The Fed move, Markets, Greenbriar (GEBRF) and Real Estate

Most believe the Fed interest rate cut is the big news later today but 1/4 point cut is a foregone conclusion. Some hope for 1/2 point but that would be bad news, viewed as a signal the economy is in trouble which it is regardless. Markets are off a little but could likely sell off this afternoon on a sell the news event. It looks like we now have a triple top in the S&P 500. Even if we go a bit higher, I am sticking to my forecast that July was a market top. There is way more downside to come than a little bit more possible upside.

On Monday it was reported that manufacturing activity expanded in New York region for first time in almost a year. New York Fed’s Empire State factory gauge jumps to 11.5 versus forecast of negative 5.

Retail sales ticked up 0.1% from July to August, after jumping the most in a year and a half the previous month, the Commerce Department said Tuesday. Online retailers, sporting goods stores, and home and garden stores all reported higher sales. If adjusted for inflation, sales growth would be negative so this news is nothing to brag about.

Industrial production posted a bigger-than-expected increase in August, but most of the gain was tied to automobiles and there was little sign of a rebound in a depressed U.S. manufacturing sector. Output climbed 0.8% last month. Economists polled by the Wall Street Journal had forecast a 0.2% increase in production.

The amount of work space factories are putting into use, known as capacity utilization, rose to 78.0% from 77.4%. The rate of utilization, however, is still 1.7 points below its long-run average.

Oil Bottoms

The marked shift in oil sentiment recently has been to a great deal prompted by a widespread concern of Chinese demand peaking this or next year as LNG displaces diesel in long-haul trucking, EV sales overtaking conventional cars since July and rail expansion eating into jet fuel recovery.

Chinese refinery runs have been declining for five straight months, with the National Bureau of Statistics reporting throughput rates at 13.91 million b/d in August amidst a widespread decline in Shandong teapot runs, as low as 55% last month.

Short positions held by hedge funds and other money managers in the ICE Brent futures contract surpassed long ones for the first time on record, with a net short of 12,680 contracts reflecting widespread concerns over Chinese demand and the US economy. Another sign a bottom is in.

US Real Estate Challenge and Greenbriar Solution

U.S. single-family homebuilding rebounded sharply in August and permits increased, but rising new housing supply poses a challenge for builders. Single-family housing starts, which account for the bulk of homebuilding, surged 15.8% to a seasonally adjusted annual rate of 992,00 units last month, the Commerce Department's Census Bureau said on Wednesday. This is good news but we are still a long way off in fixing the affordable housing shortage.

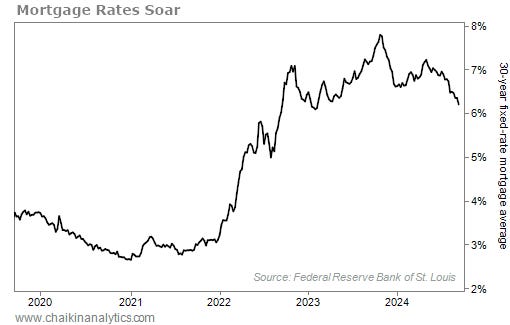

As prices rose from 2020, buyers got "sticker shock" and sat on the sidelines. It was great for sellers because prices were up, but because of high rates, most of them couldn't afford to sell and move. In 2023, sales of existing homes fell to their lowest level in about three decades.

Now, interest rates are on their way down. But they're just getting close to where they could make a difference. Today, nearly 90% of homes in the U.S. still have mortgages with an interest rate of less than 6%. Rates will never come down to the 3% level of the past, at best I expect 4.5% to 5%. This will be a slow recovery. And what if inflation heads back up.

Greenbriar announced an MOU with a house construction company for their Sage Ranch, California development and put out a very interesting perspective on US real estate market. I am going to highlight most of that info from their news release.

Greenbriar - - - TSXV:GRB, OTC:GEBRF - - - -Recent Price - C$0.48

Entry Price - $0.77 - - - - - - - Opinion- buy

Greenbriar announced that the Company has executed a 12- month Memorandum of Understanding with Cavco Industries Inc. Cavco is a builder of manufactured homes in North America with annual audited 2023 revenues of USD $1.8 Billion.

They have four manufacturing facilities in Texas, North Carolina, California, and Arizona, and more than 230 retail partners, Cavco serves customers across Arizona, California, Colorado, Louisiana, Nevada, New Mexico, North Carolina, Oklahoma, Texas, and Utah. Each of Cavco’s factory-built homes are constructed in a controlled indoor environment at a fraction of the time and cost of a site-built home and are partially or fully customizable to you’re a buyer’s wish list. Cavco has built and sold more than 500,000 manufactured homes.

Cavco is an excellent choice for Greenbriar and a 12 month window means house manufacturing will start in that window. Keep in mind, that the first start of construction will be the streets and infrastructure to support the new homes. And this will be done in phases over 6 years, which means 6 years of strong revenues for Greenbriar.

Greenbriar on the Affordable Housing Shortage and Part of the Solution

“The U.S. faces a national shortage of affordable homes – at current prices and mortgage rates, few Americans can afford to buy a house today. Americans are currently faced with choosing between mortgage payments they can’t afford, high rents which build no equity, or neighborhoods they don’t want to live in. California is a compelling example with 39 million official residents and a median family home price of USD $773,363. The Golden State has an estimated shortage of 3.5 million affordable homes. (Above from Zillow and Federal Reserve Bank).

Greenbriar received full entitlement for a 995 home, entry-level priced, green subdivision in Southern California in 2021 and a final Precise Development Plan approval in November 2023. Greenbriar has access for 3,500 more homes in Cedar City, Utah. Cavco is a designer and builder of manufactured homes in North America. Greenbriar has an immediate pipeline of 4,500 entry-level sustainable homes. Together Greenbriar and Cavco through the MOU will collaborate on placing Cavco homes at our select locations.

On Wednesday, September 11, 2024, the U.S. Department of Housing and Urban Development (HUD) announced it has implemented the most extensive changes to its Manufactured Home Construction and Safety Standards (HUD Code) in more than 30 years. While the HUD Code changes include almost 90 new and updated standards to foster innovation, improve safety and accelerate the production of homes, the HUD’s official approval for the building of duplex, triplex and quadplex homes nationwide includes a waiver allowing for immediate construction. This move, to address the nation’s affordable housing crisis, enables homebuilders to push for more creative housing solutions using manufactured homes.

Cavco was the first manufactured homebuilder to work with HUD to build the first single and double-section HUD approved true duplexes as part of its innovative Anthem series. Cavco launched the first HUD-approved multi-section duplex in Rocky Mount, VA in December 2023 and unveiled the first HUD-approved singlesection manufactured duplex in Washington DC in June 2024. This innovative single-section Anthem duplex model, the Blue Ridge, has two separate living units built on one frame or section. One of the living units is a 2 bedroom, 1 bath, and the other a 1 bedroom, 1 bath. Both units offer a spacious, open plan living area and designer kitchen and bathroom and are separated by a firewall.”

***********************************************************

Cavco will be a great fit for Greenbriar. The time to buy the stock is now, before the seller I mentioned is crossed out of the market. When this happens, the stock will rebound quickly. That said, for now stick with bids under $0.50.

The stock normally trades low volume because it is strongly held. The bottom is in with the panic sell off on high volume.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.