Trump's Big Wins, Debt Soars while Economy Slides with US$

Happy July 4th weekend to all my American readers

Trump's 4 Big Wins

1 – The bombing in Iran brought about a ceasefire between Iran and Israel and also with Hamas. Lets hope this lasts and the war ends. The Trump bashers spewed out the usual propaganda, one being he broke the law without Congress approval. I would like to remind everyone that Libya is one of seven nations that Obama bombed without Congressional approval. Over 26,000 bombs were deployed across 7 nations under his command in 2016 alone. Libya, Afghanistan, Syria, Yemen, Somalia, Iraq, and Pakistan were attacked without a single vote. Donald Trump’s recent orders saw 36 bombs deployed in Iran.

2 - Last Friday, the last day of the Supreme Court term, the court delivered its coup de grâce in Trump v. CASA, the birthright citizenship case. The justices basically eliminated universal injunctions, the key tool federal district judges had been using to keep the administration in check. I had commented how these mostly far left judges imposed over 100 restraining orders against Trump policies nation wide. These district judges are there to rule in their district, not across the nation. It's a good thing this political corruption now ends, but they basically succeeded in delaying the Trump Administration policies and agendas by about 6 months.

3 - Paramount said it had agreed to pay Trump $16 million to settle his lawsuit over the editing of an interview with Kamala Harris on the CBS News program “60 Minutes.”It was an extraordinary concession to a sitting president by a major media organization. This was no doubt election interference and $16 million is a peanut price to pay.

4 – I call it the Big Spending Bill. It passed in the Senate and now is back to the House. There is quite a bit of optimism it will pass and perhaps even today. This is not good as it is projected to add $3.3 trillion to an already out of control deficit. These estimates are always optimistic and it will likely add much more debt. As I commented, it seems that each new government is determined to outspend the previous one. We see this with Trump and also Carney in Canada.

Another Tax on Canadians

One thing I am watching for in the final bill, is a portion of the bill could increase withholding and income tax on any holding of an American asset by a Canadian or the U.S. operations of a Canadian-parented company. Every pension fund, retirement fund, investment account, and deeply interconnected investment funds with American holdings, held by the likes of teachers, municipal workers, elected officials, and regular everyday Canadian families, are at risk of this increase. The original bill stated the first increase would occur in a year, lets see what ends up as law.

This new massive spending will increase interest payments making them among the highest in the world compared to GDP.

Last fiscal year the government paid over $1 trillion of interest expense on the debt and is now higher than defense spending. Ferguson’s Law - states that any great power that spends more on debt servicing than on defense risks ceasing to be a great power.

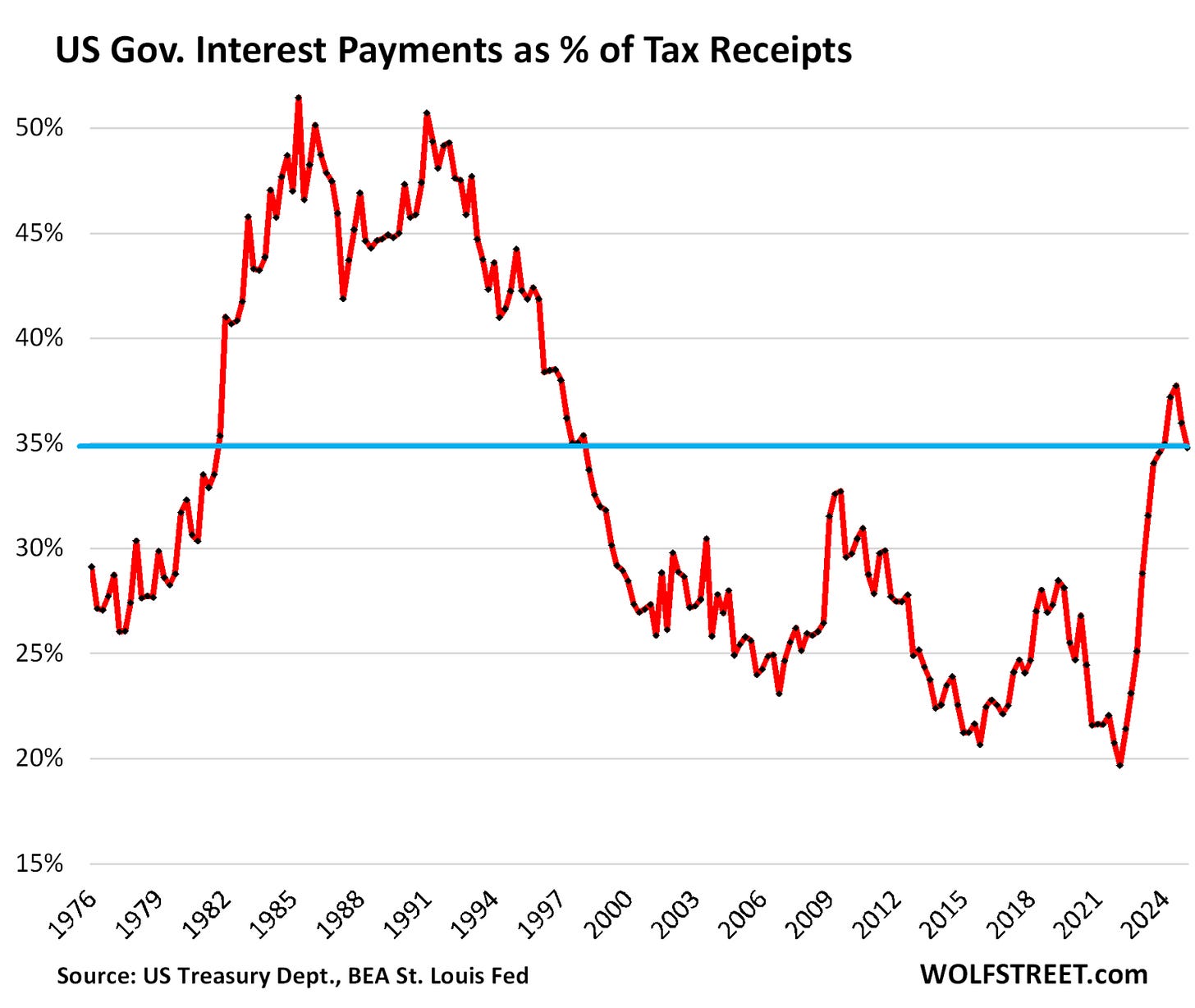

The above chart is another way to look at the interest payment burden. I often harp that we are in a period like the 1970/80s called 'stagflation'. Back then the big increase in payment was caused by high interest rates, this time it is high debt, but interest rates could go higher too.

Trump wants a lower US$ and boost the economy, especially bringing back manufacturing. He is succeeding with a lower US$, but I am not so sure the later will succeed. Economic numbers continue to decline.

Economy Slides with the US$

Economic news is bad no matter what stone you turn over, yet markets are at/near records. The Goldilocks outlook is alive and well.

U.S. consumer confidence unexpectedly deteriorated in June as households worried about business conditions and employment prospects over the next six months. The Conference Board said on Tuesday its consumer confidence index dropped 5.4 points to 93.0 this month, erasing nearly half of the sharp gain in May. Economists polled by Reuters had forecast the index increasing to 100.0.

Orders for long-lasting goods skyrocketed 16% in May to mark the biggest increase in 11 years, but the headline number was exaggerated by a flush of new Boeing contracts that masked ongoing weakness in business investment.

Inflation creeps higher in May and dims chances of the Fed cutting interest rates soon. The PCE price index shows slightly hotter increase in ‘core’ inflation. Excluding food and energy, core PCE posted respective readings of 0.2% and 2.7%, compared with estimates for 0.1% and 2.6%.

Consumer spending and income showed further signs of weakening. Spending fell 0.1% for the month, while personal income declined 0.4%.

The Chicago Business Barometer™ fell 0.1 points to 40.4 in June. The index is now 7.2 points below March's year-to-date high of 47.6 has now been below 50 for nineteen consecutive months.

Construction spending during May 2025 was estimated at a seasonally adjusted annual rate of $2,138.2 billion, 0.3 percent (±0.8 percent)* below the revised April estimate of $2,145.5 billion.

Economic activity in the manufacturing sector came in at 49 contracting in June for the fourth consecutive month, following a two-month expansion preceded by 26 straight months of contraction, say the nation's supply executives in the latest Manufacturing ISM®

News today that U.S. hiring unexpectedly picked up in June as employers added 147,000 jobs despite President Donald Trump's wide-ranging import tariffs, federal layoffs and immigration constraints

All told, more than 260,000 federal workers have been fired, taken buyouts or retired early this year. The monthly jobs reports have tallied just 59,000 losses so far because many employees are on administrative leave pending court challenges, according to Capital Economics.

The U.S. economy contracted a bit faster than previously thought in the first quarter amid tepid consumer spending, underscoring the distortions caused by the Trump administration's aggressive tariffs on imported goods.

Gross domestic product decreased at a downwardly revised 0.5% annualized rate last quarter, the Commerce Department's Bureau of Economic Analysis (BEA) said in its third estimate of GDP on Thursday. It was previously reported to have dropped at a 0.2% pace. The Atlanta Fed, GDP now is predicting 2.9% in Q2 so the U.S. will escape a technical recession.

With today's up move, the S&P 500 has clearly broken the double top possibility and I expect it to go higher in thinner summer trading. I see the market as very risky, with a p/e now around 29, stocks are projecting a lot of growth that probably won't materialize with a weakening economy.

It looks to me that markets will peak in July/August and be a perfect set up for the September sell off. The worse month of the year for stocks and followed by scary October. Sometimes the sell off gets started earlier in August. Stay tuned, I will be watching closely. For now enjoy the ride and raise cash levels into this rally.

he weekly chart of the US$ index shows a further breakdown this week. The index is probably headed to the 90/91 area.

The Federal Reserve unveiled a proposal last week to ease Tier 1 capital requirements for the biggest U.S. banks, though not everyone at the central bank agreed with the decision. This is probably a sign of problems in the financial system and the Fed is doing this to ease that, but add more pressure to inflation.

This plan to loosen credit standards for banks is the same reckless policies that led to the 2008 financial collapse. If they don’t lower rates, this is going to help drive the U.S. economy into a recession and steepen.

While Trump calls for urgent economic relief, some market economist's wonder if Powell is deliberately setting him up to take the blame. This crisis isn’t mismanagement - it’s intentional.

Is the Fed deliberately setting the stage for an economic collapse under Trump’s presidency, fully aware of who will take the blame?

There is no love between Fed Chair Powell and Trump and this would not surprise me. There is such a strong effort to bash and stop Trump, maybe the Fed will do their part too?

Conclusion

Stock markets are at risky levels. High inflation and interest rates will remain stubbornly high. The flight to gold will continue and commodity type investments will be the market leaders in the coming cycle partly boosted by a weaker US$. I expect further economic decline and stock markets eventually pricing in reality.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.