Welcome to all the new smart, savvy and contrarian investors who have joined my substack. I am very small here so please share and subscribe, would be much appreciated.

Last week, 48.8 tonnes of gold flowed into North American-based gold-backed funds. The last time we saw weekly flows at that level was April 2020 with panic of Covid and government lock downs.

I have been commenting for the past year that North American investors have had little participation in this gold market so far. I speculated that we needed higher prices to wake them up, weakness in equities and crypto would also be catalysts. We got all three in the past week.

Another factor is gold has been in the news more as Trump and Elon Musk's DOGE want to confirm the gold is actually in Fort Knox. Trump plans to visit Fort Knox and said “We’re going to take a look and if there’s 27 tons of gold, we’ll be very happy,” Trump told the audience. “I don’t know how the [expletive] we’re going to measure it, but that’s okay. We want to see lots of nice, beautiful, shiny gold in Fort Knox.”

I don't know where he got that 27 ton number or if it is a miss quote and no doubt that small amount will be there. However, Fort Knox is suppose to hold 4,603 tons. While a visit is great, there has to be a complete audit, because the Fed stores the countries gold in 3 main locations.

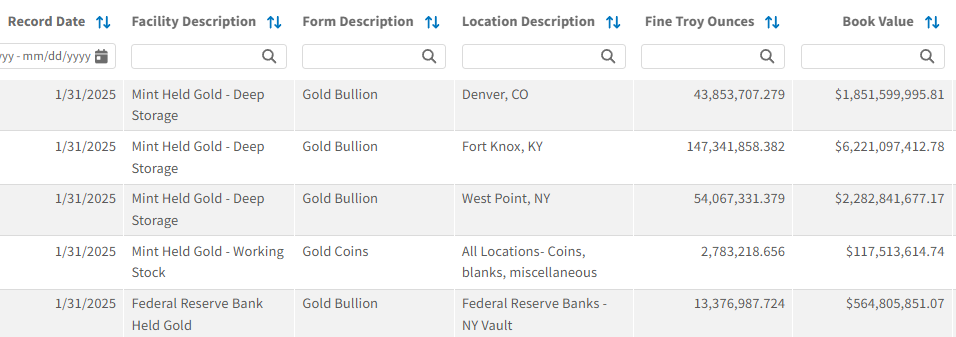

I took a screen shot of the U.S. Treasury report on gold reserves. You can see that Fort Knox has the largest amount at the 4,603 tons if you convert ounces to tons, but there is also large holdings in NY and Denver. They need to be audited as well. All the gold may or may not be there but who has the ownership is what is important. I expect a lot of the gold has been lent or leased out.

What is more interesting is there has been talk of the U.S. revaluing their gold reserves that currently are on the books at $42 per ounce. If say the gold was valued around current prices it would be almost $800 billion from around $11 billion. That could be injected on the government balance sheet and reduce the deficit. Heck why not value it at $5,000 or $10,000 and gain a bigger benefit. I believe the main reason they have kept it at $42 is to support a narrative that gold is not worth much and the U.S. dollar is the be all end all. An audit would be a must to revalue.

In 1974, the US Mint opened the Fort Knox vaults to a group of journalists and a congressional delegation so they could see the gold reserves. Since then, the Fort Knox vaults have been opened one other time. In 2017, Treasury Secretary Steve Mnuchin visited with Kentucky Gov. Matt Bevin and congressional representatives.

It would be a shock for markets if all the physical gold is not accounted for. It would probably result in a higher valuation for gold over a weekend. That's when Central Banks drop shock bombs or fix it bombs. That may also be a reason why physical gold has been pouring into the NY Comex.

Since Trump’s election in November, 393 metric tonnes of gold have been moved into the Comex vaults in New York, pushing its inventory up by 75 per cent, says the Financial Times.

Federal Reserve/Treasury reports Gold stock around 261 million ounces

A lot of the gold coming into Comex is being sucked out by Central Banks for physical delivery and by the bullion banks as well. It is all part of the scramble for physical metal.

For many years, gold bugs and gold investors have been waiting for the day when physical gold starts to set the gold price over the Comex futures market. Well, guess what, that day has arrived.

Gold's Deja vu

During WWII gold was moving out of Europe and Britain to prevent German confiscation and pay for the war effort. By 1947, the United States had accumulated 70% of the world’s gold reserves at 8,134 metric tons that they report to this day . The United Kingdom had gone from being the world’s greatest creditor to the world’s greatest debtor. Countries had sold off most of their gold and dollar reserves, as well as their foreign investments, to pay for the war. What few reserves remained were then quickly running out. Trade deficits meant there was little hope of replenishing them.

Like WWII for the last few years gold has been flowing from the West to the East driven by a lack of confidence in fiat currencies with ludicrous deficit spending, gold becoming a tier 1 asset under Basel III in 2022 and the Biden administration weaponizing the dollar against Russia. Demand for gold by central banks and investors in the East has primarily driven the gold bull market.

Up until recently, investors in the West - particularly in the U.S. - have largely remained on the sidelines. So far and 1 week is not a trend, we see some movement into Gold etfs and this is probably large investment funds and Western Bullion Banks.

I have been commenting that a revival in Western bullishness would spark the next leg of the bull rally and drive gold well over $3,000 and towards $4,000 per ounce and higher. Earlier in February Bank of America, put out a buy and for gold to hit $3500. To achieve this target they said investment demand would have to rise about 10%. That is very little. In 2024, the World Gold Council reported Investment demand grew 25% in 2024, the strongest rate since 2020. Annual investment demand totaled 1,180 tonnes with a value of US$90 billion. A 10% increase would be a measly $9 billion

Most North America Investors Still not Buying Gold Stocks

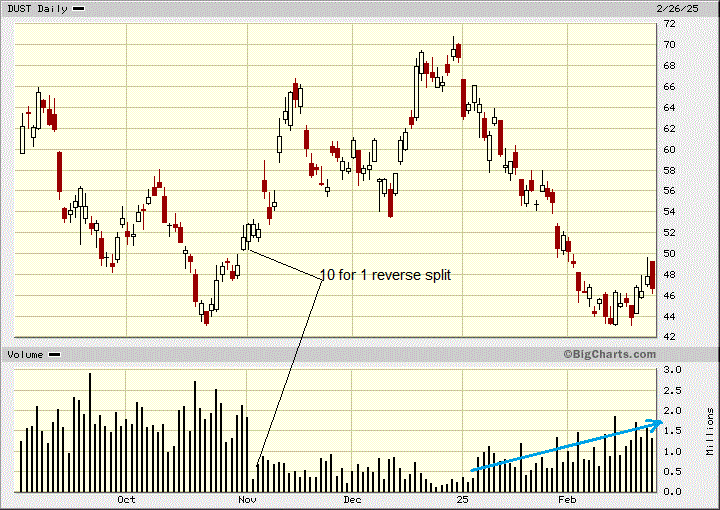

Not only are investors not buying, they are still shorting. I have highlighted the DUST etf that is 2 times short the gold stocks. They started shorting last May with heavy volumes in the DUST etf around 10 to 20 million shares daily. The DUST chart below shows a little reprieve but that is only because the etf did a 10 for 1 reverse split effective November 1, 2024, so the share price changed that day from about $4 to $40 so naturally volume drops because of the way higher share price. Now the volume is back to 1 to 2 million equivalent to last years 10 to 20 million.

If we look at the 2 times bullish NUGT etf below, we can see investors are still not coming in.

These 2 charts I put together game from a recent Royal Bank report. On the left highlights the GDX (senior gold stocks) and GDXJ (junior producers) that have shown outflows since 2020 and even in the first almost 2 months of 2025.

I am also showing their chart of four senior gold producers. The dark blue is Kinross +118% and light blue is Agnico Eagle. The other two, Newmont and Barrick are about the same. I highlight that our pick of Kinross was picking the right horse. At the time I said that Kinross has the highest leverage to rising gold prices and it looks like the market has agreed.

Newmont is on our Millennium Index. Barrick and Newmont are the go to stocks for large institutional buyers and the fact they have not moved much is just another indicator that North American investors have been ignoring gold and gold stocks.

Once investors realize the major equity markets are no longer working, investors will turn to what is working which will be commodities, the mining companies, and especially gold and silver. The juniors and silver will also have a big move when retail investors come in. I see 2025 as being a year of big market changes. The precious metal stocks on our list could easily see 100% to 300% gains this year when North American investors join the party.

The recent pull back or consolidation in gold prices is healthy market action. You can't go straight up, but we will see $200 plus days with gold prices.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.