Why FRU’s 9% Dividend Could Power Your Income for Years

Freehold Royalties: A 9% Dividend Stream Backed by Rock-Solid Royalties

“Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.” - John D. Rockefeller

Here is an awesome stock for the Millennium Index. It's 9.3% yield suggests some fear of a dividend cut, but it is safe for now. Worst case, with a cut the yield would still be 6% -7%.

Good morning!

In a world where commodity price swings keep many investors awake at night, Freehold Royalties Ltd (TSE: FRU) stands apart as one of the most reliable income-generating companies in the North American energy sector. With a unique royalty-focused business model, a geographically diversified asset base, and a management team laser-focused on shareholder returns, Freehold has carved out a niche that delivers consistent dividends (29 consecutive years paid – Investing.com), even in turbulent energy markets.

Share Price: $11.45 - - Exchange: TSE - - Shares Outstanding: 164M

52W Range: $10.53 - $14.62 - - Revenue: $309.5M - - Net Income: $149.4M

Freehold currently offers an annual dividend yield of approximately 9.3%, based on its share price of CAD $11.45. The company pays a monthly dividend of CAD $0.09 per share, totaling CAD $1.08 annually.

Freehold’s dividend payout ratio (distributions as a percentage of funds from operations) typically ranges between 60–70%, which leaves ample buffer to continue payments during periods of weaker commodity prices – their track record shows this. The dividend payout ratio in Q4 2024 was 66%.

You can see from their dividend payment history that the dividend does get cut at times – 2009's GFC, 2016's Oil Price Collapse and the pandemic lock-downs of the early 2020s. This simply means PlayStocks will continue to monitor FRU to ensure investors get the maximum value for their investment dollars - make hay while the sun shines.

While there is currently a recession risk in many major economies, we believe there will be a floor price for oil in the $50-$60 dollar range during a recession and this is due to increased military spending – demand. Especially with a land war in Europe – more on this later.

In 2024, Freehold reported royalty and other revenue of $309.5 million, a slight decrease from the previous year due to lower commodity prices. Despite this, the company achieved funds from operations (FFO) of $231.0 million ($1.53 per share), reflecting its resilient business model . Net income rose to $149.4 million, a 13% increase from 2023, with profit margins improving to 48% from 42%.

To support its growth initiatives, Freehold amended its credit facilities in Q4 2024, increasing borrowing capacity to $450 million and extending the term to November 2027. As of year-end, $301 million was drawn, resulting in net debt of $282.3 million. The net debt to trailing FFO ratio stood at a manageable 1.2x, reflecting the company's disciplined approach to leverage.

Freehold executed $411.7 million in acquisitions during 2024, expanding its presence in the U.S. Permian Basin and enhancing its Canadian portfolio. These acquisitions contributed to a 10% year-over-year increase in proved and probable reserves per share . The company's diversified asset base across North America positions it well for future growth.

You can see in the WTI chart above there is strong long term support in the $45-55 range with strong resistance now sitting in the $60-$70 range.

On this chart for FRU seen above, we can see the stock has been in a recent multi year down trend and it's currently near the bottom of its channel marked in gray. The long term support channel is roughly between $10.00 (marked in blue) and its current price of $11.44. Two noticeable drops in the past decade come from the collapse in oil prices 2014-2015 and the lock-downs.

As you can see, volume has been seen to be somewhat strong on its down days, and a little bit below average during its small climbs however the strong volume seen in the $10.55 - $11.25 range suggests consolidation at that level. If volume is your only indicator – I'd say it points to lower before higher. RSI reads neutral. MACD is close to a bearish crossover as well. Current technicals suggest further downside pressure in the short term, offering long-term investors a chance to accumulate shares near key support levels.

The above chart more clearly shows the 10/25 Moving Averages which shows the lines converging but no convincing sign of a cross over yet. My other basic MA setups, 25/100 and 50/200 are not good with the 25/100 showing the current down trend still has strength while the 50/200 set up a Death Cross in early to mid December 2024. The last 3 candlesticks suggest a bearish continuation with the final candlestick being the weak part of this signal. None of this is good, but points to getting a potentially good company at an even better price. Long term strong resistance sits around $10.38 and with strong near term support in the $10.80 - $11.20 range, Bears and Bargain Hunters will aim for the $10.90 - $11.15 range. Bulls will buy now – 9% yield is great, averaging down at better prices. We must note the dividend cut off is at the end of May so absolute bargain hunters seeking an even higher yield will probably want to wait and see if this stock goes a bit lower than its current price, closely following WTI oil prices aiming to stay above $50.

We feel this stock can easily perform better, especially if Freehold can weather current prices while maintaining the current dividend and strengthening their assets which is exactly what they seem poised to do. Even still, their history shows over time this is a dividend stock worth holding. If oil prices strengthen back to the $75 - $80 range you can easily expect the stock to be price between $15.50 and $17. And if oil stays above $50, a 9% yield will mean not a cheap stock forever.

Dividend Sustainability: How Low Can Oil & Gas Go?

With approximately 97% of revenue derived from royalties (rather than capital-intensive oil production), Freehold avoids costly operational expenses and instead collects a percentage of revenues from third-party operators. This model ensures stable cash flow with minimal capital risk.

A press release from March 2025 suggests management believes the current dividend is secure all the way down to $50/bbl WTI. Our own analysis suggests a high dividend yield may be sustainable down to $45 WTI.

We believe oil is unlikely to trade below the $45-$50 range, even in a recession. Here's why;

Military Mobilization Is Quietly Putting a Floor Under Oil Prices

Most investors focus on civilian demand when assessing oil prices. But few are paying attention to how global military buildups are quietly creating a backstop under oil demand — even if a recession hits.

Consider these facts:

Both diesel and bunker fuel — essential for military logistics — are refined directly from crude oil. There are no easy substitutes.

The Ukraine war has shown how heavily artillery is still used, artillery doesn't magically appear on the battlefield – it is driven there, towed there or airlifted there.

With tensions escalating in Ukraine, NATO increasing deployments, China rapidly expanding its navy, and multiple countries likely building up strategic fuel reserves quietly, we believe military demand will set a hard floor under oil prices — even in recessionary environments.

Our internal analysis suggests a $45–$50 WTI floor is likely, which aligns with Freehold Royalties’ (FRU) stated dividend sustainment levels. FRU’s royalty structure means it benefits from production volumes, not just high prices — positioning it well in this emerging environment.

FRU Asset Base: Diversified Royalty Streams Across North America

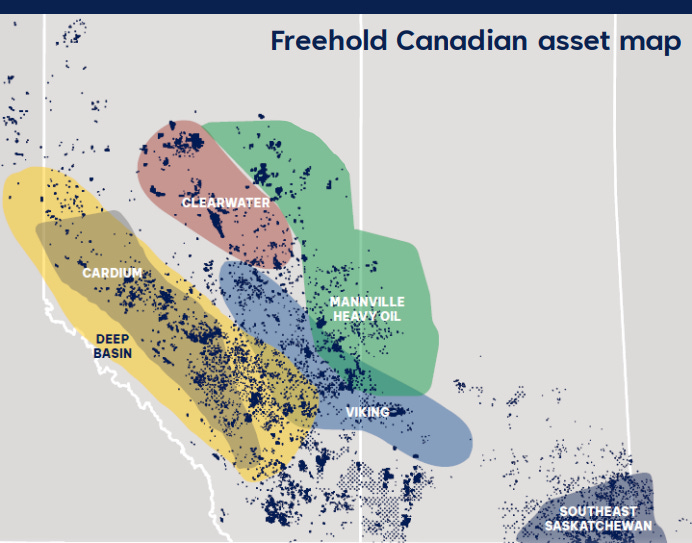

Freehold holds royalty interests in over 6.4 million gross acres, making it one of the largest non-government mineral title owners in Canada. Its assets span Canada and the United States with 64% of its Royalty Acres in Canada producing 58% of revenue, and 36% of its Royalty Acres in the US producing 42% of revenue.

The U.S. portfolio has grown substantially over the past five years, providing geographic diversification and access to some of the most productive basins in North America:

- Permian Basin (Texas & New Mexico) – High-margin oil royalties

- Bakken (North Dakota) – Light oil production

- Haynesville (Louisiana & Texas) – Prolific natural gas royalties

In Canada, Freehold’s holdings are concentrated in:

- Viking (Alberta & Saskatchewan) – Light oil

- Cardium (Alberta) – Mature oil field with steady production

- Montney (Alberta & BC) – Emerging liquids-rich natural gas

Revenue is split approximately 55% oil / 45% natural gas, offering balance and flexibility.

Recent Acquisitions and Expansion

Freehold has aggressively expanded its U.S. portfolio in recent years to diversify revenue and reduce exposure to Western Canadian price discounts.

Key acquisitions include:

- 2022: US$123 million acquisition of Permian and Haynesville royalties (Texas/Louisiana)

- 2023: US$54 million purchase of Bakken royalty lands in North Dakota

- 2024: US$87 million investment in additional Permian mineral titles, increasing exposure to high-margin oil

Management has signaled plans to continue opportunistic acquisitions, focusing on low-decline, operator-diverse royalty assets that enhance cash flow stability.

Freehold’s U.S. expansion gives it access to stronger assets, more stable cash flow, and enhanced dividend potential — all while sticking to its low-risk, royalty-focused business model. For retail investors, this means greater income stability, diversification, and long-term value creation without the high costs or risks of drilling and operations.

Bottom Line:

Freehold Royalties offers investors a rare combination of high income and operational resilience. With a 9% yield, a 29-year track record of dividend payments, and a royalty-based model that minimizes capital risk, FRU stands out in the energy sector. While near-term technicals suggest caution and possible further downside, long-term fundamentals remain strong. For income-focused investors willing to weather commodity cycles, Freehold represents an attractive opportunity to lock in stable cash flow with upside potential as oil markets stabilize or strengthen.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.