Welcome and thank you to all the new, smart, savvy and contrarian investors who have joined my substack. I am very small here so please share and subscribe while this is free.

Sales of new single-family houses in the United States fell 0.6% month-over-month to a seasonally adjusted annualized rate of 617K in June 2024, as high prices and mortgage rates continued to weigh on buyers' affordability. It is the lowest reading in seven months and well below forecasts of 640K.

Also, "New Residential Sales" report matched the other weak measures: Homebuilders tend to average about six months of sales. Now, though, they have been carrying about nine months supply, a very significant 50% overage.

In June 2024, existing-home sales fell as the median sales price climbed to the highest price ever recorded. All four major U.S. regions posted sales declines. Year-over-year, sales waned in the Northeast, Midwest and South but were unchanged in the West.

"We're seeing a slow shift from a seller's market to a buyer's market," said NAR Chief Economist Lawrence Yun.

Canada will fare a lot worse as there was a crazy real estate bubble in recent years, far out doing price increases in the U.S. It is obvious that Canada did not learn from the U.S. 2007 real estate bubble burst.

For Canada, I have been predicting a plunge in home prices. We saw a levelling off and small price decline in 2023 and I compared it to the Coyote who chased the road runner and just went off the cliff. He freezes in mid air and hangs there.

Guess what, the coyote just turned his head and looked down. You know what happens next.

Most of the low interest rate mortgages come due in 2024 and 2025, unlike the U.S. that has mostly 25 and 30 year mortgages.

Here is a typical story I saw in one of the Canadian news channels. Canadian family bought a house in 2021 for $800k in Toronto. They secured a 3 year fixed rate mortgage at 3.2%. Bank is now offering the family 7.1% which translates to a leap from $3000 to $5100 per month. The husband is working 70+ hours a week. He only comes home to sleep. New normal. Sad.

Interest rates came down 1/4 point again today but It won't be enough and neither will another 1/2 point decline. The only solution is much lower home prices. A 30% drop will not surprise me, but it will a lot of people.

In Canada, the GTA experienced another slow month for new home sales in June, bringing year-to-date sales to less than half of the record-low seen in 2023, The benchmark price for condos — an average price excluding outliers — was about $1.023 million, and for single-family homes it was about $1.613 million, according to the data collected by Altus Group. Prices declined by 6 per cent for both home types compared to the year before.

Overall, 1,139 new homes were sold last month, a 46 per cent drop compared to June 2023 and 59 per cent less than the 10-year average, the report said.

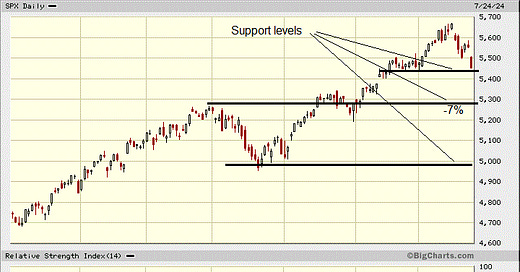

In my January outlook for 2024, I commented the best time for the stock market, S&P 500 would be the first half of the year. The last two months I have been encouraging to sell the main equity markets and book the nice gains. September is the worst month in the markets and then comes scary October. Often corrections get started in August and right on cue as we move into the 2nd half of the year, July, markets are rolling over.

At this point I am only seeing a correction, but the Magnificent 7 tech bubble has probably peaked. I have been warning about this for two or three months. On my July 12th substack and newsletter I highlighted the short position on the Magnificent 7 soared to record highs. Smart money was betting their hay day was over and I suggested to heed this warning. The market and the 7 started heading south 3 days later.

Gold is up today with markets tanking and I expect this rotational to continue.

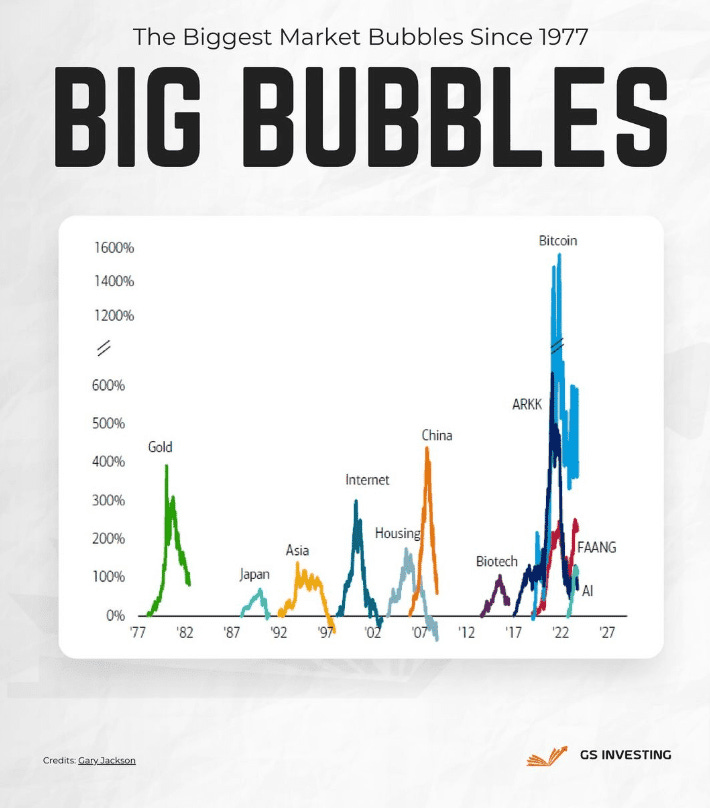

I saw a very interesting chart today, credit Gary Jackson and GS Investing. I participated and made money on either the way up or down on the Gold, Japan, Internet and Housing bubbles. What I find interesting this time around is that so much money was printed out of thin air that we three bubbles at the same time – Bitcoin, FAANG stocks and AI.

Like all bubbles they will mostly unwind 100% back to the levels of 2018, 2019 when the massive money printing began. The coming recession and bear market is going to be nasty!

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.