Zonte Metals -Drilling Hits - Finally

Welcome and thank you to all the new, smart, savvy and contrarian investor who have joined my substack. Please share well this remains free. I have followed Zonte a long time and patience has paid off. Even though the market has not figured this out yet, it soon will.

Zonte Metals - - - TSXV:ZON - - - OTC:EREPF - - - Recent Price - $0.10

Entry Price - $0.09 - - - - - - - - Opinion – strong buy to $0.12

Zonte has released drill results and I say Wow! and Finally! Zonte hit visible copper in all 7 drill holes with the best intersect in hole CH23-05 with 11.2 meters of 0.42% copper including 2.64% over 0.5 meters. This is potentially economic grade, Zonte just needs to find more of it now. IOCG systems typically run between 0.3% and 1.0%.

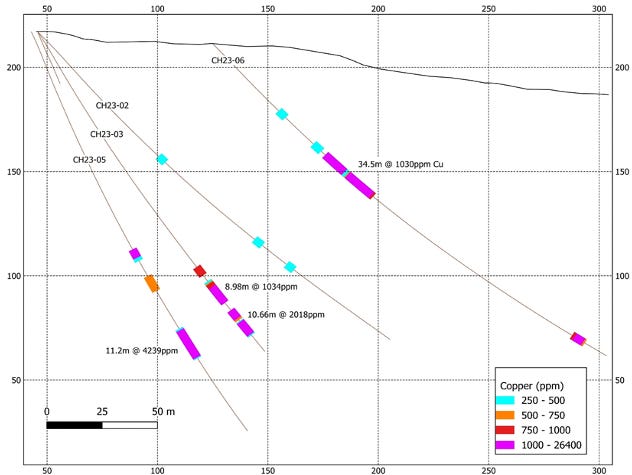

Hole CH23-06 had the longest intersect at 34.5 meters of 0.10% copper.

A total of seven drill holes were completed, totalling 1706m, at the K6 target among the 12 targets at the Cross Hills Project, NFLD. The drill holes were positioned to test numerous aspects within the combined dataset. Drilling was hampered by a number of technical issues, however, the seven drill holes did successfully test a portion of the target. Three of the 7 holes had decent hits. CH23-03 also hit 0.41% copper over 4.75m.

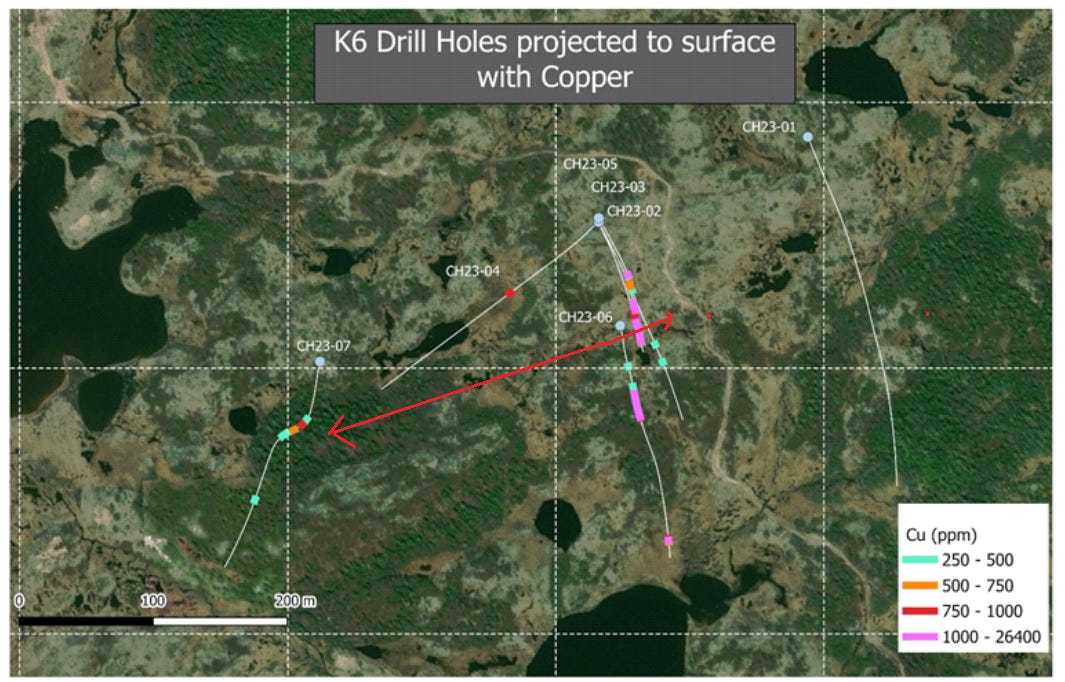

Drilling indicates mineralization open along strike to the west and to depth. The above graphic is the drill map and I drew in the red line to give you an indication of the strike direction.

Zonte acquired Cross Hills in 2018 so it has been over a 5 year wait for some good drill results, but that said, it is a brand new ball game now. It appears that Zonte has figured out Mother Nature's secret at Cross Hills. This is extremely bullish for the other 11 targets that are much stronger and larger. Zonte drilled K6 first because it was most advanced technically and logistically was easy to drill.

The graphic above depicts the fanned drill holes at different depths. Hole 6 is only about 50m deep and it hit the 34.5m of 0.10% copper and as the drilling went deeper, the grades increased, with the deepest, hole 5 with the 11.2m of 0.42% copper. Including the top shorter 0.3% intersect this hole is down around 100m to 130m given the angle of the drill hole. It appears hole 2 was above the zone.

Another very positive aspect is chalcocite grade is increasing at depth. As I pointed out a while back, this is the strongest of the various types of copper mineralization. Zonte also highlights that alteration indicates that shallow hole 6 could be open to depth.

This is very positive and great results for first pass drilling using the new exploration techniques. It will all be good drill results going forward. I don't know how the market will react. In a more normal or decent market, no doubt the stock would go up. However we are in the worst junior mining market in decades, so it is anybody's guess. That said, the stock should be bought and accumulated at these low prices. Importantly, this is just not a copper discovery, but of a brand new copper belt in Canada, not yet on geological maps.

No matter what the retail market does or the stock, this news will get the majors extremely interested. And I can tell you that all of them are following this.

The stock is suppose to start trading at 10AM

I did a stock chart the other day, so thought I would do an update on the copper chart. Copper's outlook is the most bullish of all metals as shortage looms. It is benefiting from growing and inflated economies coming out of Covid-19 and decades of under investment will mean shortages no matter what pace the EV market grows.

Copper has broken to the upside from a wedge pattern and $4 is the first and mild resistance, more a psychological number.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.