Trillion Energy TCF, BFG, ZEFI, AZT

Welcome and thank you to all the new smart, savvy and contrarian investors who I have joined my substack. I am still very small here so don’t be shy to share and subscribe.

About 2 weeks ago, I had a lengthy conversation with Jay Park a new director of Trillion Energy in 2023. Mr. Park was formerly CEO (April, 2018, to September, 2020) and then chairman (September, 2020, to January, 2022) of ReconAfrica (RECO). He had huge success with RECO getting the story out and moving the stock up about 15 fold. I asked him how he came across Trillion and what got his interest. He commented that he has many contacts in the industry and that is how he became aware. He liked the company because it was way under valued and has huge potential with their oil play in the Cudi-Gaba Province while the natural gas, SASB field will give a solid base and cash flow.

I did not want to put an update and buy the stock until we got some news that the rework of their gas wells would be a success. We got that good news Tuesday. And as a reminder, the main reason the stock is down where it is - a hedge fund that owned 35m shares went under had to liquidate last October. Since then the market lost confidence in TCF's ability to remedy the gas field but now that is finally happening.

Trillion Energy - - - CSE: TCF, OTCQB: TRLEF - - - - Recent Price C$0.15

Entry Price - $0.23 - - - - My Opinion -Strong buy, average down to $0.19

TCF provided this operational update for the SASB gas field well intervention program.

South Akcakoca-2 well was perforated over the intervals 2319.5-2323.5 (4.0 m), 2339.6-2341.3 (1.7m) and 2411.1-2412.8 (1.7m) for a total of 6.4 m (all measured depth “MD”). Well hole pressure (WHP) was 86 psi before perforation, the WHP increased to 1046 psi. The well flowed continuously from the morning of July 9th and by July 10th afternoon the flow rate was 0.70 MMcf/d with a WHP of 140 psi; July 12th flow rate was 1.2 MMcf/d with a WHP of 156 psi; July 14th flow rate was 1.88 MMcf/d with a WHP of 312 psi; last data point at 4:30 pm July 15th flow rate was 2.88 MMcf/d with a WHP of 318 psi.

South Akcakoca-2 well will be continued to be monitored until it reaches a stable rate. The production characteristics indicated that perforating the new zones blew the water out of the well, but also indicate that the reservoirs that were water blocked are cleaning up and producing gas.

Guluc-2 well was perforated over the intervals 3512-3514.5 (2.5 m), 3749.5-3751.3 (1.8 m), 3770.7-3772.4 (1.7m) and 3781.6-3783.3 (1.7m) for a total of 7.7 m (all MD). WHP was 650 psi and increased to 1243 psi before settling to 1098 psi. Guluc-2 will be flowed to clean the water and perforation debris out and be capable of gas production, however, it will than be shut in while South Akcakoca-2 well gas production stabilizes. The increase in the WHP during perforation indicates gas flowed into the borehole from the new perforated zones. Updated flow rates have yet to be established for this well due to the ongoing testing of SA-2.

The perforation operation is currently continuing ongoing on West Akcakoca-1 well after which it will perforate the remaining pay in Akcakoca-3.

Arthur Halleran CEO of Trillion stated:

“The fantastic response of South Akcakoca-2 once the water was lift off the perforations indicates that the reservoirs will produce the gas they contain once the water loading is removed. The wells are going to be perforated and monitored during clean up to evaluate the reservoirs response. The next phase of this project is to install the smaller production tubing (2 3/8”) to allow the wells to produce for a few years before water loading occurs again.”

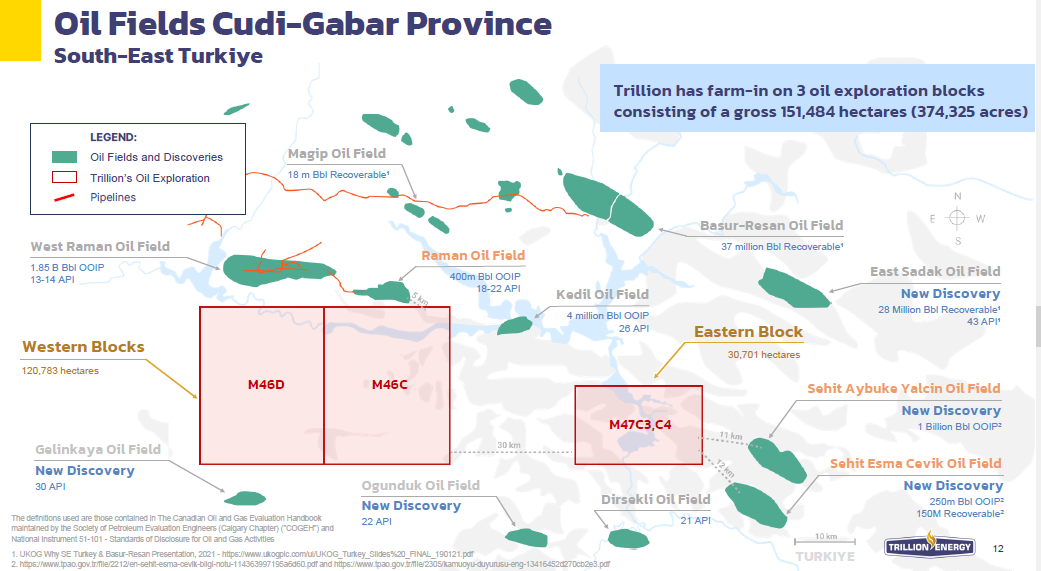

In conclusion, this intervention program on the SASB gas field is going to succeed very well. With this increased cash flow and their recent $2.4 million financing will ensure funding for the first oil exploration wells. Three Blocks in the Cudi-Gabar Province M47cs, c4 and M47c,d total 374,325 acres. These are on trend with major oil fields and a new discovery of 250m Bbl OOIP is just 12 kms away and another just 11kms.

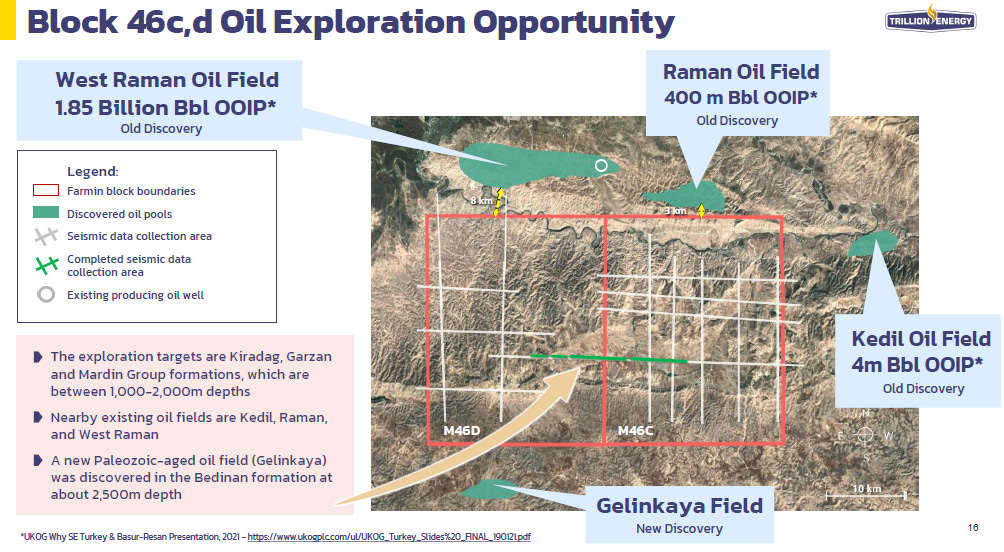

The next graphic is a close up of Block 46c,d where they will drill first. It is surrounded by past and more current oil fields. I highly doubt Mother Nature skipped this block and I expect TCF will make one or more major oil field discoveries this year and next.

On the chart, the down trend has been broken (blue lines) and we have a higher high since the May bottom. Next resistance is around $0.20 and a good close above this would mean the stock is on it's way higher.

Giant Mining - - - - CSE: BFG, OTC: BFGFF - — - - Recent Price - $0.65

Entry Price - $0.80 - - - - - - - Opinion - buy

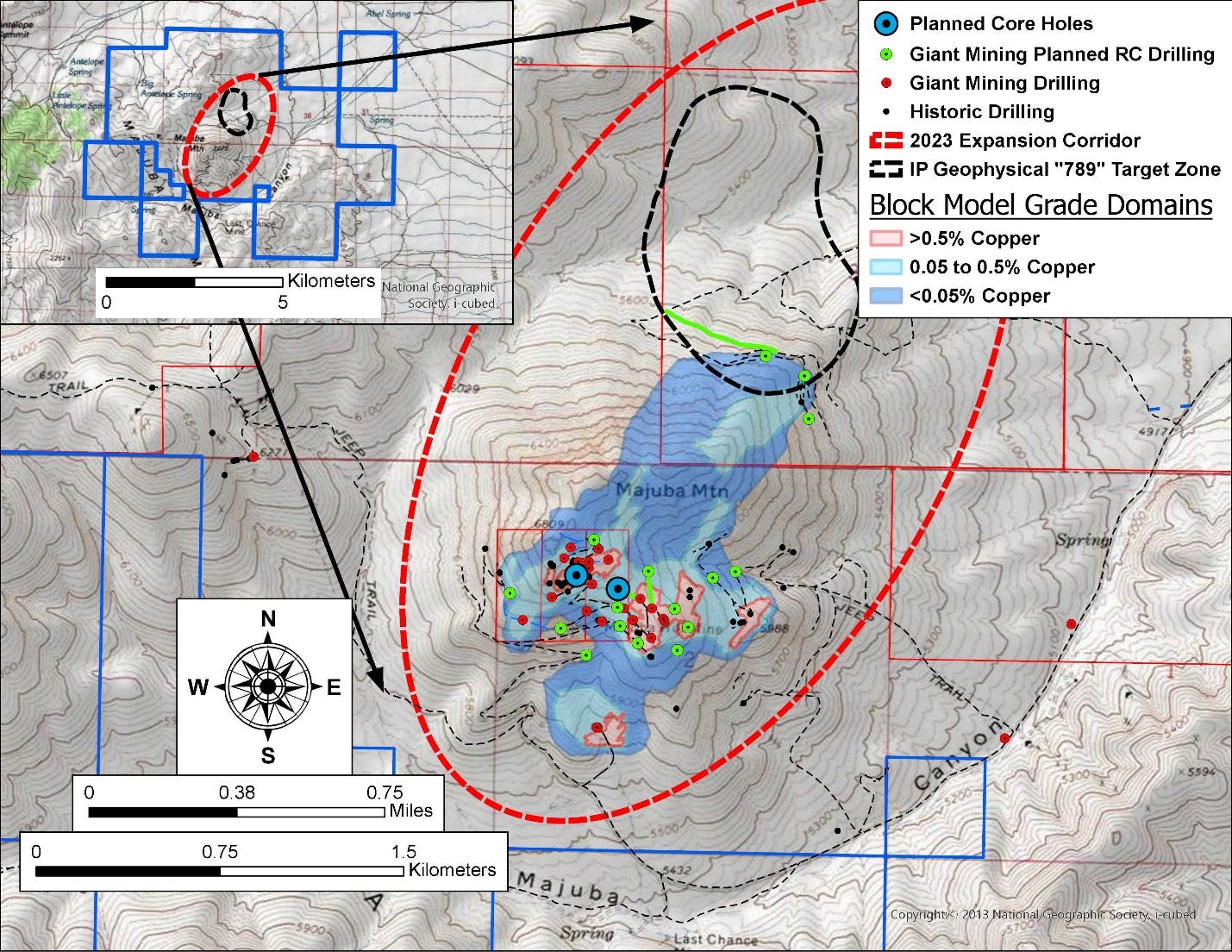

Giant Mining announced the successful completion of new road construction at the Majuba Hill Porphyry Copper Deposit in Pershing County, Nevada.

This drill road and drill site construction is being done by Legarza Exploration, LLC (“Legarza”), and will provide additional drill locations for our ongoing and future drilling. The upcoming drill program is proposed to be 3,900 meters (12,800 feet) of reverse circulation (RC) drilling across 16 drill holes and 488 meters (1,600 feet) of core drilling within the existing exploration target area. Additionally, the Company is also contemplating drilling two deep core holes, each expected to reach depths of up to 3,500 feet (1,066 meters).

This graphic shows the exploration target and proposed drill locations. The time to buy the stock is before drilling starts.

Zefiro Methane - - - - - CBOE:ZEFI - - - - - Recent Price - $1.70

Entry Price $1.60 - - - - - - - Opinion - buy

ZEFI continues to build an outstanding management team with another JP Morgan exec. I doubt these people could be attracted to a company unless it had huge potential. Today they appointed Catherine Flax to the board of directors. With decades of experience in Wall Street banking, Ms. Flax was recognized by Financial News (Dow Jones) as the most influential woman in European investment banking in 2012. Ms. Flax will work directly with Zefiro founder and chief executive officer Talal Debs.

In the 1990s, Ms. Flax held investment banking positions with an energy concentration, including managing North American power origination for Morgan Stanley in its New York office (1998 to 2004), as well as North American power and gas origination for UBS in its Stamford, Conn., office. Ms. Flax then pivoted to J.P. Morgan, where she held roles to include head, global commodities corporate marketing/sales and structuring (NYC), global head, commodity finance business (London), and chief executive officer, global commodities for Europe, Middle East and Africa (London). In 2012, Ms. Flax was appointed chief marketing officer of J.P. Morgan, out of its New York City headquarters. Thereafter, Ms. Flax joined global banking giant BNP Paribas as its head of commodity derivatives (Americas).

Her comment in the news release

"I am thrilled to be part of the team at Zefiro, whose integrated business concept is uniquely focused on the actions that need to be taken to address the methane emissions crisis in the United States," said Ms. Flax regarding her appointment to Zefiro's board of directors. "Zefiro has built a robust and scalable model for measuring and monitoring emissions of methane in accordance with the latest methodologies for carbon offsets. Zefiro is differentiated in that it has its own crews and equipment to perform remediation work to prevent potentially harmful emissions. Environmental responsibility is more important than ever in 2024 for American organizations of all sizes and I look forward to working with Zefiro's team as it takes an execution-focused approach to providing impactful and meaningful solutions with a long-term and global vision."

The company and stock is still flying well under the radar. For how long I don't know, but at any time this could start moving much higher.

Aztec Minerals - - - - TSXV:AZT, OTCQB: AZZTF - - - - Recent Price -C$0.22

Entry Price - $0.40 - - - - - - - Opinion - buy

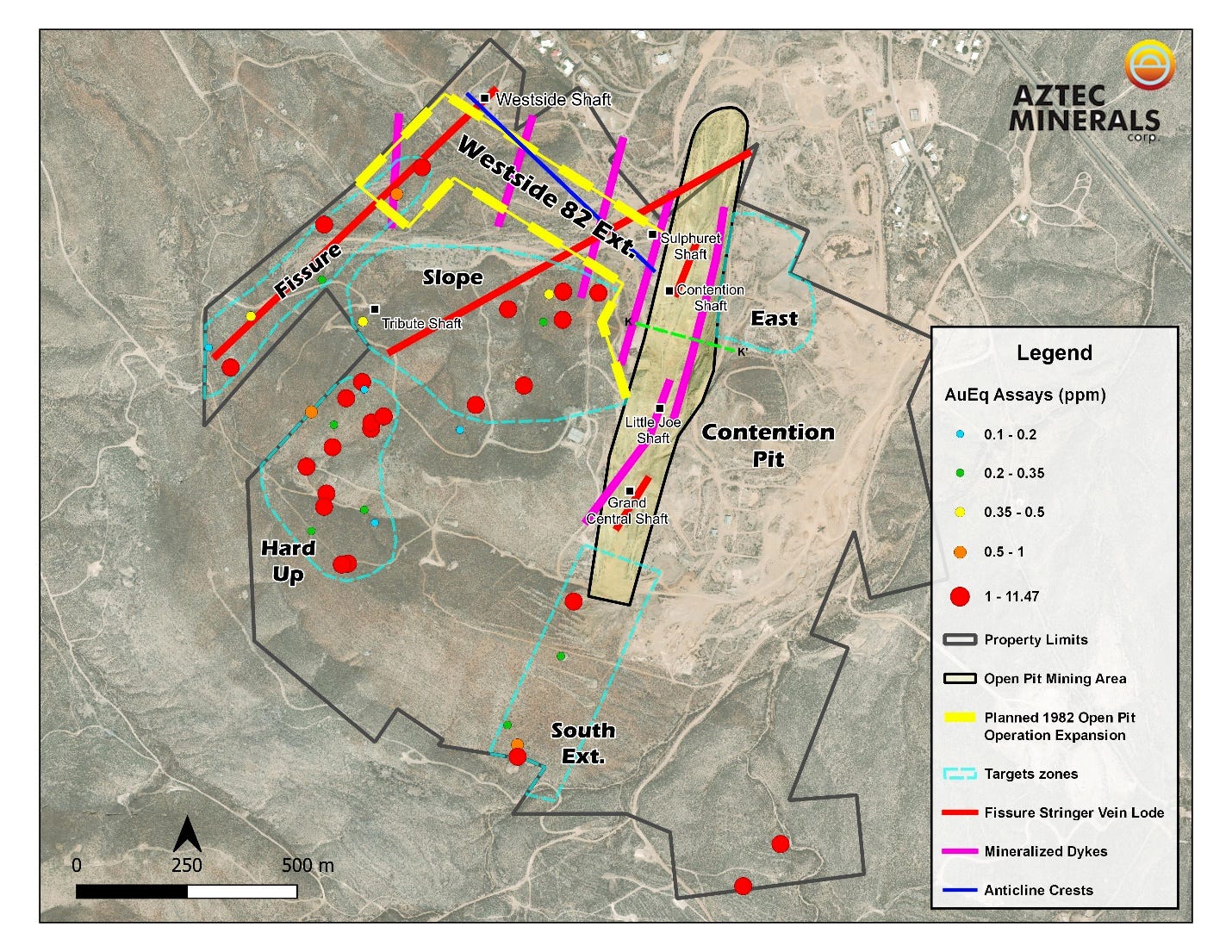

AZT announce some very good assay results from the 2024 surface reconnaissance exploration program that has discovered indications of broad gold-silver mineralization. High grade assays of 8.66gpt Au, 225 gpt Ag (11.47 gpt AuEq) and .94 gpt Au, 268 gpt Ag (8.29 gpt AuEq) indicates further potential to extend the mineralized footprint beyond the Contention pit zone. The program has confirmed that Au-Ag mineralization extends south of recently discovered Westside Target Area.

The following are highlights of recent drilling intersections supporting the exploration model

TR21-22: 2.44 gpt Au and 66.56 gpt Ag (3.39 gpt AuEq) over 65.5m (including 16.80 gpt Au and 374.36 gpt Ag over 7.6m)

TR21-03 - 5.71 gpt Au and 40.54 gpt Ag (6.28 gpt AuEq) over 32.0m

TC 23-01: 3,477 gpt Ag over 1.52m from a zone of 733.9 gpt Ag over 7.6 m within 125 m of 1.63 gpt AuEq

TR21-10: 1.39 gpt Au and 56.40 gpt Ag (2.20 gpt AuEq) over 96.0m

TR21-13: 1.8 gpt Au and 36.9 gpt Ag (2.33 gpt AuEq) over 70.1 m

TR21-17: 1.73 gpt Au and 56.20 gpt Ag (2.53 gpt AuEq) over 64.0m

TR21-08: 2.09 gpt Au and 47.1 gpt Ag (2.76 gpt AuEq) over 39.6m

Hole TC23–02 – 1.69 gpt gold and 29.07 gpt silver (2.03 gpt gold AuEq) over 45.3 m, including 10.1 m grading 6.63 gpt gold and 72.81 gpt silver (7.49 AuEq).

These are very good drill numbers and if the company hits more of these in the next drill program, the stock is going to move in this much better gold market. The stock has had a good bump this week, up from $0.17. This is a very good graphic and highlights the higher grade samples in red.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.