Trump Gaining, Election Stocks, SPX, Silver Breaks out, Canada at Bottom

Welcome and thank you to all the new, smart, savvy and contrarian investors to my substack. If you like outside the box thinking, a humble analyst that has spent his career studying market and economic cycles, picked numerous tops and bottoms, someone not afraid of controversial topics and can be a bull and a bear, your at the right place. Please share and subscribe.

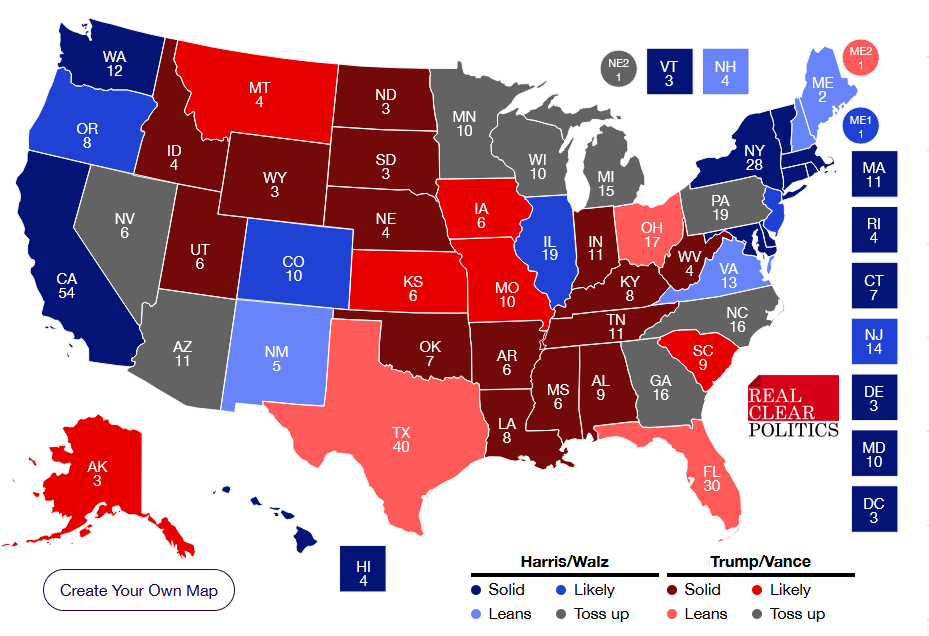

Trump is gaining further in the polls and today polymarket has him at 61.4% to win and Harris at 38.4%. Trump is leading in most of the battleground States and Wisconsin is about even. Harris leads in Minnesota.

On the Real Clear Politics polls, the map looks a lot red but it is still close because NY and California carry a lot of electoral votes. Real Clear lists all the battleground States as a toss up. Despite Trump gaining, remember a lot of votes were cast early before his lead showed up.

I believe our energy stocks will benefit with a Trump win, but I am not willing to add any more of these yet, but still might do so ahead of election day. There are a lot of bargains in the sector and it is out of favour right now. I also suspect there was intervention with oil prices ahead of the election and will be interesting to see if we get the month end take down in October. It is too close to matter so if my suspicions are correct we won't see an October take down in oil prices. Oil prices have come down with markets blaming no strike back on Iran by Israel yet. However, this is shortsightedness.

I expect the gold market to continue no matter who wins. It seems doubtful either party can bring down excess spending and inflation. Although there may be slight hope with Trump as there has been talk of Elon Musk taking a role to improve government efficiency and reduce spending. That said there will have to be massive military spending. Trump might be able to end the Ukraine war as they have no control of their destiny and totally rely on the U.S., but it appears Israel is hell bent on doing a lot more and odds are high that the U.S. will get dragged in. There is no love between Trump and Iran as Iran has threatened to assassinate Trump. No matter who wins, it looks like the middle east will escalate. This makes me bullish on oil as well.

The S&P energy index did jump about 60% when oil&gas prices jumped with the start of the Ukraine war in early 2022. However, they have been basically flat since with a slight upward bias of higher lows. I will be watching for an upside break out.

I am bearish on the general equities market no matter who wins the election, It is simply over bought and over valued with a dangerous concentration of 10 stocks or so.

Today Goldman Sachs is agreeing with me and says the stock market party is over. Goldman Sachs (GS) strategists led by David Kostin estimate that the S&P 500 index will deliver an annualized return of 3% over the next decade — well below the 13% returns in the last 10 years and the long-term average of 11%.

Much of the downward revision is thanks to a high starting point going into the next decade. Because total returns have been so strong — and appear to be continuing on that trend to end 2024 — it’s typical for future return growth to appear smaller in comparison. Goldman is also accounting for a slightly more GDP contraction over the next decade. The main drag on Goldman’s forecast, however, is due to an “extremely high level of market concentration,”

I have been ringing the alarm since July and although I thought the market could go higher, that the risk for another few percent was not worth it. Lock in the years gains. I am looking at the SPY etf here so you can see that this market rise is on lower volume. I think that also reflects the concentration into a handful of stocks.

“The premium valuation for the top 10 stocks is the largest since the peak of the Dot Com boom in 2000,” the Goldman strategists said. And if they are close with a 3% annual return than you will probably be better off with gold.

I am watching the DUST and NUGT etfs for retail sentiment and I am still quite amazed.

The volume was very high, almost 30 million with the drop in DUST on Friday. I wonder if this was capitulation or did these investors carry their head in the basket to jump right back in ?. There was no buying in the bullish NUGT yet either as it's volumes remain weak.

Judging by DUST volume so far today, they are jumping right back in.

Copper prices have been strong again this year but the big news today is silver. I have commented that silver usually lags golds rise but when it does catch on it often out performs gold. To benefit, we bought some silver stocks in April and if this breakout holds, I am planning a new silver pick.

I know many Canadians have been down on markets and their portfolios. It is no wonder.

According to Macleans article as of February 2018, Canada’s market is not only bad; it’s the absolute worst performing market in the world. Okay, we’re leaving Venezuela off the list, but among the 106 global markets tracked by Bloomberg, Canada was number 105. (The energy market was also devastating the Venezuelan market but that country’s crisis is a much more complex story, with inflation expected to hit 13,000% that year while unemployment climbs to 30%.)

We know the TSX Venture market did far worse than the TSX main index so it was probably down with Venezuela.

This is why I have been going with mostly U.S. stocks in the last few years. The gold stocks are fine because they trade on U.S. exchanges and most of their volume derives from the U.S.

So where are we today? The Canadian market kept going down and hit new lows in 2021. In 2022, the Canadian market finally went above the 2018 levels. It was down and sideways again until mid 2024 when the Canadian TSX started up again, helped by gold. I don't know where the TSX stands in the world today but it is probably still below the top 80.

That said the TSX Venture market is around the same level as 2018 so is no doubt the worst stock market in the world. Even Venezuelan rallied +66% this year.

But Venezuela stock market has soared over 200,000% since 2018. Yes that is not a typo. Now don't get excited, that was mostly run away inflation. Every so often they divided the stock index by 1,000 to adjust for inflation. That said, that Venezuela stock market was the only one Canada could beat is very pathetic!

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.