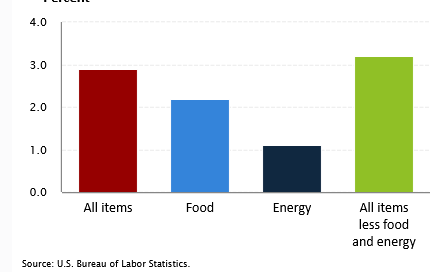

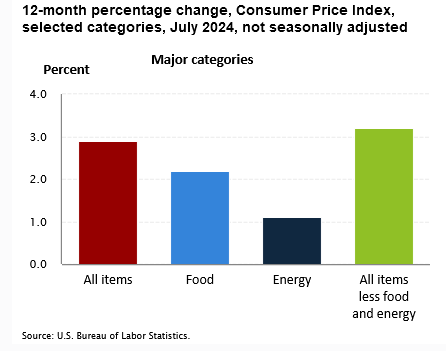

The CPI inflation report out today and it was a good news, bad news scenario. The headline number eased a bit as expected to 2.9% from 3% in June. The bad news is that core inflation (less volatile food and energy) that the Fed watches more closely edged higher to 3.2%.

On a monthly basis, prices rose 0.2%. Food prices were up 2.2% on the year. Energy prices were up 1.1%, and gasoline prices were down. Much larger price gains came in transportation services (8.8%) and shelter (5.1%) that pushed up “core” inflation to 3.2%

With the Middle East Conflict, energy prices will be key in coming months

The energy index was unchanged over the month, after declining in the two preceding months. If you recall I highlighted they did that with seasonal adjustments. The gasoline index was also unchanged over the month. (Before seasonal adjustment, gasoline prices rose 0.8 percent in July.)

These seasonal adjustments make little sense because now in July 2024 gasoline was much lower but the BLS says they seasonally adjusted it lower again. This is now 3 months in a row. Is headline inflation just a seasonal adjustment to fit a narrative?

Lets look at gasoline prices.

This July, gasoline prices are way lower than last July so makes no sense the BLS had to adjust lower this month. Perhaps because they adjusted the previous 2 months lower when they were way higher, they are balancing out adjustments. Basically making the numbers to fit a narrative.

Now the BLS measures prices at numerous gas stations around the country, but the Comex Future price heavily influences price as do crude oil prices, the input to make gasoline. Gasoline prices are also seasonal with higher demand in summer. Note above the steep decline after last summer. There has to be a repeat or else energy and gasoline is going to be pushing inflation higher again. I doubt prices will come down like last year because now we have the Middle East conflict that I have been predicting to escalate.

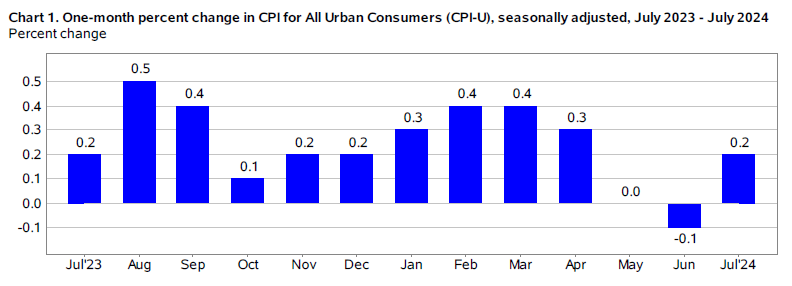

Look at these defense stocks, they are also predicting more war, not less.

Northrop Grumman Corporation (NOC) $505 -52 week high

Northrop is a leader in the defense and aerospace industry, benefiting from rising global defense spending and a strong pipeline of government contracts. The company’s expertise in areas like autonomous systems, cybersecurity, and space exploration positions it well for long-term growth. Northrop Grumman’s focus on innovation and strategic investments in next-generation technologies give it a competitive advantage in securing new contracts. With a solid balance sheet, consistent cash flow, and a commitment to returning value to shareholders through dividends and share buybacks, NOC presents a compelling investment opportunity in the defense sector.

Lockheed Martin Corporation (LMT) $563 – new all time high

Lockheed Martin, a global defense and aerospace giant, is positioned for sustained growth, driven by its unmatched portfolio of advanced technologies and military platforms, including the F-35 fighter jet. The company’s robust order backlog and long-term government contracts provide revenue visibility and stability. Lockheed’s focus on expanding into emerging areas like hypersonics, space exploration, and missile defense enhances its growth potential. With a strong balance sheet, consistent dividend growth, and a commitment to innovation, Lockheed Martin is well-equipped to capitalize on increasing global defense spending, making LMT an attractive investment.

RTX Corp (RTX) $117 – 4 year highs

RTX Corp, formerly Raytheon Technologies, is a leader in aerospace and defense, benefiting from its diverse portfolio of products and services across both commercial and military sectors. The company’s Pratt & Whitney engine division and Collins Aerospace segment are well-positioned to capitalize on the recovery in global air travel, while its defense segment continues to secure significant contracts in areas like missile systems and radar technologies. RTX’s focus on innovation and technology development ensures it remains competitive in key growth areas like hypersonics and cyber defense. With a strong balance sheet and a commitment to shareholder returns, RTX Corp is a solid long-term investment.

Known for the Patriot Missile on Aug 6th was awarded a $478 million contract from the NATO Support and Procurement Agency (NSPA) to supply additional Patriot GEM-T missiles to Germany.

Howmet Aerospace (HWM) $94 – new all time highs

Howmet is poised for growth, leveraging its leadership in advanced engineered solutions for the aerospace and transportation industries. As air travel recovers and the demand for fuel-efficient aircraft rises, Howmet’s lightweight, high-performance products are in high demand. The company’s expertise in titanium and aluminum components gives it a competitive edge in the aerospace sector. Howmet’s focus on operational efficiency and cost management, coupled with its strategic partnerships with major OEMs, positions it well for sustained growth. With a strong balance sheet and robust cash flow generation, Howmet Aerospace is an attractive investment in the aerospace supply chain.

The commercial sector was the main benefactor recently as Q2 revenue of $1.88 billion, up 14% year over year, driven by commercial aerospace, up 27%.

All these stocks have surged since mid July as they have become part of the market rotation out of tech. And are telegraphing more war.

Kellanova Co (K) $80.25 - 8 year high

Kellanova Co, the newly rebranded Kellogg Company, is well-positioned to benefit from its strategic focus on high-growth, high-margin snack foods and plant-based products. With a strong portfolio of iconic brands, Kellanova is capitalizing on consumer trends favoring convenience, health, and sustainability. The company’s global reach and ability to innovate in response to changing consumer preferences give it a competitive edge. Furthermore, Kellanova’s commitment to expanding in emerging markets provides additional growth opportunities. As the company continues to streamline operations and focus on its core strengths, Kellanova is set to deliver consistent revenue growth and shareholder value.

Kellanova shares are up on the news that they apparently agreed to be bought by Mars in the all-cash deal. The stock is up from the $60 level since reports of the merger first surfaced in early August. Kellanova was spun off from cereal-focused WK Kellogg (KLG) last year and has since posted a series of strong earnings, even raising its guidance for FY24 after its most recent analyst-beating results.

I mentioned the election yesterday and found this news today quite bizarre!

The European Union’s (EU) internal market regulator sent a warning letter to X owner Elon Musk ahead of his interview with former President Donald Trump on the platform, saying that “interim measures” could be taken against the social media site. It never ceases to amaze me the extent the far left will go to stop Trump. Simply unbelievable!

Steven Cheung, a spokesman for the Trump campaign, wrote that the EU “should mind their own business” and accused them of attempting to interfere with the U.S. election in November. The EU, he added, “has no authority of any kind to dictate how we campaign.”

Interesting - A spokesperson for the commission told the Financial Times that Breton did not have approval from EU President Ursula von der Leyen to send the letter to Musk. So is Breton working for the EU or the U.S. far left?

I listened to the interview and found it very good because it was different, just like a conversation, not so much hype and political BS you would hear on a campaign stop.

I guess the far left did not want numbers like this.

X said that Trump’s talk with Musk received 73 million views between 7:47 p.m. and 10:47 p.m. ET. There were also 4 million posts about Trump and Musk during the same time period, garnering nearly 1 billion views, according to the social media platform.

Also on Monday, Musk said that he would be willing to host Vice President Kamala Harris, the Democrats’ nominee for president, for an interview on his platform. I seriously doubt this would ever happen, because they would not be able to control the narrative and Musk is far smarter than Harris and for that matter, Trump too.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.