Welcome to all the new, smart, savvy and contrarian investors who have joined my substack. Sorry, I put this out mid day but just getting on my substack now.

Trudeau 2.0

As I expected Carney is the new liberal leader voted in by a landslide. Carney is simply Trudeau 2.0 and was Trudeau's economic advisor during the disaster in the Canadian economy. The only significant challenge was former MP Ruby Dhalla who was the only outsider in the race that was speaking about progressive policies. So they simply disqualified her on grounds of election interference and inappropriate campaign funding. They simply did not want Dhalla's messages getting much attention.

You might find this interesting from the mayor of Lima, Peru, has a message to Canadians: Think twice before making Mark Carney your prime minister.

Mayor Lopez Aliaga says based on Carney’s actions when he was chairman of Brookfield Asset Management, there should be serious questions asked about Carney’s character. In an interview from Lima, Aliaga said Brookfield, chaired by Carney, was “making massive profits off a toxic contract” plagued by bribes.

The Municipality of Lima is currently suing Brookfield in a New York City court. It’s part of an ongoing legal battle that has been going on for years.

Economic Data Flawed – What a Surprise

For years I have been questioning the integrity of U.S. economic data and that things did not make sense, so I found this interesting from Jeffrey A. Tucker of the Brownstone Institute

“For years, I’ve waited for some honesty about economic data. The official numbers have not made sense. The labor numbers were all over the map, with growing disparities between data-collecting methods. The output numbers did not fit with on-the-ground realities. The price numbers from government did not reflect sources from private industry. Putting it all together, we have been surrounded for years by an unannounced inflationary recession with awful jobs numbers.

Testing my intuition against real experts, I commissioned a study from some serious data mavens who know this world better than I. They concluded that prices had risen at twice the levels admitted, that labor markets were weak, that output was low, and that we’ve been in a technical recession since 2022.

We published that study and awaited the blowback and refutations. They never came. Not one communication to me took issue with the numbers. “

Another article is titled, “Voters Were Right About the Economy. The Data Was Wrong.”

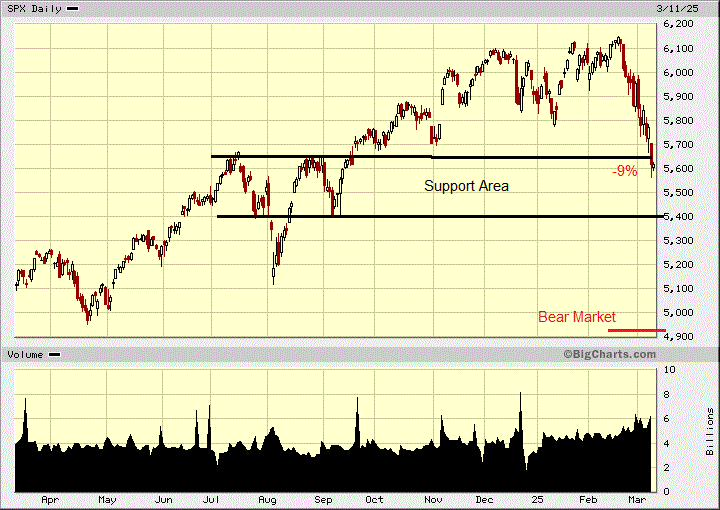

Markets tanked big yesterday so a relief rally would be no surprise today and neither is this correction. I have been warning of a bubble top since last July and saying don't be greedy and raise cash levels, just as Warren Buffet was. The strength of the Trump rally surprised me but it has been completely unwound now and then some. You here a lot of blame about tariff uncertainty but I believe the real issue is the market is starting to price in a U.S. recession.

Recessions usually result in bear markets and especially when markets are so over priced and over bought. I warned about these markets again on February 26th, just before markets really started to head south. See Feb 26th update and my 2025 Outlook here.

So far this is just a correction down -9% and I expect a lot more downside ahead. However, seldom to markets go straight down and I expect we will see some kind of rally from the current support area. That could provide an opportunity to sell more equities. Don't get sucked in with the 'buy the dip' crowd.

There is more to this correction than just a bubble top deflating. S&P earnings have been coming down since mid 2024.

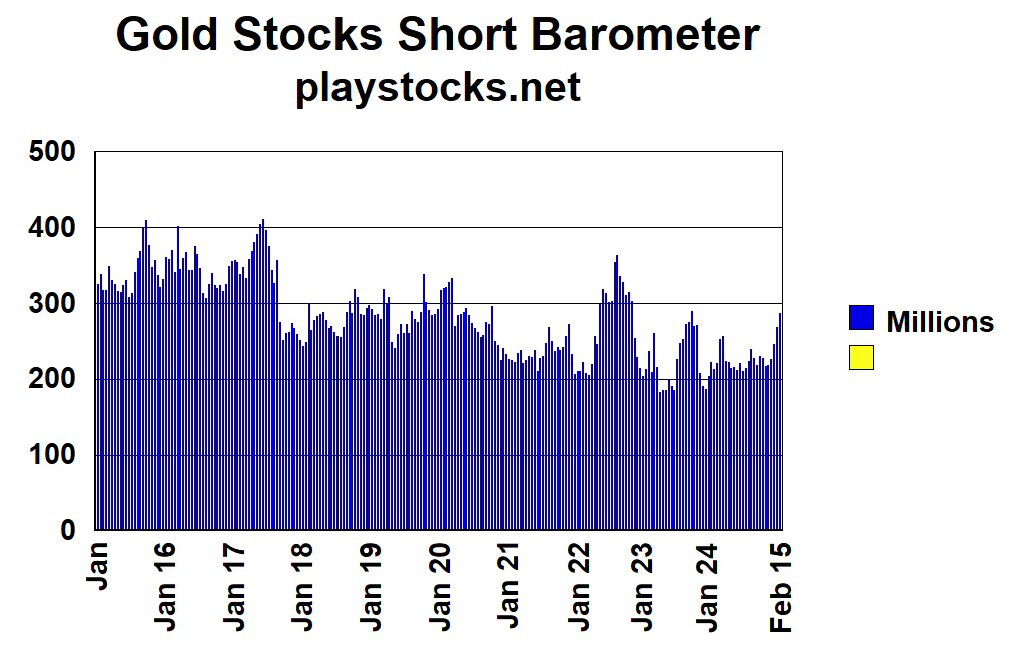

My gold stock short barometer shows the first significant up tick in the number of shorts since mid 2023. The up tick is mostly the last month to February 15th data. Will be interesting to see month end numbers. The last two times, 2022 and 2023 that short positions increased significant there was a soon to follow rally in gold stocks.

This is a 5 year chart of Kinross with Newmont and Barrick Gold. Newmont and Barrick are the go to gold stocks for institutions when they come into the gold stock market. You can see they have gone nowhere yet and still well below 2020/21 highs when gold made it's previous move higher from $1,200 to $2,000. This bull market in gold stocks has hardly got started.

Trump's 25% tariffs on Canada took effect on March 4th with 10% on energy/oil. However tariffs on any goods under the North American Free Trade agreement are postponed another month. I don't know everything covered in the trade agreement but will be the automotive sector for certain. In the case of oil, the tariffs lowered the price of Canadian oil, a disadvantage to Canada.

Tariff Battle

President Trump has reinstated 25% tariffs on global steel imports and increased tariffs on global aluminum imports to 25%, effective March 12, 2025, impacting multiple sectors.

Today President Trump said he has instructed his commerce secretary to put an additional 25 per cent tariff on all steel and aluminum coming into the United States from Canada, bringing the total tariff on those products to 50 per cent starting Wednesday.

The president said the move is in response to Ontario's 25 per cent surcharge on electricity shipped to 1.5 million American homes and business across three states. The electricity charge was originally reported as a tariff but it sounds like it is actually a surcharge and in this case, Ontario companies will not have to pay it, but will be added to the price for U.S. importers.

The U.S. can probably get away without buying Ontario electricity this time of year. Demand is not real high until summer with air conditioning demand. There is monthly data on electrical generation and sales at Ontario IESO. However, it will be two months before we will be able to see the effect on the data.

I think it is just economic suicide for Canada to take on an economic power 10 times it size. Canadians will pay a heavy price for many years to come just for political posturing by Canadian Bureaucrats who will feel no pain at all.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such