Trump Wins (DJT Pops) and Clinton's Surprise, Oil jumps, PZG and Gold

Investors still placing wrong bet on gold stocks!

Welcome and thank you to all the new, smart, savvy and contrarian investors to my substack. If you like outside the box thinking, a humble analyst that has spent his career studying market and economic cycles, picked numerous tops and bottoms, someone not afraid of controversial topics and can be a bull and a bear, your at the right place. Please share and subscribe.

I was one of the few to predict Trump to win in 2016 and I predict he will win again. In 2020 I thought Trump would get reelected, but it was a very close race and the out come uncertain. I gave odds of Trump winning 52% and Biden 48% in 2020. For 2024 I would say odds for Trump 60% vs Harris 40%.

There are several key reasons.

Remember that Harris was the worst rated Vice President in history. Favourable media cannot fix all of that;

The polls are about even. Polls normally favour Democrats and under mark Republicans (Trump). Remember 2016, Clinton was way ahead in the polls but loss. This even stance in the polls really means Trump is probably well ahead;

Hillary Clinton has been talking about an 'October surprise'. Meaning that Republicans would come out with some false damaging story on Harris with probably so called Russian involvement. Well there has been a surprise but not what Hillary was predicting. The surprise was the hurricane Helene and now even more so with Milton expected to hit Wednesday. FEMA is the (Federal Emergency Management Agency) set up to aid U.S. citizens in case of emergency.

What Helene revealed is that FEMA had used up it's budget on Ukraine, sending them $$ and equipment like electrical transformers now needed and $640 million on U.S. immigrants. People in the numerous states affected by Helene are very upset with the Biden-Harris administration favouring foreigners. Milton could add to this but Florida is prepared. Florida Governor Ron DeSantis has said his state "does not rely" on FEMA. DeSantis said "You saw in western North Carolina, you saw people that were very desperate. So I authorized air assets, National Guard, state guard, Highway Patrol, to go into western North Carolina. You have a situation where the first people that they come in contact with is some state guard unit from Florida and not any of the federal assets." furthermore “We rely on FEMA to basically be a bank account”. However that bank account is dry, perhaps some emergency funds will get authorized?

“It’s the economy stupid” was a phrase coined by James Carville in 1992, when he was advising Bill Clinton in his successful run for the White House. In 1992, the US was experiencing an economic recession and the incumbent president, George HW Bush, was perceived as out of touch with the needs of ordinary Americans. Does that sound familiar? Officially there may not be a recession at this time, but the economy for the most part is worse then 1992.

Democrats should know their poor economic performance is a big negative for them, but they have been trying to fix it by manipulating data. Intervening in oil markets to bring energy and inflation down and highly bogus job numbers. The September jobs report was another case in point. I highlighted how they padded numbers with the 'birth death rate model in previous months. This time they padded huge government job numbers.

And lastly, Trump Media (DJT) stock has reversed and moving up strongly on no news. Market narrative finds no excuse, but I would bet the market is starting to factor in a Trump win, so this stock will do better.

Bogus September Jobs Report

The September job numbers came in at 254,000 trying to show the Biden/Harris economy is doing very well. This is much higher than job growth in August, which was 159,000, and blew economists' expectations for a 140,000-job gain out of the water. The unemployment rate also dropped to 4.1 percent, despite forecasts it would hold steady at 4.2 percent.

However, people aren't stupid, they know the real jobs market they are facing. See survey below.

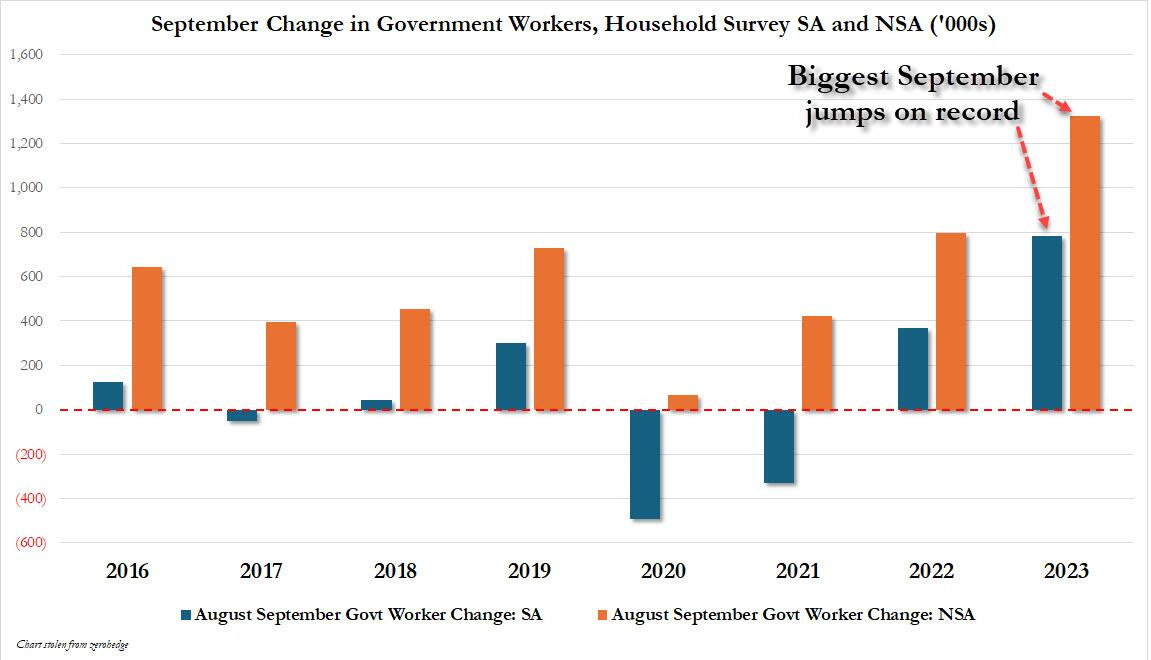

In September, the number of government workers as tracked by the Household Survey soared by 785K, from 21.421 million to 22.216 million, both seasonally adjusted (source: Table A8 from the jobs report). This was a record monthly surge in government workers (excluding June 2020 which was a reversal of the Covid collapse months before).

September traditionally sees a huge jump in government workers (for example - teachers go back to school), the BLS has traditionally smoothed over this jump using seasonal adjustments. as noted earlier by Andrew Zatlin of Southbay Research. Historically the September adjusted number has been relatively tame, regardless of how large or small the unadjusted number was, this time something changed as the unadjusted number of government workers absolutely exploded by a record 1.322 million leading to a record September increase in adjusted government workers.

What is more, the majority of jobs are tending to be more orientated to part time, lower paid. Full-time employment in the US has been negative year-on-year for eight consecutive months. There continues to be question marks over the quality of the jobs added. Leisure & hospitality (78,000), private education and healthcare (81,000) and government (31,000) again were among the sectors with the strongest job gains.

The report also revised job growth figures from August and July. It added 17,000 to August's total, bringing it to 159,000, and added 55,000 jobs to July's total, upping the monthly growth to 144,000.

The narrative for the market sell off on Monday was that the strong job numbers meant no chance of a 50 point cut in the Fed's November meeting. You would think that most of these high paid Wall Street analysts could see through these manipulated numbers. Perhaps they are just buy side cheerleaders and Democratic supporters?

Of course there are some skeptics of rosy government statistics with the vast majority as ordinary Americans who are not fooled. They say the economy is far from being in great shape.

A recent Gallup poll showed that only 3% of Americans rate economic conditions as "excellent," with just 19% saying things are "good" overall. A much larger 48% say the economy is in "poor" shape.

Things may be looking up in Washington and on Wall Street, but 62% of Americans believe economic conditions are "getting worse." Only 32% say they are improving.

On this topic, there is very little confidence in governments and media. I saw results of a new survey on Canadian news media today. Canadians’ confidence in news media has continued to decline, with just 32 percent saying the information presented by news outlets is “accurate and impartial,” according to in-house research by the Canadian Radio-television and Telecommunications Commission (CRTC). Trust in the media has fallen by 4 percent compared to 2023, while satisfaction with the quality of news coverage has fallen by 6 percent, according to the report.

Given that Bidenomics has failed miserably (I gave a comparative analysis to Trumpnomics back in July), the polls and bad news with FEMA this month I expect Trump to win if he is not assassinated. It will still be close, but I say odds of 60% Trump wins and 40% chance for Harris.

The only other significant factor is election fraud and if you don't think that is on the rise, maybe you have been living under a rock?

The Biden administration is sending piles of illegal immigrants and refugees to the election Battleground states. Their intent is to swing these into blue states. These immigrants mostly vote Democratic and often there are only 10,000 to 20,000 vote margins in these states. It is the same stunt Trudeau is doing in Canada, by sending refugees into the 3 major cities that have most of Canada's parliament seats.

Of course this all is easier to do with no proof of citizenship or voter ID. I will not get into it but simply quote what Elon Musk said. “The purpose of no voter ID is obviously to conduct fraud in elections.” Musk pointed out how it is “literally impossible” to prove fraud if no voter ID is required, saying it enables “large-scale fraud.”

“So, yeah, the purpose of no voter ID is obviously to conduct fraud in elections, obviously. There can be no other explanation,” Musk concluded.

Election laws are up to each individual State. So why are the Feds suing Alabama from removing about 3,200 non citizens from their voting list. They should have never been on it in the first place.

Democrats sued Georgia’s State Election Board September 30, over a new rule that requires counties to hand-count the number of ballots cast at polling places on Election Day. A Republican-led group is also challenging Georgia’s new requirement that poll workers count the total number of ballots by hand, saying it’s another example of the State Election Board overstepping its legal authority. A lot of the argument is the board are not elected officials so cannot change rules. It should be the State Legislature.

My point is all of these legal battles, and those days and weeks after the election all add to uncertainty.

Oil Stocks Jump

I hope many of you bought some of the 3 oil stocks I suggested September 26th, they had a nice move and the Permian PR April 2025, 14 Calls were up about 70%. There is lots of time for further gains with these stocks.

Oil ran up to the resistance area I marked around $77 and has come down hard today. If we are in a new bullish move, support around $71 (previous resistance) should hold. Very volatile is the word, and news out of the Middle East could pop it back up fast. There has not been much oil shut down in the Gulf with hurricane Milton so far but maybe tomorrow as the storm moves north, but it's path is projected to miss oil facilities.

Paramount Gold Nevada - - - NY: PZG - - - Recent Price - $0.42

Entry Price $0.38 - - - - - Opinion - buy

Paramount announced that during a state Technical Review Team (“TRT”) meeting on October 3rd, the Environmental Evaluation (“EE”) for the Grassy Mountain project was approved as completed. The approval marks the start of the 225-day legislated timeline for the issuance of draft permits.

Paramount’s President, COO and Director, Mr. Glen Van Treek stated, “With the approval of the EE, Grassy Mountain has now entered the final step towards obtaining draft permits from the State of Oregon. We now look forward to the release of the Federal draft Environmental Impact Statement on track to be released in February 2025.”

The Grassy Mountain feasibility study, completed at a gold price of $1,750 per ounce, projects an average annual production of 47,000 ounces of gold and 55,000 ounces of silver. At a moderate increase to $2,100 gold, the post-tax project NPV increases from $114 million to $189 million.

The junior gold stocks have not got much traction yet, but there was some positive news today. Global physically backed gold ETFs saw their fifth consecutive monthly inflow in September, attracting US$1.4bn. Inflows were concentrated in North America during the month while Europe was the only region that experienced outflows, albeit only mildly. North American funds witnessed inflows three months in a row, adding US$1.4bn in September.

PZG stock has been trading between $0.40 and $0.49 so is a buy near the bottom of this range.

It's positive North American investors starting to get into gold, but are still making the wrong bet against the gold stocks. Volumes in the gold stock ETFs like NUGT, GDX and GDXJ remained subdued but volume in DUST that shorts the gold stocks is soaring even as investors lose money.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.