US Recession Looming And Dictator Trudeau Still at It

U.S. home prices kept on rising to end the year, data released Tuesday confirms. Prices nationally rose 3.9% annually in December, according to the S&P CoreLogic Case-Shiller index, a faster gain than the 3.7% increase in November.

Demand for housing is still robust enough for further price gains, but as I have commented before, rent prices have started to move down, builder confidence is falling and in a recession, auto sales decline first and than housing.

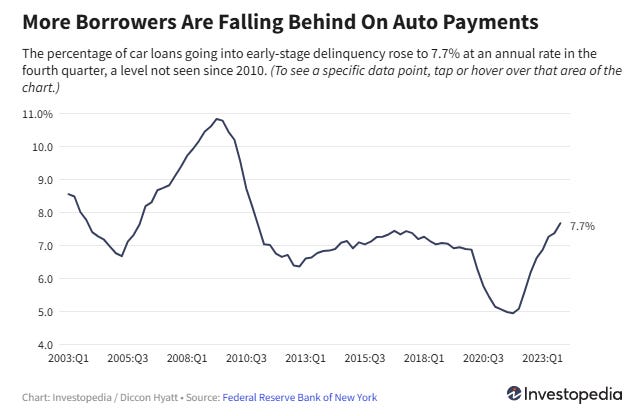

Earlier this month it was reported that Auto Loan delinquencies hit a 13 year high. The problem is driven by expensive cars and high interest rates on car loans.

Data released February 4th by the Federal Reserve Bank of New York show that car owners fell a month or more behind on their auto loan payments at an annualized rate of 7.7% in the fourth quarter 2024.

It is no wonder that news today saw U.S. consumer confidence plummeted in February, the biggest monthly decline in more than four years, a business research group said Tuesday.

The Conference Board reported that its consumer confidence index sank this month to 98.3 from 105.3 in January. That’s far below the expectations of economists, who projected a reading of 103, according to a survey by FactSet.

Dictator Trudeau handing out Taxpayer $$ on his Own Whim

Trudeau is taking part in the summit of world leaders in Kyiv to mark the third anniversary of Russia’s invasion of Ukraine. Trudeau said he is resigning, has no support from Canadian voters and has shut down parliament. He just rambles off on his own accord like a dictator and gives tax payer dollars away when Canada is in shambles. Giving away what little military equipment Canada has.

Back at the end of 2023 CBC news reported 58% of the military's equipment is considered "unavailable and unserviceable" — says a recent internal Department of National Defence (DND) presentation obtained by CBC News. According to Global Fire Power - Canada military is comparable to very small countries like Argentina and Algeria. And this ranking is based on 80% of equipment that is in a state of readiness when we know it is only 58% and probably less now.

And what is working - Canada has been giving to Ukraine

Yesterday, Canada’s pledged funding in military assistance to Ukraine includes Leopard 2 main battle tanks, armoured combat support vehicles, anti-tank weapons, small arms, and ammunition.

“Canada has concluded negotiations with Ukraine on the terms of its $5 billion contribution and will disburse half of the funds, totalling $2.5 billion, in the coming days, with the remaining sum soon to follow,” the government said. Trudeau also committed to sending Ukraine additional military equipment, including 25 third-generation Light Armoured Vehicles, two armoured combat support vehicles, and four F-16 flight simulators.

Sell Bitcoin short etf SBIT - - - Recent Price $12.75

Entry Price $11.90

Twice Bitcoin has dropped low to where we could have made a profit on our SBIT, but it was for very short duration or outside of trading hours. Finally we got our move down this morning.

Sell the SBIT etf around $12.75 and we have about a 7% profit from our $11.90 entry point. Not the best timed trade, but we will strive to do better on the next one. I expect Bitcoin will rally and we can go short again.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.