Victoria Gold/Zonte, Why are so many planes crashing?

Struthers Report V29 # 10.2 Gold, BTO, GRB

Thank you and welcome to the 20 or so new, savvy and contrarian investors who have joined my substack. Please share with your investor friends and family as I intend to keep this free until 5,000 subscibers.

I have been predicting the August bottom was the end of the gold correction. There were two positive signals last week as gold sketched out a candle stick morning star reversal pattern. It was not a perfect hammer that tested $1921 on September 14th but close enough. I also consider this a close enough test of the August bottom. Next I want to see a break above the down trend channel (blue line). Then ultimately a move above resistance around $1980, which would be a higher high than last rally. Stay tuned!

Zonte Metals - - - - - TSXV:ZON - - - - - - Current Price - $0.06

Entry Price $0.12 - - - - - - - - - - Opinion – buy

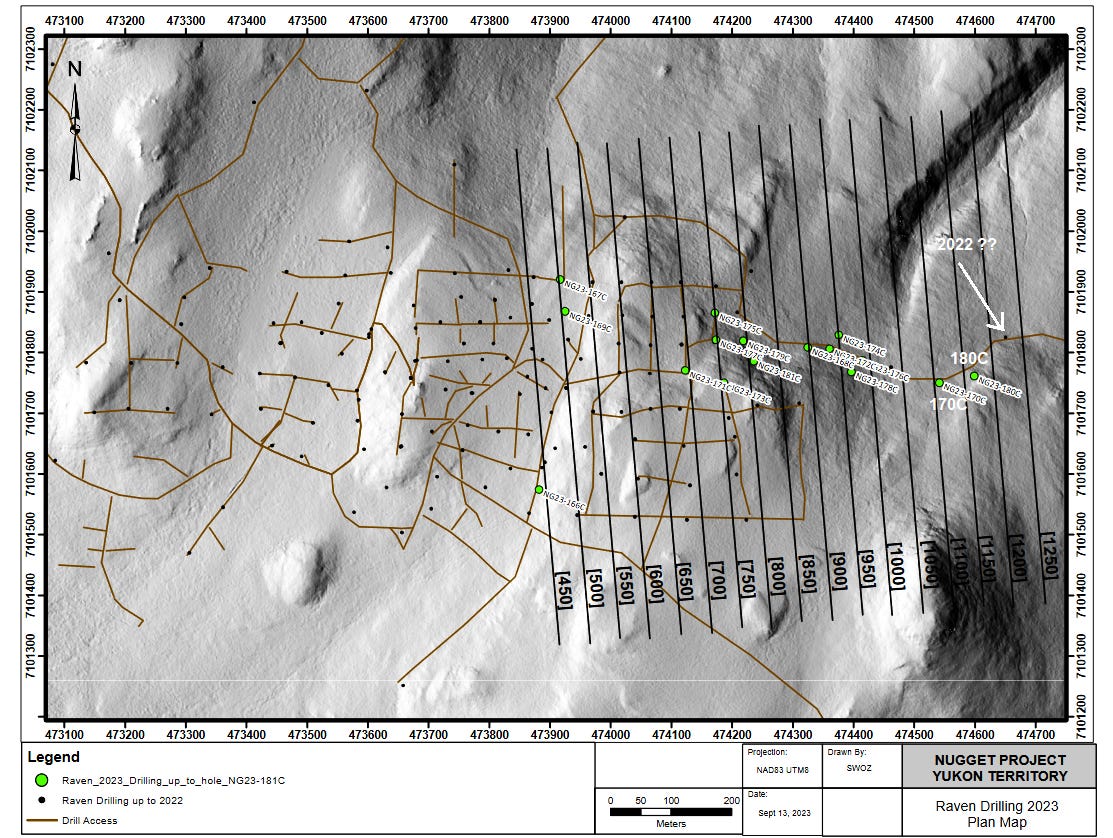

Victoria Gold only announces drill results on their Raven project on Zonte's border twice a year. They did not release all the results of 2022 drilling and I have speculated that it was because they were on or near the Zonte border. However on Sept. 14th Victoria gold announced more drill results and are much more closer to Zonte's border. Here is the drill map from Victoria Gold's news release. The far left border on this map is not the Zonte border, it is about another 500 meters. However, this new drilling is about another 500 meters closer to Zonte's border, holes 180C and 170C.

Hole 180C had a high grade hit of 221 g/t silver and 2.34 g/t gold over 0.8 meters.

Hole 170C hit 70.9 meters of 0.82 g/t gold and 14.03 g/t silver.

Victoria Gold CEO admits there is a high grade trend towards Zonte’s border (east) "A busy 2023 exploration program served to validate and expand the mineralized footprint of Raven while increasing overall confidence in the Raven deposit," stated John McConnell, president and chief executive officer of Victoria. "With each successive season, Raven has grown in size, and 2023 should prove no different as we focused exploration towards growth of the deposit along strike -- particularly to the east, where 2023 results underscore the development of a high-grade trend."

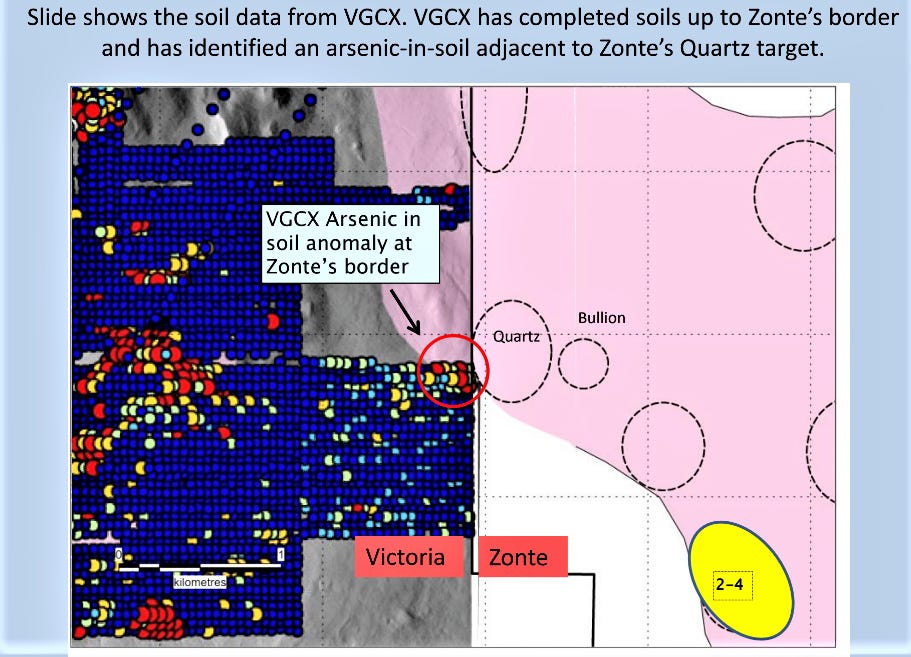

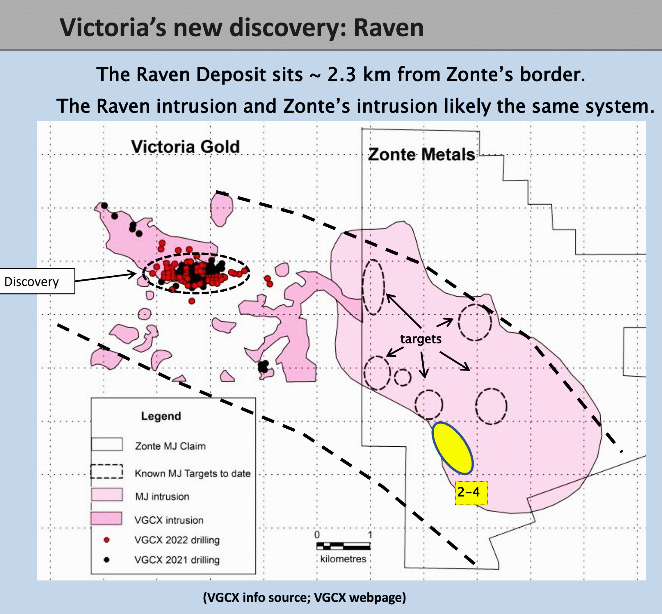

Zonte has a presentation on their MJ project next to Victoria Gold and is worth reviewing. Here is one slide from that presentation that puts Zonte's strong potential in view. Keep in mind that is is on 2022 data so Raven is now about 1/2 km closer.

In better markets for junior exploration, this would be a strong buy on this news, but as in my last update, just go with bids until these funds or fund that is forced to sell is done liquidating.

Last Friday, Victoria Gold announced they are buying all the Yukon assets of Sabre Gold Mines (SGLD) for $13.5 million in cash and stock. What is so pathetic and only proves we are in the worst junior mining market in history is Sabre Gold did nothing on the news. The deal is worth about 18 cents per share for Sabre and it just sat at 14 cents and traded a very pathetic 15,000 shares and 2/3 of that pathetic volume was on the other trading platforms.

Nobody is watching the juniors. They are dead dead dead!

And news in Colombia. On one hand B2Gold says Gramalote is uneconomic and on the other hand they decide to buy out AngloGolds 50% interest for US$60 million in staged payments. This deal was announced today Sept. 18th and $40 million of the payments only occur if there is a construction decision in the next 5 years.

The real reason they cannot develop Gramalote is because they do not own key claims that Zonte Metals has, so in their effort to expand they bought Sabina Silver earlier this year for $1.1 billion and are now constructing a mine on the Goose project, Nunavut Canada that was acquired in the Sabina acquisition.

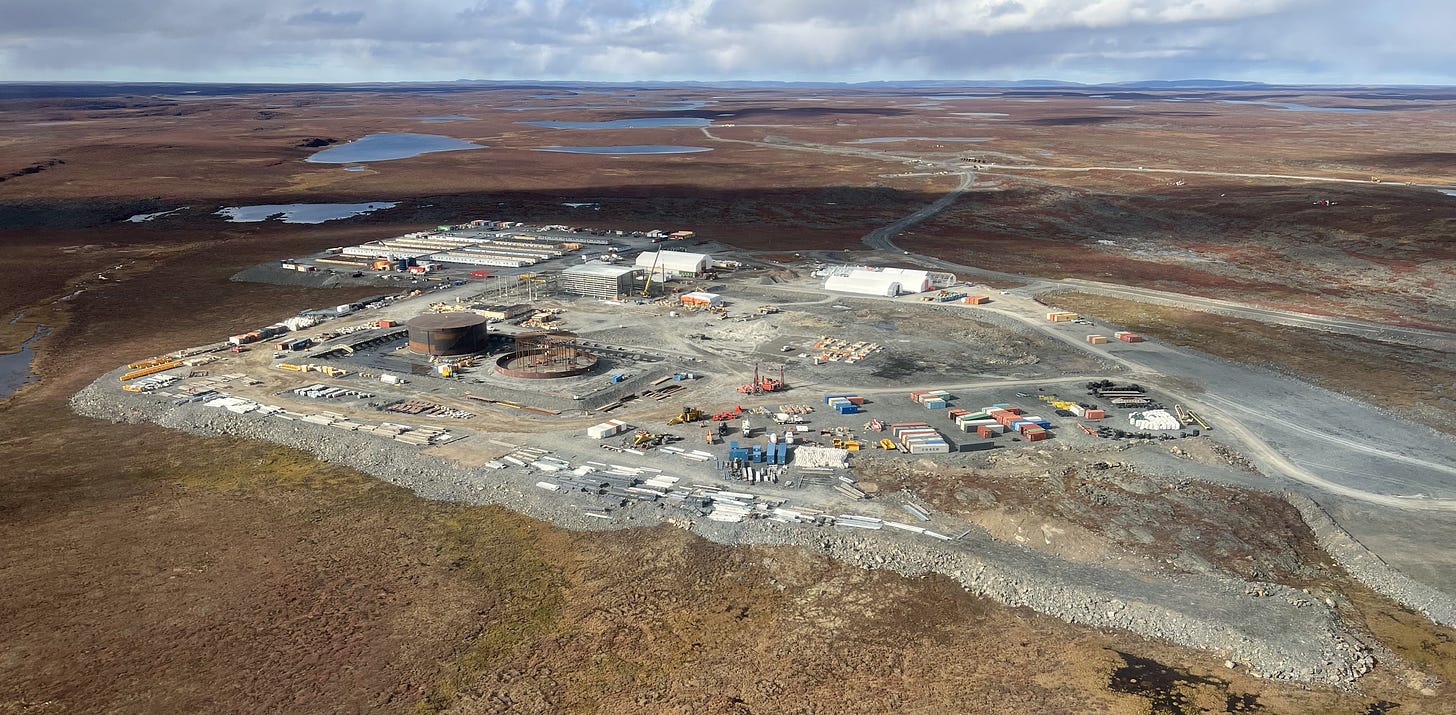

This mine is in the middle of no where with absolutely no infrastructure. B2Gold is building a town to house workers. There is an airstrip that B2Gold has received 100s of shipments on and this will expanded to 5,000 feet to accommodate passenger jets and large cargo jets. They have built a 163 kilometre winter ice road between their Marine Laydown Area (MLA) and the Goose Project that will operate between February and end of-April, depending on temperatures. They built their own sea port and will have a total of 7 large sea shipments for this shipping season.

24 million litres of Artic type diesel fuel will be delivered this year. No doubt the Goose project and MLA will have the biggest diesel storage tanks in the world, other than refineries. The MLA is located approx. 130 km north-northwest of the Goose Property and is the primary staging area for equipment, material, fuel, and other supplies. It was built by Sabina Silver. Picture of Goose project.

This will be a very high cost mine, but it has very high grades of near 6 g/t for a heap leach type mine. However, cold weather can negatively affect the heap leach rates. It will be interesting to see how production plays out on this one.

In more good Zonte news, CEO Terry Christopher bought 124,000 shares in 3 separate transactions last week. There are many reasons that insiders sell, a new house, divorce, moving etc., but only one reason they buy. They believe the stock will go higher.

Greenbriar TSXV:GRB - - - - - - - - Recent Price - $0.88

Entry Price - 1.15 - - - - - - - - Opinion – buy

A new filing has been submitted by PBJL/PREPA to the Energy Board of Puerto Rico (PREB). The settlement discussions between PBJL and PREPA are now coming to a positive conclusion at a requested settlement date of October 3rd. Then it was just be left for the Financial Oversight and Management Board for Puerto Rico (FOMB) to consider an official approval for Montalva. Hopefully that can happen within a few months, but the last hurdle. The stock has not been this cheap since early 2020.

Why are so many planes crashing – Time to buy airlines?

It seems there have been a lot of plane crashes in the news. This is further emphasized with news that Trudeau's plane broke down in India. I decided to look into this and I was also wondering if the time might be coming to buy airline type stocks. They were hit with Covid, high fuel prices and labour shortages, perhaps things can't get any worse and a time for bottom fishing. They all crashed in 2020 then rallied some in 2021, but since then have basically gone sideways. Seems they just can't get off the ground.

I did not find any evidence of more crashes and it is probably just more media coverage because of all the airport chaos being reported. I did find that Canada might be among the worse for safety. Accidents declined in 2020 and 2021 because of far less air traffic. I did uncover all kinds of problems or challenges for the industry so still might be a bit early to buy, especially if we go into recession as I am predicting.

For Canada it would have been better off if Trudeau's plane broke here and he never got to the G20 meeting in India. Some would say a mid flight failure would be better still. India expert Vivek Dehejia, economics and philosophy professor at Carleton University who was in India for Mr. Trudeau’s 2018 visit, said the Sept. 9–10 trip “was a miniature repeat of the 2018 fiasco, when Trudeau went from one gaffe [to] another.”

“Trudeau is looking at India, not through that strategic lens, but through the lens of his domestic political constituencies—in particular, the large Canadian diaspora who have been reliable Trudeau Liberal voters,” he said.

Delhi’s statement scolds Trudeau for supporting the Sikh Khalistani separatist movement, which has a base in Canada. And there has been no good reason why Ottawa suspended trade talks with India. Trudeau also skipped the leaders’ dinner, which Mr. Dehejia described as “really bad form,” and pulled away from a ceremonial lengthy handshake. As usual it is very obvious, Trudeau cares about nothing except Trudeau. Too bad they sent another plane to bring him back, he should be left there.

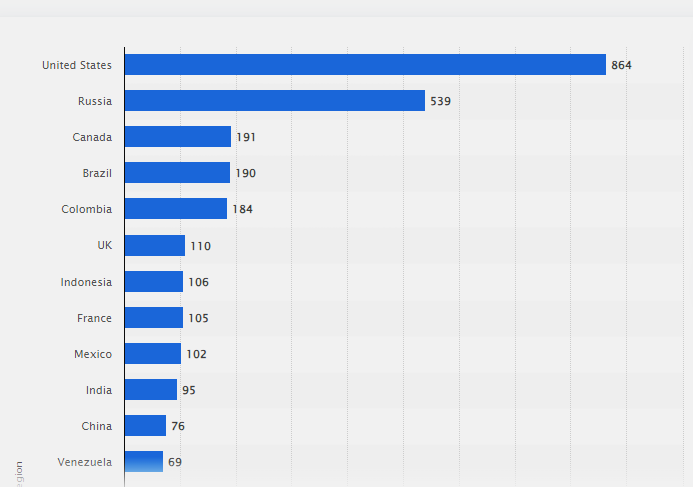

When I was researching airline crashes I first came across this chart from statista. What stood out to me is why such a small country like Canada has the 3rd highest fatal airline accidents. You can understand U.S. and Russia at the top because they are big countries with lots of flights. Generally the U.S. is considered 10 times the size of Canada.

In 2021 the U.S. carried 666,153,000 passengers, China 440,301,216, Russia 3rd with 96,851,770 and Canada was way down at 19th spot 24,951,000. Brazil was above Canada in 7th place and Colombia in 18th place. The US carried 27 times more passengers than Canada, but the US only had 4.5 times more fatal air accidents. The number of flights in Canada also dwarfs the US.

The U.S. accounted for close to 1/3 of world wide airline fights in 2022 with 21,908/day vs 72,591 world wide. The United States has the world's second-largest air travel market, with more than 369 million passengers being transported in 2020. Several factors explain the leading position of the U.S. market. First is the country's size in terms of geography, population, and economy. Combined with the lack of a high-speed passenger rail network, these three factors create a huge demand for domestic flights, with this often the only feasible option for long-distance trips. Second is the country's status as a hub for intercontinental travel.

Countries and regions with the highest number of fatal civil airliner accidents from 1945 through February 28, 2022

In 2020 Canadian airlines carried less than 1/3 the passengers compared to 2019 and total airline employment fell almost 1/3 at -32.7%. The accident rate has fallen from about 6 accidents per 100,000 hours flown in 2010 to 4 in 2019, a reduction of 33%, before rising again to 5.8 during 2020. Statscan does a poor job and very slow so we only have 2020 data, but it is worth noting that all the accidents in 2020 were Canadian registered planes, not one foreign registered plane was involved in an accident.

And it sounds like Statscan is getting worse. Wayne Smith, the head of Statistics Canada, just announced he is resigning, saying the independence of his agency is compromised by new information-technology arrangements. Smith says Shared Services Canada now holds an effective veto over many of the statistical agency’s operations. Yup, government wants to control all the data.

You would think that Canada being next door to the U.S. with similar safety standards would have a similar accident rate not a much higher one. During the period of the chart above, Brazil and Colombia would be considered more like 3rd world countries and that is where Canada fits in for aviation safety. I will leave it there, it just seems everything is broken in this country.

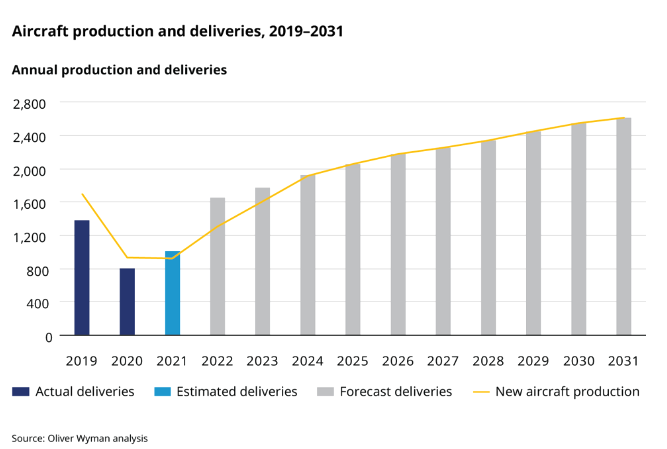

This next chart shows the drop in aircraft production with Covid and 2022 and now is just getting back to and above pre Covid levels. What many don't realize is that when the West slapped sanctions on Russia, they turned around and seized about 500 commercial aircraft that were in the country at the time. These still remain in Russia so adds to the plane shortage.

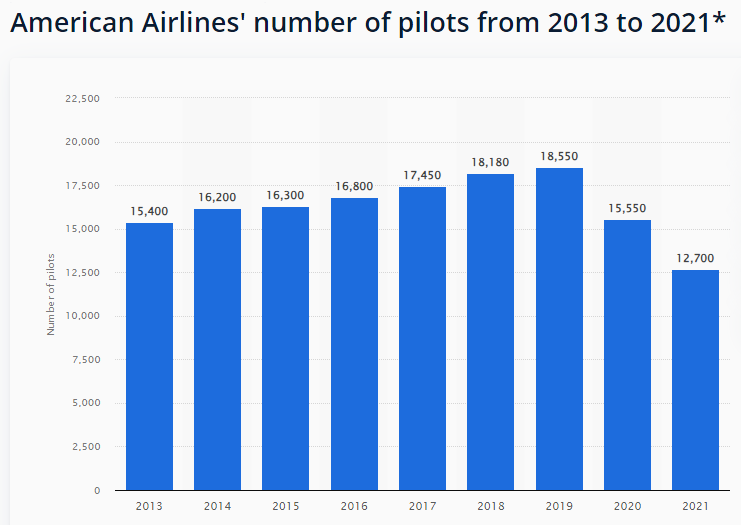

It is a similar problem with pilots. This chart is American Airlines but they are all the same and still have not recovered to pre Covid levels.

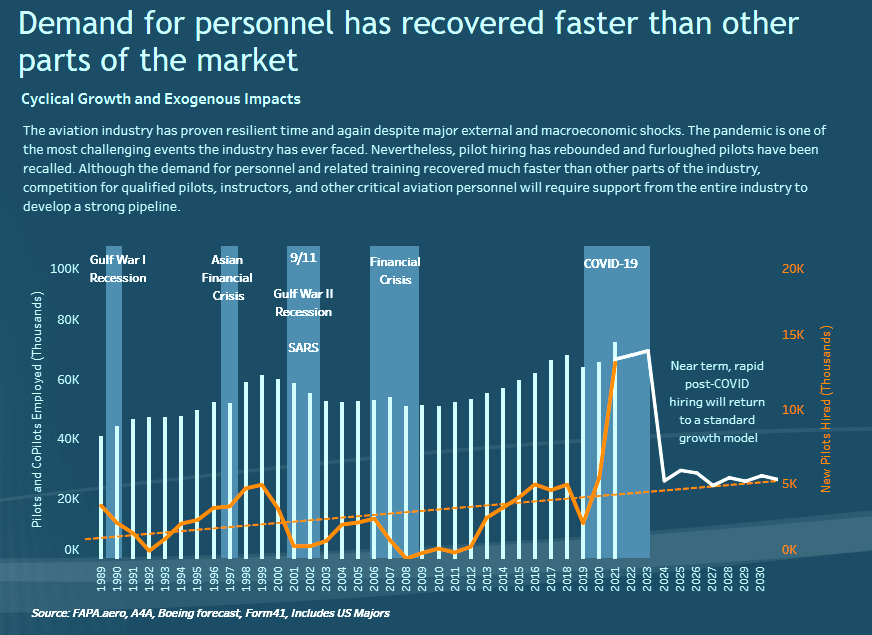

These next charts are from a Boeing forcast. Hiring for pilots and support personal has really ramped up and looks like they could get closer to normal in 2024.

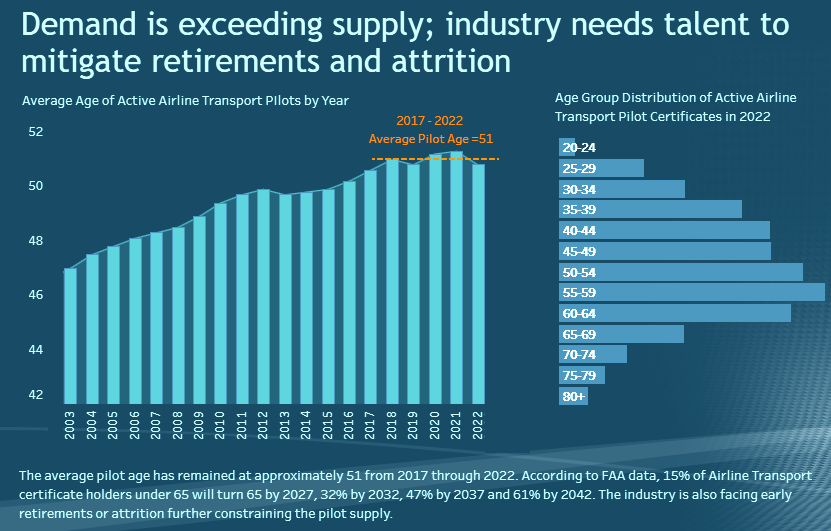

A bigger problem shown in the next chart is that the average age of pilots is 51 years so there will be a lot retiring. The biggest age group is 55 to 59 that are close to retirement and there is a lot over 60 years of age.

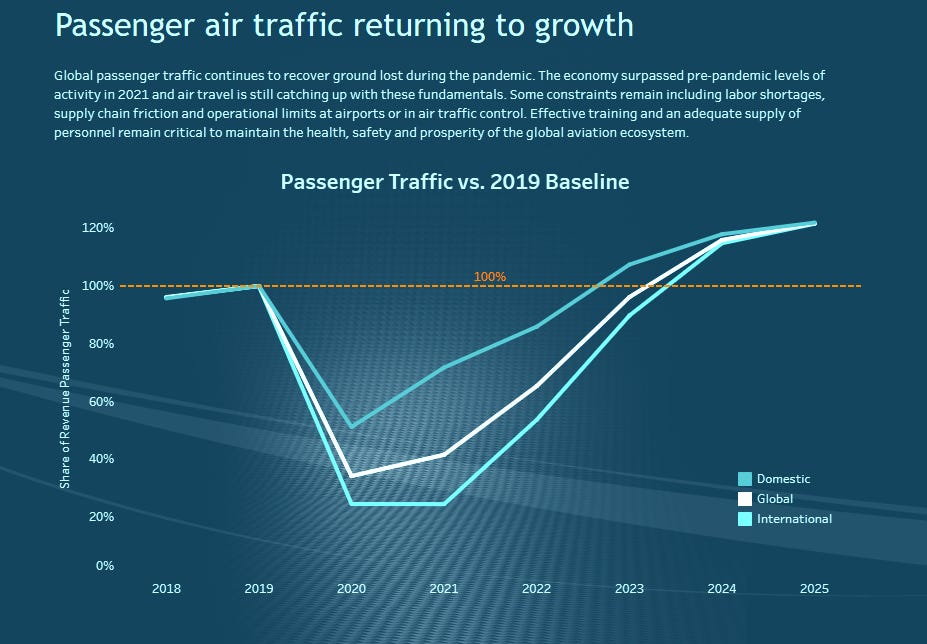

The big issue is that passenger volume has already recovered and are growing above 2019 levels, probably because of pent up demand. When you add together fewer planes, pilots, mechanics etc. with higher passenger demand, it is why you hear the horror stories and chaos at airports. This could take years to resolve, as a lot of these jobs take years of training.

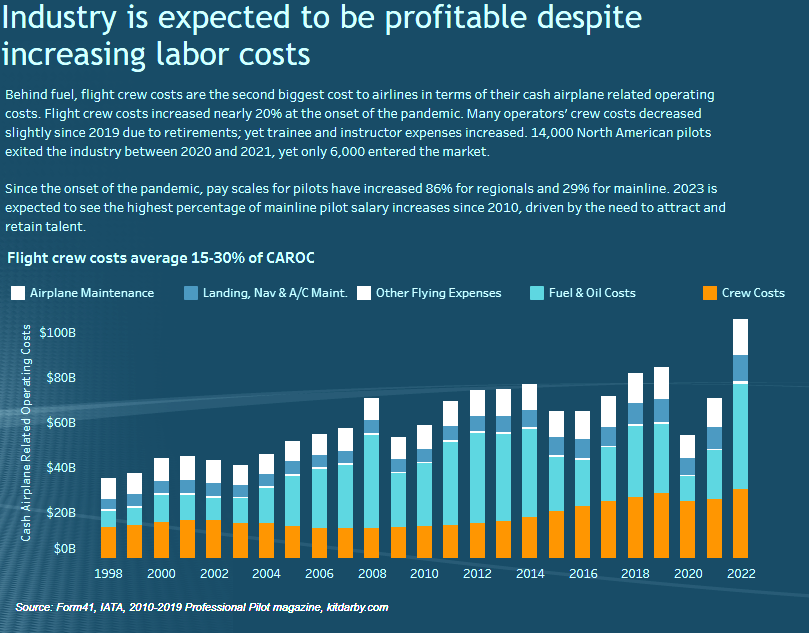

This next chart shows the effect of high fuel costs and crews, especially pilots. Since the pandemic, U.S. pay scales for regional pilots increased 86% and for mainline pilots 29%. This data also gives us some good numbers on the effect of Covid and the vaccine mandates. During 2020 and 2021, 14,000 North American pilots left, yet only 6,000 entered the industry, so a 8,000 pilot short fall. The airline industry received $54 billion in Covid relieve money under the U.S. Cares Act to protect payrolls so we can safely assume there were no layoffs. The 14,000 would be mostly retirement and vaccine mandate firings.

The U.S. airlines are pulling out of the red and starting to make some money but nothing to get excited about. They also have to pay back $14 billion of the $54 billion in Covid relief money they received. This will keep a lid on profits for a while.

I am using a chart of the airline etf 'JETS' to give a good snap shot of the stock performance. Easy to see the Covid plunge in 2020 and it looks like a dead cat bounce in 2021. The stocks than sank back down to lows in October 2022 with the high fuel costs. There was decent rally that peaked this past June. Most of the air line stocks are down to support levels and I am afraid they will fall through and test the 2022 lows. Fuel costs are rising again and the industry still faces a lot of challenges to meet the rise in passenger demand with not enough support staff and pilots.

And than there is Air Canada TSX:AC - - - - - Recent Price - $20.30

The number of Canadian pilots applying for certification to fly commercial aircraft in the United States nearly quadrupled to 147 last year from 39 in 2021, according to the U.S. government. There is and will continue to be big pay raises to keep pilots in Canada and that will cost the air lines.

The latest air accident in Canada was in Vancouver on September 3rd when two wing tips of two planes collided at the airport casing damage to both planes.

It is no surprise that Air Canada ranked last in on-time performance among the 10 largest airlines in North America. A Canadian Press dispatch to the Post says that Canada's biggest carrier landed 51 per cent of its flights on time last month, according to figures from aviation data firm Cirium. WestJet Airlines, which placed seventh, saw 62 per cent of its trips make it to the gate on time. During the busy summer holidays there has been many cancellations and delays of flights. Some weekends there was shortages of air traffic controllers. Maybe air traffic control is the cause of more accidents in Canada?

Financially, Air Canada has really improved and has had 3 profitable quarters. They have also paid down almost $1.9 billion in debt in the past year or so. They still have about $14 billion in long term debt. However, the performance of the stock has been far worse than the U.S. airlines. At around $20 it is not much above the lows in 2020 and has been stuck in a sideways trading pattern.

In conclusion, there are too many challenges for the industry to get fully off the ground and I expect airline stocks will linger with a downward bias for at least the next 6 to 12 months.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.