Trump Tariffs Best Thing For Canada, TSX Venture Breaks Out, HEM, GPAC

Thank you and welcome to the new, smart, savvy and contrarian investors who have joined my substack. I am very small here so if you find this interesting please share and subscribe.

Trump's tariff threats are the best thing to happen to Canada because it has brought Canada's broken economy to center stage. It is revealing how pathetic, lazy, naive Canadians and their business have become, exemplified by the poor leadership of the Trudeau government. Canada relies on the U.S. and cannot even trade among itself. There are more Canadian Provincial trade barriers than there are to the U.S., just plain dumb and poor government across the country. We cannot even distribute our oil and gas across the country, but instead send to the U.S.

Conservative Leader Pierre Poilievre recently called for the elimination of interprovincial trade barriers in Canada, among other measures, to strengthen domestic trade in light of the tariff threat.

“We need to knock down interprovincial trade barriers to have true free trade across our country. We are in this state because we trade twice as much to the Americans as we sell to ourselves,” he said.

And the Canadian economy continues into oblivion. The Canadian Association of Insolvency and Restructuring Professionals says 2024 saw a 15-year high in business and consumer insolvencies – about 375 insolvencies per day. Insolvencies rose 12.1% last year compared with 2023, with business insolvencies leading the way, up 28.6%. Construction, transportation and warehousing, and accommodation and food services were the sectors that saw the biggest increases.

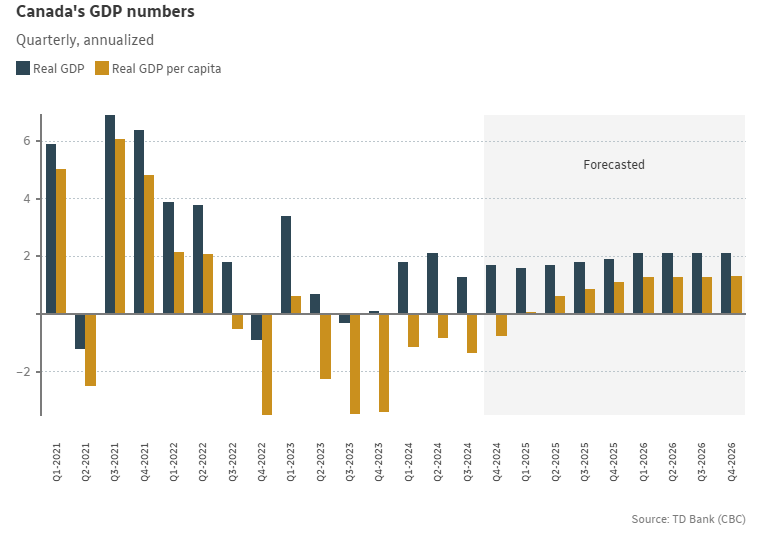

Canada's economy contracted by 0.2% in November, more than expected, the largest contraction since December 2023, reported last Friday. Contraction on a per capita basis - for over two years. I believe TD Bank’s forecast below is way too optimistic.

The country added nearly 1.3 million people in 2023 - a 3.2 per cent increase — while the economy grew by just 1.1 per cent in the same time period. Simply put, more people taking slices out of an economic pie that hasn't grown much bigger. Stats Canada is slow but I expect the numbers in 2024 were about the same.

And a last thought on the Trudeau government - is with the prologue of parliament it also ended the committee that was investigating the Trudeau's green fund scam.

TSX Venture Index Finally Breaks Out

On better news my hope of a breakout on the TSX Venture market has come to reality. However, before we break out the champagne, I want to see a clear break above 660 which would also be a clear break above 2023 highs.

U.S. Economy

The big economic news will be the headline jobs number tomorrow. Employers added 183,000 jobs in January, more than expected, private payroll firm ADP said on Wednesday, perhaps pointing to a good number tomorrow. Economists had forecast a gain of about 150,000 ADP jobs following December’s increase which was revised upward to 176,000 from the 122,000 original estimate.

And on the other hand, the number of Americans filing new applications for unemployment benefits increased moderately last week, consistent with gradually easing labor market conditions. Initial claims for state unemployment benefits rose 11,000 to a seasonally adjusted 219,000 for the week ended February 1, the Labor Department said on Thursday. Economists polled by Reuters had forecast 213,000 claims for the latest week.

As I have been commenting for a long time, economic and job numbers were probably manipulated ahead of the election so it will be interesting to see where they land now. We are just starting to see post election numbers in the last month or two and so far there is a trend of weakness, but nothing shocking or a big deal so far.

However just reported yesterday, Trump's nemesis, the trade deficit saw a record high. The U.S. goods trade deficit increased in 2024 to a record $1.2 trillion, which must have President Trump chomping at the bit for new tariffs.

On the topic of Trump, I mainly focus on policies that effect economies and markets but Trump’s sudden announcement on Gaza surprised senior members of his own administration. There were no meetings about it. We have heard similar things about Greenland, Canada and Panama.

And many, many other announcements. A lot say he is crazy and an idiot and we all know he likes to cause controversy and be in the news but I wonder if it might be a part of a Blitzkrieg strategy. All his executive orders, actions and seemingly off the wall announcements and comments do come out as surprises and overwhelming in numbers. Perhaps it is all to keep the Democrats and his opponents confused and jumping here and there as each news item evolves. Something to think about as the saying goes, ' there is method to my madness'.

All of this news can seem chaotic and unpredictable. But beneath it all, Trump has a vision, whether you agree with it or not. To achieve his policy goals, he argues, the federal government has to change: First, it must become more efficient. Second, the “deep state” that Trump believes opposed him during his first term must go. I think this is all part of this new world order and cold war that I intend to give a deeper dive into.

Here is another thing, I had a real laugh at, the Trump Derangement Syndrome (TDS) that I often heard about, but now saw a meaning to it . 'That’s a mental illness that causes sufferers to lose reason and all sense of proportion when they hear the word “Trump.” The word triggers them to the point where they cannot discuss policy differences rationally but resort to name calling, screaming and even physical attacks.' That's funny, in Canada we just say 'F _ _ _ Trudeau!'.

Hemostemix - - TSXV: HEM, OTC: HMTXF - - Recent Price - $0.285

Entry Price - $0.215 - - - - - - - Opinion - buy

Hemostemix has expanded into Dominican Republic and insiders have bought a good chunk of stock around current prices and the stock has retraced into a support zone where I suspect it has bottomed in this correction. The stock made a run and is making headlines with its innovative ACP-01 Stem Cell Therapy—a breakthrough treatment that is poised to redefine regenerative medicine. This cutting-edge technology, developed by a dedicated team of scientists and clinicians, represents a promising step forward in addressing a range of medical conditions with unmet needs. To recap.

ACP-01 Stem Cell Therapy harnesses the regenerative potential of adult stem cells to stimulate healing and repair damaged tissues. By leveraging proprietary techniques to optimize the isolation and concentration of stem cells, Hemostemix is paving the way for therapies that could significantly improve patient outcomes. Early research indicates that ACP-01 not only enhances tissue regeneration but also modulates inflammatory responses, which is crucial for reducing recovery times and improving overall health.

One of the most exciting aspects of ACP-01 is its versatility. The therapy is being explored for its applications in treating degenerative diseases, cardiovascular conditions, and various autoimmune disorders. Its broad potential has generated enthusiasm among medical professionals and investors alike, as it offers a multi-faceted approach to addressing complex health challenges. The company’s commitment to rigorous scientific validation and clinical excellence underscores its dedication to safety and efficacy.

Moreover, Hemostemix Inc. is actively engaging with the global biotech community, participating in collaborative research initiatives that further enhance the therapy’s development. This strategic approach not only accelerates clinical trials but also fosters an environment of innovation and knowledge sharing. Investors are optimistic about the future prospects of ACP-01, as its promising early results pave the way for larger-scale studies and potential regulatory approvals.

In summary, ACP-01 Stem Cell Therapy stands as a beacon of hope within the biotech sector. Hemostemix Inc.'s focused pursuit of groundbreaking treatments exemplifies the dynamic progress in regenerative medicine. As research continues and clinical applications expand, ACP-01 could very well become a cornerstone in the evolution of patient care—ushering in a new era of therapeutic possibilities and improved quality of life for countless individuals.

On February 3rd, Hemostemix posted an update on social media, sharing an inside look at its latest initiative in the Dominican Republic, with a team of cardiologists who have the capacity to treat 110 patients per month. This team of cardiologists have previously treated 200 ACP-01 recipients. At $37,000 (U.S.) per ACP unit, the team has the capacity to treat five times the number of patients currently forecasted to be treated.

Then the next day, on the 4th CytoImmune that is Hemostemix's new manufacturing partner is subscribing to $336,500 (U.S.) in a non-brokered private placement of Hemostemix Inc. common shares at a price of 29.5 cents ($336,500 (U.S.)/69.789 cents (exchange rate) equals $482,167.68) (1,634,466 common shares), subject to the approval of the TSX Venture Exchange.

Furthermore, the stock did have quite a run so a correction and consolidation is healthy. It has pulled back into what I see as the support zone, so I suspect it is soon ready to move back higher.

Great Pacific Gold - - - TSXV: GPAC, OTC: FSXLF - - Recent Price - $0.48

Entry Price - $0.93 - - - - - Opinion – Buy, average down to $0.62

It has been a while since I updated this stock, it was originally Fosterville and like all junior explorers it is beaten way down but with the market turning, so is time to revisit some of the good juniors that survived the last few years.

Great Pacific announced that drilling has commenced at the high-priority Hampore target within their Kesar Project in Papua New Guinea. Additionally, the Company has commenced a Mobile Magnetotelluric (MobileMT) geophysical survey across the broader project area to refine geological targets for future exploration and drilling.

Key Highlights:

Initial drilling at Hampore, which has commenced, is designed to test beneath a recently identified high-grade existing outcrop identified through mapping and rock chip sampling, which returned exceptional gold values, including: 110 g/t gold (KCRX24120) and 93.3 g/t gold (KCRX24119) announced December 12, 2024.

High-resolution airborne Mobile MT geophysical survey underway to inform further drilling with approximately 450 line-kilometers flown to-date (52% complete)

Construction of multiple diamond drill pads is underway to test a variety of high-priority targets identified through geological mapping and high-grade rock chip sampling across Hampore.

This graphic shows the target and drill hole plan. Gold mineralization from rock chip samples occurs in Bonanza Free Gold in arsenopyrite-rich quartz veins, often associated with Bi, Te, and Se. And Electrum-Base Metal Veins within sulfide-rich breccias containing galena, sphalerite, and pyrite, enriched in Ag, As, Sb, Pb, and Zn. I believe this has strong potential to generate high grade drill results.

"Drilling is well underway at Hampore, which has demonstrated exceptional grades and extensive sulphide mineralization in surface samples to-date," stated Greg McCunn, CEO of Great Pacific Gold "We are quickly testing our theory that Hampore and Fufunambi in the East Vein Zone represent the core feeder zone of the extensive system that makes up Kesar. The Mobile MT survey and the key observations made recently by our team and consultants will be invaluable in gaining a more fulsome understanding of this tremendous Project."

The stock has put in a triple bottom and a wedge pattern has formed on the chart. I expect some good drill results will cause an upside break out. Investing an equal $ amount will average us down to $0.62.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.