Thankyou and welcome to new subscribers. And all new and current subscribes please share my substack with investor friends and family as it is free at this time.

I have been warning for months that higher inflation was on the way because energy prices would go up as government botches a policy on energy transition. This month prices were expected to go up 3.6% but consumer prices overall rose 3.7% from a year earlier, up from 3.2% in July. That’s the second straight bump after 12 consecutive declines in annual inflation. On a monthly basis, prices increased. 0.6%. That followed a 0.2% rise in July and marked the biggest jump in more than a year.

The good news is that core inflation dropped a bit, but I expect the Fed will raise rates 25 points later this month. They will induce a bad recession, sorry Goldilocks.

And this is August data when oil prices were in the $80 to $82 area, now we are closing in on $90. I have a near term target of $94/95. The jump this week is based on EIA’s September issue Short-Term Energy Outlook (STEO), that predicts a 200,000 b/d decrease in global oil inventories in fourth-quarter 2023. EIA’s forecast also predicts that the Brent crude oil spot price will average $93/bbl in fourth-quarter 2023. As of September 8th, the number of US oil rigs continues to drop at 632 compared to 759 a year ago.

Also I have been pointing out, fuel prices are back on the rise with gasoline prices now well above the August highs. Distillates that include diesel fuel are at very low inventory levels, at or below 5 year lows. This is going to be a long term problem because there have been no new refiners built to handle the new demand from the marine shipping industry to comply with new pollution standards adopted worldwide.

The major cause in the rise of diesel fuel prices and their shortages since 2020 is mostly a result of changes to marine shipping standards for engine fuel. Ocean-going vessels and large ships traditionally used “bunker fuel” with sulphur levels as high as 5%, or 50,000 ppm, sulphur. Bunker fuel burned on these ships was a large source of harmful air pollution in the U.S. and the world.

Marine Shipping, a Huge Demand Factor

New standards for marine diesel fuel were put in place January 2020 called the MARPOL Convention, that reduces the sulphur content in the fuel from 3.5% to 0.5%. The worlds shipping trade is huge, estimated at 60,000 ships. In 2019, ships transported 11.08 billion tons of goods. This requires a great demand of fuel, close to 640,000 tons per day. The marine residual fuel demand is approximately 49.5% of the global residual oil. This makes marine the single biggest factor on the oil demand side.

Compliant fuels include very low sulphur fuel oil (VLSFO) and marine gas oil (MGO). Some ships limit their air pollutants by installing exhaust gas cleaning systems, also known as "scrubbers". This is accepted under the MARPOL. The majority of ships trading worldwide switched from using heavy fuel oil (HFO) to using VLSFO. This is also a factor increasing shipping costs with significantly higher cost for the cleaner fuel. The low sulphur fuel was already phased in from 2006 to 2010 for on road diesel.

Enerpure has a Solution

Now in comes Enerpure that either had lucky timing or astute management and maybe both. Enerpure is like an energy, tech and green company all wrapped up in one.

Enerpure has over 15 patents in 12 countries around the world. This is no startup company with already $36 million invested and support from provincial and federal governments. It is proven technology and has been running at their first facility for almost 3 years. In late 2020, EnerPure began commercial operations at its Southern Manitoba Facility and continues to produce and sell fuel to Maersk, the largest shipping company in the world.

The company recycles used motor and industrial oils and produces marine quality fuel. The opportunity is huge. Enerpure's research shows that dated technologies have only been able to recycle 20% of global waste oil and is unable to target the remaining 80% available. That approximately 80% equates to 22 billion litres of the 28 billion litres of waste oil generated globally on an annual bases. It is either disposed of in an environment unfriendly way and in most cases is probably burned as a cheap heating oil alternative. Burning this dirty oil (hazardous material) will give off hundreds times more pollutants.

This also means Enerpure will also be able to generate carbon credits. Each Enerpure facility can can reduce green house gases by 13,500 tons annually.

The company does not have to build huge refineries, but has a very small foot print. They bring the solution to the problem and will end up with 100's of these recycle facilities globally.

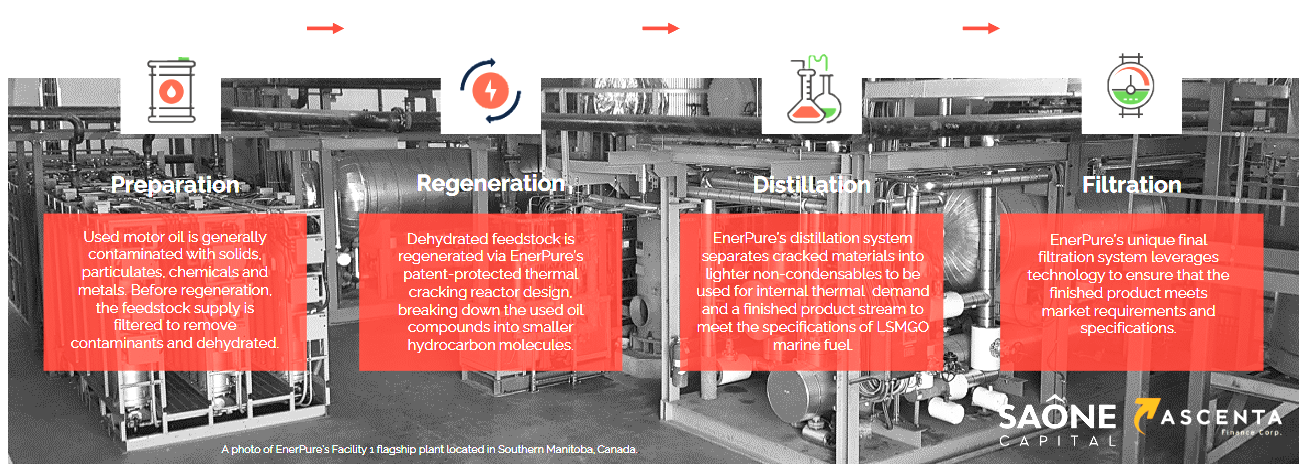

There is a short 4 minute youtube video that shows the inner workings of the facility and is a good introduction and over view of the company. The graphic next page is from their presentation and shows the basically continuous flow plant units.

This next graphic from their presentation is a good snap shot of their solution and plan. It did not turn out so well with a screen shot but I suggest reviewing their presentation as well.

I have no doubt that major energy companies are and will be all over this. It is an ideal pet project to promote their ESG initiatives. They make a good hint at this in the above graphic, speaking of an offtake agreement with a Supermajor. These types of deals could mean a really fast roll out.

The current equity raise along with $40 million debt financing will go towards commercialization, expanding the number of facilities by around 11 in North America . Last October they announced a JV with Gold Fuels that will provide the capital costs for their 2nd facility in Alberta. On September 5th this year they announced a long-term lease of a site in South-Central Alberta for the deployment of one of their used motor oil (“UMO”) regeneration units.

This next slide shows very robust financial returns on their planned roll out. Note that each plant only costs $12.5 million and they are not showing much of an increase in CAPEX after 2025 so they must be projecting the use of other companies money, like in the form of JV or offtake agreements. The margin is a very good 34% and they are projecting $300 million in revenues with just 21 plants.

Conclusion

I suspect this could be conservative projections if they sign deals with a few majors. And they do see potential for 100s of these plants around the world. It is only about $12.5 million per plant with about a 18 month construction to production phase, which can enable a quick and large expansion.

This is a rare opportunity to invest in a very unique company that can generate large returns and also help the environment.

The current equity offer is at Cdn$0.55 per share that includes 1/2 warrant exercisable at Cdn$0.85 cents for 12 months after an IPO or liquidity event. It would not surprise me if this gets bought out before the IPO and we could make 10 times on our money. After this finance round and fully diluted there would be about 150 million shares out. A valuation at $5.50 would be $825 million, not a far stretch if they are able to land 2 or 3 deals with major energy companies. Long term I can see much larger potential. If 21 plants generate $300 million, than 100 plants would be close to $1.5 billion.

Accredited investors can buy with a minimum Cdn$11,000 and I can get you in touch with the appropriate contact, and fortunately through an Associate of mine at Asenta Finance there is also crowd funding available. You can invest as little as Cdn$1,100 and is available until October 16, 2023 or until Cdn$55,000 is raised.

For crowd funding, go to this link and register. Then just click on Enerpure and you can view information on the company and follow instructions to invest. I would not wait until October 16th, it could get sold out earlier.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.