2024 Outlook

Often I do my yearly outlook in February, but the last couple years have been earlier and easier to predict what is likely to happen. 2024 is quite easy to see what will happen and it is best described as volatile, full of surprises and events we have not seen in most past years.

In 2023 I was fairly accurate predicting the S&P 500 would rise and I have already called a double top in December 2023. The prediction of a new gold bull market came true. I expected economies would slow considerably and enter recession, Canada has but the US is more resilient. I predicted the Fed would pivot too late and since they have still not made that pivot, the jury is still out. For quite some time I have been commenting that inflation is entrenched and will not fade easily. January 11th 2024 inflation numbers spelled that out pretty good. I thought energy prices would be stronger than they were. Although they did move up into September, they gave all those gains back by December. Enough of 2023, what does 2024 look like:

A Strange US election year

More War and less Oil

Economies weaken while inflation remains entrenched

Climategate unravels further

Gold to new highs in 2024

Election uncertainty in 2024

2024 will be a year like no other and one reason is the uncertainty the US election brings. Trump will lead the Republican party and currently he is well ahead in polls of Biden in swing states. All these charges against him will go through courts all year and you have to live under a rock not to realize this is all politically motivated. If there ever was a year of election interference this is it. It is possible Trump gets elected while in jail? It is very very uncertain how this will pan out.

Currently it appears that Biden is running but actually he is not fit to and at some point he will probably surprise and step down. Most of his own party, Democrats don't want him to run. Biden's approval ratings are lower than Richard Nixon at the height of Water gate. The problem is Democrats think VP Kamala Harris would be worse so Biden will stick out close to the end. Biden could actually end up impeached, at least in the House, another excuse to dump him. I just wonder who the Democrats will pull out of the hat? They must have a plan, but their stable looks quite bare. It is possible they pull Michele Obama out of the hat?

Than there is Robert F. Kennedy Jr. If there was ever true solid Democrats it was the Kennedy s. However the current Democrat party wanted nothing to do with him. It is unfortunate, because I think of all the candidates he would be best. He will run as an independent and that is going to upset the apple cart like nothing seen since 1992 when independent Ross Perot got 18% of the vote and cost Bush the election. Kennedy had numbers of over 20% in recent polls. There is likely to be 2 or 3 other substantial independents like Jill Stein, Cornel West and Joe Manchin. It will be the year of independents and they will likely take a lot more Democrat votes than Republican. A new Gallup poll released on Friday, January 12th reveals that a record low percentage of Americans who identify as Democrats in 2023 hit a record low of 27%, but the Republicans were at 27% too but not their all time low. Most revealing 43% identified as independents, tying the 2014 record.

Trump again, surprise surprise surprise

War is unpredictable at almost anytime

The Russia Ukraine will probably drag on all year with little change. Russia seems happy with the ground they already secured and will just keep wearing down Ukraine. It is only U.S. and NATO support that keeps Ukraine going and perhaps Russia is waiting and hoping Trump wins the election. Trump and the Republicans would likely cut support for Ukraine and that would force Ukraine to make a deal. Even if Trump wins though, he could not do anything until sworn to office in January 2025.

There is a potential dangerous reaction this year, that comes amid growing reluctance in both the US and Europe to continue directly funding Ukraine. With the military situation on the ground turning more desperate by the day, a marketing campaign for this highly controversial proposal is underway. An excerpt from a recent guest editorial in the Financial Times sets the tone with the rather direct title, “Seizing Russian assets is the right thing to do”. At this point the U.S. has frozen U.S. assets Russia held (treasury bills). If the U.S. decides to confiscate and give these assets to Ukraine, it would send a very bad message that investing in the U.S. can come with perils. It is only going to speed up the US$ decline and rise of the BRICS.

January 16th, Germany decided to go it alone and provide Ukraine with over 7 billion euros in military aid, it is only helping to weaken Europe and NATO. “Today we see that Germany is trying to go solo, it hasn't fooled anyone, and in particular it is trying to stop supporting the European Peace Facility," EU Commissioner Thierry Breton said in Paris on Jan. 16, Politico reported.

The Middle East war is more likely to cause problems as it is becoming more evident this will expand into a regional war. I have been concerned with this all along and now we see numerous attacks on ships The latest escalation is the UK and the U.S. launching numerous attacks on Houthi positions in Yemen. This will do nothing but make them more determined with their attacks. These countries, terrorists what ever you want to call them have no fear or worry about the U.S or NATO. They have witnessed the botch retreat out of Afghanistan and in Ukraine, the bark has been way bigger than the bite. Also Pakistan said its military had carried out strikes inside Iran, a day after Iranian forces conducted an airstrike in Pakistan.

Worst yet it seems the Biden Administration and Trudeau don't realize we are at war and with their loose border policies, terrorists are easily streaming into both countries. A major terrorist attack in the U.S. and Canada could be one of the surprises in 2024. I am most concerned how vulnerable our power grids are and how much havoc a long term outage would cause.

Energy Oil&Gas

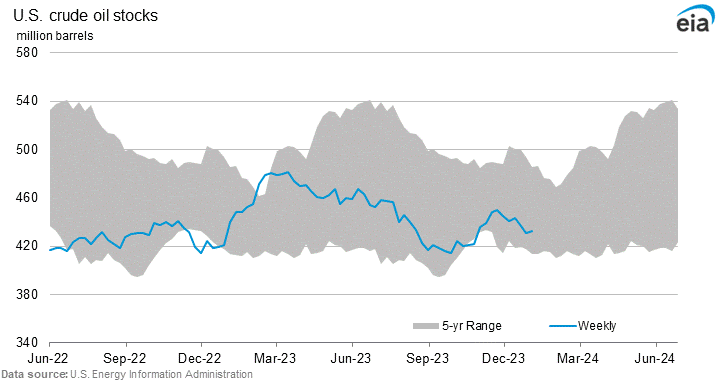

I am bullish on oil&gas because I see the likelihood the middle east conflict will get worse. Oil shipments could stop. There could be an oil embargo? At the same time we have the Biden Administration and Trudeau declaring a war on fossil fuels. Given the current geopolitical events this is one of the dumbest things I ever saw. Oil&Gas did move up at first into September on the conflict but has since come back down. I believe there is a lot of intervention to keep prices down because it's an election year and low prices will help the current Democrat party, plus low oil prices help lower Russia's cash flow. We might see real shortages before prices respond a lot and is something I am watching closely. Crude oil stocks are at the bottom of their 5 year average.

Canada data is so old it is not worth looking at but there could be a distillate fuel oil problem. I have noticed that the price spread between gasoline and diesel fuel has widened to about 30 to 40 cents per litre at petrol stations.

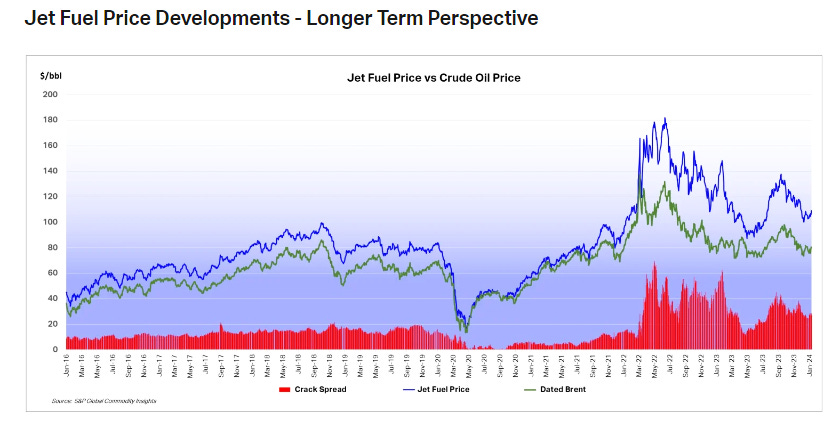

The price of jet fuel also came down from the September 2023 peak but is still elevated and the spread with Brent Crude is still quite wide.

Everyone is bearish on oil&gas. I saw one report where only 3 of about 40 analysts were bullish. Oil&gas stocks are very cheap. I believe it comes from prices not holding up with the middle east conflict and all the hype about the transition from fossil fuels to electric or green. However global energy consumption is expected to grow by 1.8% in 2024, largely driven by strong demand in Asia. Despite still-high prices and unsolved supply chain disruptions, demand for fossil fuels will reach record levels, but demand for renewable energy will rise by 11%.

Electric cars account for 1% of vehicles on the road in the U.S., according to Experian Automotive's second quarter 2023 report. Why is this important? You have heard me talk about the 'S' curve when it comes to technology and when a new technology penetrates 5% to 10% of the market, it has gained acceptance. EVs are a long way off and many never be accepted, at least with the current technology. This recent cold spell showed an EV weakness in spades. In Chicago, probably hundreds of Teslas were abandoned at charging stations because they would not charge in the cold.

Charging stations have essentially turned into car graveyards in recent days as temperatures have dropped to the negative double digits, Fox Chicago reported. "This is crazy. It’s a disaster. Seriously," said Tesla owner Chalis Mizelle. What is so sad is these Tesla owners did not even seem aware this type of problem would occur in cold weather. The bad news on EVs has been everywhere. Hertz Global said it would cut its EV adoption losses by offloading a third of its global fleet to buy gasoline-powered cars. That will put 20,000 EVs up for sale, including those from Tesla (TSLA), in response to weak take-up and elevated repair costs. Major auto companies Ford and GM have also cut EV production.

People have been sold a pile of hype and BS. The real purpose of climategate is to raise taxes and distribute more $$ to the wealthy. Once markets catch on that this move to electric is not feasible with current technology, oil&gas will come back into focus. What I have been saying all along is that the current battery technology has to improve 100% and I don't see that anywhere or anytime soon.

The bigger problem is this push to electric and war on fossil fuels is going to cause energy shortages. Another thing that will cause a reality check with those fooled by climategate.

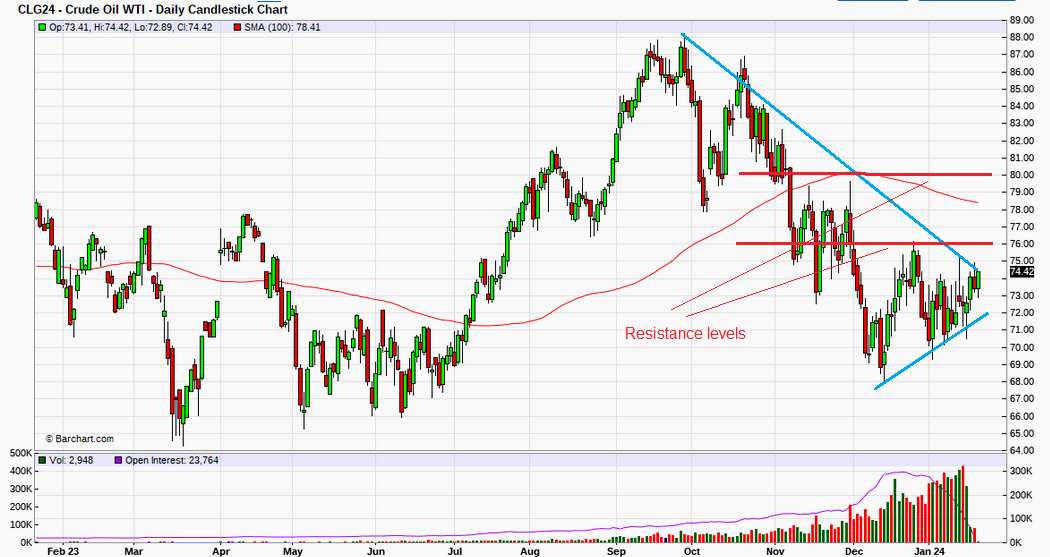

Currently the oil price is down near lows and has been stuck in a range between $70 and $77 since early December 2023. The down trend is not broken yet as we need a higher high around $77 and then a solid break above $80. There is a wedge pattern developing as well that should break to the upside.

Economy, Interest rates and General Equities

I would assume that you have heard over and over again that the Fed will soon pivot and that will be great for stocks. Nothing could be further from the truth. In previous bear markets, the actual bottom occurred long after the Fed pivot. To be clear, a pivot is when the Fed cuts interest rates for the first time after raising them. I could give numerous samples, but let us look at the past two bear markets.

The Financial crisis of 2007/08 – The Fed pivot was August 2007 and the bear market bottomed in February 2009, 18 months later.

The Dotcom bubble of late 1990s/2000 – The Fed pivot was December 2000 and the bear market bottomed in September 2002, 21 months later.

The problem is that the Fed always acts too late. Remember not long ago when they said inflation was transitory and they were far too late raising rates. I was critical of the Fed about this two years ago. The market consensus is that inflation will continue to fall but I believe it has become entrenched. The Fed will not be lowering rates because inflation is conquered but will pivot long

after the economy is in recession and stock markets declining again. Chairman Powell has made it very clear that he intends to error on the side of excess tightening, fearing inflation will bounce back if he does not. This certainly increases the odds that the Fed will pivot too late to fend off a steeper bear market.

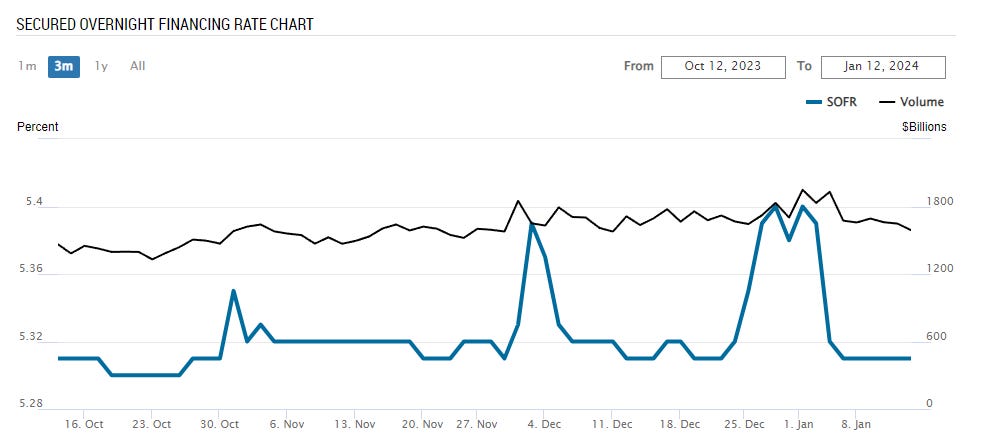

The Fed's dovish stance in December was a surprise and it was not because they beat inflation. They had little choice but show a dovish stance because the liquidity in the all-important interbank system had hit dangerously low levels, resulting in the highest SOFR print since they started raising rates, and the biggest spike since the last time there was a repo market crisis in March 2020.

SOFR hit 5.39% on December 1st, its highest level since replacing Libor in April 2018. This benchmark high was reflected across both sections of the repo market with financing rates remaining elevated over the first few days of December before slowly declining thereafter. So the Fed turns dovish at the mid December meeting. And liquidity got tight again at the end of December. The Fed is losing control of the market because of crowding out caused by high government debt and old debt that has to be rolled over into new treasuries or bonds.

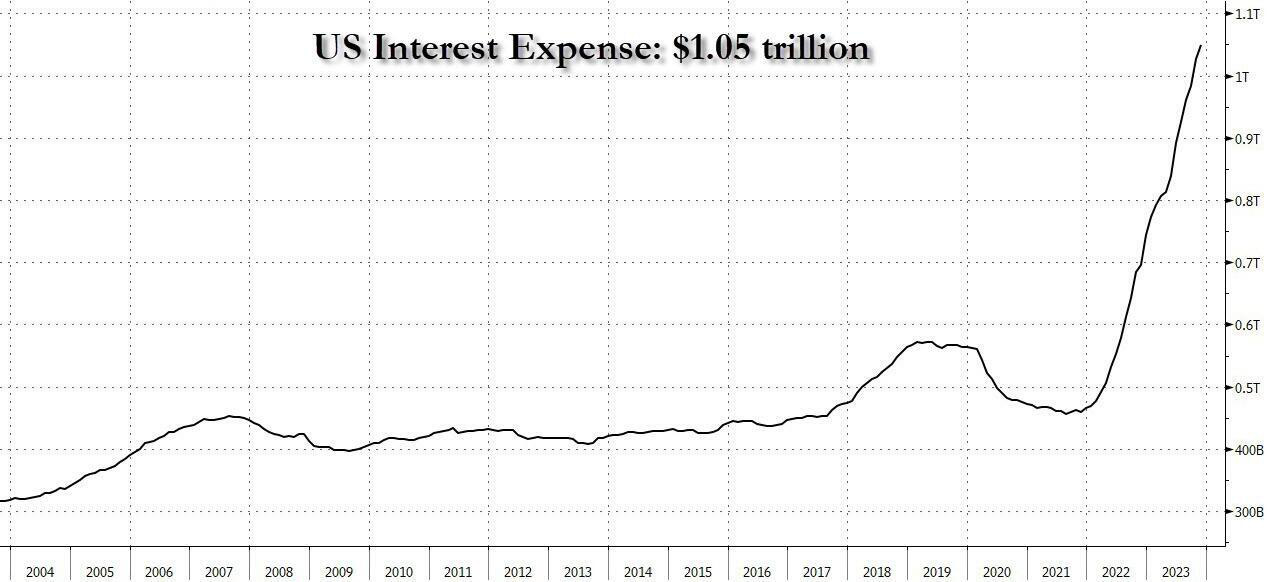

Just the interest on the current debt is skyrocketing. And there is a real problem with the massive budget deficit. Their really unable to refinance this debt. The Fed is going to have to go back to QE but they won't have a good excuse this time to blame it on, except uncontrollable government debt. Perhaps they will escalate the middle east war, maybe attack Iran and put the blame there?

I think that's going to lead to a crisis in the dollar, which will lead to a crisis in the economy and cause golds next big up move and the markets down move. The stock market dropping will be the straw that breaks the Fed's back when it comes to giving up on maintaining higher interest rates. Therefore it will be the stock market and economy that forces the Fed's hand, inflation will remain entrenched.

If you look back, I think there’s been about nine tightening cycles since the ’70s and only two have been soft landings, and even then they were questionable. So, the statistics are against the Goldilocks narrative. There’s no fiscal discipline in the United States. The government and the people have gotten used to free money. It’s going to be hard to tighten things up. It will end up forced upon them by the market. In the 1970s it took the Fed 10 years fighting inflation, we are now just in year two.

Furthermore, the economy is not near as strong as most believe.

Ten of the last eleven jobs numbers have been revised downward. Revisions receive less attention from the financial media than headline numbers which works well for the government in an election year.

U.S. commercial bankruptcy filings jumped 72% to 6,569 in 2023, primarily due to increased interest rates, tougher lending standards and pushback from the pandemic. There were more corporate bankruptcies in 2023 than there were during the pandemic of 2020. There were 642 corporate bankruptcy filings in the U.S. in 2023, according to S&P Global Market Intelligence. That was a 72.6 percent increase over the 2022 total and the largest number of bankruptcy filings since 2010.

Bulls are harping about strength in U.S. retail sales that rose more than expected in December, boosted by an increase in motor vehicle and online purchases. Keeping the economy on solid ground heading into the new year, so they say. However, most if not all the increase is simply inflation. Headline inflation may come out at 3% to 4% but that is not what consumers are paying at the retail level. Inflation is worse than the government data suggest. The government revised the CPI formula in the 1990s so that it understates the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers which would equate to all and more of the retail sales increase. It is good news that consumers are still buying though, but as mentioned above, they are hooked on cheap money that is no longer so cheap.

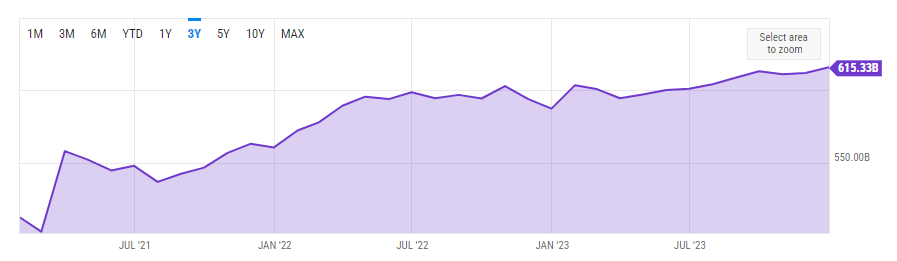

On this 3 year chart of retail sales, you can see the increase in 2021 and 2022 as inflation picked up. In the past year December to December, retail sales are up +4.8% so a little ahead of headline inflation but below what is real inflation (7% -8%) that consumers are likely paying.

Industrial production moved up 0.1 percent in December and declined 3.1 percent at an annual rate in the fourth quarter. Basically it has been flat to down in the past year, not a sign of a healthy economy.

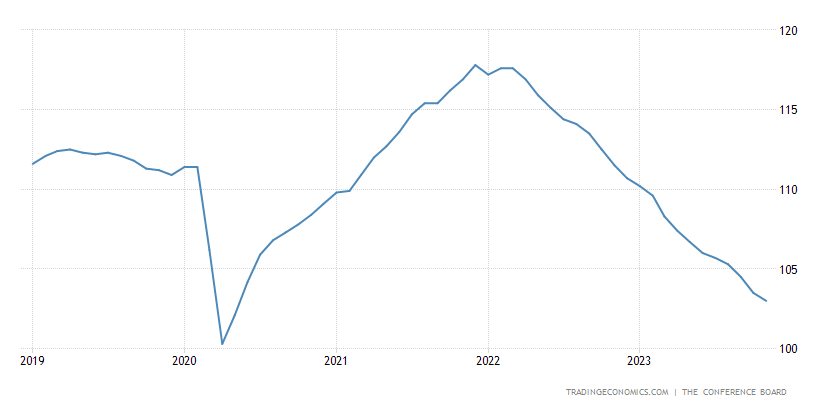

The Conference Board Leading Economic Index® (LEI) for the U.S. declined by 0.5 percent in November 2023 to 103.0 (2016=100), following a (downwardly revised) decline of 1.0 percent in October. The LEI contracted by 3.5 percent over the six-month period between May and November 2023, a smaller decrease than its 4.3 percent contraction over the previous six months (November 2022 to May 2023).

The Conference Board Leading Economic Index is a predictive variable that anticipates (or “leads”) turning points in the business cycle by around 7 months. After the recovery from Covid-19, it peaked at the end of 2022 and has been declining ever since.

I predicted the US economy would weaken in the last half of 2023 but GDP stayed pretty decent. I believe the biggest risk in 2024 is a U.S. recession. I don't think with all the underlying weakness that I highlighted above that the U.S economy can avoid a recession. It is most likely going to be a hard landing, sorry Goldilocks and the stock market will decline and the Fed will pivot for the bad reasons .

I commented about the January effect for the stock market. The first week was down but a bounce back on day 5 brought the S&P 500 back about even. Let's see where we end the month at, but for now perhaps we are seeing a signal of a sideways market, likely a topping pattern. The S&P bounced up this past Friday and that looks pretty positive, but not enough to call this a definite break out from a double top. That said probably the best chance for a bullish move in the market is the first half of 2024 before economic weakness shows more of it's ugly face.

I just see the downside risk is greater than the upside for 2024. And I say again, it will be a year of surprises.

And an outlook would not be complete without gold.

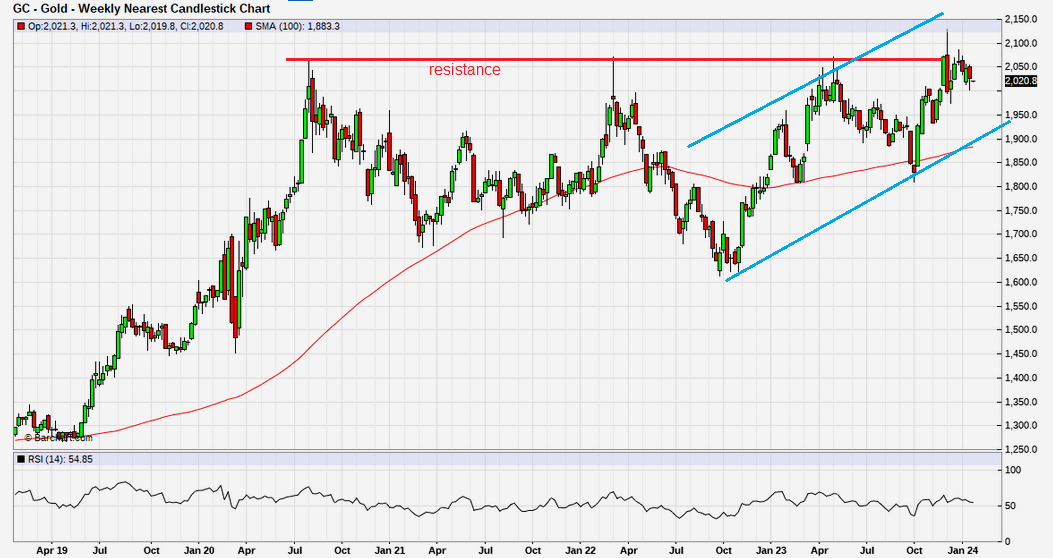

I think the best description is that gold is undecided. There has been a good rally since the middle east conflict and gold did make new highs but not a decisive break out. As I have been saying, we need to see a solid close above $2150 to bring back some excitement and buying, especially into the gold miners. If stock markets continue to rally (attract $$) and no further escalation occurs short term in the middle east than gold may test the bottom of it's up trend channel (blue line).

I am bullish for 2024 and believe we will see that break out, but the exact timing is the question. Perhaps one or more of the surprises I expect in 2024 will be the trigger. Perhaps the realization that inflation is not beat but the Fed has to lower rates because of a recession. That will be very bullish for gold.

It is going to take strong break out in gold to wake up the market. Retail traders are no where to be found while Central Banks keep gobbling up gold at record amounts. Retail always piles in at the tops. I have been pointing out how depressed Canada's junior market is, another very grim statistic.

Total financings on the TSX Venture totalled just $250 million in November. Year to date, IPO financing activity on the TSXV exchange is down an incredible 83% from $178 million to $30 million. Total financings are down about 27% from $5.5 billion to $4 billion year over year.

Canada juniors are unique in some ways. First we had the steep bear market from the 2011 top and next Canadian retail traders took a bath on Cannabis stocks that have mostly gone to zero (did not effect Australia juniors). So they then decide to jump into crypto in a big way in 2021 and 2022 just when that market was peaking and before it tanked. Sure bitcoin has recovered some but thousands of others have not with another, in a string of failers making news today.

Terraform Labs - the company behind the collapsed cryptocurrencies TerraUSD and Luna is filing for Chapter 11 bankruptcy in the U.S. TerraUSD, along with its sister token Luna, failed in 2022 after the stablecoin lost its peg to the dollar, wiping out an estimated $40B in market value. Terraform Labs, which is already facing fraud charges brought on by the U.S. SEC, is also expected to face a class-action lawsuit in Singapore.

I commented before that there were over 7,000 crypto related trading vehicles and I see now it is up to about 10,000. This is a totally unregulated market that anyone can create a crypto currency or trading vehicle. It is beyond the wild wild west. This is ending badly for many speculators, you really cannot call them investors because crypto is not an investment, simply a speculation or gamble, like a casino. If you read the crypto ETF prospectus, the risks go on for dozens of pages. Unreal!!!!

I am also expecting more softness in housing markets, but I will leave that for another update. I will just say that Canada's two largest housing markets saw double-digit declines in sales in 2023, as the highest mortgage rates in decades put home ownership out of reach for many would-be buyers. The Globe reports that there were about 66,000 residential sales in the GTA last year. That is down 12% from 2022, and 46% below the record number of sales seen in 2021. It was a similar story in Metro Vancouver, where residential sales totalled about 26,000 last year, down 10.3 % from the year before and 41.5% from 2021. Prices were flat to slightly down.

In 2020 it was COVID, and 2021 was the supply chain. 2022 was inflation, and 2023 was interest rates. Now, the biggest investing risk going into 2024 looks like it will be geopolitics. A more polarized world has given way to structural market risk. It can also be hard to plan for such wild cards, or what I call surprises. We have possible Middle East escalation, Russia-Ukraine challenges EU/NATO stability and Asia-Pacific escalation (Taiwan, South China Sea, North Korea). In North America a messy U.S. election, border security, civil relations. Just pick your poison and those are only the easy ones to see. Surprises could be more deadly.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

Sorry, both times I have gone with your advice it has cost me money, down $19,000 now. Should I continue? Thanks.