It is amazing that some cities are experiencing violent riots and the far left lunatics are more concerned about Trump bashing than their own citizens. The latest and famously used temporary restraining order was used by Newsom in California to stop Trump from deploying National Guard and troops. "Trump is turning the U.S. military against American citizens. The courts must immediately block these illegal actions," Newsom wrote on X.

Of course this is another BS narrative. It is well within the Federal governments authority to deploy the National Guard and Troops to protect federal buildings and personnel and that is what they are doing. They cannot make arrests or be on the offensive on rioters, but they can protect the federal agents making arrests of illegal immigrants.

A district appeals court, the same day over turned Newsom's TRO from a federal court, allowing a federal appeal. Most likely a ruling will be made that Guardsman and Troops can be used defensively only and Newsom will claim this is some kind of win stopping Trump, when in fact it is all status quo.

I pointed out before that President Trump is grappling with a seemingly endless array of national temporary restraining orders (TROs) issued against his policies by obscure district court judges (predominantly appointed by his political opponents). However, the general public is getting a high-profile opportunity to observe a scenario that business leaders already know. The US may have been founded on the concept of three co-equal branches of government, but the judiciary, and the legal profession more broadly has steadily claimed for itself powers over the everyday lives of citizens that are wildly out of proportion. Many call it 'lawfare'. To me it looks like an agenda to try and stop Trump at all costs. He was elected on a platform to reduce immigration and expel illegal and criminal immigrants, but hey, it does not matter what the people want, only the elites.

More Trump bashing this weekend with the Anti-Trump 'No Kings Day' protest to coincide with DC military parade. The far left wants this to over shadow the military parade with over 1,800 protests projected and no other than Christy Walton of Walmart wealth is a big supporter. She is a big democrat supporter and just coincidence that Walmart had to terminate thousands of migrant employees who were paid less than citizens. Trump ended the CHNV parole program that permitted migrants to work in the United States, instantly changing the immigration status of 500,000 noncitizens.

It's all about bashing and stopping Trump, no matter what it is, good, bad or ugly. You don't have to like the guy or agree with him, but this lawfare is wrong!

War and Oil (Drill Baby Dill)

As you know, I am of the opinion that the Ukraine war will escalate and the middle east war had high risk of turning into a regional war. For that reason, despite weakness in oi&gas, I have maintained a heavy weighting in the Millennium Index and kept oil&gas stocks on the Selection List.

No surprise the war premium is coming back on the oil price

As you probably heard, Israel strikes last night killed Iran’s top three generals, according to Iranian state media, and targeted military bases and nuclear sites across the country. The timing was probably Israel fearing that Trump and Iran appeared to be close to a preliminary agreement that included provisions about uranium enrichment that Israel refused to accept.

The long term down trend in oil has ended with a double bottom this spring and the recent break out that last 2 days. I used a 3 year chart here for a longer term perspective. I now expect a test of the $80 area. It is looking today that we will see a higher from $70 back in early April.

It is Friday the 13th, and looks like a lucky day for our investments.

I kept the Millennium Index with a pretty heavy oil&gas weighting because so many of these stocks were cheap and under valued and providing pretty good dividends. This is starting to pay off with a lot of these stocks rebounding from April lows.

Millennium Index for Paid Subscribers

On the index, I currently see Cenovus CEV, Vermillion VET and Devon DVN as buys. VET and DVN produce a lot of gas, but the big driver in price action is investor change in sentiment. Perhaps later this year these energy stocks will move back up to more average multiples. Devon is trading at just 3 times cash flow and VET 2.2 times.

President Trump has not seen any action on his 'drill baby drill' rhetoric, but now that prices are improving, we could start to see action on new exploration areas opened.

The Millennium Index is having a fantastic year with the energy stocks now moving from over sold positions. The gold stocks and Nutrien are the big positives so far this year but the energy will start to add to it. The index is up 21% so far this year plus 4.1% dividend yield. It is blowing away comparative indexes.

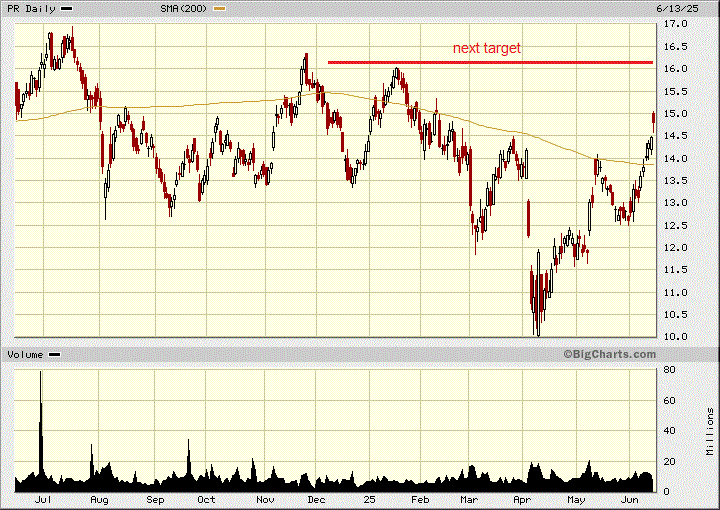

On our Selection List, Permian has seen a big rebound, despite week oil prices

Permian Resources - - - NY:PR Recent - - - - - Price - $14.80

Entry Price - $9.23 - - - - - - - Opinion - buy

We have a cheap entry price with PR because of the Earthstone merger and the stock plunged almost back to our entry price in April, but has now bounced back strong. It has moved above the 200 day MA and today broke out with a higher high.

The stock is only trading at 2.9 times cash flow. On May 7, reported the first quarter, Permian Resources generated net cash provided by operating activities of $898 million, adjusted operating cash flow of $961 million and adjusted free cash flow of $460 million. Adjusted diluted shares outstanding were 847.8 million for the three months ended March 31, 2025.

“Permian Resources delivered another outstanding quarter, highlighted by strong operational performance and lower costs. Through our team’s relentless pursuit of enhancing our low cost leadership, during the quarter we reduced controllable cash costs per Boe by 4% quarter-over-quarter and lowered D&C costs to $750 per foot, which helped generate record quarterly adjusted free cash flow of $460 million,” said Will Hickey, Co-CEO of Permian Resources.

I believe the stock still has a lot of upside with a low valuation and a base dividend now of $0.60 for a 4% yield.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.