happens out of the gate. In fact the ETF may never gain that much interest.

I am suggesting to sell Bitcoin on the day the ETF is launched or 36,500, what ever occurs first. This is capitalizing on the hype and Bitcoin into resistance on the chart.

Of note, Sam Bankman-Fried is expected to take the stand later this week on the FTX fraud. Would it be strange if the Blackrock ETF launches at the same time?

S&P 500, What Next?

The S&P 500 has hit my 4200 target. A drop lower into the support area would be bad news because it would be a lower low in the current correction. And a drop to 4050 would be a total break down and likely mean we are headed to a bear market. On a rally, 4400 is now resistance.

Canadian Bank Stocks hit new lows. Below is the ZEB ETF chart that tracks the big six banks. They will report their quarterly earnings next month and I expect bigger write downs. The Office of the Superintendent of Financial Institutions (OSFI) announced revised capital guidelines, which kick in next year, "will require institutions to hold more capital for mortgages where payments don't cover the interest portion of the loan (i.e., negatively amortizing mortgages)," the regulator said last week. During the first nine months of the fiscal year, the banks have set aside $9.45-billion, more than four times the amount set aside in the prior year. Homeowners are bracing for a shock interest-rate jump in their mortgages when it is time for renewal.

Cracks in the Housing Foundation getting Bigger

A new survey says the number of Canadians struggling with their mortgage payment is on the rise. A Canadian Press dispatch to The Globe reports that about 15 per cent of borrowers say they find the financial aspect of their mortgage "very difficult," up from 11 per cent in June and 8 per cent in March, says a survey done by the Angus Reid Institute . 79 per cent of survey respondents are worried or very worried they will face higher payments when it comes time to renew their mortgage.

According to Stats Canada, households’ total interest paid in Q1 of 2022 totaled $93.44 billion. In Q1 of 2023, that number grew to $146.20 billion and will have increased even more when Q2 data for 2023 is released. This is huge debt growth in a short period.

Homeownership in Canada fell to 66.5% in 2022 – a 20-year low. Its all-time high was reached in 2019 at 68.6%. This is a massive decline in a very short period of time.

Canadian GDP contracted by 0.2% on an annualized basis in Q2 of 2023, well below market expectations of a 1.2% expansion. Meanwhile, Canada’s productivity rate has fallen nearly every quarter over the past three years! I suspect we are already in recession. When housing crashes and there is no doubt it will, we can buy the Bank Stocks a lot cheaper with higher dividend yields.

It's all about Trust

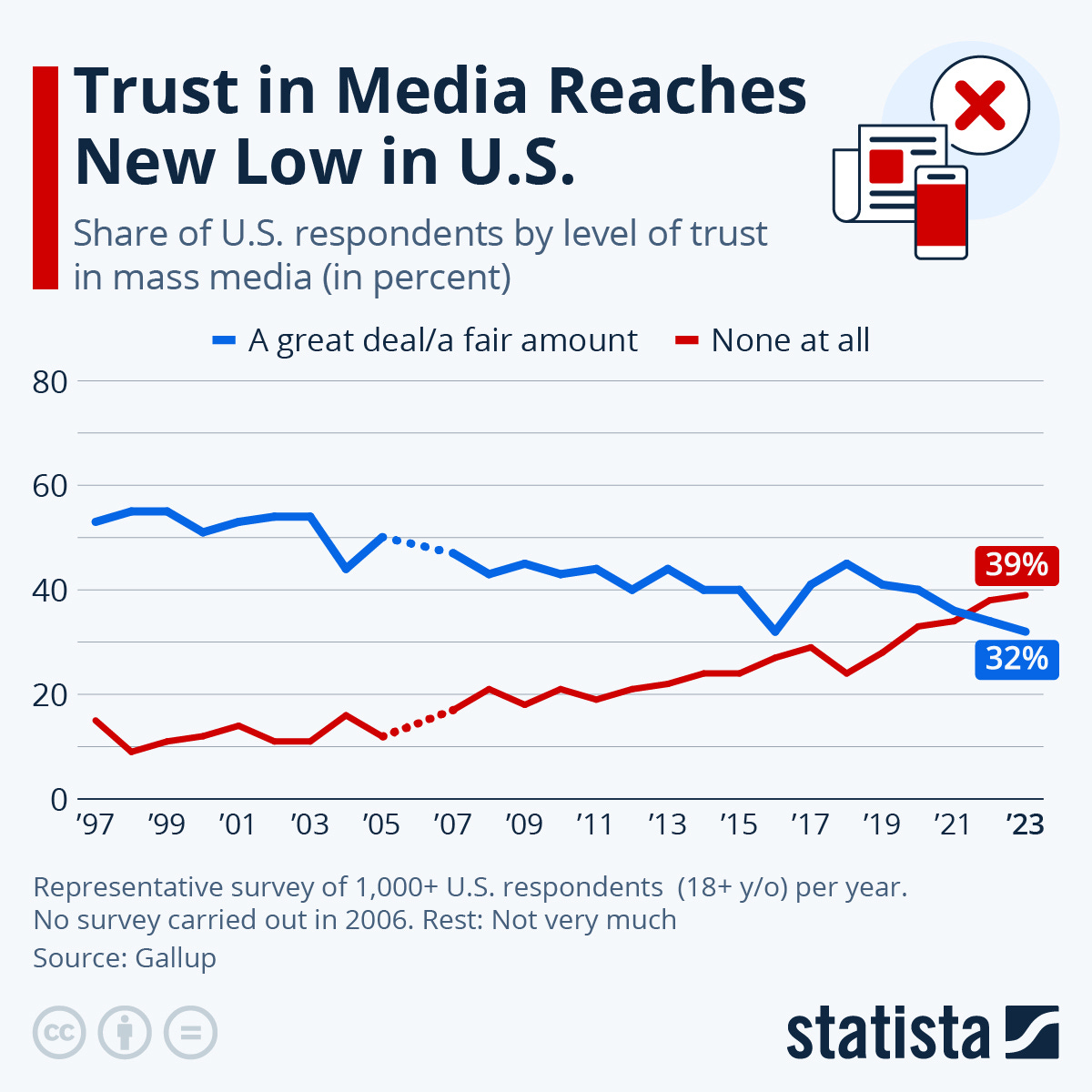

In September, the number of Americans saying that they trusted the media a great deal or a fair amount reached a low of 32%, comparable only to the result from 2016, the year of President Donald Trump's election. Then the share of Americans saying they had no trust at all in the media still stood at a comparatively low 27%. Since then, this share has been climbing, reaching a new high of 39%. Therefore, 2023 is arguably the year with the lowest recorded trust in U.S. media.

Moderna - - - - - MRNA - - - - - Recent Price $77.25

Sell November $110 Puts if the stock hits $70. Their Q3 report is November 2nd

Trust is a long-term investment and I doubt the media will get it back. Once public confidence in a company or its product wanes, rebuilding can be very tough and time-consuming. Moderna hit new lows today and a damaged reputation can lead not only to reduced sales of the vaccine in question but can cast doubt over their other products. Consumers might become hesitant to use other medications or treatments produced by the same company, leading more impact. Moderna has no other products but has some in their pipeline. As concerns about vaccine injuries rise and trust in big pharma diminishes, investor confidence can waver. This can lead to reduced stock prices. Bingo!!!!

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.