Sticky Inflation, Oil Inventory Low, lookout Cold Winter

Welcome and thank you to all the new, smart, savvy and contrarian investors to my substack. If you like outside the box thinking, a humble analyst that has spent his career studying market and economic cycles, picked numerous tops and bottoms, someone not afraid of controversial topics and can be a bull and a bear, your at the right place. Please share and subscribe.

In general I see most markets in a sideways to slightly down move, so I am waiting for more clarity before making some new stock picks. Gold is consolidating gains, oil up and down with general markets lacking traction. I am watching some great potential picks though.

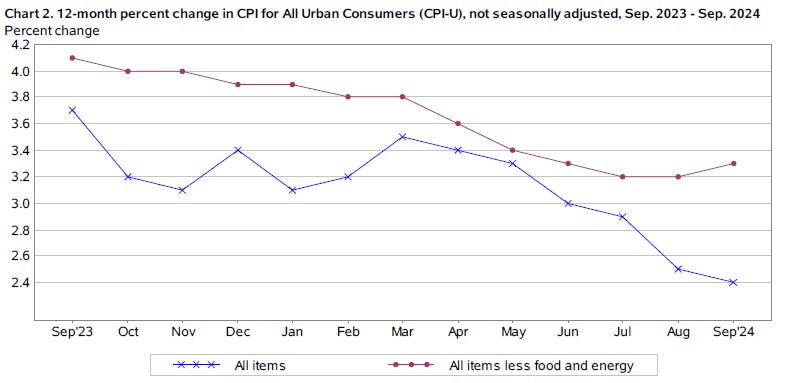

Inflation came in a bit higher than expected but still a pretty good number before the election. Once again falling energy prices brought the low number in.

Headline consumer price index inflation was 2.4% in September, according to Bureau of Labor Statistics data. The 2.4% year-over-year increase in the index compares to average economist forecasts of 2.3% headline inflation, according to FactSet data.

The 0.2% month-over-month increase in headline inflation compares to estimates of 0.1%, and a 0.3% jump in core inflation compares to forecasts of 0.2%.

According to the BLS, the energy index fell much more in September than August. The energy index fell 1.9 percent over the month, after declining 0.8 percent the preceding month. The index for shelter rose 0.2 percent in September, and the index for food increased 0.4 percent.

This chart from the BLS shows that core inflation has been stuck around 3.3% the last 5 months, still well above the FED's 2% target. As I have been commenting for a few months now, it is only falling energy that has rescued the headline inflation number. I don't believe that is sustainable.

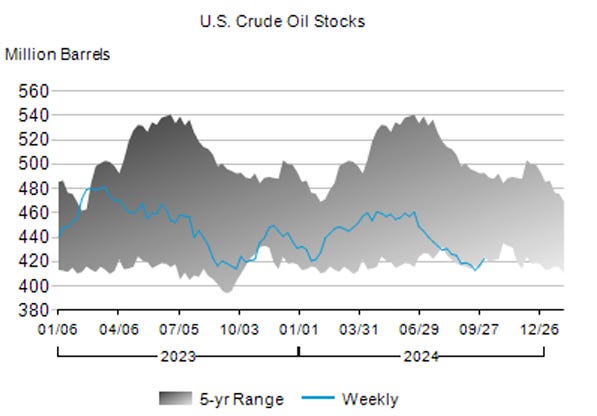

Crude oil inventories in the United States rose by a shocking 10.9 million barrels for the week ending October 4, according to The American Petroleum Institute (API). Analysts had expected a build of 1.95 million barrels. The EIA report was much lower, but above expectations.

Crude inventories rose by 5.8 million barrels to 422.7 million barrels in the week ended October 4, the EIA said, compared with analysts' expectations in a Reuters poll for a 2 million-barrel rise.

Together, gasoline and distillate fuels declined by some 9.42 million barrels last week. Analysts said that draw was primarily due to stockpiling ahead of Hurricane Milton.

Oil Inventories are a multi year lows but the market is pretty complacent considering the hurricane risk this year and the middle east conflict. There could easily be another 1 to 3 hurricanes in the gulf yet this season and if one should hit the oil producing region, there is just no room for any problems.

The International Atomic Energy Agency (IAEA) warned in May that Iran possesses enough material to produce at least three nuclear warheads. However Iran is some time away from developing a weapon or the missiles. That said there is now speculation that Russia may now be assisting Iran in this respect, in exchange for the missiles and drones.

It is expected that Israel will respond to Iran's missile attack and they would likely target Iran's oil production to cut off their money spigot and their nuclear facilities to set back Iran's nuclear weapon development.

The Biden administration has been in several talks with Israel. I would bet they are putting off the attack until after the election and in return the U.S. would provide more support at that time. A large flare up in the war and resulting higher oil prices could further hinder the chance of Harris becoming president and Democrats holding the Senate. Biden last week made it clear that he is not in favour of Israel attacking Iran’s nuclear sites.

This week, resistance and support has been effective for the oil price. I am very interested to see if we get another month end sell off in October. It will be too late to affect inflation numbers ahead of the election so I am speculating no sell off and a side ways market for now.

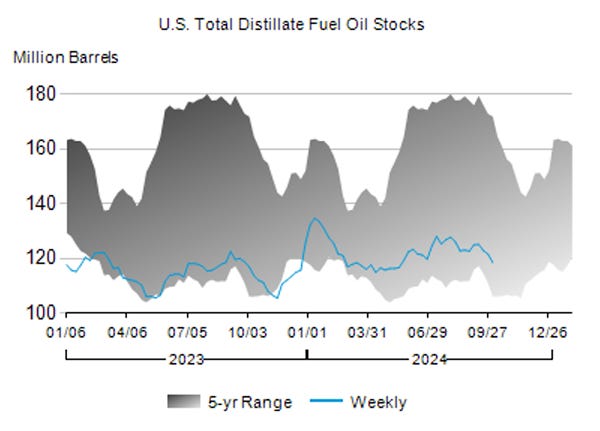

Another concern is heating oil inventories ahead of the winter. Normally there is a summer buildup and this did not occur last year nor this year. Last year was fortunate with a very warm winter and inventories did a very rare thing and increased in the winter. Note the 2024 01/01 top. I am hearing noise about a colder than normal winter. October 17th is the NOAA forecast but there are a few out now:

The Almanac, taking into account the effect La Niña has on the weather, along with our long-standing formula, they anticipate the winter of 2024-25 will be wet and cold for most locations.

Weather Channel much of the northern tier of the U.S., from the Northwest to the Northern Plains and upper Midwest, may skew a bit colder than average in December. That may be due, in part, to a weak La Niña expected to develop this fall.

The Weather Network says currently, the La Niña conditions are still rather weak. When we look back in history at years that had similar (weak La Niña) conditions, there is actually a surprising consistency to how winter started during those years.

In most cases, winter got off to a strong start during the month of December, and in some of those years, colder than normal temperatures started as early as November.

It seems the jury is still out if the La Nina develops and how strong. Weather is unpredictable and because last year was way warm, it makes the odds higher this year will be colder. Where I live I got our first frost last night. Last year it was late in October.

I have been commenting about the negative effect government policy is having and will have on energy. An interesting piece in the Globe today.

The Globe and Mail reports in its Thursday, Oct. 10, edition that Canada's energy sector is currently burdened by a complex set of rules and regulations, leading to a costly and inconsistent policy framework.

In the next few weeks, Ottawa is set to unveil draft regulations for capping emissions in the oil and gas sector, as well as finalizing clean electricity regulations aimed at achieving a carbon-neutral grid by 2035. Industry leaders have raised serious concerns about the potential negative impact of these policies on sector investment, particularly in decarbonization efforts. An earlier report by S&P Global estimated that the emissions cap could lead to a $60-billion reduction in capital investment over the next decade, representing a significant blow to the economy.

What I have been seeing in the numbers is that investment capital is fleeing the country in record amounts. Canadians are investing more abroad too. Canada has the highest carbon tax in the world and the highest corporate tax rate in the world. Now top that off with what will be the highest bureaucracy impediment and it spells continued disaster and a continued path farther down 3rd world status. Yes, Canada is rated at 30 among the 32 developed countries. Once we drop below the 32, Canada comparison will be with 3rd world countries.

I am working on an economic report on Canada but it has been slow. I find it so depressing and maddening I don't like to work on it

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.