Silver Breakout - The Best Silver Stocks

Welcome and thank you to all the new, smart, savvy and contrarian investors who have joined my substack. I am still small here so please share and subscribe while this is still free.

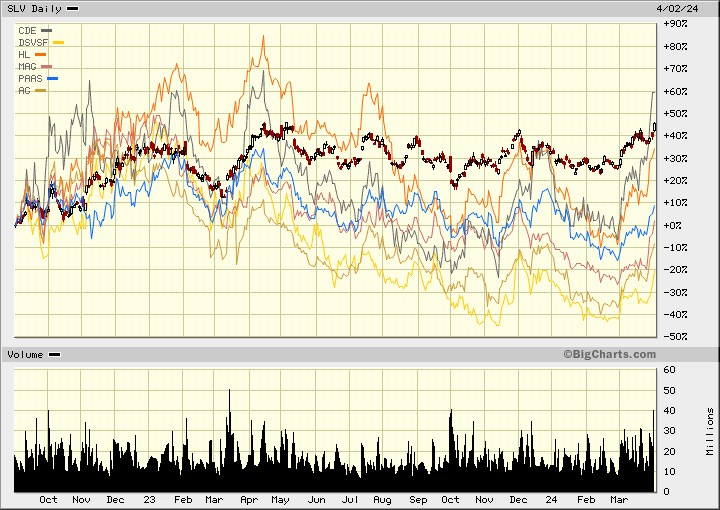

This chart compares the silver etf 'SLV' to 5 well known silver producers, Hecla, Coeur Mining, Majestic Silver, Mag Silver and Pan American Silver. Also non producer Discovery Silver. Like the gold stocks, the silver stocks are beat up. SLV shows a 40% gain since the September/October 2022 bottom while only Coeur Mining has out performed but that is because it is really a gold producer now. Hecla has almost caught SLV and Pan American shows a small gain during the comparison period.

Coeur Mining CDE might be remembered as a silver stock, but in 2023, 70% of their revenue came from gold. They do have about an equal value of reserves in silver compared to gold so there is still leverage to silver. Couer stock has moved up of late and that is related to the gold price increase.

First Majestic Silver -AG use to be one of my favourites but I am not to happy with their performance of late. In 2023 production was 26.9 million silver equivalent (AgEq) ounces, consisting of 10.3 million silver ounces and 198,921 gold ounces. They get about 60% of revenue from silver.

Hecla Mining - HL is an old well known silver stock and currently about 60% of revenues are from silver production. It should do well with rising silver prices.

Two silver stocks lagging on the chart that should do more than catch up is Pan American Silver - PAAS and Mag Silver - MAG, so I am adding these two to our Selection list along with Discovery Silver as huge leverage to silver and a take over target and also lagging silver on the chart.

Pan American Silver - - - TSX/NY:PAAS - - - -Recent Price - $15.80

Dividend yield 2.5%

Shares Outstanding 364.7

Pan American Silver trades like and is valued like a silver company but it is really a gold company when it comes to production so it is one of the gold stocks that has lagged recently. However Pan American has huge silver resources, over 1 billion ounces Measured and Indicated so it is like a gold stock with several silver linings.

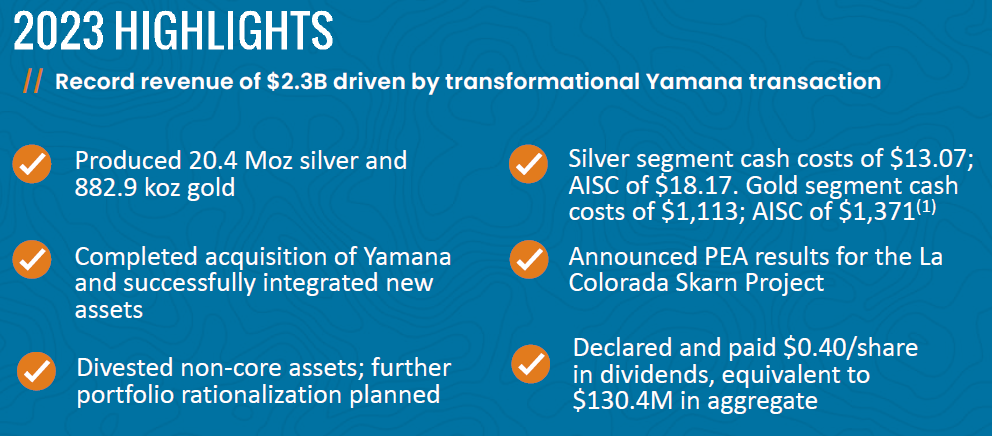

For 2023 silver production was 20.4 million ounces and gold production was 882,900 ounces

For silver they realized a price of $22.94 so gross revenue was about $468 million

For Gold they realized a price of $1,951/oz so gross revenue was $1.72 billion

You can see that gold is over 70% of revenues but the stock has not responded to the rising gold price as well as many other gold stocks.

They have 1,033,800,000 M&I ounces silver at $6/oz in the ground is about $6 billion value and 16,083,600 M&I ozs gold at $150/oz in the ground is about $2.4 billion. PAAS has a market cap of US$7.76 billion, less cash plus debt for a value of $6.12 billion. You can look at the stock as either the silver is valued cheaply or the gold valued cheaply. The current dividend gives about a 2.5% yield and I would expect this to rise as gold and silver go higher.

Pan American enters 2024 in a solid financial position with cash and short-term investments totalling $440.9-million and the full $750.0-million available under our undrawn credit facility. Total debt of $801.6-million was related to construction and other loans, leases and two senior notes Pan American assumed through the acquisition of Yamana.

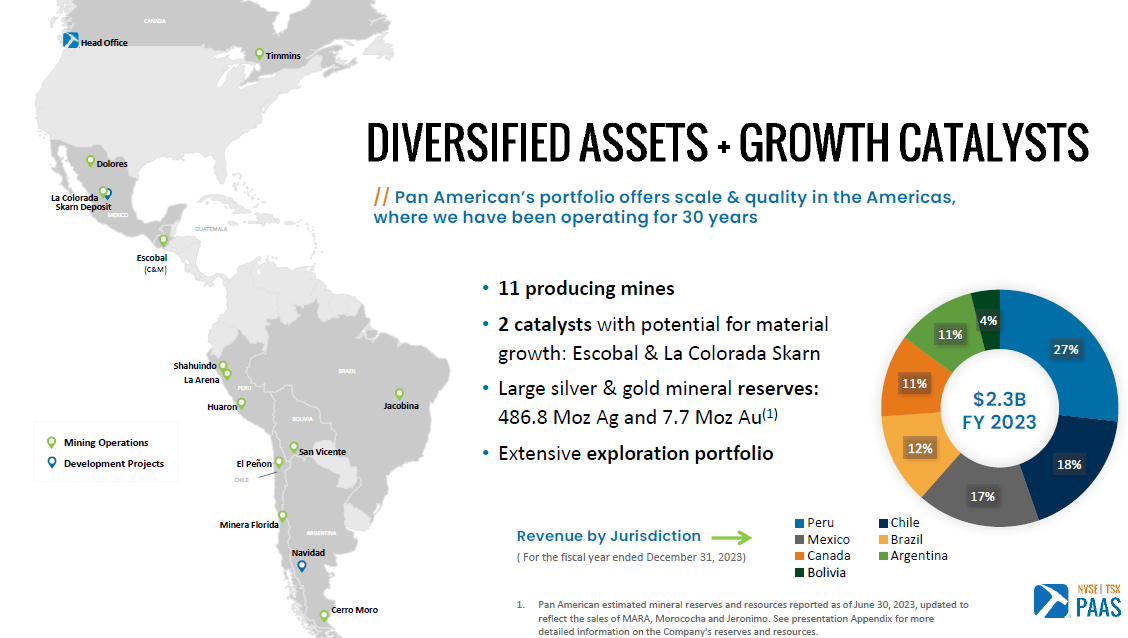

Pan American acquired Yamana Gold this year so that will drive growth for 2024. The company is very diversified with 11 producing mines so rather get into each mine, this graphic from their presentation gives you a good idea of the diversity.

Conclusion

The company is well diversified and in strong financial shape. Their gold and silver ounces are valued cheaply like most miners now, but I don't believe the stock has responded as well to the rising gold price as others. I see it catching up.

The company believes their stock is undervalued as well because they announced a normal course issuer bid to buy back up to 5% of the stock. They will have rising revenues and cash flow for 2024. Their guidance for 2024 is 21 to 23 million ounces silver at AISC of $16 to $18.50 per ounce. For gold they are projecting 880,000 to 1 million ounces production at AISC of $1,475 to $1,575.

PAAS will have very good margins for 2024 and the higher gold and silver prices will add to this significantly. Of note and because New Pacific Metals -NUAG is on our list, Pan American owns an ~11.6% undiluted interest in New Pacific, which is advancing the Silver Sands exploration project in Bolivia. Don't be surprised if Pan American buys out New Pacific.

The stock is way down from 2020/2021 highs so has lots of leg room to the upside. We need to see a close above $17 for a higher high and confirm the turn around. I see that soon.

I believe the stock could easily break the $20 resistance and get back close to $30 or better this year. That makes the Call Options attractive as well.

I like the January 2025 $20 Call option for US$2.50.

Mag Silver - - - TSX/NY:MAG - - - - Recent Price – US$11.45

Share Outstanding 103 MILLION

Mostly Institutional held, owning 70%

No debt and US$68.7 million cash at Dec 31, 2023

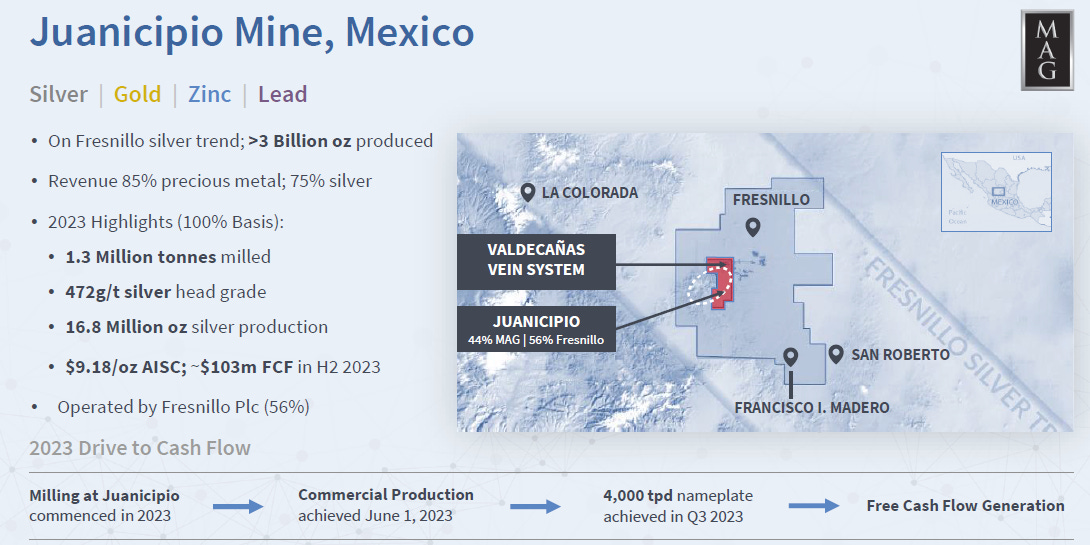

I have followed Mag Silver for many years and is a relatively new producer because their mine just started production in 2023, so it is probably not known so much as a major silver producer. This principal asset is a 44% interest in the Juanicipio Mine located in Zacatecas, Mexico, which achieved commercial production at its 4,000 tonnes per day (“tpd”) processing facility on June 1, 2023.

MAG's partner is Fresnillo plc a London based company that debuted on the London Stock Exchange in 2008 following a successful, profitable and decades-long track record as a Mexican mining company. Due to history as part of the Peñoles Group, Fresnillo can trace its origins back to the commencement of Peñoles' mining operations in 1887 and smelting and refining operations at Torreon in 1901.

The Juanicipio mine is high grade at 472 g/t silver and low cost at $9.18/oz AISC, so will be a real cash cow for Mag Silver, now that it is in production. A mine does not get much better than this one and I don't think the stock is reflecting this fact.

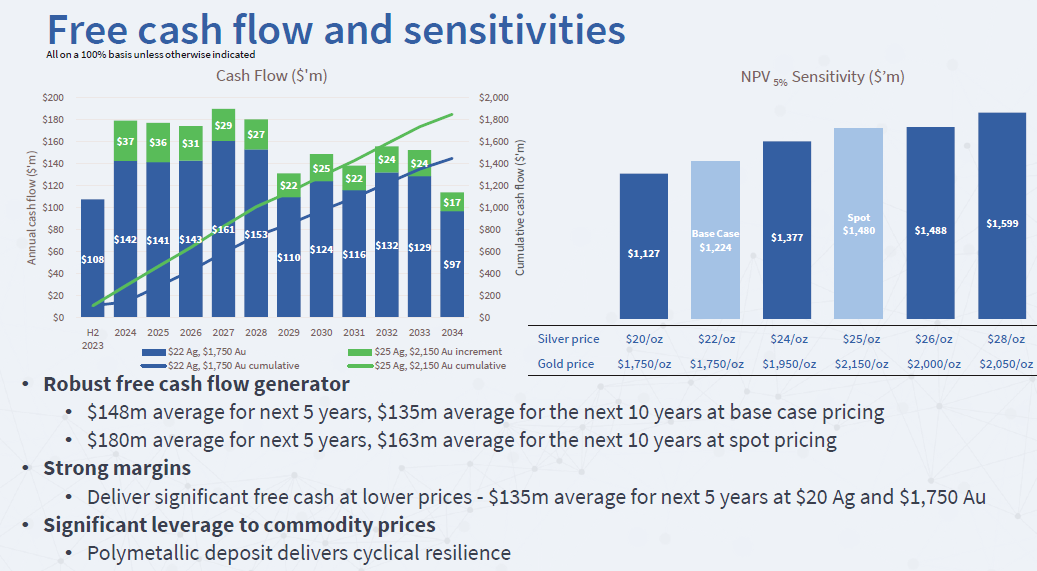

The silver recoveries are good at 88% and in the last half of 2024 the mine generated free cash flow of about $103 million in which $33.4 million went to Mag Silver. This is a great slide from their presentation that shows free cash flow at very conservative base case pricing and at spot prices.

Free cash flow of $180 M/year at current spot prices. If we get the prices I expect, hang on tight.

The mine has M&I resources of 406,277,000 AgEq ounces – Mag Silver 44% would be 178,740 ounces. The current valuation for MAG is about $6/oz silver about the average of other companies but this is an above average mine.

There is tons of upside exploration potential here so will be a very long mine life and the potential the mill rate could be expanded in a few years to increase production.

Conclusion

About 75% of revenue is from silver so this is a pretty pure play on silver. Cash flow for the 4th quarter was around US$36 million and with higher silver prices we could easily see cash flow in 2024 for MAG around $160 million

The stock is trading at around 11.5 times cash flow according to Marketwtach. If it simply maintains that multiple, the stock should move to about $18.00 in 2024.

On the chart, the long term down trend has been broken and the stock is about to break out to a higher high and above first resistance around $12.00.

Discovery Silver - - - TSX:DSV OTC:DSVSF - - - Recent Price – C$0.85

Shares Outstanding 395 million, Eric Sprott owns 23% and Institutions 37%

Many of you will remember this one as it was on the Selection List quite a while but we got stopped out in 2022 at $1.55. We can buy back much cheaper now.

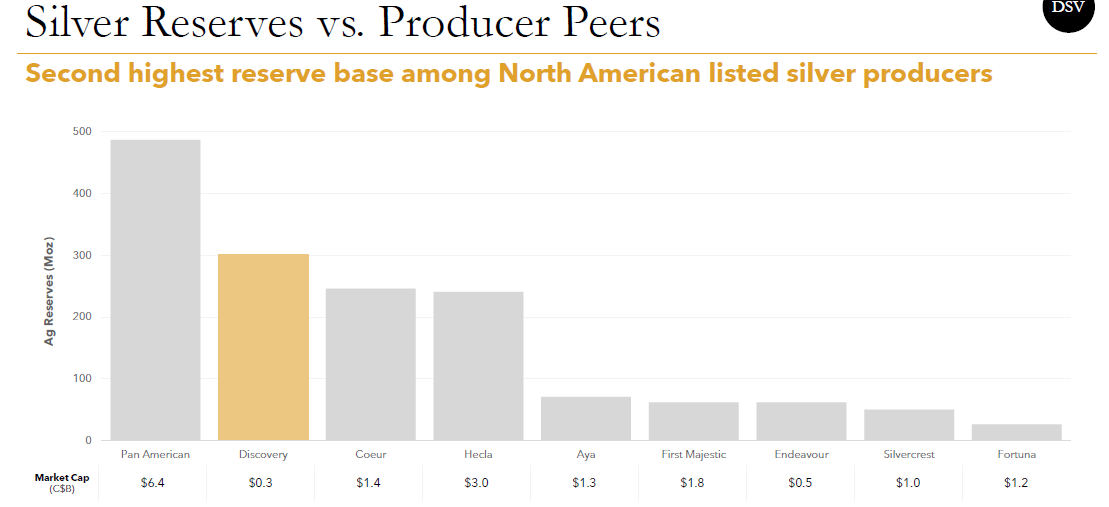

Discovery's flagship project is its 100-per-cent-owned Cordero project, the world's largest undeveloped silver deposit. The feasibility study completed in February, 2024, demonstrates that Cordero has the potential to be developed into a large-scale, long-life project with low unit costs and attractive economic returns that offers the combination of margin, size and scalability. Cordero is located close to infrastructure in a prolific mining belt in Chihuahua state, Mexico. In the chart below, Mag Silver would fit between Aya and Hecla.

Summary of Cordero feasibility study results:

Large-scale, long-life production: 19-year mine life with average annual production of 37 million ounces silver equivalent in concentrate in year 1 to year 12 and 33 Moz AgEq in concentrate over the life of mine;

Highly profitable: low unit costs with all-in sustaining costs per AgEq ounce of under $12.50 (U.S.) in year 1 to year 8 and under $13.50 (U.S.) over the LOM, placing Cordero in the bottom half of the cost curve;

Tier 1 reserve base: reserves of silver: 302 Moz, gold: 840,000 oz, lead: 3.0 billion pounds and zinc: 5.2 billion pounds, positioning Cordero as the largest undeveloped silver deposit globally;

Clear upside potential: 240 million tonnes of measured and indicated resource sit outside of the feasibility study pit, highlighting the potential to materially extend the mine life at modestly higher silver prices;

Low capital intensity: initial development capital expenditures of $606-million resulting in an attractive after-tax net present value to capital expenditure ratio of 2.0;

Attractive economics: base-case after-tax net present value discounted at 5 per cent of $1.2-billion (U.S.) growing to $2.2-billion (U.S.) in year 4, when the project reaches final completion to 51,000 tonnes per day.

Conclusion

At December 31, Discovery had a strong cash position of almost Cdn $59 million so they have plenty enough to move this through permitting to the construction phase. DSV submitted Environmental Impact Assessment (MIA) in August 2023; review process is ongoing

The deposit is massive. With the Feasibility and more drilling, the Measured & Indicated Resource grew by 70 Moz AgEq to 1,202 Moz AgEq within the pit outline.

Discovery has a market cap of US$255 million less cash a value of about $210 million. This puts a value per ounce of a measly US$ 17 cents. I expect a lower valuation with a lower grade deposit but the average grade in the first few years of mine life is around 100 g/t silver which is pretty decent for an open pit.

As you can see on the chart, this had a much higher valuation with less ounces and about the same silver price, but it is beaten down like every miner. The down trend is broken and the stock is close to breaking out to a higher high and resistance around $0.95. From here it could soon get back to the $1.50 area.

As you have probably noticed, from yesterday's report, silver has broke out today, currently at $26.77 on Comex. I bought silver coins from my dealer yesterday, Colonial Acres. It is the most silver coins I have seen in stock there for years. I would not wait long, I expect this will soon get bought up.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.