I sent this earlier this afternoon to paid subscribers, hopefully the Moderna Puts are around the same price Monday, if it interests you.

Inflation Stubborn while Economic Data Mixed

U.S. wholesale prices rose a bit faster in October and the latest “bump” in inflation, to use the words of top Federal Reserve officials, could prevent the central bank from reducing high U.S. interest rates as aggressively as Wall Street had expected just a few months ago. The producer-price index advanced 0.2% last month as prices also rose a bit faster in September than previously estimated. The increase in wholesale prices in the 12 months that ended in October climbed to 2.4% from 1.9% and matched the highest level in four months.

The Empire State Manufacturing Survey. The headline general business conditions index shot up forty-three points to 31.2, its highest reading in nearly three years. New orders and shipments rose substantially

Retail and food services sales reached $718.9 billion in October, marking a 0.4% increase over September. The figure is seasonally adjusted but not adjusted for inflation. With Core CPI at 0.3% last month, the real sales growth is only 0.1%

The monthly growth figure topped market expectations for a 0.3% increase, according to consensus estimates from Trading Economics, but represented a deceleration from the upwardly revised 0.8% increase recorded in September.

Industrial production dropped 0.3% last month after a downwardly revised 0.5% decline in September, the Federal Reserve said on Friday. Economists polled by Reuters had forecast industrial production falling 0.3% after a previously reported 0.3% decrease in September.

China and Europe Economic Woes

With the Trump win, there has been plenty of concern how proposed tariffs might hurt European and especially the Chinese economy.

Europe has been in recession or around zero growth for over 2 years, mostly because of extreme left policies pushing up energy costs and the Ukraine war adding more so. Germany is Europe's economic engine and it was hit hard as green policies blew up energy prices. Germany pays 3 times the international average for electricity. German consumers paid one of the highest electricity prices in the world in 2021 at 31.80 cents, they currently pay 32.80 cents for a kilowatt hour of electricity. That is another increase of 3 percent.

With a toxic cocktail of high energy costs, worker shortages and reams of far left government red tape, many of Germany’s biggest companies, like Volkswagen and Siemens to a host of lesser-known, smaller ones are experiencing a rude awakening and scrambling for greener pastures in North America and Asia. Germany’s largest aluminum smelter, Uedesheimer Rheinwerk, said it would shutter the plant by the end of the year due to the high cost of energy.

The country’s green transformation, the so-called Energiewende, has been a disaster. What these green scammers hide is the fact you still have to have the fossil fuel plants for back up because of wind/solar being intermittent. In essence you are building two power grids and of course at least double the cost. They harp about batteries in the future but they are not very feasible and add a lot more cost. Than the German government in a green scam craze closed the nuclear plants and just as it was losing access to Russian gas, the country switched off all nuclear power.

This is a perfect example along with Canada how a government can destroy the economy and companies/stocks within it. Just about a week ago the German government collapsed.

Scholz’s center-left Social Democrats, Vice Chancellor Robert Habeck’s environmentalist, left-leaning Greens and Christian Lindner’s pro-business Free Democrats, a party that has mostly allied with conservatives was the coalition that fell apart. It is easy to see that there was too many different ideologists within and when Scholz fired Finance Minister Lindner following disagreements over how to revive the shrinking economy, that was the end.

The good news is Europe is going to the right after the far left woke, green, immigration and excess regulation policies have become very sore issues with voters. For decades, political parties of all kinds joined forces to keep the hard-right far from the levers of power. Today, this strategy - known in France as a cordon sanitaire (or firewall) is falling apart.

It got going in 2022 with a right-wing bloc that includes a nationalist anti-immigration party won a narrow majority in Sweden’s parliament. Six EU countries - Italy, Finland, Slovakia, Hungary, Croatia and the Czech Republic - have hard-right parties in government.

In the Netherlands this July by the signing of a royal decree, the new right-wing Dutch government has become a reality. High cost of living, environmental issues, and a perceived failure to manage the asylum system were some of the key issues.

European government still has a majority of far left and center leaning parties, but with big gains from the right they can no longer be ignored.

China is it's own cup of tea as communist and their economy has been going down. Real Estate continues to fall in the country, manufacturing is slowing and we can see this in their oil demand as China is a big importer of oil.

China’s refinery throughput in October fell by 4.6% year-over-year to 14.02 million b/d, the seventh consecutive month of year-over-year declines, with independent teapot refiners in Shandong province bearing the brunt of that pain as their utilization rates plunged to 58%, almost 20 percentage points lower than they were a year ago. But don’t forget that China is the most advanced country when it comes to EVs so this has softened oil demand, not just industry.

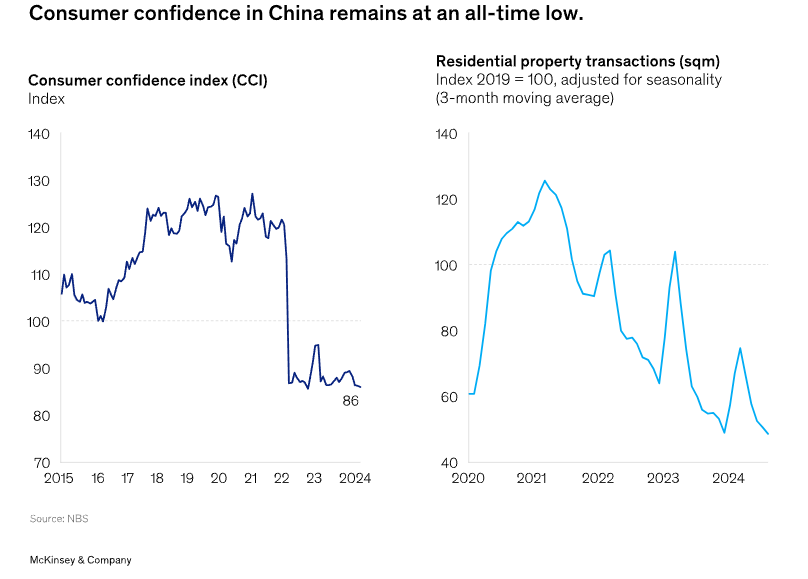

This next chart on Consumer Confidence shows confidence has really not come back from the pandemic, but Chinese air travel abroad has bounced back to pre pandemic levels. You can see the decline in real estate. It looks bleak but there are a lot of myths about the Chinese economy and poor understanding. Where the change and strength is coming from is quite surprising.

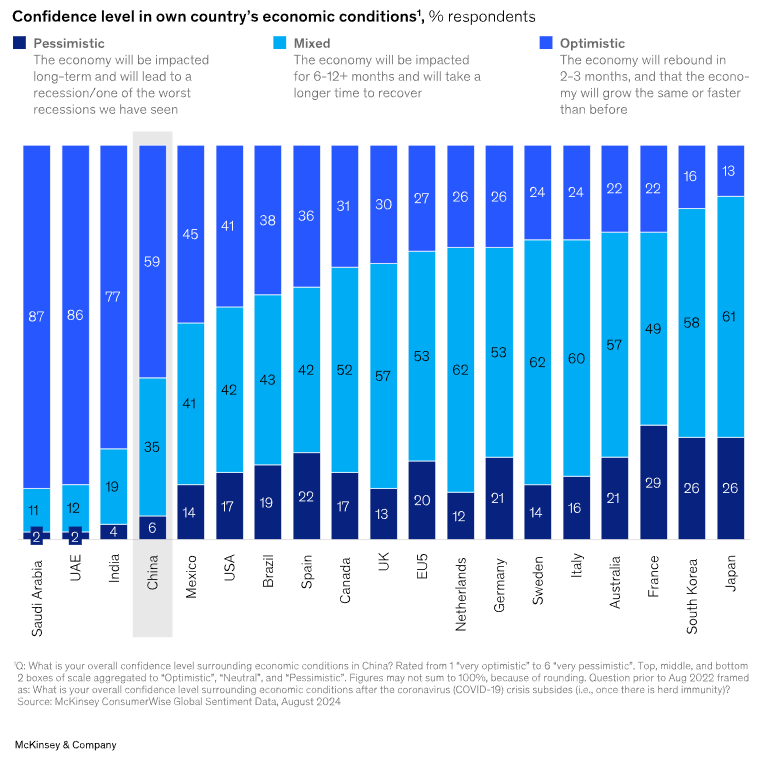

When you compare China to other countries it is a very robust story and their Black Friday blows the U.S. away. You can see that the Chinese are way more confident in the future of their economy than most of the western world and 18 points higher than the U.S.

China has it's own Black Friday, they call Singles' Day.

Every November 11, Alibaba offers steep discounts on online goods through its Taobao and Tmall platforms. Chinese consumers love it and the last Singles' Day before the pandemic hit, Alibaba sold a whopping $38 billion in one day.

Since then, Singles' Day has morphed into a multiweek event, because 24 hours wasn't enough time to fulfill all the orders. Other e-commerce players have also joined in Singles' Day. This year, the Singles' Day shopping spree started on October 14 and ended on November 11.

According to data provider Syntun, sales across all major e-commerce platforms grew about 27% to 1.44 trillion yuan. That's about US$200 billion and is about 20 times larger than the $9.8 billion U.S. online retailers sold during Black Friday last year. To put in further perspective, $254 billion was sold online during last year's entire holiday season in the U.S.

Tariffs on China will hurt them some but their domestic consumer market is growing strong and could start to out weigh the negative factor from tariffs when they come. And although the U.S. may be the biggest importer of Chinese goods they are just a fraction of the total.

During 2023, Chinese exports to the United States were US$502 billion which was 14.8% of China’s total exports. That means that over 85% of China exports will not be affected by Trump's tariffs.

Very Negative Oil Market Sentiment

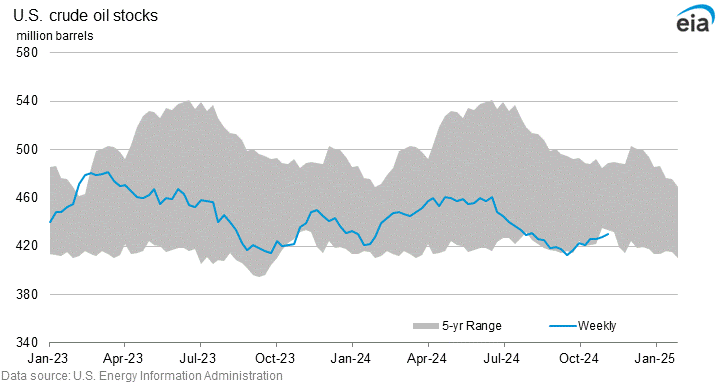

My economic points on China and Europe relate to the very negative sentiment in the oil market. Recent news adding to this is the International Energy Agency believes that global oil supply would exceed demand by a whopping 1 million b/d in 2025, equal to almost 1% of total production worldwide, driven by the U.S., Guyana and Canada, keeping its demand projection for next year unchanged at 990,000 b/d.

Bearish sentiment continued to dominate oil markets this week despite steep gasoline and diesel draws in the U.S. and oil inventories still at lows.

There is a lot of bearish news on the world economic front, but I believe this is priced in. The biggest negative shoe that could drop is a fall in U.S. economic data. I have been concerned that data was manipulated so badly ahead of the election that the U.S. economy is much worse than Wall Street believes. Edward Dowd has just confirmed my concerns, Trump inherits turd economy.

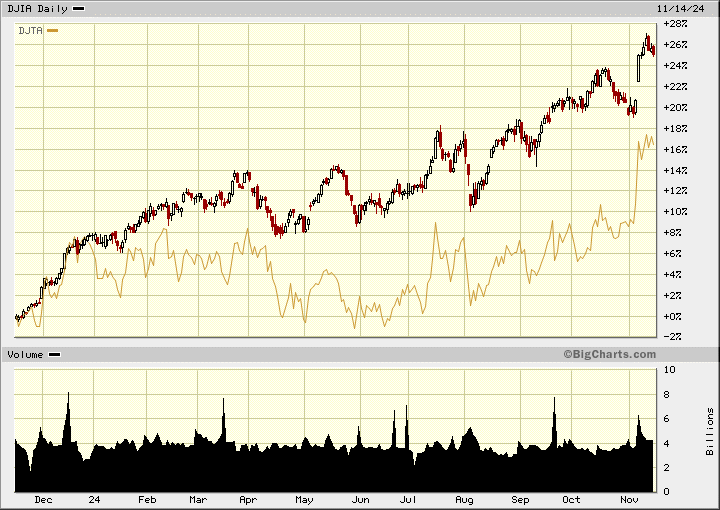

The U.S. stock market is pricing in a very robust economy and my main concern is they have it wrong. On a positive note I have been critical of the recent leg up in the market and one of the main reasons it was not confirmed by Dow Theory. However, that has now changed in November with the Transports (+17%) now making significant highs and confirming the rally in the Dow.

I have been commenting that big Pharma would be a sector hit hard with the Trump win and that has started to show big time this week. No surprise but Trump announced this week that Robert F. Kennedy Jr. as his nominee to lead the Department of Health and Human Services (HHS), in a statement on social media.

“For too long, Americans have been crushed by the industrial food complex and drug companies who have engaged in deception, misinformation, and disinformation when it comes to Public Health,” Trump wrote on X as part of his announcement.

The HHS, created in 1979, oversees 13 separate agencies. The most well-known are the Centers for Disease Control and Prevention (CDC), the Food and Drug Administration (FDA), and the National Institutes of Health (NIH).

Kennedy said he looks forward to “working with more than 80,000 employees at HHS to free the agencies from the smothering cloud of corporate capture so they can pursue their mission to make Americans once again the healthiest people on Earth.”

“Together we will clean up corruption, stop the revolving door between industry and government, and return our health agencies to their rich tradition of gold-standard, evidence-based science. I will provide Americans with transparency and access to all the data so they can make informed choices for themselves and their families,” he added.

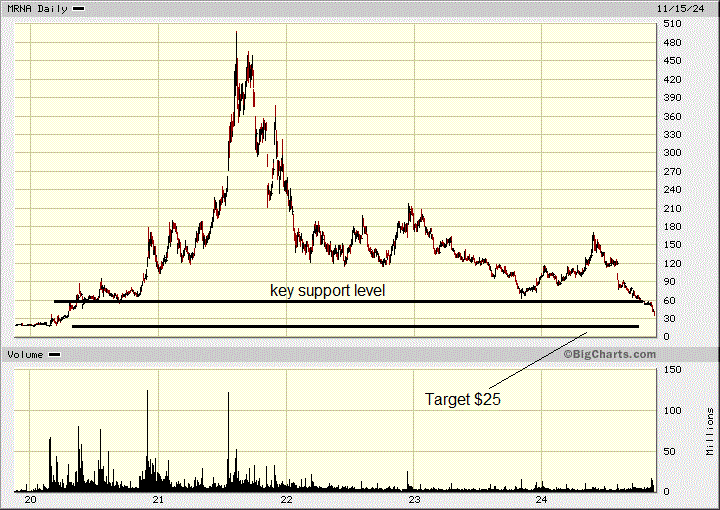

Moderna Q:MRNA - - - Recent Price - $37.30 - - - Target near term $25 and then $0

Buy Jan 2026 $25 Puts

We have made some big profits shorting Moderna with Put options twice. I last commented on the stock back in August that I missed another short opportunity after it plunged on Q2 results. I thought the stock might have a bounce back and I would short again. I should have just gone ahead and bought Put Options then.

The stock broke down on the chart in early October when it dropped below $60. I am showing a long term chart here so you can see the importance of $60. The stock is going to unwind all of it's gain and head back to $25.

When I previously suggested Put Options, I commented that this stock will eventually go to Zero and I still believe that. It is not zero yet but is down -92% from it’s high, not much left to go. The only thing Moderna has is MRNA technology. I have called this a failed technology because it is not very effective and not safe. Once all the fox are driven out of the FDA and CDC hen house, the chances of Moderna's products getting approved are very slim.

I also expect the MRNA Covid shots will be taken off the market leaving Moderna high and dry.

You probably did not see this in main stream press but it made it into USA today just over a week ago, Idaho has removed the Covid shots. Board members at Southwest District Health, outside of Boise, questioned the vaccine’s safety during their Oct. 22 meeting and narrowly voted to stop providing the shot in the six counties they serve.

This is going to spread to other state health departments. Simply because government and health officials do not want to admit their wrong is why the end of these shots will drag out a while longer. As governments and health officials change in elections or appointments, change is easier. I would be surprised if the shots make it to next years flu season.

Option premiums are high on the stock, but one could go out long term to January 2026 as the premiums will stay high for several months yet. The January 2026 $25 Put is about $4.20. If the stock hits my $25 target this option will probably go to $9 to $10.

The current put/call ratio is 0.82 where 0.7 is considered bullish and 1.0 considered bearish, so the stock is still priced too bullish by this measurement.

ZEFIRO METHANE- - - Cboe: ZEFI - - - - OTC: ZEFIF

Recent Price C$0.70 - - - - Opinion – buy

Today the Company announced consolidated financial results for the fiscal quarter ended September 30, 2024.

Generated record revenues of $10.0 million USD, an approximate 7% increase from the quarter ending June 30, 2024, and 26% compared to quarter ending September 30, 2023.

Record gross profit of $3.3 million USD (approximate 33% gross profit margin).

$460,297 USD of adjusted earnings before interest, taxes, depreciation, and amortization (“Adjusted EBITDA”) , an approximate increase of 107% compared to quarter ending June 30, 2024.

The company is making great progress on revenues for an early start up. The potential has barely begun at this point.

Mohit Gupta, joined Zefiro as its Chief Financial Officer in July. Mohit is also a veteran of the energy trading markets and at JP Morgan was one of the pioneers in the development of North American carbon credit markets,

I suggest this interview by the Arm Chair Trader

Mohit talks through Zefiro’s incredibly important mission to cap oil and gas wells which are spouting extremely important methane gas into the atmosphere. Zefiro owns companies which are working across five US states to identify and cap the wells which are harming the environment.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.