Tariff Effects and How Canadians can Protect Themselves

In this issue:

Details of tariffs

Canadian government likely response is fight and make it worse

Canada is the mouse against the elephant

More tariffs April 1st

Short and longer term effects

Canadian recession headed to depression

How Canadians can Protect Themselves

Cracks getting wider in U.S. economy

Hemostemix and Recon Africa

If Canadians thought they went through terrible inflation in the past few years, they have seen nothing yet. Sadly and crazy, is this could have been avoided with good leadership.

Details came out from the U.S Trump administration Saturday that you can view here. It is the worst case scenario that I contemplated which is 25% on all imports with no exceptions, other than energy at a lesser 10%. It is spelled out in very plain detail and facts that the tariffs will remain until substantial progress is made to curtail illegal immigration and illicit Fentanyl crossing the borders.

However Canadian leaders in the Liberal government and Provincial premiers like Doug Ford and some others chose to fight. This is either incompetent insanity or corruption to advance their political agendas, maybe both! It seems it is just far left mentality to fight and stop Trump, they don't care about the people, just their own agenda.

It started with tariff threats from Trump and our leaders decided to go straight to war. In any war or disagreement the first step is you try to negotiate for a settlement or at least buy time. Canadian leadership decided to go straight to war and because the U.S. is an economic giant compared to Canada it is like a mouse taking on an elephant. It is crazier than Ukraine taking on Russia with no outside help because Canada is not going to get any outside help here.

Canada can create some annoyance like some bites on the elephant toes, but Canada is going to get crushed in this trade war. Many, including Alberta premier Danielle Smith, one of Canada's big banks have called on the government that immediate action can be taken by appointing a border czar to deal with Trump's border czar to progress and negotiate a solution, but no such thing occurred. Canadian leaders don't want a solution, but a conflict to further their agenda and blame it all on Trump. The government propaganda will come out strong blaming Trump and sadly many Canadians will be fooled. They did it with Covid and proved it worked. They will do it again.

Trump knows the Canadian leadership is weak and the country going down hill big, he is exploiting it to his advantage.

This is just the first set of tariffs that Trump is using to try and improve border security and illegal Fentanyl crossing the border. Some will argue that way more Fentanyl is seized at the Mexican border compared to Canada, but did you ever stop to think it is because it is making it through the Canadian border and not being seized. Terrorists know it is a lot easier to get into the U.S. from Canada.

U.S. Border CBP has intercepted more individuals on a terrorist watch list crossing into the United States from Canada (358) compared to Mexico (52) in fiscal year 2024. That is a factor of 7 times more. Foreign nationals have also been exploiting genuine Canadian visas to enter the country with the intention of then crossing illegally in the United States, according to federal authorities.

More tariffs are threatened for April 1st if there is not progress made on Canada reducing it's trade deficit with the U.S.

Now Canada has announced more border security, bought two Blackhawk helicopters and many drones to patrol the border. However the idiotic Canadian government bought Chinese drones that can't be used because the U.S. Government won't use them and the U.S. has been considering a total country ban on Chinese drones. Is the Liberal government that stupid or did they do it to antagonize the U.S.? And two helicopters are a joke, at their 250 km/hour cruising speed they could patrol the border once a day if they flew continuous. A gave detail on the border in this substack.

Canadian political leaders intend to use the trade war to enact emergency pandemic type measures. This is just insanity and probably advancing communist style government.

There are 3 hits from tariffs, probably 4 in Canada's case:

This is immediate in the currency markets as the Canadian dollar will plunge on Monday and the days to follow and more so if tariffs increase or persist. This immediately increases the price of all goods because between 1/2 and 3/4 of what we use is imported or priced in US$;

The tariffs themselves soon increase the prices of goods and stuff in the sector they are applied to. Ontario will be hit hardest because of huger automotive trade with U.S.;

Canadian companies and investment leaves the country for the U.S. Business will try and manufacture more goods in the U.S. This is exactly what Trump wants;

The government reaction will cause more problems for Canadians. We will know more when we see what they do, but more money printing as they are hinting about will just mean higher inflation.

Canada is headed to far worse economic times than we are already experiencing!!!!!!!!!!

If you don't believe me, this expert probably spells it out better what Canada should do. Ian Lee, Associate Professor at Carleton University's Sprott School of Business talks with Financial Post's Larysa Harapyn

What Canadians can do

For the last two years I have been promoting U.S. stocks and cash along with precious metals and precious metal stocks. This is because the C$ loonie and economy was in big trouble and will plunge at even faster rate now. You should convert C$ to US$ and gold even now. The C$ will plunge this week but probably further over time because how I expect Canadian governments to respond.

Expect higher interest rates not lower ones. Well over 10% won't surprise me in a long trade war. I will have more details as we see the government response.

I have been harping about this for years, to stock up on perishable goods because they will only go way higher in price because of inflation. This will accelerate big time now.

We are well protected holding our Canadian precious metal stocks. They trade mostly on U,S, exchanges and their price will be set there so just convert to higher C$ price as the loonie plunges.

More detail to follow but the Trudeau government is enacting tariffs against the U.S. and doing nothing about the border and Fentanyl crisis and it is a crisis in Canada. This is a strong sign this will be a drawn out trade war and Canadian governments are going to enact their own agendas at the expense of the people and blame it on Trump.

Cracks in U.S. Economy Widening

Markets sold off on Wednesday not because rates held pat but, the Fed finally acknowledged that price inflation remains a problem. In the official FOMC statement, the central bankers removed language stating, “Inflation has made progress toward the Committee's 2 percent objective,” and simply conceded “inflation remains somewhat elevated.”

No surprise to readers here and to reiterate, the CPI has climbed the past three months, from 2.4% in September, 2.6% in October, and 2.7% in November. And higher still at 2.9% for December. The last time we saw a 2.9% was in July. In fact, the annual CPI was only 3.1 percent in June 2023.

Markets were down again Friday after the US economy grew at a slower pace in the fourth quarter, with the US Bureau of Economic Analysis (BEA) reporting GDP to have risen by 2.3%. This was below original forecasts of 2.6%. A comment from one economist.

"I think what we can say is that we're entering this year with the economy still on a pretty good footing," Wang says. "Yes, the headline GDP number for the fourth quarter was a little bit lower than expected. But, if you average the four quarters, 2.5%, still strong growth in consumer spending, pretty strong growth in business investment, although that rate of growth has decelerated a little bit."

Problems Brewing in U.S. Real Estate

Contracts to buy U.S. previously owned homes fell in December to snap a four-month streak of increases, with particularly sharp declines in the pricier Northeast and West regions as higher mortgage interest rates dented affordability.

The National Association of Realtors (NAR) said on Thursday its Pending Home Sales Index, based on signed contracts, fell 5.5% last month to 74.2 from a downwardly revised 78.5 in November.

Economists polled by Reuters had forecast contracts, would be unchanged in December following a 1.6% increase in November. There are problems brewing in U.S. real estate.

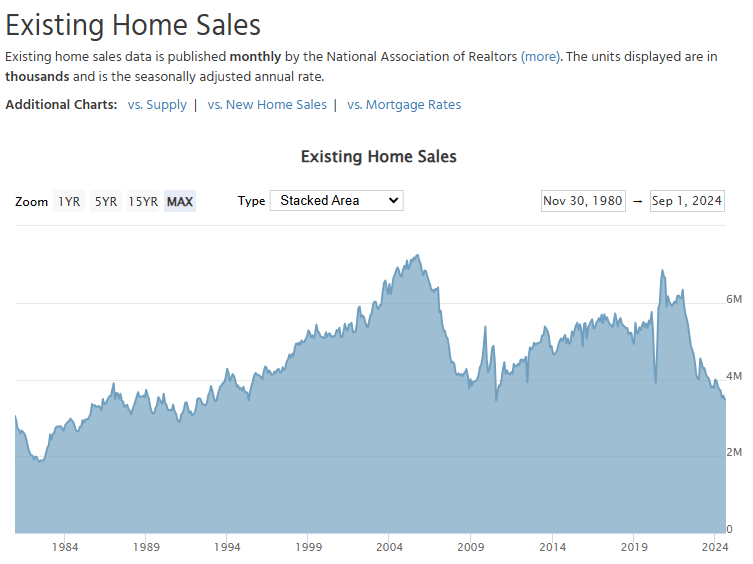

The number of single family homes for sale is at bubble levels, last seen in the 2007 real estate bubble. And this next chart showing the numbers that are selling, existing home sales is down to levels last seen after the real estate crash of 2008/09.

The problem is buyers can't afford the 7% mortgage rate at current home prices and those with cheaper mortgages won't sell but the ones that have to renew mortgages have to sell. Than you get a situation like Greenbriar's Sage Ranch that has affordable homes that qualify for low assisted mortgage rates and it is being held up by government bureaucrats. Trump says he is going to fix this bureaucracy but it is at the regional and state level. Trump has way too many things to fix. Good luck

The December Personal Consumption Expenditures Price Index increased in line with expectations, up 2.6% from year-ago levels. When volatile food and energy costs are factored out, the Federal Reserve’s preferred measure of inflation increased 2.8% from one year ago, in line with expectations. However, as I have been saying 'sticky inflation'.

Chicago business-activity index falls further into contraction territory in January, the Chicago PMI, fell 1.2 index points to 46 in January. Economists polled by the Wall Street Journal forecast a 48 reading.

Readings below 50 indicate contraction. The index has fallen sharply from the November reading of 55.8, which was the highest level since May 2022, when business picked up following the end of the UAW auto strike.

Hemostemix - - - TSXV:HEM, OTC:HMTXF - - - - - Recent Price - $0.31

Entry Price $0.22 - - - - - - - - - Opinion - buy

Hemostemix Inc.'s sales of ACP-01 treatments are gaining traction, following its social media campaign and presentations in Puerto Rico. So far sales are small but just getting started and I expect they will continue to build the waiting list. The stock had quite a run, but has pulled back some and consolidated so a decent buy level for those who missed it earlier.

"Advanced sales of ACP-01 enables the purchaser/patient to understand if they are patient one, 10 or 500, and that certainty is helpful," stated Thomas Smeenk, Hemostemix chief executive officer. "Advanced sales enables Hemostemix to schedule the physician's time and schedule production time. While our numbers are modest at this point, the first signed commitments amount to some $400,000, which is a good start for 2025 with 11 months of selling ahead of us. In my meetings this week with physicians who have treated some 200 patients to date, I am struck by their response to the same question I ask every physician I meet who has treated with ACP-01, 'Talk to me about your patients and what you have witnessed in terms of your patient's outcomes?' Yesterday, an invasive cardiologist who has, as a team of three cardiologist, treated 200 patients with ACP said to me: 'I've used a lot of stem cell products. ACP-01 in the heart is unbeatable; it rebuilds heart function. That is unique. No other autologous stem cells work like ACP-01.'"

Recon Africa - - TSXV:RECO, OTC:RECAF - - - Recent Price - $0.85

Entry Price - $0.56 - - - - - - - - Opinion - buy

The market reaction to news on their exploration well was dissapointing. Clearly market expectations are high and I believe the market wanted to see a commercial well with production. As I have commented many times this is grassroots exploration and there are no discoveries on shore to help identify types of structures and targets. I have no doubt the oil is there and it is only a matter of time and which well makes the discovery. Offshore Nambia is booming, onshore will follow lead by RECO.

Booming offshore. According to Westwood’s Wildcat, “the Upper and Lower Cretaceous plays opened in the Namibian Orange Basin by the Venus and Graff wells in 2022, have delivered nearly 5bnbbl after the first nine wells, making it the second largest oil province to have emerged globally in the last decade”.

Furthermore, the 7 exploration wells that followed up the Graff and Venus play opening discoveries have resulted in four follow-on discoveries with an estimated recoverable oil resource of 2.8bnbbl.

This pull back in the stock is an excellent buying opportunity for long term investors.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.