Gold ETF flows, Nevada Area Play Update, GLM

In the week ending August 31, the advance figure for seasonally adjusted initial jobless claims was 227,000, a decrease of 5,000 from the previous week's revised level, according to the Department of Labor. Pretty much in line with expectations, so no big deal.

The Federal Reserve's "Beige Book" report on Wednesday described employment levels as "generally flat to up slightly in recent weeks."

However ADP job numbers came in about 40,000 below consensus. U.S. businesses generated just 99,000 new jobs in August, paycheck company ADP said, to mark the smallest increase since 2021 in another sign of a rapidly cooling labor market. Perhaps a prelude to a weaker jobs report tommorrow.

The ISM Services PMI in the US edged higher to 51.5 in August of 2024 from 51.4 in the previous month, above market expectations that it would ease to 51.1, to extend the positive momentum in activity for US service providers

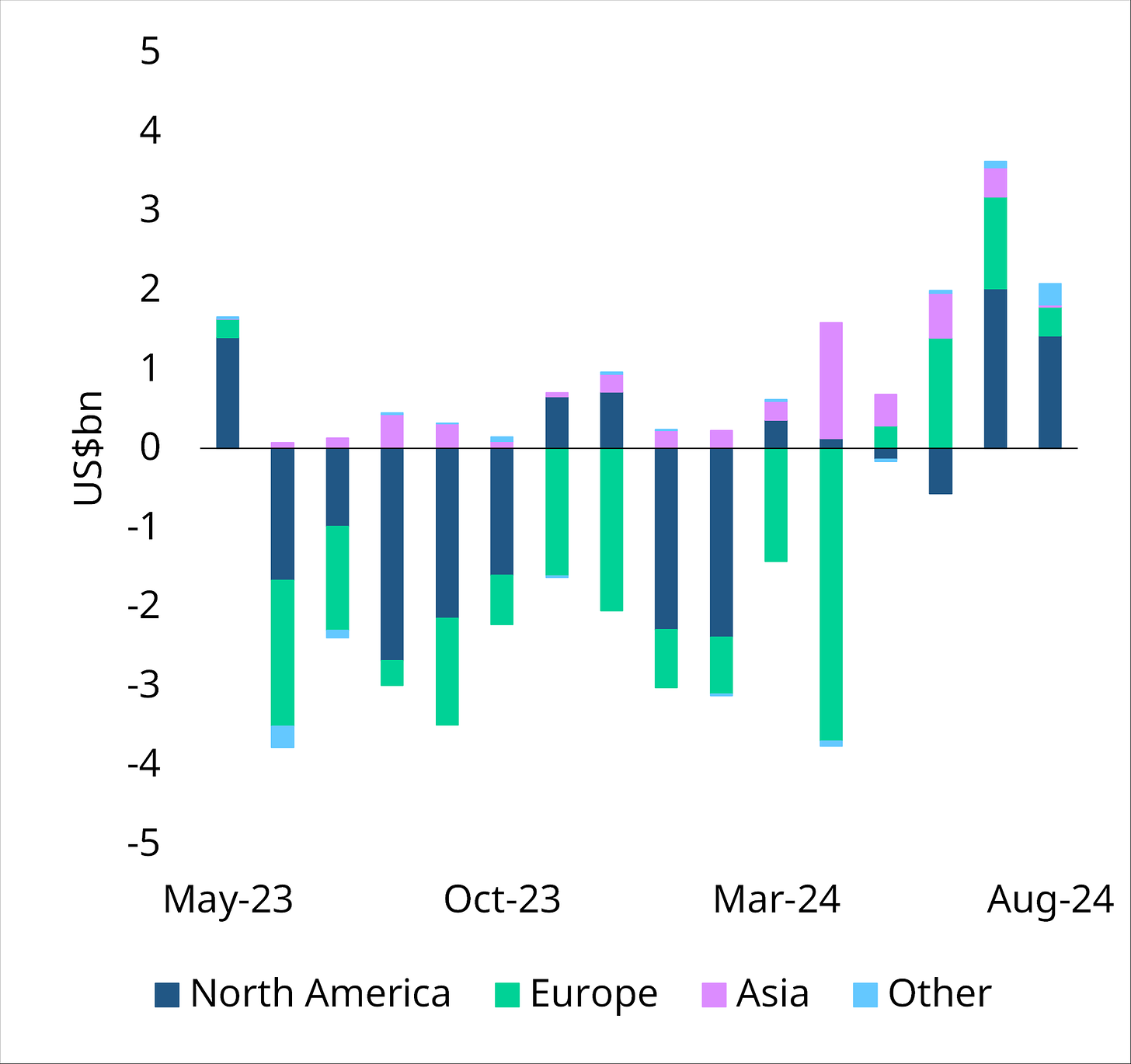

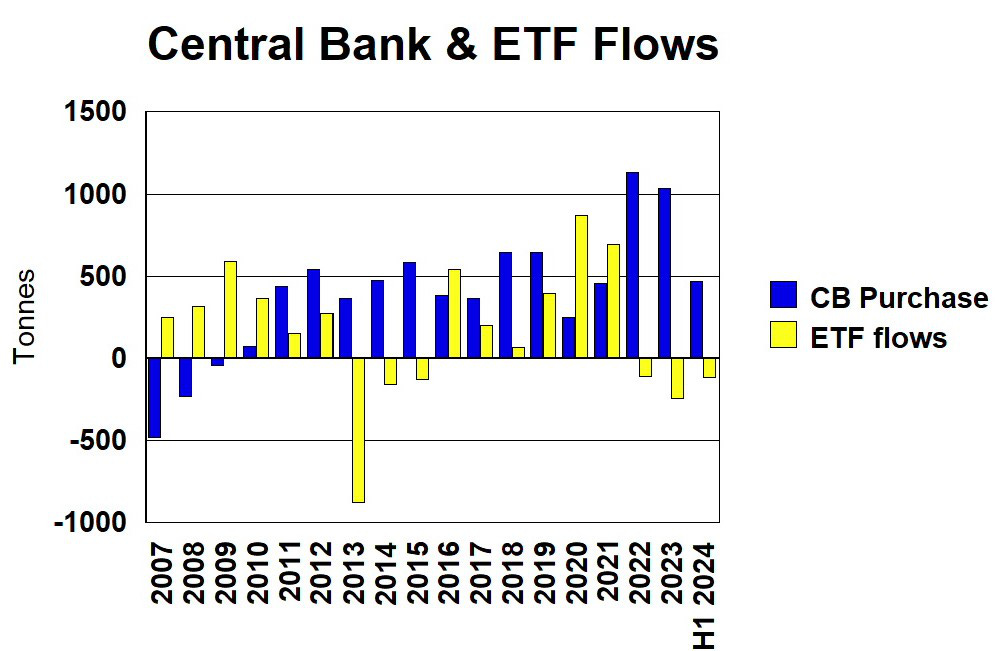

Global gold ETFs added US$2.1B in August, extending their inflow streak to four months. Even so these inflows are still very small at about 100 tonnes for 2024 thus far.

To compare, in 2020, the last time there was some investor interest in gold, the ETFs added about 800 tonnes that year as you see from my playstocks.net chart.

Golden Lake Exploration - - CSE:GLM - - - Recent Price – C$0.06

Entry Price $0.06 - - - - - Opinion – buy

Golden Lake liked my last write up, so I convinced them to become an advertiser at playstocks. For disclosure purposes they are now a paid advertiser.

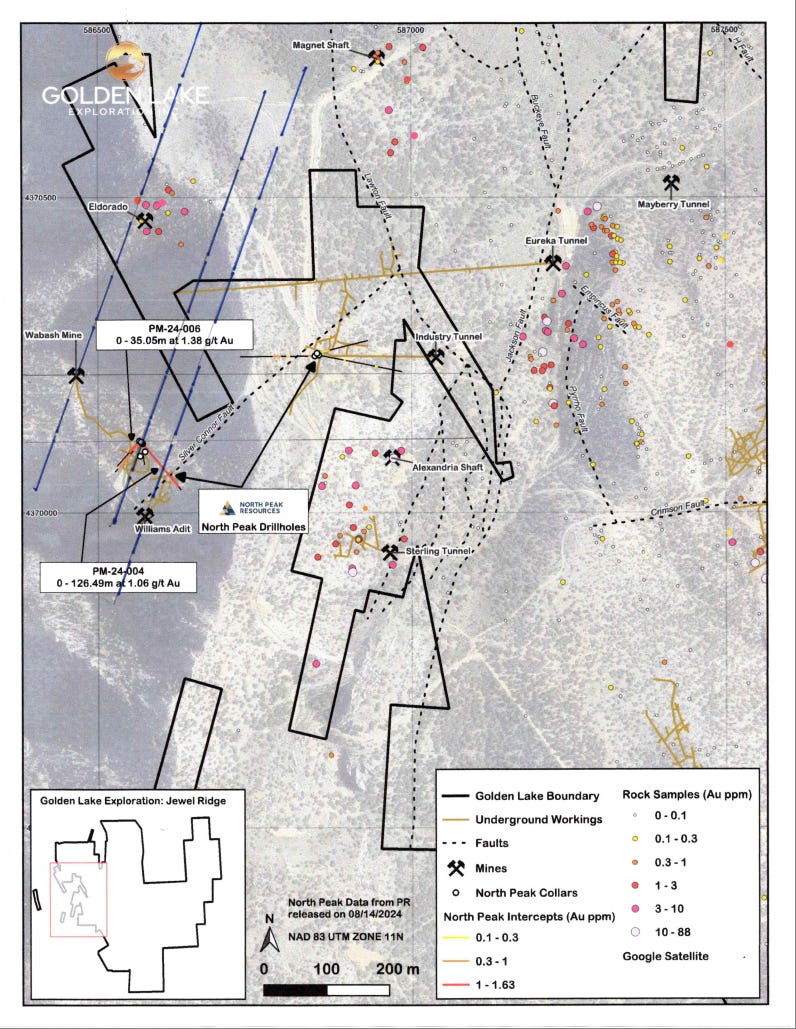

Today North Peak Resources (TSXV:NPR) reported more nice drill holes (see red lines on map below). Once again very proximal to GLM's Jewel Ridge borders which may continue on to their Eldorado and Magnet Shaft historic mines.

GLM is now planning to drill at their El Dorado ground to see how it all connects. This area has not been drilled before and has several high-grade surface and dump samples obtained by Golden Lake from El Dorado. Magnet Ridge is coincident with the prominent untested IP anomaly, highlighted in my last write up

North Peak’s Hole #22 Intersects Good Width and Grade Next to the Historic Chicago Mine

56.4 g/t Au over 1.5m (5ft) within 23.1 g/t Au over 6.1m (20ft) included in 7.0 g/t Au over 27.4m (90ft) from Surface

Hole #21 Returns 1.49 g/t Au over 53.4m (175ft) from Surface

Again, North Peak has a market cap of $33 million and Golden Lake only $5 million. I believe Golden Lake has the better property and the prominent IP anomaly that likely controls this mineralization is on Golden Lake's Jewel Ridge. On the map, GLM's Jewel Ridge is outlined with the black borders and you can see how very close is the NPR drilling.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.