Trump Trades Soar, Bitcoin, Green plunges while Oil&Gas up, PR, APA

Consumer prices rose 2.6% from October 2023, meeting average economist estimates of 2.6% headline inflation, according to FactSet. It’s the first time since March annual inflation was up month-over-month, with inflation coming in at a 3.5-year low of 2.4% last month. Core inflation was 3.3% in October, matching forecasts of 3.3%, where it stood in September.

The index for shelter rose 0.4 percent in October, accounting for over half of the monthly increase. The energy index was unchanged over the month, after declining 1.9 percent in September. As long as energy prices stay low inflation should stay around 3% for now. Trump's tariffs could increase inflation but we are months away form that. I am watching the very low oil inventories. Trump will like build back up the Strategic Reserve as well.

A few investors were critical that I spent too much time on the election. My comeback was it can have very significant impact on the economy and certain stocks sectors. The market election reaction this year was perhaps the biggest ever. It surprised me how fast and big the effect was. I think because it was a solid landslide win for Trump/Republicans so they can make many changes.

Bitcoin $100k Magnet

We got it right with Bitcoin but sold too early. I thought 23% was pretty good in 2 weeks but we could have got much more if we waited until after this past weekend. However, that is the tough thing with the ETFs, they don't trade on the weekend so you need to determine whether to trade or not by Friday. Bitcoin is volatile and weekend moves can be big in both directions, as was last weekend.

I think $100k is the magnet and Bitcoin is topping out. Interesting, Ethereum is not confirming the rally. I think it is too risky to go long and my next trade will be on the short side.

Gold sold off more than I expected as the election hedge was obviously a much larger portion of the market long position. Most traders were expecting a close race and the uncertainty of it. Although I predicted a Trump win, my major concern was a close race that provoked a lot of legal battles. It is way better for markets with the Trump decisive win.

Gold broke through first support and the current level is not that strong. It would not surprise me if gold tested the $2,500 level. That would about an 11% correction, the most significant of this bull market thus far. Regardless, I believe this election related trade is short term. Inflation and excess government spending will remain under Trump for at least the next two years. There are other market sectors that are going to see larger long term moves as well.

Climate Scam

Remember this whole climate scare is all about raising taxes and distributing wealth. Mother Nature will determine the climate. The green energy sector was already beat up pretty bad and it got whacked a lot more with the election.

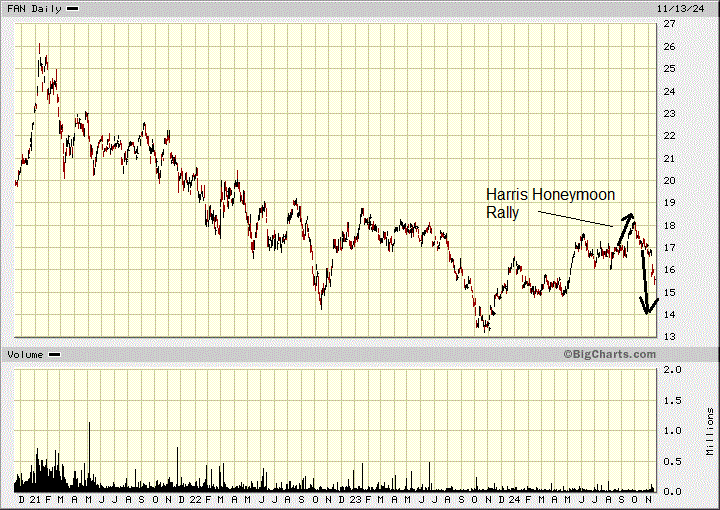

I am just going to show the solar (TAN) ETF, the wind (FAN) is about the same. You can see the peak in the Biden rally in early 2021 and then a steady plunge. There was a brief rally when Harris took over from Biden and there was some hope she would win, but come November the ETF plunged. I expect it is headed for $13 and lower.

I expect the pharmaceutical sector to suffer under Trump. He promised to let JFK Junior to reform the sector and I think this is a good thing. However the focus of recent decades was way too much on making profits at the expense of safely and healthcare. Upcoming changes will probably hit these companies bottom lines.

The S&P 500 Pharmaceutical Index started declining as Trump moved up in the polls and just hit 6 month lows. This down trend has further to go. We made big profits with our Pharma stocks in the past year and there is just one left on our list that we have not sold. I wish I sold this early in the year, but we just bought in January and profits came so quick, I thought it would gain more.

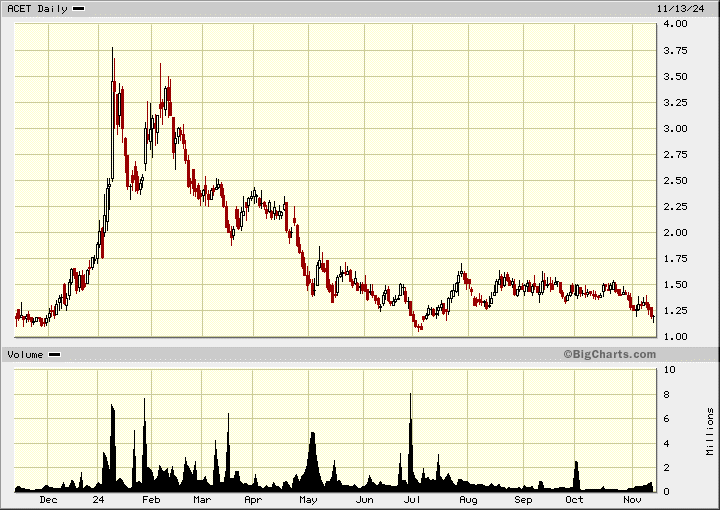

Adicet Bio —— Q:ACET- - - - - Recent Price - $1.20

Entry Price - $1.80 - - - - - - Opinion - sell

There is nothing wrong with the company, it is likely to suffer with other U.S. pharma stocks.

We made on average about 175% on the other three biotechs (TRML, NKTX, NKTR) so we still did very well on average with 3 big winners and 1 loser.

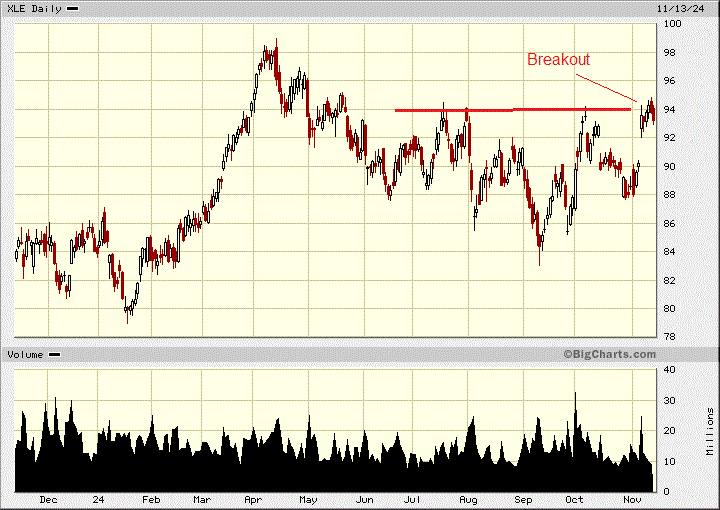

The S&P energy ETF (XLE) has broken out on the chart even though oil prices are down since the election. Many comment the energy did better under Biden, but that is only because of war that spiked prices for a while.

Oil has bounced off of the support area and if we end up with a good up move today we will have a strong reversal pattern. The oil&gas sector will do very well under Trump, here are a couple oil&gas stocks that I sent out on the paid list few days ago that I suggested as buys.

Permian Resources - - - NYSE: - - - - PR Recent Price - $14.50

Last week PR announced its third quarter 2024 financial and operational results and revised 2024 guidance. The company is doing very well but like most all oil&gas stocks it is out of favor and the sector very depressed. I believe this will improve under Trump and the sector is due for a rally to more normal valuations regardless.

Recent Financial and Operational Highlights:

Reported crude oil and total average production of 160.8 MBbls/d and 347.1 MBoe/d during the quarter;

Announced cash capital expenditures of $520 million, cash provided by operating activities of $954 million and adjusted free cash flow of $303 million;

Continue to drive operational efficiencies, resulting in reduced cycle times/lower well costs;

Reduced D&C costs to ~$800 per lateral foot, which represents a 16% decrease from 2023;

Announced quarterly base dividend of $0.15 per share, a 150% increase compared to the prior quarter. Represents initial base dividend under the Company's updated return of capital strategy;

Maintained strong balance sheet with leverage of ~1x and ~$2.8 billion of total liquidity;

Ended quarter with undrawn revolver and $272 million of cash;

Received upgraded credit ratings by Moody’s, S&P and Fitch;

Targeting investment grade credit ratings in 2025;

Closed previously announced Barilla Draw transaction, adding ~29,500 net acres and ~9,900 net royalty acres directly offset existing operations;

Increased mid-point of full year oil and total production guidance by over 4% to 158.5 MBbls/d and 341.0 Mboe/d;

Third consecutive increase of guidance primarily driven by strong performance of base business.

The stock has bounced off strong support around $12.60 and appears to be breaking this years down trend. However we need to see a clear break above resistance, a high high, lets say $15.50.

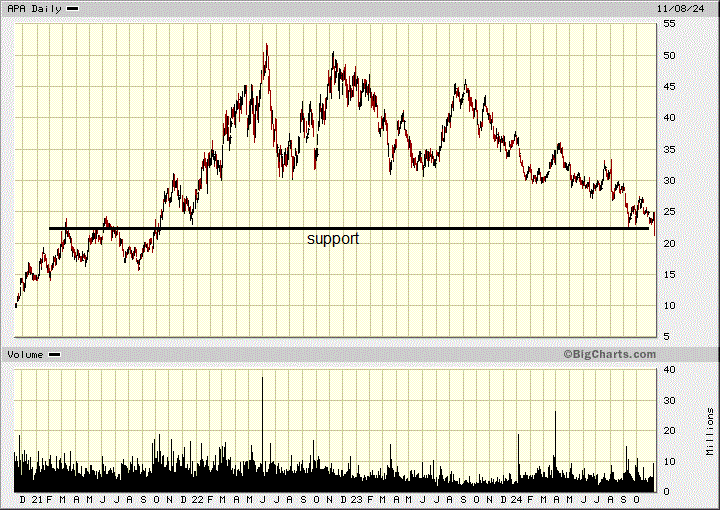

APA Corporation - - - Nasdaq: APA - - - - Recent Price - $21.77

APA announced its financial and operational results for the third quarter of 2024 with a reported loss attributable to common stock of $223 million or $0.60 per diluted share. This was primarily driven by non-cash impairments of assets in the U.K. and assets held for sale in the Permian Basin. When adjusting for this and other items that impact the comparability of results, APA’s third-quarter earnings were $370 million, or $1.00 per diluted share. Net cash provided by operating activities was $1.3 billion, and adjusted EBITDAX was $1.6 billion.

“Third-quarter results were strong across our operating areas, driven by higher-than-expected production and lower costs,” said John J. Christmann IV, APA’s CEO. “Adjusted global oil production exceeded the high-end of our guidance range and was up nearly 30% year-over-year. The integration of Callon is effectively complete, and we expect to capture most of the cost synergies by year-end. This, combined with the non-core Permian Basin asset sale, will significantly lower per unit costs as we move into next year.”

Third-quarter reported production was 467,000 BOE/day. Adjusted production, excluding Egypt non controlling interest and tax barrels, was 395,000 BOE/day, approximately 2% ahead of guidance.

The company expects total fourth-quarter production on a BOE basis will be the highest of the year despite ongoing curtailments in the Permian Basin in response to weak regional natural gas prices.

We own APA because of their take over of Callon. The stock sold off on these Q3 results and it has been hit harder than many but I believe the stock is going to bounce off of long term support here.

The stock did very well with strong growth through acquisitions but this has turned into a short term disadvantage in this down market as they adjust their operations for consolidation and synergies of this stronger growth of the previous 2 years. They went form $4.4B revenue in 2020 to $11 billion in 2022 and look to be back to around $9 billion this year. APA has almost 50% gas production that has saw weaker prices than oil so that has not helped them. That said it could be their advantage if we get a more normal winter and prices continue to rise further. Since summer Nat Gas prices have moved up from around $2 to $3.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.