U.S. Economy OK?

This week the Fed reassured us that the economy is just fine, but that is their job to promote a stable economy and markets. They only admit a problem when it is too obvious to ignore. However, there was some better numbers this week.

U.S. existing home sales unexpectedly increased in February. Home sales rose 4.2% last month to a seasonally adjusted annual rate of 4.26 million units, the National Association of Realtors said on Thursday. Economists polled by Reuters had forecast home resales would drop to a rate of 3.95 million units.

Initial jobless claims remain steady increasing by 2,000 to 223,000 in the week ended March 15.The business organization’s index of leading indicators fell by 0.3% in the month, following an upwardly revised 0.2% drop in January. However this has been falling for well over a year.

Canada Collapsing

No doubt you have heard about Hudson Bay stores going bankrupt. It is a Canadian icon and all 86 stores will be closing. This is not the only big retailer to close doors in Canada this year. Several retailers have announced closures since January.

Peavey Mart, which acquired TSC Stores, is closing all of its 90 stores across Canada. Because gardening is a hobby of mine, this was one of my favourite stores. They also had good pricing on farm supplies and hardware. I just stopped in this week for 40% to 70% off bargains.

Low-cost fashion retailer of 75 Ricki’s, 54 Cleo stores and 53 Bootlegger stores announced the closure of stores across Canada.

Major Canadian retailer, Frank and Oak, filed for bankruptcy.

Johnston & Murphy, a U.S. footwear and clothing company, announced it is shutting all of its Canadian stores and e-commerce site as of Jan. 18.

All this had nothing to do with Trump tariffs. “Maybe the one good thing about Trump is the slap in the face we need to build pipelines and build mines in this country,” Ted McGurk, head of investment banking at TD Securities. However, I commented earlier that tariff uncertainty would negatively affect business confidence.

Confidence among small businesses plummeted to an all-time low in March, with sentiment lower now than anytime during the pandemic, the 2008 financial crisis or in the aftermath of 9/11, according to the Canadian Federation of Independent Business (CFIB).

There are around 1.29 million small businesses in Canada as of 2024, out of 1.3 million business total. Small companies employ over 10 million Canadians. Small and medium-sized companies contribute over half of Canada’s GDP. Just another part of the deepening recession.

Election Propaganda

The Canadian Liberals will call an election this weekend hoping to take advantage of momentum with new leader Con Man Carney and their diversion with Trump tariffs.

I believe it is is the most important election in Canadian history and will be covering it because it will have dramatic effects on our economy and markets. I am amazed how Liberals have risen in polls, but beware that polls are often manipulated and used to persuade voters. The last poll, I saw, the sample size was way too small to be accurate. I am hoping Canadians are not dumb enough to give the liberals a 4th mandate. They wrecked the country and economy with their policies in their last 3 terms, Canada desperately needs a change. It is obvious which way I lean.

Carney is no different than what we already saw with the liberals. He was Trudeau's economic advisor the last several years and look where that led us. He is godfather to Crystia Freeland's child, they are all just one big family and Carney with about the same cabinet as Trudeau. He is a staunch supporter of climate change and carbon tax. Don't be fooled by their election ploy to remove the carbon tax. Canadians have been unhappy and against the carbon tax for well over 2 years, why are they removing just now, ahead of the election? Carney visited France and England and came back saying a carbon market is required to trade with world partners. If elected he will simply put the tax back on but hidden from consumers. It will go on business and get passed on to consumers. And I have no doubt that Canada does not need a carbon tax to trade with our biggest trading partner, the U.S.

I call him Con Man Carney because he is trying to pull a con on Canadians. He has never been elected to parliament and his positive experience is as a bankster. He is a lead director of the World Economic Forum and promotes their socialist agenda. He believes that is more important than what Canadians want. Carney himself said that he is probably viewed as an elitist or globalist, but said that is actually what Canada needs right now.

Carney and the Liberals will use the Trump tariffs as a diversion to try and convince Canadians that Carney and the Liberals are the only choice to deal with it. In reality all the problems in Canada like the housing, economy, health, crime and drug crisis to name a few came with the liberals open border, climate/carbon tax, socialist, tax and spend policies.

Canadians have to realize, that Trump did the exact same thing in his first term, back in 2016. He imposed 25% tariffs on Canada and in about a year, a new trade deal was negotiated and the tariffs removed. The only reason it is a big deal this time because it is being used as election propaganda. Like 2016, is probably how it will play out again if Canada has an effective government.

Conrad Black is a well know business man and a political proponent in Canada. This is how he put it

“The fact that Mark Carney has suggested the Chinese yuan could serve as a world reserve currency merely indicates the intellectual bankruptcy of the incoming prime minister. Can we please come to our senses and assure that the coming election is about the failure of the Trudeau government and the authoritarian socialist and irrational environmental opinions of Mark Carney? Donald Trump is a foreign leader and we will deal with him from a position of strength, provided we have a serious government.”

Canada slipped to 18th place from 15th last year in the World Happiness Report, placing it among the "largest losers" in happiness rankings over the last two decades. In 2015, before Trudeau was elected late that year, Canada had placed 5th.

Gold Stocks

Finally, as measured by the HUI index, gold stocks have got back to their 2020 levels when gold hit $2,000. I want to see a close at 375 or better as a clear break out, and it is coming.

I have been commenting that North American investors are not in the gold market yet.

Just recently, JPMorgan Chase suggests that precious metals and related securities comprise less than half of 1% of all savings and investment assets in the U.S. This is very important because they estimate that the 40-year mean market share was 2%.

Gold doesn't have to win the war against the U.S. dollar or supplant the U.S. 10-year Treasury. All it has to do is revert to mean. If the market share reverts to mean, demand for this asset class (precious metals and precious metal securities) increases fourfold in a market that right now accounts for 23% of the world's savings and investment assets.

Also looking very recently at the quarter financial s you're starting to see gold companies that aren't beating their quarterly forecasts; they're murdering them, clobbering them.

Gold Stocks Beating Gold

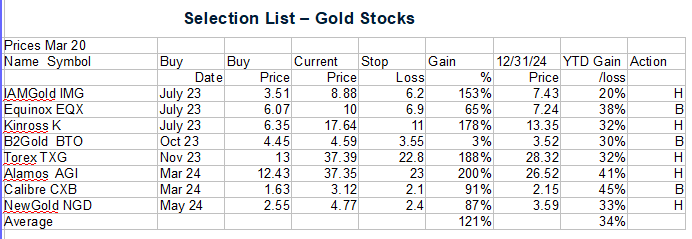

Gold stocks finally out performing gold. In 2025 the gold stocks are starting to show the leverage to gold as gold is up +14% this year and the gold stock index HUI, GDX and GDXJ are up about +26%. I am happy to report that our gold stocks are beating these indexes by a decent margin, up +34%.

On the list, right now I see as B2Gold, Equinox that is buying Calibre as the best buys on the list. That said, we could see a consolidation in gold prices and the stocks could provide a little lower buying level. Gold and silver and the relevant stocks are performing quite different so I am going to divide them on our Selection List for better comparison purposes.

I am now planning on moving down the food chain some and will add on some advanced juniors that have very good deposits and juniors that are developing mines.

A brief update on Intel as I suggested buying as a turnaround. We might be a bit early but never the less in near what I expect is a bottom. We might need a better market to finally crack resistance on the chart, but I don't think there is much downside from here.

Intel Corp - - - INTC - - — - Recent Price - $23.95

Entry Price - $22.60 - - - - - Opinion – buy on weakness, below $22.50

Last week, Intel announced a permanent CEO following the abrupt departure of Pat Gelsinger in December. Lip-Bu Tan has been appointed as chief executive at a critical time for the chipmaker, as well as the semiconductor industry as a whole. Intel took off on the news, climbing nearly 5% before the close last Wednesday, and another 12% to $23/share in premarket trading. The stock continued higher to about $26 but could not crack resistance on the chart.

Tan joined Intel's board in 2022 after a decade leading chip design software company Cadence (CDNS) - whose stock rose over 4,000% under his leadership - but quit the INTC board last summer over reported disagreements with Gelsinger's turnaround plans. In the interim, Intel CFO David Zinsner and product chief MJ Holthaus have been running the company, spinning off Intel's venture capital unit and exploring a stake sale in its chipmaking unit Altera. There have also been loud calls to take more serious action, such as separating Intel's costly foundry biz to focus on design.

On his appointment, Tan said, “I am honored to join Intel as CEO. I have tremendous respect and admiration for this iconic company, and I see significant opportunities to remake our business in ways that serve our customers better and create value for our shareholders.”

“Intel has a powerful and differentiated computing platform, a vast customer installed base and a robust manufacturing footprint that is getting stronger by the day as we rebuild our process technology roadmap,” Tan continued. “I am eager to join the company and build upon the work the entire Intel team has been doing to position our business for the future.”

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.