With ETFs the Amount of Fiat Paper Bitcoin Soars

The Amount of Paper, Fiat Bitcoin Soars

Please share this far and wide because investors deserve to know what is really going on. Especially Crypto and Bitcoin ETF investors.

Back in January of this year when the Bitcoin ETFs were approved, I speculated it would not create anymore physical demand for Bitcoin and all the ETFs would leverage the same Bitcoin held at Coinbase. This was my comment in January

“I will also point out that the majority are partnered with Coinbase, which is a big factor. Coinbase will act as the Custody Trust Company holding Bitcoin for many of the ETFs . Looking at Coinbase financial statements, as of September 30, 2023, Coinbase held $114 billion in customer crypto assets and $248 million in Bitcoin at fair market value as it's own investment. Bitcoin was about $27,000 at that time. Coinbase might buy more Bitcoin, but most likely all these ETFs will leverage the same Bitcoins at Coinbase. The fractional reserve banking system going on for decades. The ETFs will be a great way for Coinbase to earn fees on their Bitcoin investment. Technically they would not have to buy more Bitcoin until the ETFs achieved a market cap over $450 million approximate at today's Bitcoin prices. That is a lot of money and I doubt it happens out of the gate. In fact some of the ETFs may never gain much interest. There is quite a bit of competition.”

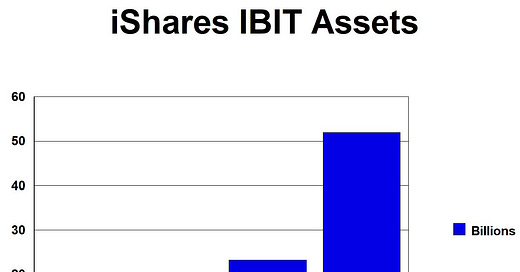

Current day - the Bitcoin ETFs proved an enormous success. One of the more popular, iShares Bitcoin Trust (IBIT) started trading January 11th and as of December 30th lists $52 billion in assets in the ETF. This alone is over 100 times more than the $450 million I mention above.

The assets held in IBIT have jumped 123% from September 30 to December 30 and sure Bitcoin has gone up but only about 31% from about $64k to $92k in the same time period. Huge amounts of $$ are being diverted into these ETFs instead of actual Bitcoin.

IBIT Claims 366,448 Bitcoin??

iShares IBIT September 30,2024 quarterly report claims they hold 366,448 Bitcoins, their Q4 report is not out yet, the December 30 number is from their daily website update.

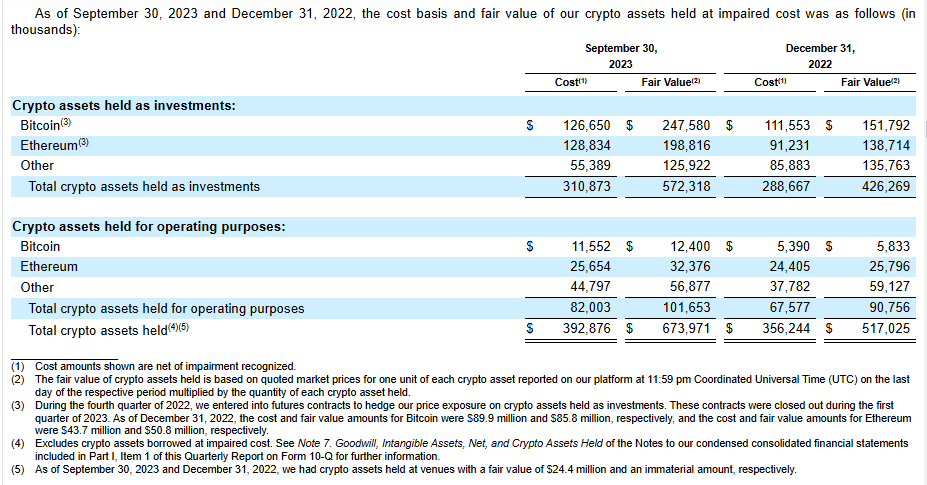

Coinbase is the custodian for IBIT among many others, so I checked Coinbase's 10-Q as of September 30 2024 and they held $1,260,718,000 in Crypto assets. Those held for investment would be the major source that Coinbase would use to back ETFs. There financial statements reveal $592,684,000 in Bitcoin and Ethereum at $311M and other coins at $357M.

Bitcoin was around $64,000 on September 30th so Coinbase held around 9,260 Bitcoin as investment, this compares 9,185 Bitcoin as investment at Sept 30 2023. In the past year, the number of Bitcoin that Coinbase holds as investment has not changed much at all. My speculation in January that they would all leverage the same Bitcoins is bang on!!!!!!!!

This is the opposite of what one would think should happen when in this 12 month period Coinbase became the custodian of Bitcoin for most of the ETFs. Here is how Coinbase describes their Crypto investment assets in their quarterly reports.

Crypto assets held for investment

Crypto assets held for investment are primarily held long term. The Company does not engage in regular trading of these crypto assets but may lend crypto assets held for investment through Prime Financing or stake these assets. When crypto assets that were loaned are returned, they continue to be held for investment. See Note 6. Collateralized Arrangements and Financing for additional details on Prime Financing. Crypto assets held for investment are initially recorded at cost and are subsequently remeasured at fair value on a specific identification basis at the end of each reporting period, with changes in fair value recognized in net income. Fair value is measured using quoted crypto asset prices within the Company’s principal market at the time of measurement. Fair value gains and losses on Crypto assets held for investment are recorded in Losses (gains) on crypto assets held for investment, net in the Condensed Consolidated Statements of Operations. Cash flows from crypto asset investment purchases and sales are recorded in Net cash used in investing activities in the Condensed Consolidated Statements of Cash Flows.

I took a screen shot of Coinbase's quarterly reports on Crypto assets for the two quarters I am using for numbers. Here is the most recent quarter, Sept. 30 2024.

And here is the September 30, 2023 report on Crypto as investments.

To conclude, these Bitcoin ETFs just hold Bitcoin as a ledger entry on a financial statement. They hold no physical Bitcoin or very little and certainly Coinbase is not holding Bitcoin for them as their custodian. The ETFs are just part of a fractional reserve system to divert $$ from buying physical Bitcoin. This should come to no surprise to anyone who has followed the gold market for years.

Regardless, I still plan on trading the ETFs because Bitcoin's volatility makes it attractive. Since April 16th, out Bitcoin trades have netted 34.7% while Bitcoin went up 31% in the same time period. A good real return and not a paper one. I believe I can improve on this as there was a bit of a learning curve on Bitcoin trading patterns. Stay tuned for the next trade, probably on the short side with SBIT again.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.