Weak Jobs #s, Greenbriar, Coca-Cola, Kimberly Clark, Ivanhoe, sell Bitcoin

Mid Day Market Report

Not much on the economic front this week, until tomorrow. Monday it was reported the U.S. leading indicators index fell again in July. The leading index for the economy fell 0.6% in July, the fifth straight monthly decline. Economists polled by the Wall Street Journal had forecast a 0.4% decline.

Tomorrow we get Jobless claims, PMI and existing home sales. Most eyes are on the Fed meeting this week in Jackson Hole.

I have been critical of the US job numbers and expect the headline number has been inflated more so in an election year. Each month they revise the previous month lower and today we get the yearly revision. Surprise surprise surprise as Gomer Pyle would say!

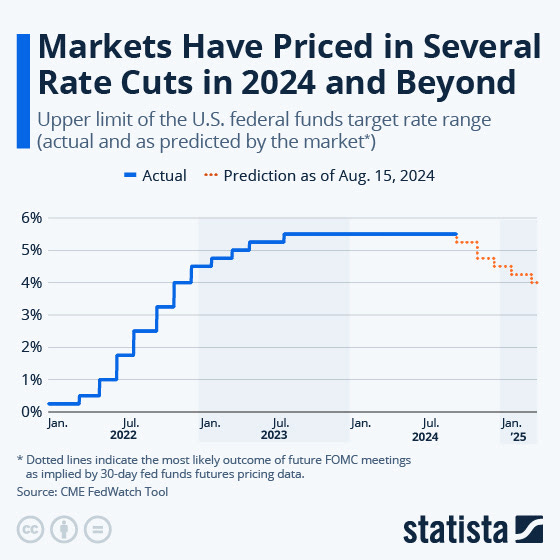

U.S. added 818,000 Fewer Jobs than previously thought from March 2023 To March 2024, Government said today. That would translate into about 70K fewer jobs per month. I would bet next years revision is higher considering all the padding ahead of the election. Markets are pricing in aggressive interest rate cuts, but the market always seems to hopeful here.

Greenbriar Sustainable Living - - TSXV:GRB - - OTC:GEBRF -C$0.45

Entry Price $0.77 - - - - - - - - Opinion – buy

I have learned there is a large seller in the market wanting to sell a large block. There is a buyer for these shares as well, but the terms on the price is up in the air. Until we see a large block trade, the stock will remain weak and I would just try buying with bids. Don't chase the stock.

There can be all kinds of reasons somebody has to sell, like poor health, buying a new home, a divorce, financial problems and many more. It is sort of ironic though because this weakness in price comes at a time the company prospects were never better. Think of this low stock price as a gift.

For Sage Ranch, the city is rewriting the water report. Once the new water report is finished it will go to the city for re-approval and signature by the city, Voya will advance the USD $40 million construction loan and Greenbriar will start building.

It is not going to take a long time to do the report again, but it is government so they will use up some time. Meanwhile I would just try bids for the stock at the current bid price or lower. Once I see a cross go through that takes out the seller, I will send an alert. I have no idea how long this will be, but I would say a matter of days or weeks.

Coca-Cola Co (KO) $69.56 – new all time highs

Coca-Cola stands as a quintessential leader in the global beverage market, boasting an unmatched portfolio of iconic brands. Its recent financial performance underscores its robust growth trajectory, driven by a combination of strategic innovations and expanding market reach. The company's commitment to sustainability and health-conscious product offerings aligns with evolving consumer preferences, positioning it well for future success. Moreover, Coca-Cola's extensive distribution network and strong brand equity offer a significant competitive edge. As it continues to leverage these strengths while exploring new markets and beverages, KO is well-poised for continued robust performance and long-term shareholder value.

The stock is a long time favourite of Warren Buffet and currently pays a quarterly dividend of $0.485 per share.

Kimberly-Clark Corporation (KMB) $144.60 - 52 week high

Kimberly-Clark demonstrates a compelling investment case with its solid fundamentals and resilient market position in the consumer goods sector. Known for its trusted brands like Huggies and Kleenex, Kimberly-Clark benefits from a steady demand for essential products, driving consistent revenue and profit growth. The company's focus on cost efficiency and innovation in product development supports its competitive stance. Additionally, Kimberly-Clark’s strategic investments in emerging markets and e-commerce platforms enhance its growth potential. With a strong dividend yield and a track record of financial stability, KMB presents an attractive opportunity for investors seeking both income and capital appreciation.

Based on its first half results, the company has updated its 2024 outlook. Adjusted Operating Profit and Earnings/Share ares now expected to grow at a mid-to-high teens percentage rate. The stock has a current dividend yield of 3.4%.

Ivanhoe Mines (TSX: IVN) C$18.30, just below May's all time high of $21.30

Ivanhoe Mines represents a dynamic opportunity in the mining sector with its promising portfolio of high-quality projects. The company’s flagship projects, including the Kamoa-Kakula copper mine, underscore its significant growth potential. Recent advancements in resource development and exploration underscore Ivanhoe's commitment to driving value and scaling operations. As global demand for copper and other key metals surges, Ivanhoe is well-positioned to capitalize on this trend, offering substantial upside potential. Its strategic partnerships and operational efficiency further enhance its investment appeal, making Ivanhoe Mines a compelling choice for those seeking exposure to the thriving mining industry.

Kamoa-Kakula copper mine, the world’s third-largest, has reached commercial production in the Democratic Republic of Congo (DRC), the company said this past Monday.

“Kamoa-Kakula’s operations team continues to achieve a very rare feat in our industry, delivering world-scale copper development projects ahead of schedule, while also advancing smoothly through to commercial production at an impressive rate,” Robert Friedland, Ivanhoe’s executive co-chair, said in a release.

He added that the mine’s record-setting production in July of 35,941 tonnes marked the rapid copper growth in the second half of the year, with the stage three concentrator ready to raise Kamoa-Kakula’s annual capacity from about 450,000 tonnes to more than 600,000 tonnes.

Sell Bitcoin, the IBIT etf at $34

Bitcoin has been quite volatile bouncing roughly between $56k and $61K since we went long August 6th with etf IBIT at $31.90. With markets all recovering, I thought Bitcoin could go much higher, but I am afraid it is capped at $62k and lower. Currently it is around $60K and I have decided to sell IBIT at current prices around $34. I will watch for another good entry point on the long or short side. This makes our 5th trade with Bitcoin ETFs, 4 winners, 1 loser so far. Below here is a one month chart.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.