Welcome and Thank you to all the new smart, savvy and contrarian investors who have recently joined my substack. Please share and subscribe while I still have this free.

This week in my article on Dr. Copper, I promised to reveal the best pure copper producer. I am also including another copper junior that I own.

Capstone Copper - - - - TSX:CS - - - - - Recent Price - $6.30

52 week trading range $4.40 to $7.25 - - - Shares outstanding, 695 million

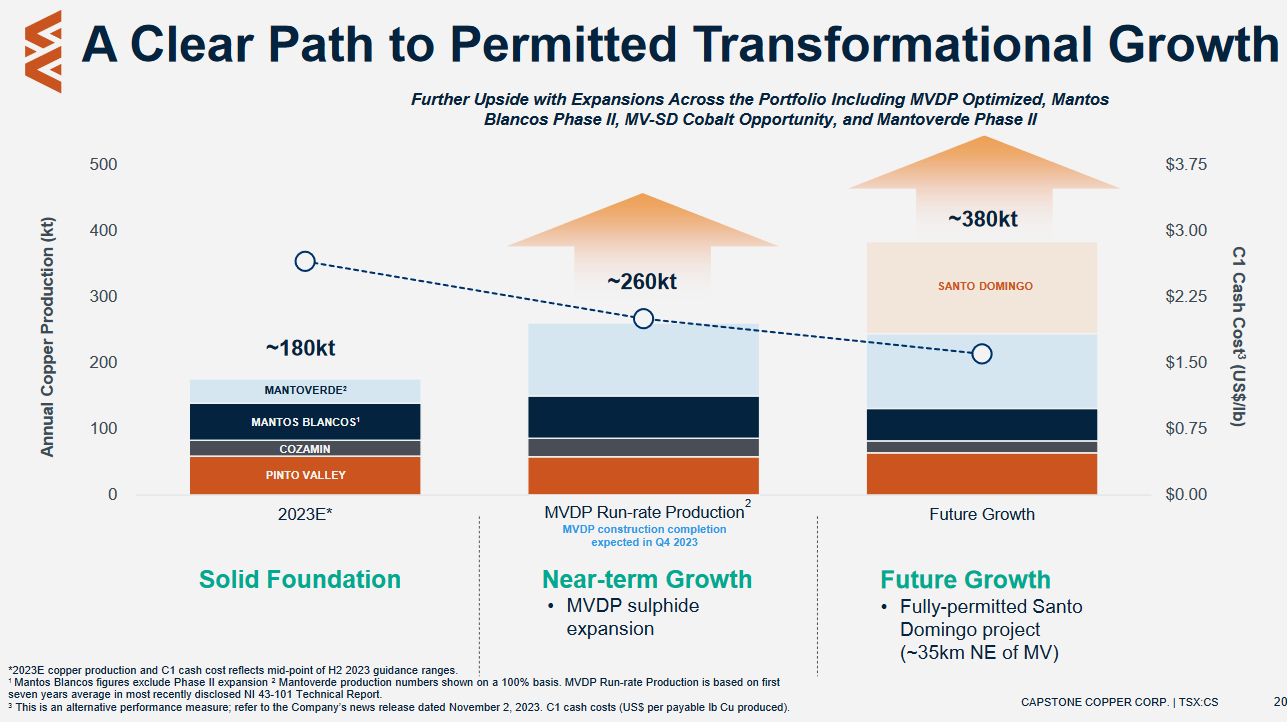

Capstone is a pure copper producer with 4 producing mines, one in Arizona, one in Mexico and two in Chile. And 97% of it's revenues are derived from copper sales. An expansion of their Mantoverde Mine in Chile is going to significantly increase copper production in 2024 and lower costs. Here are the operating results of the four mines in Q3 2023. All operations performed a bit lower in Q3 and are temporary in nature.

Pinto Valley mine, Arizona USA

Copper production of 13,600 tonnes in Q3 2023 was 3 per cent lower than in Q3 2022, mainly on lower mill throughput during the quarter (Q3 2023 -- 47,426 tonnes per day (tpd) versus Q3 2022 -- 48,143 tpd), resulting from unplanned eight-day downtime related to the secondary crusher jack shaft replacement and counter shaft repairs. Grade was consistent quarter-over-quarter (Q3 2023 -- 0.34 per cent versus Q3 2022 -- 0.34 per cent). Recoveries were lower compared with the same period last year (Q3 2023 -- 87.4 per cent versus Q3 2022 -- 89.1 per cent).

Mantos Blancos mine, Chile

Q3 2023 production was 12,200 tonnes, composed of 9,100 tonnes from sulphide operations and 3,000 tonnes of cathode from oxide operations, 11 per cent lower than the 13,600 tonnes produced in Q3 2022. The lower production was driven primarily by lower dump throughput, grade and recoveries impacting cathode production. The mill throughput of 14,176 tpd in Q3 2023 was impacted by mill downtime caused by planned repair and maintenance of the concentrator plant that lasted six days (liners and major components change). Recoveries were lower in Q3 2023 compared with the same period last year (76.3 per cent in Q3 2023 versus 79.3 per cent in Q3 2022), mainly driven by ore characteristics in the upper areas of the mine. A plan to address the plant stability during the second half of 2023 is under way that includes improved maintenance and optimization of the concentrator and the tailings system.

Cozamin mine, Mexico

Q3 2023 copper production of 5,900 tonnes was lower than the same period prior year, mainly on lower mill throughput (3,567 tpd in Q3 2023 versus 3,829 tpd in Q3 2022). Recoveries and grades were consistent quarter-over-quarter.

Mantoverde mine, Chile

Q3 2023 copper production of 8,600 tonnes was 26 per cent lower compared with 11,600 tonnes in Q3 2022. Heap operations grade was lower as a result of mine sequence (0.32 per cent in Q3 2023 versus 0.45 per cent in Q3 2022), and recoveries were lower (66.5 per cent in Q3 2023 versus 86.7 per cent in Q3 2022) due to lower solubility ratio of the processed mineral and lower grades, all of which was partially offset by higher heap throughput (2.7 million tonnes in Q3 2023 versus 2.5 million tonnes in Q3 2022). Throughput from dump operations was lower compared with the same period last year due to a temporary sulphuric acid supply shortfall in September, and grades were consistent with the same period last year.

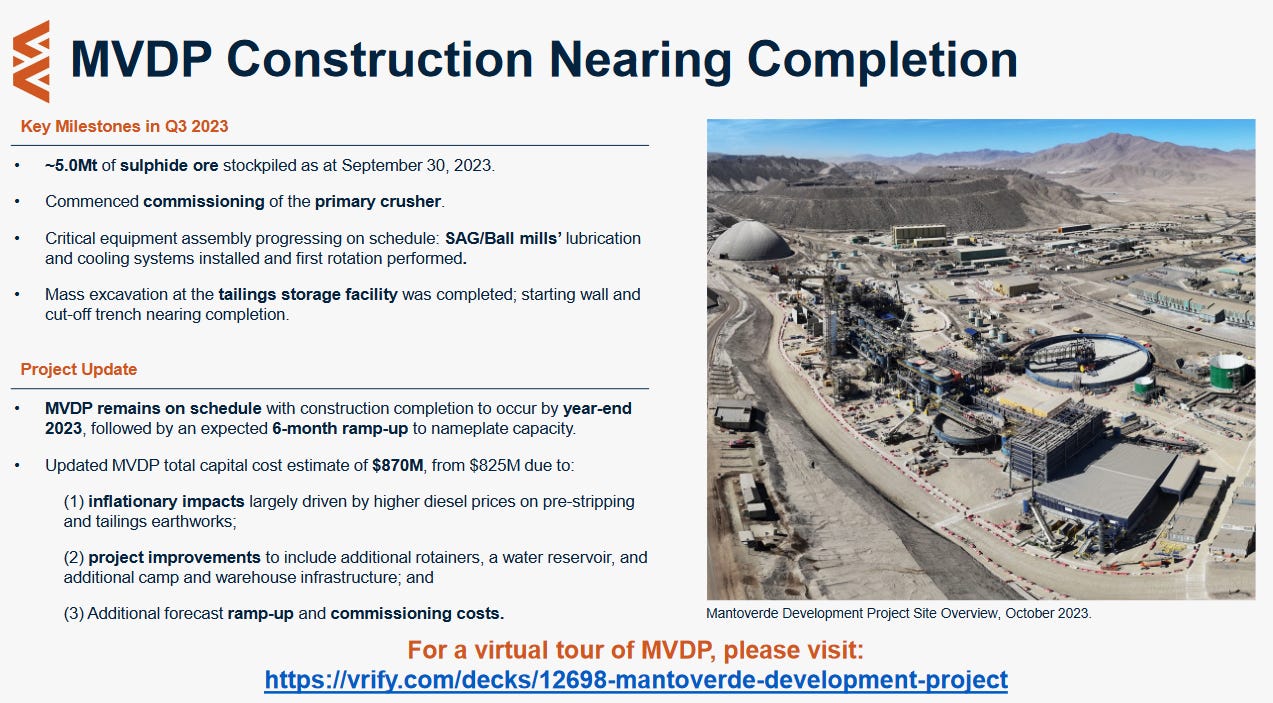

Mantoverde development project overall progress at 93 per cent and remains on schedule. Construction is progressing well on all key areas of the project. Total project spend since inception was $763-million at the end of September, 2023, compared with $706-million at June, 2023. The project is on target for construction completion by year-end 2023. As the project nears completion, the updated total project cost is estimated at $870-million, which is a 5-per-cent increase and includes approximately $20-million in project improvements.

Financial

Total available liquidity of $424.5-million as at Sept. 30, 2023, composed of $129.5-million of cash and short-term investments, and $295-million of undrawn amounts on the corporate revolving credit facility. Capstone is in strong financial shape to get the Mantoverde on stream and from that revenues and cash flows will see significant increases.

Conclusion

Q3 2023 copper production totalled 40,300 tonnes at C1 cash costs of $2.88 per payable pound of copper produced. Copper production in the third quarter was impacted by an unplanned eight days of cumulative downtime at Pinto Valley related to the secondary crusher jack shaft replacement and counter shaft repairs, plus planned maintenance downtime at Mantos Blancos. Lower production levels and maintenance expenses were the key drivers related to higher consolidated cash costs in the quarter.

With Capstone, you get the leverage to copper prices and exposure to strong production growth. The stock dipped with the over all market weakness in September/October and has recovered. The drop in the stock in 2022 was when copper prices had some substantial weakness, see copper charts, page 5.

The stock has strong resistance above $7.00 and will probably take higher copper prices or when their increased production and revenue comes on stream in 2024. The stock has saw a very good rally and I would look for some weakness or pull back to around $5.50 to buy.

GSP Resources - - - - - TSXV:GSPR - - - - - Recent Price - $0.11

Shares outstanding - - - 27 million approx.

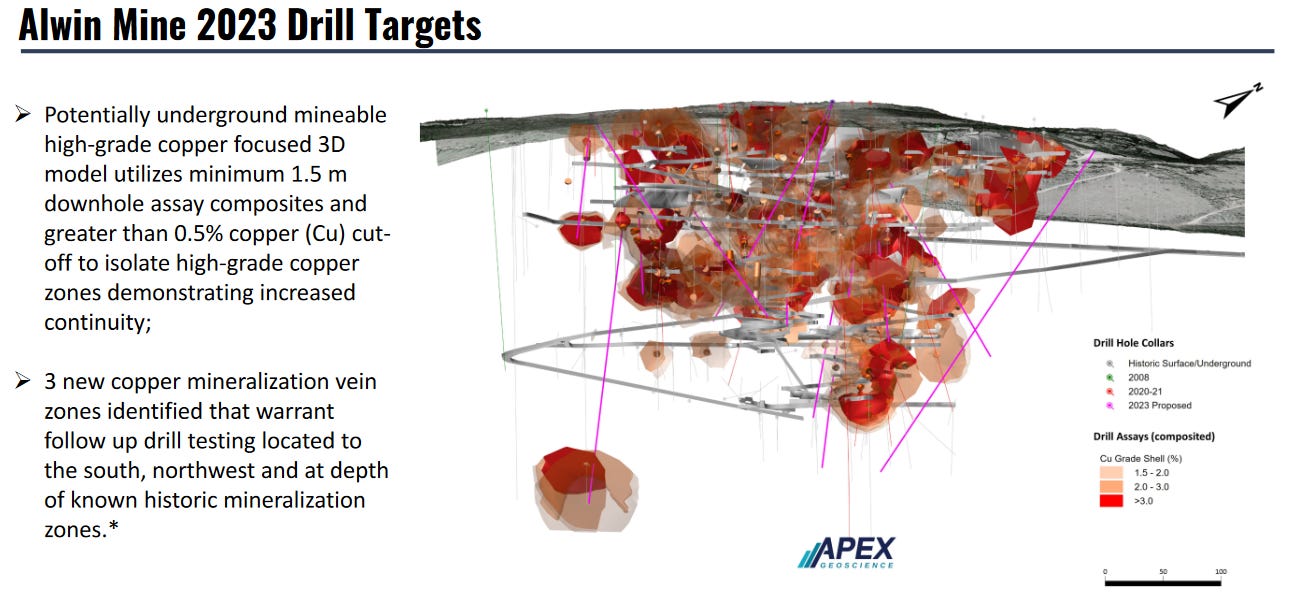

GSPR just finished drilling 5 holes on their Alwin mine copper-silver-gold property. It is approximately 575.72 hectares and is located on the semi-arid, interior plateau in south-central British Columbia. The historic underground mine was developed over 500 metres long by 200 metres wide by 300 metres deep.

The Alwin property is adjacent to the western boundary of Teck Corp.'s Highland Valley mine, the largest open-pit porphyry copper-molybdenum mine in Western Canada. Alteration and mineralization of the Highland Valley hydrothermal system extend westward from the Highland Valley mine onto the Alwin property (see GSP's news release dated Jan. 30, 2020).

A total of five HQ-size diamond drill holes were completed totalling 640 metres. Drilling was completed from three sites along a strike length of approximately 100 metres, including the upper and lower levels of the 4 zone. All five 2023 drill holes exhibited visual sulphide mineralization intervals interpreted to be part of or adjacent to the historic 4 zone. Observed pyrite, chalcopyrite, bornite and molybdenite mineralization exhibited structurally controlled (in the form of millimetre-scale to centimetre-scale vein sets, fracture and fault infill) as well as fine to coarsely disseminated, domanial and blebby textures

.

GSP's president and chief executive officer, Simon Dyakowski, commented: "Our team is excited to share the preliminary results of the 2023 drill program. We look forward to providing further updates as we receive analytical assay results for the five 2023 drill holes. The primary objective of the 2023 drill program was to drill test the Alwin 3-D copper mineralization vein model recently developed for the high-grade past-producing Alwin copper mine with a focus on evaluating the upper and lower extents of the unmined historic 4 zone. The potential to further expand the multiple parallel polymetallic mineralization zones at Alwin remains a significant exploration upside that requires further confirmation drilling. Potential new zones previously identified from historic drill holes to the northwest, south and at depth of the historic mine area remain untested and will be targeted with additional drilling in 2024."

The stock reacted well on exploration results back in August/September and I expect it will again in upcoming drill results. There has been a nice base built around 11 cents to spring off of. There is only 27 million shares out and management/insiders hold about 30%. The current valuation is very low with a market cap of just $3 million.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.