Gold and Bitcoin hit my near term targets and Oil closed above $83.

I had a target on gold of $2070 and yesterday June Comex gold hit a high of $2063 so close enough for target met. I am expecting gold to break above $2070 but it will probably consolidate some between here and $2,000 before breaking out.

It is worth repeating that Gold is a highly liquid asset, which is no one’s liability so carries no credit risk. Historically it has preserved its value over time.

March saw gold ETFs net inflows of US$1.9bn (+32t) for the first time in ten months, but this was not enough to prevent the net quarterly outflows of US$1.5bn (-29t)

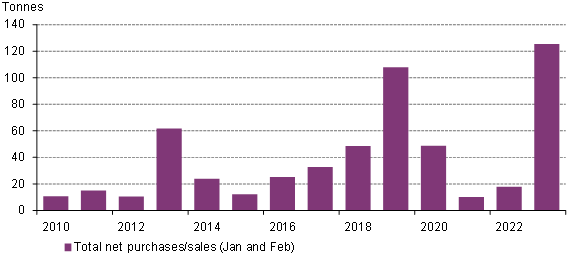

Central bank gold buying momentum showed no signs of stalling in February. Reported global gold reserves rose by 52t during the month – the eleventh consecutive month of net purchases – following January's 74t.

On a y-t-d basis, central banks have reported net purchases of 125t. This is the strongest start to a year back to at least 2010 – when central banks became net buyers on an annual basis.

My April 8th substack comments on Bitcoin was that there was resistance around $30,000 so might as well consider selling then at over $28,000. On Tuesday Bitcoin moved to over $30,000. More than 87% of all BTC future trades liquidated in the past 24 hours at that time were short, or bets against a rise in prices, CoinDesk reported. Losses from these trades amounted to some $145 million in the process. It appears a lot of this rally was on a short squeeze, an indicator to me that this rally could be a last gasp in this roughly one month up move. Plus it moved into long term resistance on the chart.

I mentioned resistance is around $30,000 and Bitcoin hit almost $31,000. Looking at the chart an extreme to 32,000 to 33,000 would not be out of the question, but regardless I would be selling or taking some profits here.

And one last thing is Oil. I commented that I wanted to see a solid close above $83 to signal a break out. We got a close of $83.26 on Wednesday. The break out looks a bit undecided to me, but never the less, I now believe we will be in a higher trading range. I would not like to see a close below $79 and on the upside we should see a move to around $88.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication