Dear investor, many precious metal stocks that are known or perhaps remembered as silver stocks, actually can have a substantial amount or around half of their production from gold and many have been ignored in the gold bull market. One of the reasons I picked Pan American Silver and Coeur Mining and both are lagging our gold picks in performance. However, they are still up 73% and 27% respectively. Pan American has performed among the best with the silver stocks.

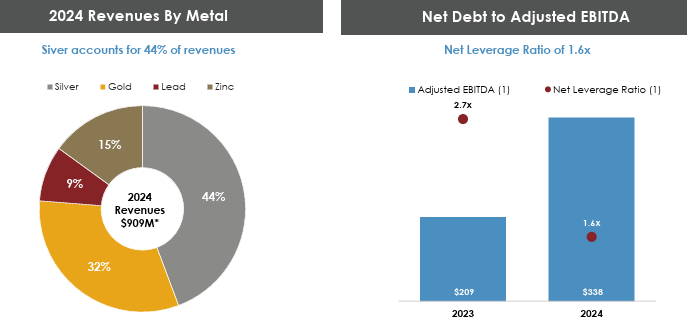

To make my case, let's have a closer examination of my recent pick, Hecla Mining. As you can see in their presentation, 32% of revenue in 2024 was from gold. In 2024 Hecla sold 132,442 ounces of gold at an AISC of $1,990 and their realized price in 2024 was $2,403 per ounce. Their realized silver price in 2024 was $28.58 per ounce.

In 2025 Hecla could easily realize $3,100 per ounce gold sold and probably higher. That is a 29% increase and all that will go to the bottom line. Costs per ounce are expected to be around the same in 2025 as 2024. Cash flow from operations for the year 2024 was $186.5 million and increased 19% over the prior year due to higher revenues. At $3,100 gold, I calculate it could add an additional $75 million in cash flow from just the increase in the gold price. We can also count on higher cash flow from silver sales over their $28.58.ounce realized price in 2024.

Hecla stock ended 2024 on a down slope around $5.20 and at current prices around $6.00, the stock is not reflecting much if any higher cash flows from rising gold and silver prices. A move to $7.60 will just get the stock back to the 2024 high. Looking at a 4 year chart, the stock just seems to be confused and undecided. As I pointed out on the chart in my original article on Hecla, there is a triple bottom and a break above the down trend channel since 2024.There is quite a pick up in volume as investors are starting to take notice of Hecla. The next major move is up.

What is Wrong? The Risks

Basically all the risks and impediments to growth reside with their Canadian operations, all because of slow permitting. Permitting has slowed to expand Keno Hills in the Yukon from 440 tpd to 600 tpd. Since Victoria Gold's heap leach pad incident, the First Nation of Na-Cho Nyak Dun have concerns. Keno Hill is in their territory so this has slowed the permitting process to increase to 600 tpd. In Quebec the permit timing of the Principal and West Mine Crown Pillar expansion pits at their Casa Berardi mine is unknown. None of these issues affect current production and cash flows and higher projections for 2025, but they are slowing substantial improvements at both mines.

We hear nice talk from the new Canadian government about speeding up permitting, but above is reality. This news just out from Taseko is bad timing and contradicts government narrative.

10 to over 15 years to develop a mine in Canada, how about 30 years and nothing

The largest copper and gold deposit in Canada has been freed from three decades of conflict.

The province confirmed in a Wednesday, (June 18) release that it will be working with the Tsilhqot'in National Government (TNG) to determine the process for any further mining activity at Teztan Biny (Fish Lake), as part of a deal to end an enduring dispute. In their own release, Taseko said the province has paid the company $75 million as part of the deal. This would only be a fraction of the amount invested to prove the deposit. I wonder if it even covers Taseko's decades of legal costs?

The agreement between the TNG, the B.C. government and Taseko Mines (TSX:TKO) essentially prevents Taseko from doing anything other than selling its holdings in the area if a project were to be ready to go ahead, while ensuring any future mining-related activity will only occur with the consent of the Tŝilhqot’in Nation.

“We fought for decades to protect the Teẑtan Biny area from mining proposals that threatened our Tŝilhqot’in values and way of life," said Otis Guichon, Tribal Chief of the Tŝilhqot’in National Government."(This deal) is something that we can all be proud of."

It also includes a 22.5 per cent equity interest in the New Prosperity mineral tenures, put into a trust for the future benefit of the Tsilhqot'in Nation. Taseko maintains a majority interest with 77.5 per cent which the company can sell at any time. And who is going to buy something that can't be built?

So a No in Canada, just go to the U.S.

As the prospect of building its New Prosperity copper mine in B.C. has all but evaporated, the company has turned its focus to Arizona. Taseko plans to spend US$230 million to develop the Florence copper project in Arizona. That’s on top of the US$80 million already spent bringing the project through the permitting process.

“We think we’re going to get permitted and start construction next year,” Taseko CEO Stuart McDonald said in an earnings call in November.

I followed Taseko a decade or more back, because Prosperity was no ordinary discovery. It was the largest in Canada and 7th largest copper deposit in the wold. The deposit contains 5.3 billion pounds of copper and 13.3 million ounces of gold. If you want to learn anymore detail, there is a great video from 9 years ago on prosperity.

.

For all the new talk from the Carney government about speeding up mine development, this news is very bad timing and so is this.

Nothing has changed, the Liberal government just talks a nice story.

BC Ferries set off a tidal wave of controversy last Tuesday after announcing a major shipbuilding deal with a Chinese state-owned enterprise (Merchants Industry Weihai Shipyards). Vancouver Island Conservative MP Jeff Kibble raised the issue in Wednesday’s question period, accusing the Liberal government of rewarding the provincial carrier for selling out Canada’s national interest.

The Liberals are set to hand over $30 million (in federal subsidies) to BC Ferries while BC Ferries hands over critical jobs, investment and industry to China,” said Kibble.

More Economic Woes

Friday in the U.S., Philadalphia Fed Manufacturing activity in the region remained weak. The survey’s indicator for current general activity remained slightly negative -4.0, unchanged from May. The firms reported overall decreases in employment, and the employment index fell from 16.5 to -9.8 this month, its lowest reading since May 2020.

The Conference Board Leading Economic Index® (LEI) for the US ticked down by 0.1% in May 2025 to 99.0 (2016=100), after declining by 1.4% in April (revised downward from –1.0% originally reported). The LEI has fallen by 2.7% in the six-month period ending May 2025, a much faster rate of decline than the 1.4% contraction over the previous six months.

Markets are over valued, the economy is sliding so high cash levels are warranted.

And in Canada

In April, manufacturing sales dropped 2.8 per cent and wholesale sales fell 2.3 per cent from March, according to Statistics Canada, significantly worse than analysts' expectations of a 2-per-cent and 0.9-per-cent decline. Statscan said. Rosenberg Research & Associates founder David Rosenberg says, "The implications for April and second quarter GDP are squarely negative and recession risks are alive and well."

The average household in Canada budgets one-third less on groceries per week than a similar household in the United States, a new survey suggests. A typical weekly food budget in Canada is CA$179, while in the United States, it is US$203, which is equivalent to roughly CA$277, the study conducted by Leger found. The survey included 1,626 respondents from Canada and 1,014 from the United States.

The 35 percent budget disparity suggests that Canadians are responding more stringently to escalating food prices, the survey report said. I disagree, I think the reality is that Canadians can only afford less.

The Liberal government believes government policy and solutions are the only way. We need huge tax cuts in Canada, and as I criticized at election time, the proposed Liberal cut was far too small. Now it is way smaller than the election hype.

The federal government’s legislation reducing the lowest personal income tax rate to 14% will save the average taxpayer $190 annually from 2026 to 2028, according to the Parliamentary Budget Office (PBO). The Liberal government recently introduced legislation providing an income tax cut for Canadians, saying it would save a two-income family up to $840 a year starting next year.

The PBO expects the average Canadian taxpayer will save $90 in 2025, $190 in the three years following, and $200 in 2029. Savings are lower in 2025 because the government will first lower the tax rate to 14.5 percent in 2025, before dropping it to 14 percent the year after

Prime Minister Mark Carney announced $4.3 billion in new support for Ukraine and additional sanctions against Russia ahead of a meeting with Ukrainian President Zelenskyy on the second day of the G7 leaders’ summit. The new support includes $2 billion in military assistance, and will provide resources such as drones, helicopters, and ammunition. That funding will count toward Canada’s NATO defence spending target, according to the Prime Minister’s Office (PMO). Clever accounting is how spending on another countries defence adds to your countries defence to meet the NATO 2% target. The other trick Carney is doing, raising salaries for the military to increase spending towards the 2% target. Over half of Canada's military equipment is out of service. This is where spending is really needed, to repair or best to replace the antiquated stuff.

Trump's Dumb Move

I will just break through all the propaganda and hype. The U.S. striking Iran was more just politics and shows Trump's eagle is bigger than his brain. Two of the nuclear sites they bombed were vacated and already destroyed by Israel. The 3rd, Fordow is buried deep in a mountain, designed to and hardened against bunker busting bombs. At best the U.S. damaged or destroyed 2 out of 5 entrances/exits and did not destroy any of Ukraine's enriched uranium. Militarily, this was a huge failure and all it did was escalate the war and put U.S. assets at risk. Market reaction was zero!

I will have more detail on possible escalations that could effect markets like oil, but I think Iran is going to take a slower measured response. The Iran government voted to close the Strait of Hormuz, but that would shut down some of their oil exports too. Perhaps they will hassle and attack foreign ships of choice to cause an effective blockage of oil. About 30% of the world's sea bound oil moves through this strait. The markets not very effective any more at pricing in the future. Oil had a short term bounce up and is now down some, so no real reaction or added risk to the price.

Gold was down, but now up +$17 as of this writing. More important, gold stocks close to breaking new highs with the HUI gold bugs index close to a break out above 435.

Big Brother will be Watching More, Than Controlling More

A Bank of Canada report released later in November 2023 found that 85 percent of 89,423 Canadians surveyed said they would not use a digital Canadian dollar, while 12 percent said they would “potentially” use it, and 3 percent said they did not know. Additionally, 82 percent said the Bank should not even be researching CBDC.

According to the Atlantic Council’s CBDC tracker, 134 countries and currency unions, which represent 98 percent of global GDP, are currently exploring a CBDC. Every G20 country is exploring a CBDC, while the countries of Jamaica, Nigeria, and the Bahamas have fully launched a CBDC.

The "EU Digital Identity Wallet" is set to roll out next year, which will offer the ability for citizens to prove who they are online without giving over their information to external websites. Privacy concerns? It may only be a matter of time before the "EU Digital Identity Wallet" is required by the government or is demanded by the private sector as a strong form of identification. Untold amounts of personal information, transactions, and other data - all stored under one framework - could become a hacker's paradise despite selective disclosure capabilities. There are also worries about mass surveillance and the potential for rating systems or scores, though others say that ship has sailed a long time ago for any modern digital economy.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.