Trump's Plan Could Work, Economy and Markets, Yen Carry Trade, Gold

Most analysts are focused on tariffs and what trouble they may cause but they are missing the big picture. I have commented many times that interest rates were not coming down despite the Fed cuts. Markets had enough of out of control government spending and deficits. The market was saying, we will buy your bonds but only at a higher yield to compensate for our risk financing your fiscal mess.

The U.S. deficit was around $800 billion before Covid than rocketed to around $3 trillion in 2020 and 2021 with Covid. There was an excuse then but the Biden government never got it under control and was $1.8 trillion in 2024. It is projected to be $1.9 trillion in 2025, a lot caused by higher interest rates on the debt.

The Trump administration faces a huge problem because the Biden administration spent way too much of the 2025 budget before Trump took office (fiscal year starts October 2024). Yellen under Biden financed a lot of debt short term, so a huge amount will have to be rolled over in 2025 and 2026 at current rates. Perhaps Yellen was hoping rates would come down?

I had little hope the Trump administration could get through this problem and a reason I was quite bearish and a proponent of stagflation. However, I now see a path through this fiscal mess, but there will still be more short term pain.

Trump's plan looks like it could work and is quite brilliant, maybe by luck but some very good hope for sure. In 1980, President Reagan tried a new economic experiment called 'supply side economics' and he was heavily criticized. Many thought he was crazy, did not know what he was doing, he is an actor, this will never work. However, it did work and Reagan was elected to a 2nd term in 1984 with a landslide victory winning every State but two.

Here is something recent, Javier Milei’s (far right) was elected in Argentina in 2023. First was an immediate 5 percent (chainsaw) slash in government spending. More reforms followed.

Public work programs were put on hold, welfare programs were slashed, and subsidies were eliminated. State-owned companies were privatized and hundreds of regulations were cut. Tax codes were simplified and levies on exports were lifted or reduced. Labor laws were relaxed. The number of government ministries was reduced from 18 to nine, and a job freeze was implemented on federal positions. Tens of thousands of public employees were given pink slips.

Sound familiar? He was heavily criticized too. “Javier Milei’s economic proposals are presented as a radical departure from the traditional economic thinking,” the economists wrote.

And what happened? Inflation, which had peaked at an annualized rate of 300 percent in April 2024, nosedived, reaching a four-year low in November 2024. In his first month in office, the Associated Foreign Press reported, Milei oversaw a record 25.5 percent inflation rate. By November 2024, inflation had fallen to 2.4 percent.

Meanwhile, Argentina’s economy officially exited recession. GDP grew by nearly 4 percent in the July-to-September quarter of 2024 after a sluggish first half, and the International Monetary Fund forecasts growth of 5 percent in 2025 and 2026.

I just read that the Wall Street Journal editorial board has declared China’s Xi Jinping as the person emerging as the “winner” from President Trump’s tariffs. "President Trump’s across-the-board tariffs will change the world order in many ways, and one winner is already emerging: Xi Jinping. The Chinese President has had an excellent week."

This is just lunacy, how can anyone be declared a winner after one day. Anyway it highlights the narrative that Trump's economic plans cannot work.

However, looking objectively, I now see a path how Trump's plan could work. Here me out before you call me a lunatic too.

Trump's tariffs are causing recession fears and a market correction causing a flight to safety which is treasuries, bonds and gold. Gold was making all the gains, but now bonds are too. This is bringing down interest rates and I expect they will come down further.

Rates were hovering around 4.5% and are now coming down and I expect will easily fall to 3.5% or even 3% with a coming recession.

I recently listened to an interview with U.S. Treasury Secretary Scott Bessent and he said that every 100 basis point decline in rates, equates to $900 billion of interest rate savings on the debt. It is quite realistic that this could knock a lot off the deficit.

He made another striking point. In 2024 Americans set a record for European vacations. In 2024 Americans set a record for food bank visits. To me something is not right here and clearly under the Biden Administration something about their policies was not working. Really a change was required, whether Trump's plan works, the jury is still out.

A recession will cut down tax revenues, however in the 3 months Trump has been in office, $3 trillion has been pledged of investments in U.S. manufacturing and development. This link provides a list of announcements. This could more than offset the effects of a recession and bounce back out of one.

Furthermore, there is Musk's DOGE cuts that could amount to $300b to $600b in savings.

These things will not be immediate effects, but by 2026 a light may shine that points to a deficit under $1 trillion, back to pre Covid-19 levels. This would be a huge improvement and really help markets.

All said though, things are going to continue very rough this year making this economic adjustment under the Trump Administration. Expect tough times ahead and more market volatilaty.

With such a strong move down on Thursday and Friday, a relief rally on Monday would be no surprise. Regardless, the NASDAQ Composite officially entered a bear market on Friday and took out the lows in last July's correction.

Note that RSI is approaching -20, a level that often marks bottoms, even if they are temporary. There is a lot of hysteria in the media about the market has “crashed,” but in reality the market is still very high. Currently the average price-to-earnings ratio of the S&P 500 is around 25, which is still about 40% higher than the historical average around 16.

Another positive factor that could help Trump's plan and the U.S. trade deficit is that the US$ has been falling and looks like it could break down on the chart. That may be good for some things on the trade front but might also unravel the Yen carry trade.

This is a monthly chart of the US$ index and it bounced off 101 this past week as it has come down quite hard since early March. A close at 99 would be a break down and probably head much lower. Recession fears and a lower interest rates might cause this.

The other thing that is screaming recession is the oil price. It totally broke down on the chart and has dropped to levels going back to 2021. It could also be telegraphing a global slow down with a trade war, not just a U.S. recession. This is the reason I was not bullish on oil but natural gas.

It appears we will not need Trump's 'drill baby drill' for low energy prices. All this main stream hype about tariffs causing inflation certainly won't happen with falling energy prices.

As far as markets go near term, the rise in the Yen is a negative factor. That is what caused the sell off last July was unwinding of the Yen carry trade. The Yen has been rising a lot since mid February and getting to a level where the trade unwound last July. In fact maybe it got started on Thursday or Friday?

Last but not least is gold that along with gold stocks, sold off heavily on Friday. I have witnessed this type of thing probably 40 or 50 times in my days. Fund managers and investors sell gold and gold stocks after steep market sell offs to raise cash to make margin calls and off set losses. All the reasons that drove gold up are still there and will reassert themselves when the market becomes more orderly. I expect gold to consolidate around the $3,000 area.

There has been a lot of physical gold moving from London to New York and what you hear most about this, it is about tariff fears. I have never talked much about that and don't wear that hat. I think it has been somewhat a factor but not the main one. In this light much of the main stream has been blaming gold's fall because it was announced there would not be tariffs on gold and likely not on silver, platinum and palladium.

I believe the main reason for the sell off is what I noted above with markets and gold has saw a very strong up move so was ripe to correct.

I believe a lot of physical moving to New York was because of strong demand for it over paper. If the big concern was higher prices because of tariffs, it could have easily been hedged in the paper market. Another factor nobody is talking about is fears of Europe going to war with Russia in Ukraine, Such an event would likely mean currency, goods and economic controls. Get your gold out while you can. Much the same thing happened in WW2, history might be repeating.

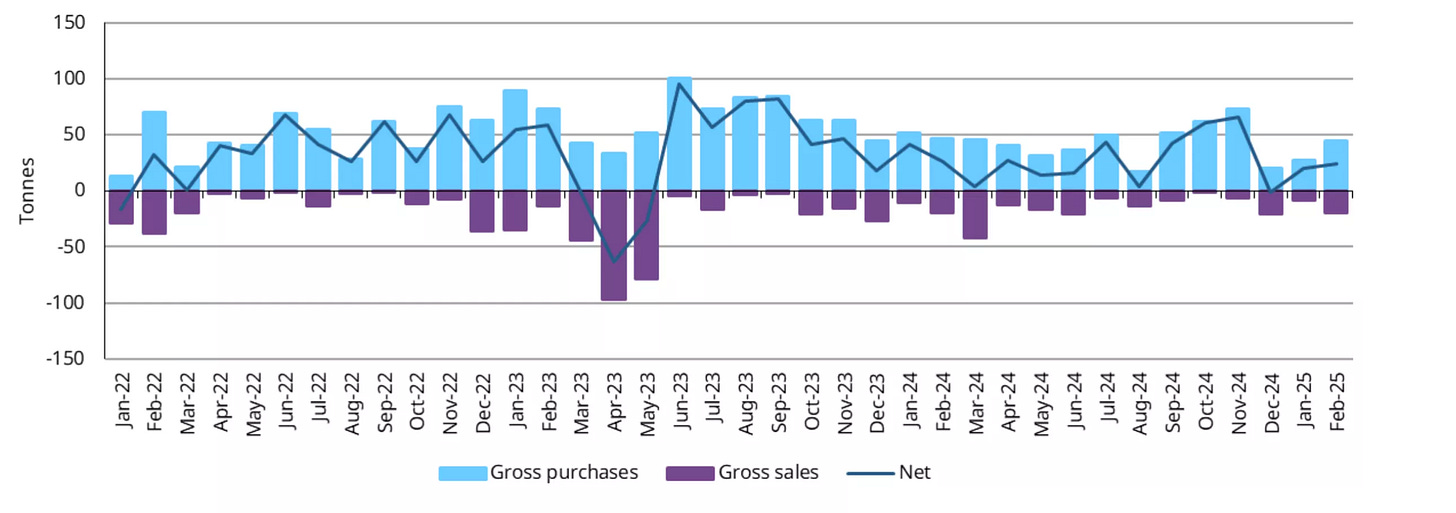

Demand for gold from central bankers continues, with data available for February showing reported global central bank gold reserves rising by 24t. Thus far, Poland, China, Turkey and the Czech Republic have led gold demand from emerging market central banks. With the lower price, they will just buy more.

And Poland, a NATO country on the border of Ukraine and Russia along with Russia ally Belarus. Poland is buying a lot of Gold and has been a big buyer since 2023. Gold Reserves in Poland increased to 448.23 Tonnes in the fourth quarter of 2024 from 419.70 Tonnes in the third quarter of 2024.

Poland has been holding their reserves, half in country and half in London at Bank of England. Could they be shifting some to New York? Usually you never find out one way or another to after the fact.

Amid the outbreak of the Second World War, the entire Polish gold reserves were secretly transported across three continents to be stored in London, New York and Ottawa. As I like to say, is history repeating?

Conclusion

The U.S. was divided before Trump won the election and still is. Half the U.S. and maybe more are in an uproar over the tariffs and government job cuts. As with any newly elected government, they try to get all their dirty work and negative policies done in the first year, hoping you forget about the tough times come next election.

I expect the economy and markets to get uglier before they get better. The jury is out and it will be a year or so before we get much clear indication that Trump's plan can work. As I say above, for the first time I see a bit of light on a path.

There is a lot of negative vibe that the Trump administration plan will fail, similar to what was said in Reagan days and Javier Milei in Argentina. Time will be the true judge but fasten your seat belts until we get there and see if we get a rough ride down or will it finish up?

Trump is trying a new economic plan and nobody knows for sure what will happen, including myself. There is lot of opinions and predictions and I have given my best observations at this time. For everyone's sake, lets hope it works out.

Gold is a buying opportunity, so I will see how the market plays out next week and may present a couple new precious metal picks. I expect silver to still lag, it has not caught on yet and has little investment demand.

Near term I am concerned about the Yen carry trade unwinding. Maybe it already started, but this could be further near term downside.

A recession, as long as it is a relatively short one will be good for the government and Trump's plan. I am expecting no inflation problem but because growth will slow, we will still be in stagflation (low growth with relatively high inflation).

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.