War, Bitcoin Hits Target, Economy sputtering, AZT, GLM, CEE

War Escalation

For the first time in history, an ICBM was used in war. Russia struck Ukraine with the missile but it was not armed with a nuclear war head, but a conventional one or possibly blank. These missiles are very costly and have low accuracy so it was not used in a war tactical manner but to send a message. Putin is warning NATO/The West about them authorizing and now use of long range missile strikes into Russia.

It is just insanity and total disregard for human life for a lame duck president on his way out and who is mentally incompetent to authorize this escalation of war with a nuclear power. The Biden-Harris administration is to blame too, but this cannot happen without the so called Commander in Chief signing off on it. The U.K. and Germany would not have gone ahead of this unless the U.S. did first.

I really wonder if this was done just to try and hurt Trump and leave him with bigger problems? I can see a pattern here as Trump's appointees see bad press from the far left and sexual assault accusations are dragged out on a number of them. It is looking like the Democrats are going to spend the next 4 years bashing and fighting Trump than what they really need to do is fix their party platform.

Just look at the two big Democratic States NY and California, they have been in total decay.

Even far left press is critical of NY. This is what the NY Times said this morning. “New York City faces an affordability crisis. Rents have soared. The century-old subway needs to be modernized, and buses are painfully slow. Piles of trash bags often line the sidewalks. The person tasked with fixing these problems, Mayor Eric Adams, faces a major corruption scandal.” Crime has also soared.

Epock Times reports today that over 700,000 people have moved out of California in just two years (2021-2023), driven away by skyrocketing costs, safety concerns, political challenges, and an eroding quality of life. Numerous businesses have left too.

Bitcoin Hits Target

My last couple updates on Bitcoin was that $100k was the magnet. Wee hours this morning, Bitcoin hit $99,500 and that is close enough.

The crypto market has grown from about $2.5T to a $3.5T capitalization since Trump's election win Trump has committed to a favorable crypto environment by eliminating laws that stifle the industry and create a Bitcoin Strategic Reserve. Influential Trump appointees Musk and RFK Junior are also very pro Bitcoin.

Another win for crypto bulls, SEC Chairman Gary Gensler just announced his coming resignation. And crypto backer and Cantor Fitzgerald CEO Howard Lutnick has been nominated as Commerce Secretary. Also reports suggest that Trump Media is in talks to buy crypto trading platform Bakkt (BKKT). I don't think there is much positive news left for Bitcoin and as I mentioned, my next trade would probably be short.

Since the election there has been 3 up waves and I am betting the 3rd wave is the final one hitting very close ($99,500) to my $100k target, I called the magnet. A significant correction is due and I see a retreat down to around $90k. I really don't like establishing a position on a Friday, but the peak thus far was before the Bitcoin ETFs started to trade and if Bitcoin bounces back above $90k today, I think it is alright to go short.

We just hit $98,900 and I am suggesting the 2 times short Proshares Bitcoin ETF 'SBIT'

Buy at $11.25 or lower

The gold rally continues, up another $30 today and 5 days in a row.

Economy Sputtering

On Tuesday Housing Starts and Building Permits were pretty flat and in line with expectations.

The Philadelphia Federal Reserve said Thursday its gauge of regional business activity stumbled to negative -5.5 in November from +10.3 in the prior month. Any reading below zero indicates deteriorating conditions. Economists polled by the Wall Street Journal expected an +8.2 reading.

Manufacturing has been soft for two years given higher interest rates and low demand. The national ISM factory index has been in contraction territory for 23 out of the past 24 months. The index slipped to 46.5% in October from 47.2% in the prior month. This is an area Trump intends to bring back with his America First policy and tariffs.

Existing-home sales rose in October to 3.4% an annual rate of 3.96 million in October, the National Association of Realtors said Thursday. The existing-home sales figure in October rose but was still under 4 million, a key threshold for the real-estate industry, indicating that home-sales activity remains at a lower level than before the pandemic.

The leading indicators of the U.S. economy has fallen almost every month since early 2022 and again for the eighth month in a row in October. The leading index dropped 0.3% last month, the Conference Board said Thursday, largely because of higher jobless claims, fewer building permits and a decline in manufacturing orders.

It is very unusual the index has been very weak, even though the economy has continued to expand. It is my suspicion that the economy is much weaker than what was reported in months leading up to the election. The masters of economic data were hard at work making rose coloured glasses.

Aztec Minerals - - TSX-V:AZT, OTCQB: AZZTF - - Recent Price - $0.20

Entry Price - $0.40 - - - - Opinion – buy, average down to $0.28

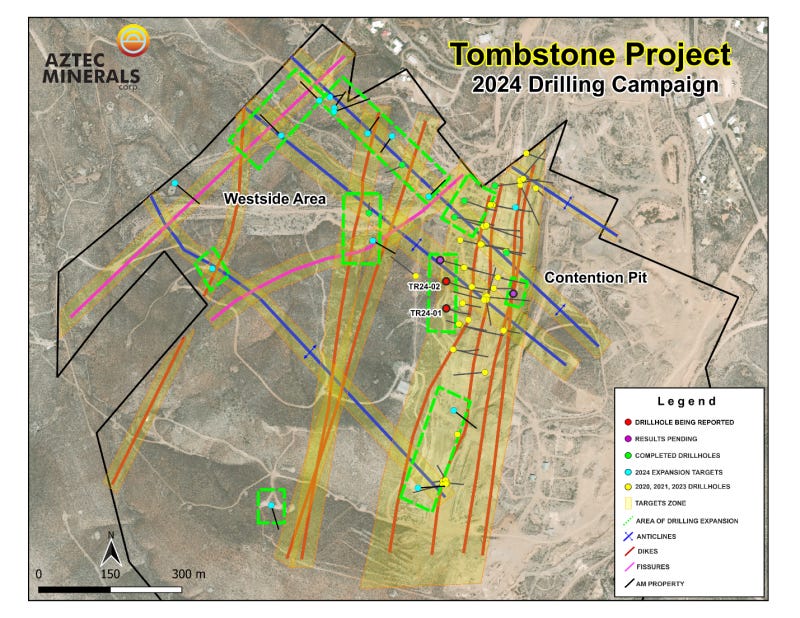

Yesterday Aztec announced that the ongoing 2024 drilling program at the Tombstone Property in Arizona has intersected broad gold-silver oxide mineralized zones in its first two step out RC drill holes in the Contention Open Pit target area. Results for hole

TR24-01 intersected 103.6 m at 0.75 gpt AuEq (0.59 gpt Au, and 12.48 gpt Ag); including 15.3 m at 3.11 gpt AuEq (2.84 gpt Au and 21.4 gpt Ag).

TR24-02 intersected 0.19 gpt Au and 8.34 gpt Ag (0.30 gpt AuEq) over 149.4m.

The 2024 RC drilling program has now completed 10 RC drill holes (see Figure 1 below), with results from the first 2 holes announced herein. Visual observations of the drilled sample materials and initial assay results continue to validate Aztec’s geological exploration model. As a result, the Tombstone Property JV Management Committee met last week and approved an expansion of the drill program from an initially planned 12-hole, 2,000-meter program, to 3,000 meters over 18-20 drill holes.

The main target of the current RC drill program is to test for shallow, bulk tonnage, heap leachable, mesothermal gold-silver oxide mineralization adjacent and below the previously mined Contention pit. The current drilling program will continue the testing of the Contention target zone and then complete Aztec’s first drilling in the Westside target zone which is comprised of several demonstrated mineralization focusing structures – anticlines, quartz stringer fissure lodes, and quartz feldspar porphyry dikes.

Aztec is proving up a nice discovery here, but the stock sold off with the correction in gold recently. This provides an excellent buying opportunity so I am suggesting to average down our entry price.

Golden Lake Exploration - - CSE:GLM OTC:GOLXF - - Recent Price - $0.045

Entry Price - $0.20 - - - Opinion – strong buy, average down to $0.12

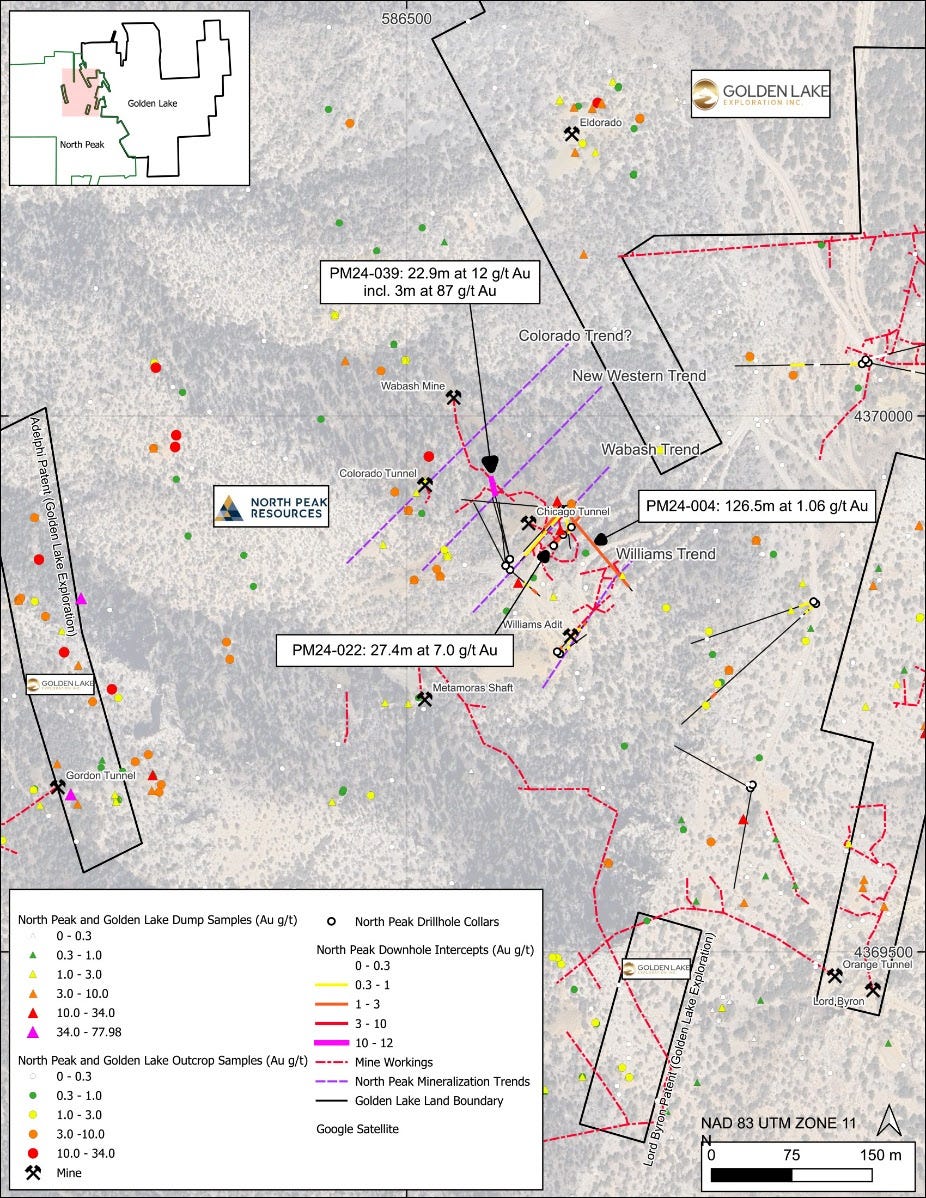

Yesterday GLM reported on the outstanding drill results obtained by North Peak Resources, on their neighboring Prospect Mountain property, occur within 150 meters from the Jewel Ridge border

During the summer and fall of 2024, North Peak completed a two-phase drilling program, centred on the historic Wabash mine area, situated very close to the common boundary of North Peak's Prospect Mountain property and Golden Lake's, Jewel Ridge property. Several drill holes completed in this locale, intersected economically significant gold grades over appreciable widths:

12.00 g/t Au over 22.90 metres, including 85.70 g/t Au over 3.00 metres (PM24-039)

1.06 g/t Au over 126.50 metres, including 4.20 g/t Au over 12.19 metres (PM24-004)

7.00 g/t Au over 27.40 metres, including 23.1 g/t Au over 6.10 metres (PM24-022)

All of the above drill holes yielding impressive results, are situated within 150 metres from Golden Lake's western property boundary (see Figure 1). More importantly, North Peak interprets such high-grade drill intercepts and several others in the Wabash mine area to collectively comprise a series of northeast-southwest mineralized trends, namely Colorado, New Western, Wabash & Williams (dashed purple lines on Figure 1).

Like Aztec, GLM corrected down from $0.065 when the gold price corrected. GLM had excellent drill results in the past during the depths of the bear market and now North Peak is drilling very close to their border and hitting good grades. More so the structures trend towards GLM's Jewel Ridge property.

GLM finished their drill program about a month ago so results could be out very soon. The stock is an excellent buy before these results come out. There is no speculation priced in the stock.

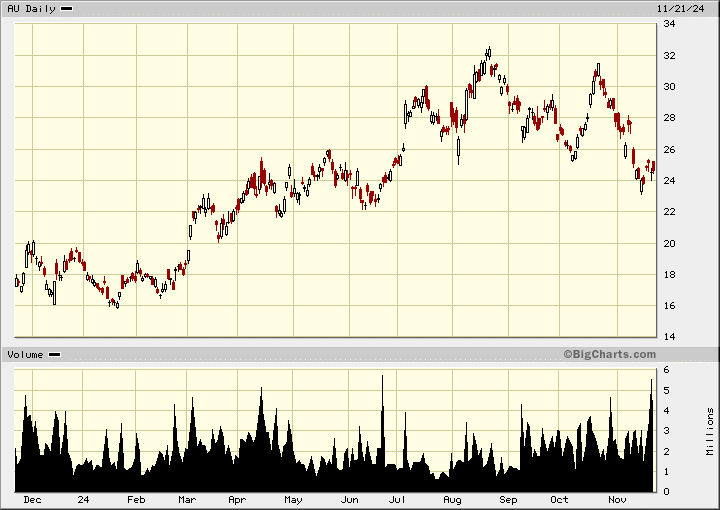

Centamin - - - - TSX:CEE now AngloGold Ashanti NY:AU

You will shortly receive for each Centamin Share - 0.06983 AngloGold Ashanti Shares and US$0.125 in cash.

Adjusting for our entry price on CEE of $1.72, the US$0.125 cash and the exchange we have an entry price of $15.90 on AngloGold.

AngloGold Ashanti NY:AU - - - - - Recent Price - $24.60

Entry Price - $15.90 - - - - - Opinion - hold

AngloGold came down with the gold correction and I will probably suggest to sell when it bounces back up. Centamin was in the Millennium Index because of it's high yield and AngloGold is yielding under 1% so it is really not a fit for the index. Nothing wrong with the company as it offers good value like most gold stocks at this time.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.