Silver Breakout Imminent - The Return of Inflation

I have not talked much about silver for some time and now is the time. I mostly follow gold because silver usually follows golds path often times with a delay and in some instances it can out perform gold in a bull market. We could be in for one of those instances because silver has lagged more so this go around. Gold is breaking out to record highs but silver is still a long way from it's $50 record highs. Silver is often referred to as poor man's gold because often it starts rising in price after gold. Many investors, especially retail will think gold has gone too high is too costly so will buy silver.

At this point there is little interest with silver in North America, I see that with wide availability of silver coins. However there is strong retail demand coming from India and also strong industrial demand there as the solar industry is starting a boom.

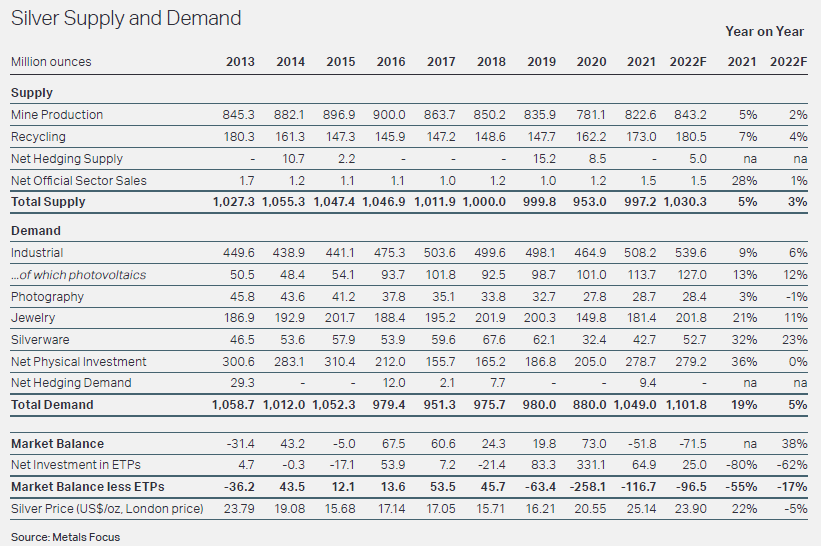

Note above that mining and supply has been flat with no investment. Demand has been increasing driven by solar panels and investment demand is flat. The supply deficit has been huge since 2019

The story with silver has not changed for years, maybe a decade. There is a continuous supply deficit with growing demand yet the silver price does not rise. Numerous analysts continue with bullish forecasts year after year based on these bullish fundamentals and they have been wrong, or should I say too early. I believe the dominating factor is shorting and price management by government principals and banksters. Their goal is to suppress retail demand in precious metals by focusing on poor man's gold, silver. This suppressing intervention has caused a coiled spring and I think it will soon release. All these bullish analysts will finally be proven correct. As they say timing is everything and I believe the time is soon arriving.

The silver price bottomed around the same time as gold, October 2022, but has been in a bull market since late 2022. You would never know it and even today, silver is up over +40% from those October lows. Official bull market is a +20% gain. The key level to watch on the chart is about $26.30 that would show a break out above a contained cap or range that has been almost 3 years.

However, don't expect fire works , silver is much like gold because investors have been beat up so long they will be very reluctant to dip their toe back in the market. It is much like trying to get a child in a swimming pool who has Aquaphobia. It will probably take silver prices of $30 to $35 to stimulate investor demand. That said, I believe the break out on the chart is imminent and we can buy silver stocks now that are beaten up to ridiculous prices. It may take some patience but rewards will be huge, especially if the silver price ends up out performing gold.

Near term, I think it will be India solar and investment demand that drives silver higher. India’s energy landscape is rapidly evolving, with solar and wind likely to meet two-thirds of future demand growth by the Financial Year (FY) 2032. 14th National Electricity Plan (NEP14) estimates India’s total annual electricity generation to grow by 1,174 TWh in FY 2022-32 period. Annual solar is expected to rise by 593 TWh

The country has a huge population of over 1.4 billion and over took China in 2023 as the world's most populace country and this brings growing energy demand.

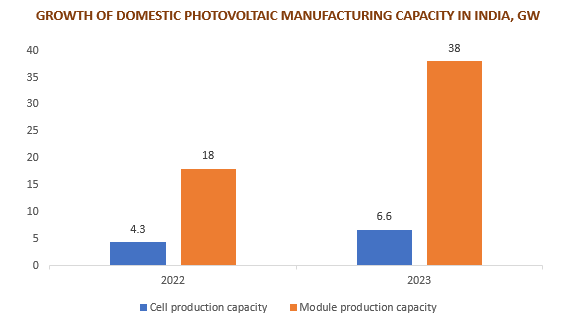

According to the Institute for Energy Economics and Financial Analysis (IEEFA), India has the potential to become the second-largest manufacturer of solar photovoltaic (PV) technology globally by 2026.

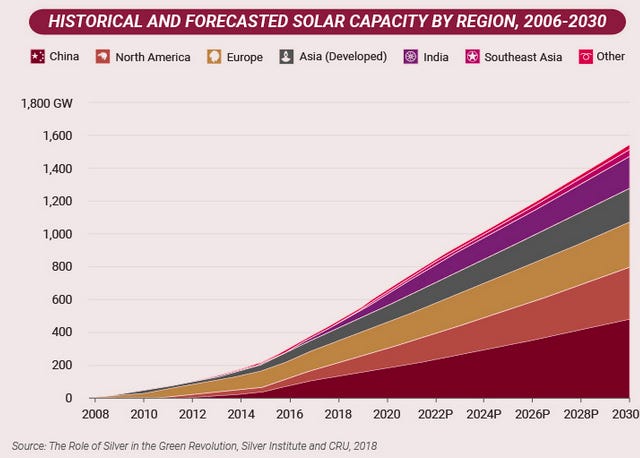

As you can see in this next chart from the Silver Institute, India has a long way to go to catch up North America and Europe. And India's solar capacity is currently less than half of China.

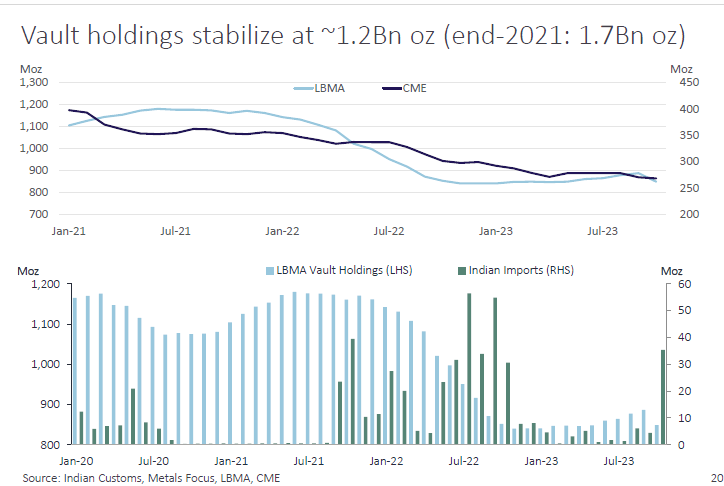

Some more charts from Metal Focus. This next chart shows that India's silver imports are volatile but a definite big increase since late 2021. The result is a big decrease in LBMA and CME inventories.

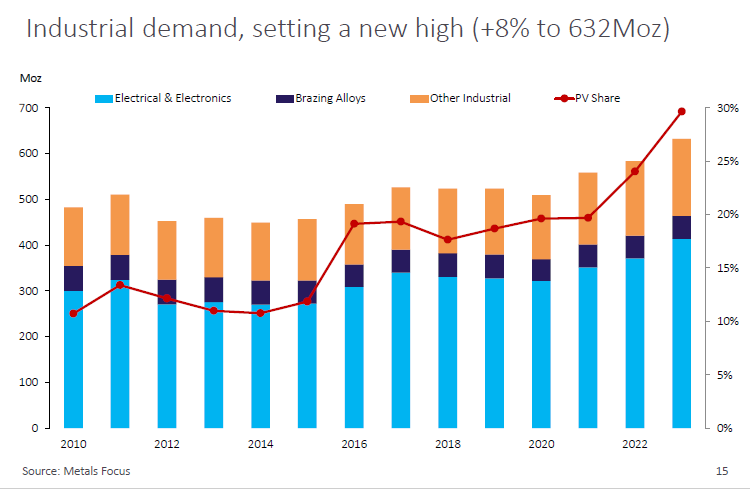

Along with India, this next chart shows the strong growing demand in solar (PV) that had been basically flat from 2016 to 2021.

Short term I believe that India will be a major driver on the silver price and longer term like all bull markets we need strong investment demand. As I mentioned, that will probably start to kick in between $30 and $35 per ounce. If silver catches up to gold, we are talking $50, $60 and eventually much higher.

Investment demand will be the key driver of the gold and silver bull market and will start to kick in this year. Precious metals have an inverse relationship with the stock markets and tend to rise when uncertainty hits stock markets. I expect that this year.

This market narrative that inflation is beat and the Fed will reduce rates is a fairy tale. As I have been saying, the Fed will lower rates because the economy is tanking. I don't rule out 1 or 2 cuts ahead of the election as a gesture or a sliver of hope to help Biden's election chances. It does not take a genius to see that inflation will not ease, in fact it will go higher. Oil hit my $85 target today and you can see on the chart that inflation data over the next several months will be comparing to the low oil prices of 2023.

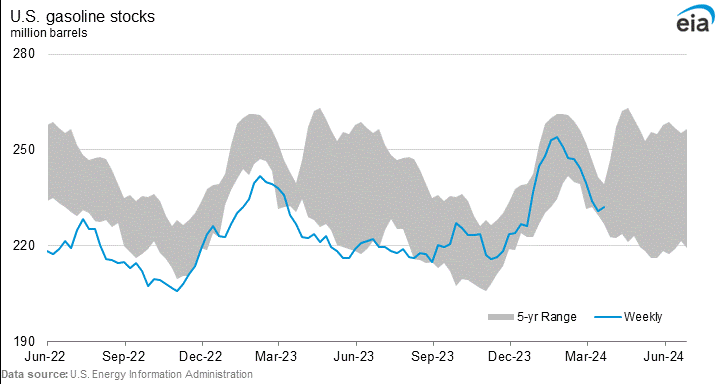

Gasoline prices show the same thing and we are not even near the peak summer demand season. I expect prices can easily reach $3.50 per gallon this summer.

The ongoing tightness in refined products has seen refiners outperforming pure upstream-focused companies by some 5 percentage points as the Red Sea shipping disruptions and refinery drone strikes in Russia kept supply restricted. Ukraine struck the Taneco refinery in Russia on Tuesday, located 800 miles from the front lines in Ukraine and boasting a capacity of 360,000 b/d, with regional media saying the drones were intercepted but still triggered a fire.

In what seems like two faced talk to me, Biden has pleaded with Ukraine not to hit Russia oil refineries because it will drive energy prices higher. I think Biden better read the basics or 'War for Dummies' to grasp reality, but I doubt he is not even sure where he is. Biden will likely have to blame the high energy prices on the oil companies and war.

EVs are not coming to the rescue either. Goldman Sachs forecasts that global road fuel demand will increase by 5% from now to 2032. I expect this is probably low because they are predicting too aggressive EV growth. Gasoline inventories are already at the bottom of the 5 year range and could drop to or below the 2022 lows.

And it will be worse in Canada, between the Trudeau government's carbon tax and policies driving down the economy, investment fleeing and the C$, loonie headed to new lows, we will probably see $2 per litre gasoline this summer and the high inflation that goes with it.

As I have been saying the last 2 to 3 years, we are in a 1970s style stagflation and this will lead to the biggest bull market in precious metals since the 1970s.

Stay tuned for Part II – My top silver stock picks

Meanwhile, buy physical bars and coins.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.